Preferred shares English is Preferred Stock, and is one of the stock categories issued by listed companies.Priority shares are a company provided by the company that is different from ordinary stock rights.Its claims are lower than the claims of corporate bond holders.It is a mixed asset between ordinary stocks and bonds.

Priority shares are usually sold at a high price and set up a minimum purchase volume.Providing fixed Dividend(DivIDEND), dividends are generally a fixed ratio or fixed amount of preferred shares.The dividend will be issued regularly, which can be issued on a monthly, quarterly or year-on-year.

Priority shares have a variety of characteristics.For example, the dividend can be delayed, that is, when the company’s profitability decreases, it can be delayed to the cumulative distribution of dividends to the next period, but ordinary shares do not have this characteristic;Priority shares are converted into ordinary shares; the fluctuation of divideous interest rates is relatively stable, that is, if the company’s stock price has fallen sharply, the dividend of preferred shares will be less affected; and the value of the stock value is anti-dilution, that is, it will not reduce the stock due to the increase in the number of stocks.Price, etc.At the same time, in terms of paying dividends and liquidation assets, asset distribution levels, preferred shares are preferred by ordinary shares.

From these characteristics, we can ensure that the shareholders of the preferred shareholders can obtain a relatively stable dividend income, and are investment products that investors are more favored by investors in pursuing stable income.

However, in the stock market investment, preferred shares will not have a significant benefit or loss as ordinary stocks, and at the same time, they do not have the right to vote for the company’s issues owned by ordinary stocks, and the preferred shares do not have the same claims.When insufficient, you can pay the preferred dividend.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- What are the differences between preferred shares and ordinary stocks?

- How to check the preferred shares sent by listed companies?

- What are the advantages and disadvantages of priority stocks?

- How to buy a company’s preferred stock?

- More US stock investment strategies

What are the differences between preferred shares and ordinary stocks?

Preferred Stock and ordinary shares (Common Stock) also belong to the company’s stock assets, but both have obvious differences in terms of sale and dividend payment.

In terms of claims, preferred shares are higher than ordinary shares, but lower than the company issued bonds.Therefore, after the company’s debt repay the debt, the shareholders will give priority to the issuance of general shareholders’ dividends, and ordinary shares have the remaining debt.At the same time, if preferred shares are accumulated stocks, it means that when the company is difficult to make profit, it can be suspended first.After the benefit rebounds, it will make up for the non-issued preferred dividends, but ordinary share dividends will not be replenished.Essence

The benefits of preferred shares are usually relatively fixed.It can be a fixed ratio or fixed amount of the facial value of the preferred stock, or a small floating according to the fluctuation of market interest rates, but it cannot obtain a large fluctuation belt of ordinary shares in the market in the market.The revenue from the coming can be converted into ordinary shares to enjoy the benefits generated when the market price fluctuates sharply, but ordinary shares cannot be converted into preferred stocks.

There are still some other differences in preferred stocks and ordinary stocks, as follows:

| Preferred shares Preferred stock |

Ordinary stock Common stock |

|

|---|---|---|

|

price |

Fixed price |

Market price when buying |

|

purchase amount |

Buy fixed shares |

Depending on investors need to buy |

|

Dividend benefit |

The dividend set by the company can be a fixed ratio of stock value, or a fixed amount, or a small adjustment of a small adjustment based on market interest rates |

The dividend set by the company |

|

Margin |

Smaller |

The benefits of dividends are largely fluctuating with the company’s profit, especially when the company’s profitability is limited, the dividend is not issued |

|

Dividend issuance level |

Get dividend issuance after repaying the debt; |

After the preferred share dividend distribution |

|

Can dividends accumulate |

When the company’s profitability weakens and the current dividend is not issued, it can be temporarily issued.When the company’s profitability increases, the previous dividend will be replenished |

No dividend accumulation |

|

Convertibility |

Preferred shares can be converted to ordinary stocks |

Ordinary shares cannot be converted to preferred stocks |

|

Dilution |

When the number of stocks increases, the value of the stock will not be diluted; |

As the number of stocks increases, the value per share will be diluted |

|

Redemption |

Priority shareholders have the right to redeem the shares with a predetermined amount |

Ordinary shareholders have no right to redeem the shares with a scheduled amount |

|

Company matters voting rights |

No voting right |

Voting right |

How to check the preferred shares sent by listed companies?

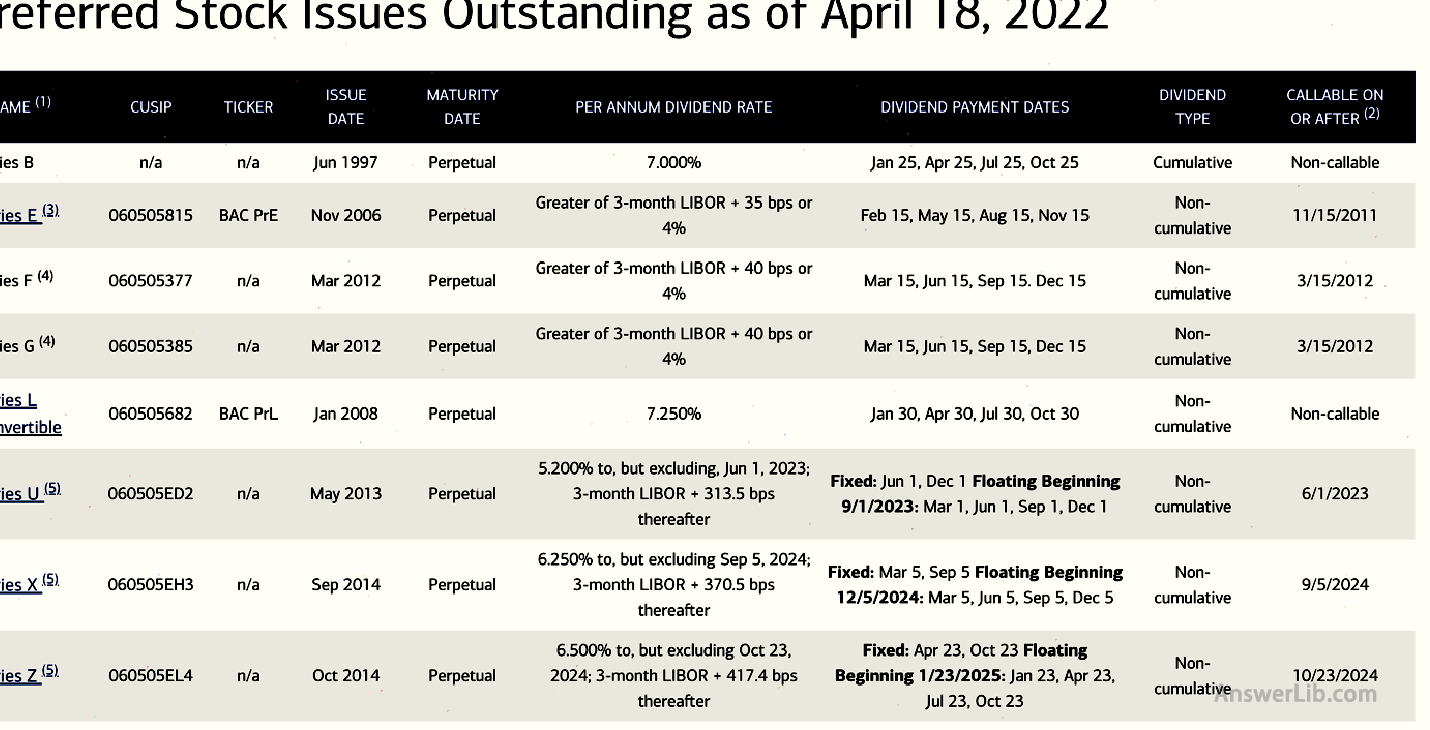

Not all listed companies will send priority shares, taking the Bank of America (BOA) as an example.You can use two methods to entangle the preferred shares distributed by listed companies:

- Websites that provide information to investors through listed companies

- By checking the listed company’s 10-K

A.Through listed company investor website

First, you can enter the “Preferred Stocks of Bank of America” in Google to search for the preferred shares currently on sale of Bank of America.

Enter in the search results Boa Investor website You can find out the results on the investment portal website of the Bank of America:

in:

- The first column: name is the name of the preferred stock.

- The second column: CUSIP is the registered serial number of the preferred stock.

- Third column: TICKER is a preferred stock code.

- Sequence: Issue Date is the date for the preferred shares.

- Sequence 5: Maturity Date is the maturity date and the expiration date set by preferred shares.When issuance, it can be set at a specific expiration date, or it can be set to permanent effectiveness.Most preferred shares are permanent and effective.

- Sixth column: Pernnum Dividend Rate is a dividend, usually a specific percentage rate of the stock value, or the dividend rate of adjustment according to market interest rates.Among them, Libor is the London Interbank Offered Rate, that is, the benchmark interest rate for short-term loans between the major global loans in the market for international banks to borrow the market.BPS is BASIS Points, a commonly used metering unit for interest rate interest rates, which is used to represent the percentage change of financial instruments.A base point is equal to 1% or 0.01% or 0.0001 100, and the relationship between the percentage changes and the base point is: 1% change = 100 basis points, 0.01% = 1 basis point.In the preferred shares sold by Bank of America, the “Greater of 3-MONTH Libor + 35 BPS OR 4%” means that the dividend uses a 3-month Libor + 35 basis point or 4% of the larger.

- Seventh column: CIFIDEND PAYENT DATES is a dividend.

- Sequence: Dividend Type is a dividend type.There are two categories: Cumulative and Non-Cumulative.Cumulative is to accumulate stocks.When the company’s profit is limited, the suspension of the ex-offering dividend can be remedied after the profitability is restored.The accumulation of stocks, that is, this type of preferred shares will not be issued in dividends.

- Sequence ninth: Callace on or AFTER is whether the stock is convertible and the conversion date.If it is Non-Calship, then such preferred shares cannot be converted into ordinary stocks, otherwise, a date will be provided.After this date, shareholders can choose to convert it to ordinary shares.

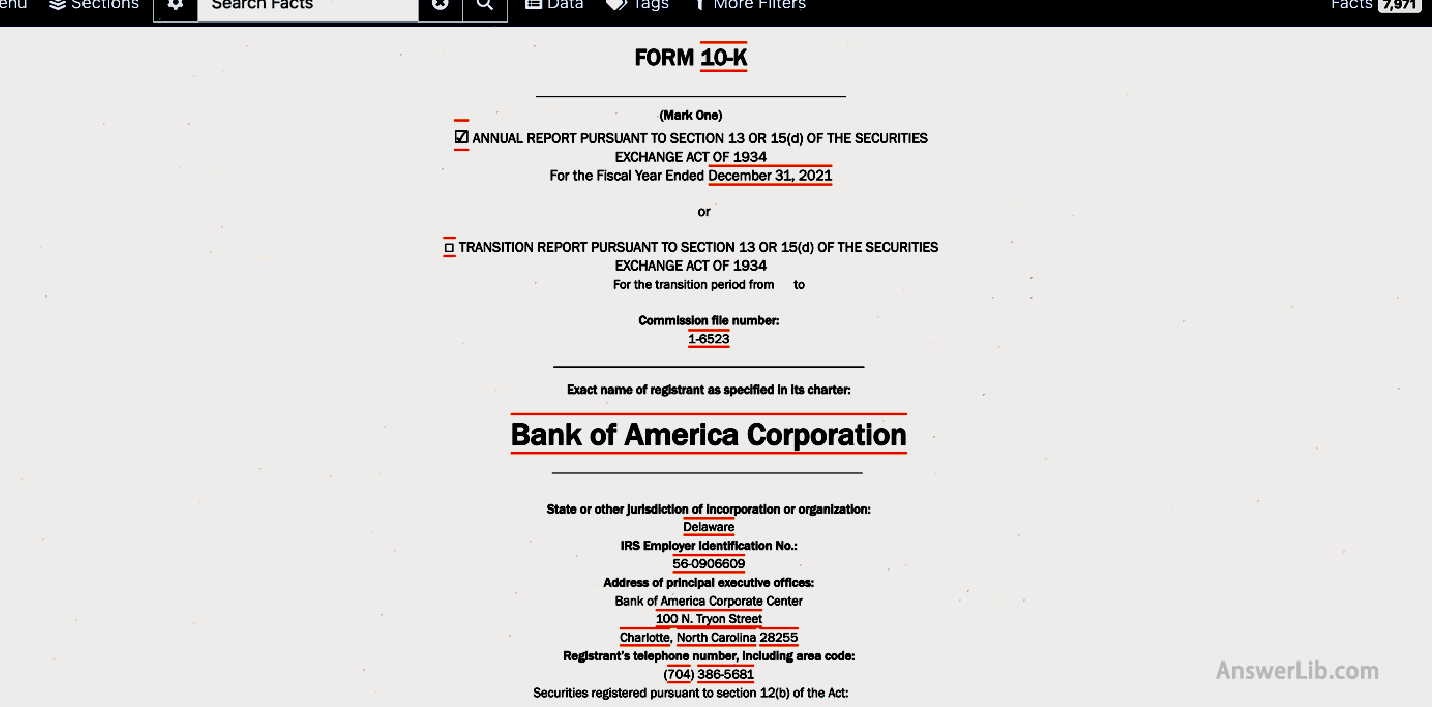

B.By viewing the listed company 10-K Report

You can pass SEC official website Come to check the Bank of America 10 – K finance Report, query the profitability of its preferred shares during the financial year.

The 10 -K report of the Bank of America 2021 Financial Year is:

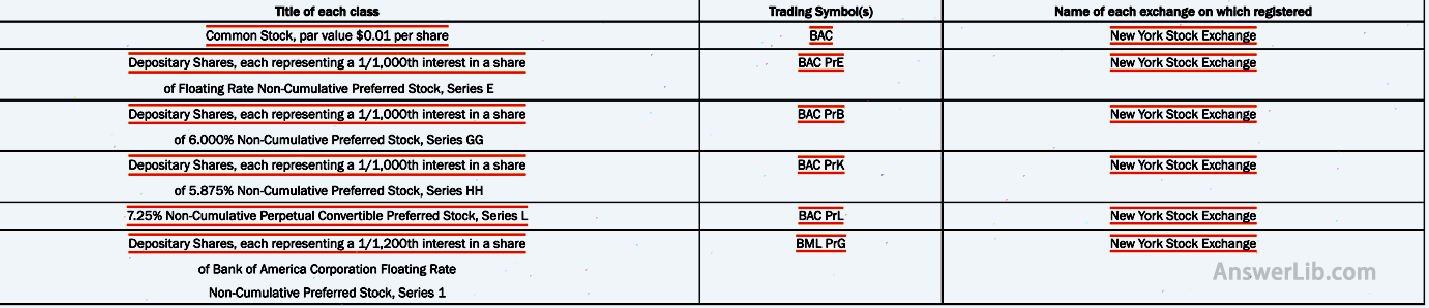

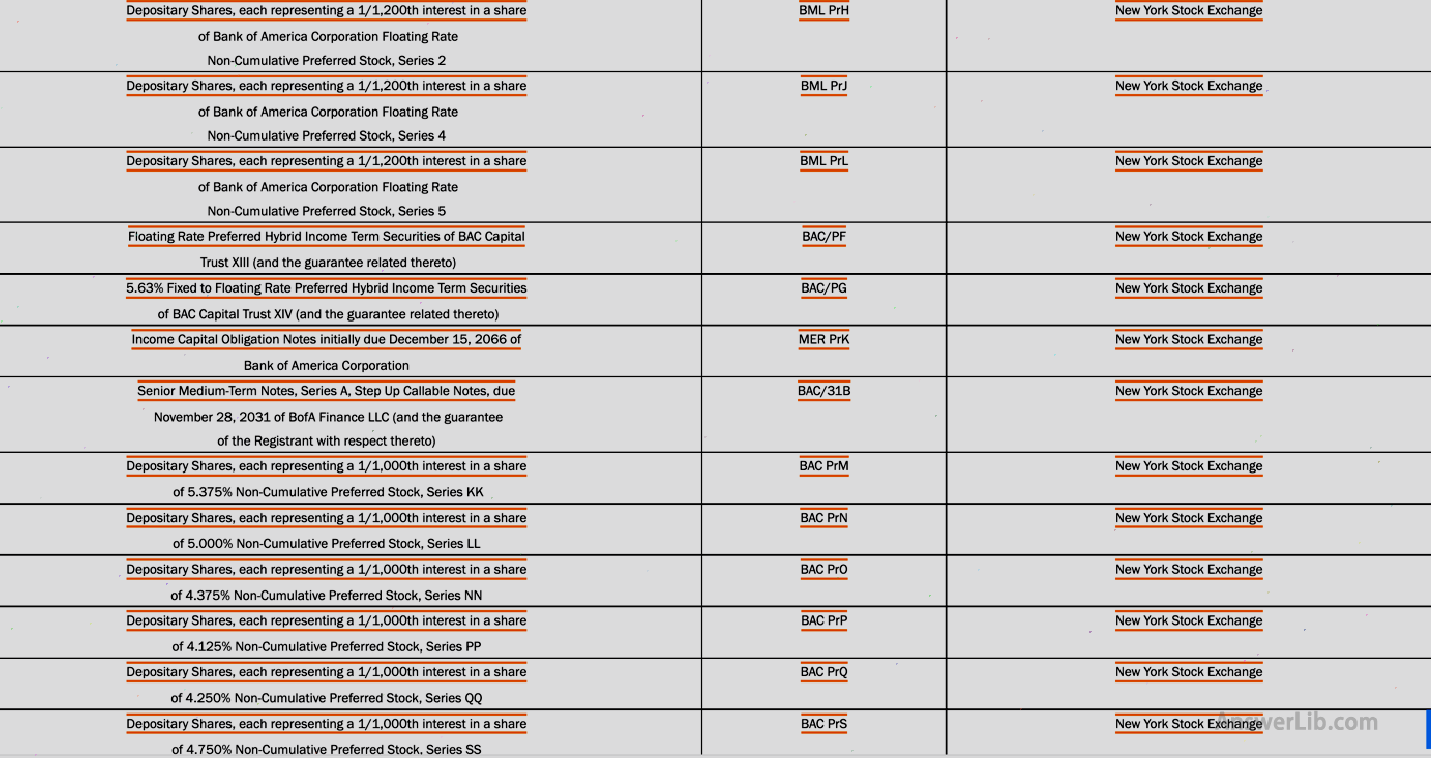

From the 10 -K financial report, you can see that in this financial report, all the preferred stock names recorded, including their dividends, whether to accumulate preferred shares, stock code, and trading venues listed and traded.

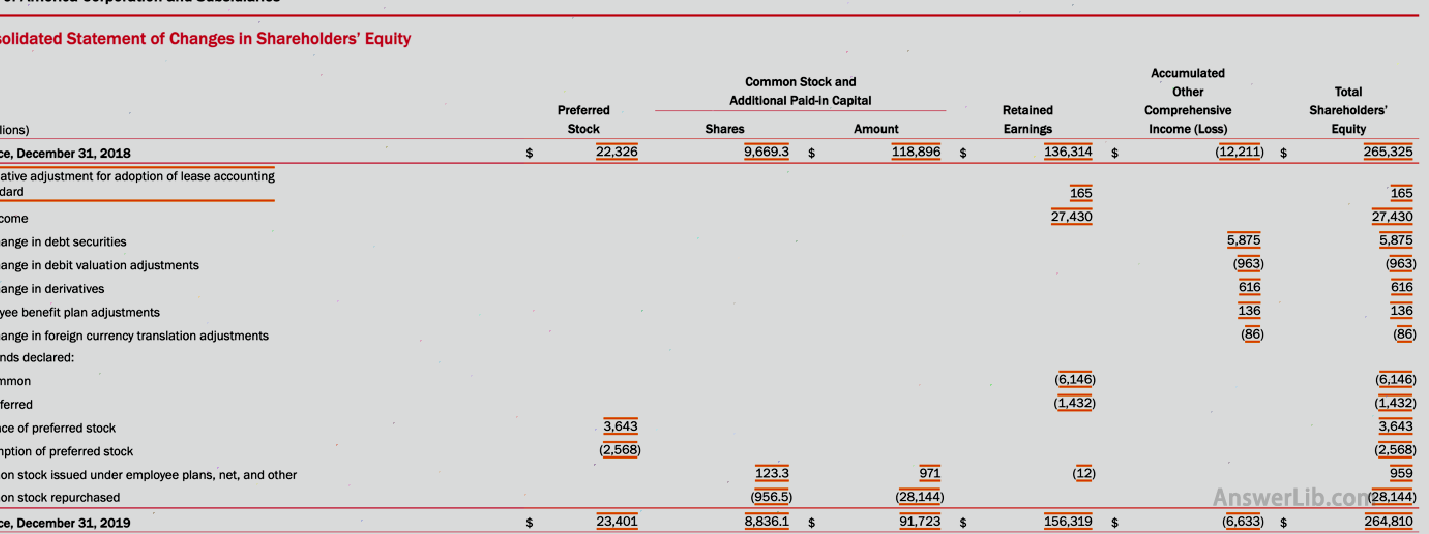

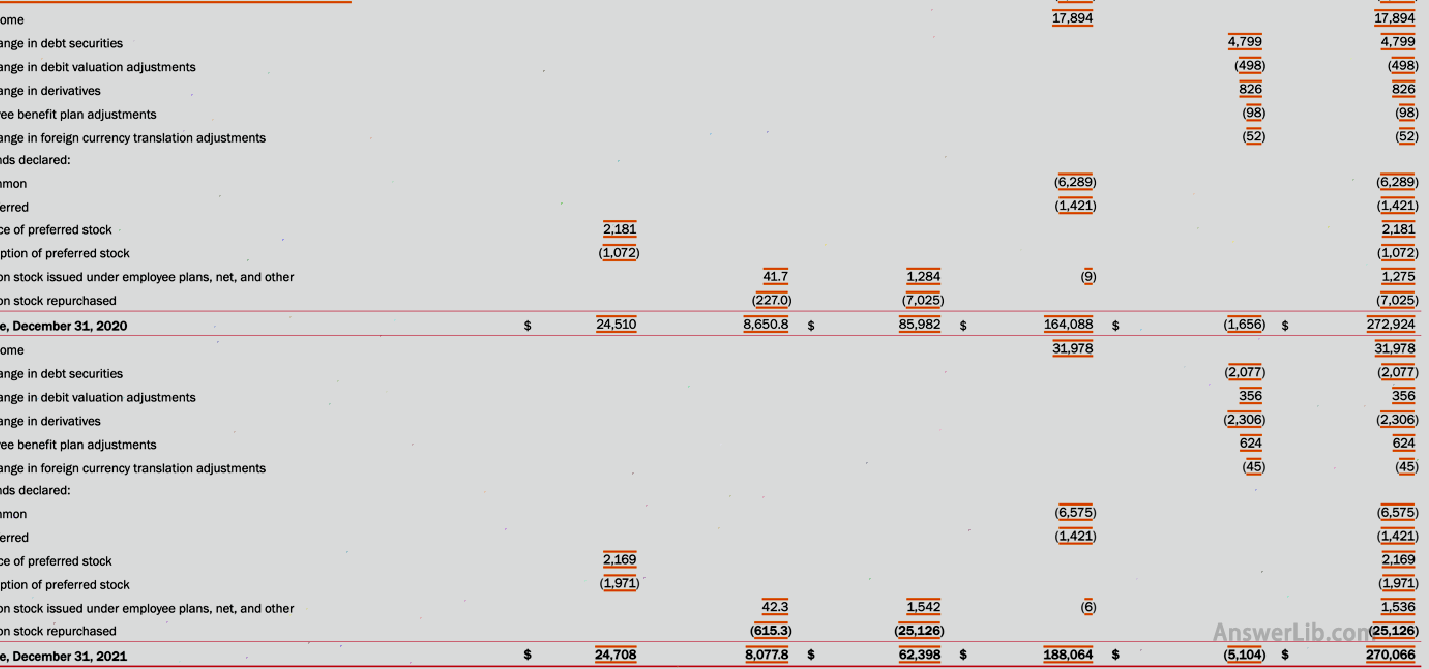

You can see in the total equity income statement in the financial report:

In the 2021 Financial Year, the income obtained by Bank of America by issuing preferred shares was $ 2,169 m, and the expenditure for redeeming preferred shares was $ 1,971 m.

What are the advantages and disadvantages of priority stocks?

For investors, preferred shares have their advantages and disadvantages like other financial investment products.

A.Priority stock advantage

Preferred shares can get dividend distribution before ordinary shares, especially when the company’s income is limited, preferred shareholders can get enough or most dividend distribution, but ordinary shares may only get part or even get dividend distribution;

The dividend of the preferred shares is fixed, or a small float occurs, so when the company’s stock price fluctuates significantly, especially when the downward fluctuations, the impact of the benefits of the preferred shareholders is very limited;

The priority shareholders have the right to propose the redeemed price to the company, so when the shareholders need, the proposed price can be redeemed at the proposed price, while the ordinary shareholders have no right to set the redemption price.The redemption price is determined by the company;

When the company increases shares, the value of preferred shares will not be reduced due to the increase in the number of shares, but the value of ordinary shares will be reduced due to the increase in the number of shares;

B.Priority stock disadvantages

The dividend interest rate of preferred shares is relatively fixed, so the shareholders of preferred shareholders cannot obtain the large returns obtained by ordinary shareholders from the significant fluctuations of the stock price, so the appreciation space for preferred shares is limited;

Priority shareholders do not have the right to vote for company matters, that is, they cannot participate in company matters, especially the strategy formulation of major matters;

How to buy a company’s preferred stock?

Individual investors can pass the vast majority Stock Including offline agents and online brokers to buy preferred shares, just like buying ordinary stocks.

However, the largest buyer of the preferred shares is usually an investment institution, because institutions can obtain certain tax benefits by purchasing preferred shares, and individual investors cannot obtain these tax benefits.