value investment, English is ValueInvesting It is a kind of investment strategy in the field of financial investment.Investors make judgments based on market conditions and their own understanding of the market, and choose to buy stocks they think that the current market value is lower than its internal value.

When the market value of the stock really reflects its inherent value, investors can benefit a lot, which sounds simple, but it is not easy to really achieve it.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- What is value investment?

- What are the key points of value investment?

- What are the targets of value investors?

- Futu Moomoo’s advantages on value investors

- Books about value investment

- What are the world’s famous value investors?

- What are the characteristics of value investment?

- What are the differences between value investment and in-depth value investment?

- The difference between value investment and growth investment?

- More investment strategies

What is value investment?

The basic concept of value investment is to buy and hold it for a long time at the price below the internal value of the stock.After the stock price reaches or exceeds its inherent value, investors obtain high benefits from the difference.

The most straightforward explanation can be considered to buy better quality items at a relatively low price.Value investment is one of the various strategies of financial investment and a special one.

Volkswagen investors often follow the opinions of the masters according to the market conditions, buy when they rise, and throw them out when they fall.

Value investment depends more on investors’ own research and judgment of the market, and usually makes a special trading operation from most investors.

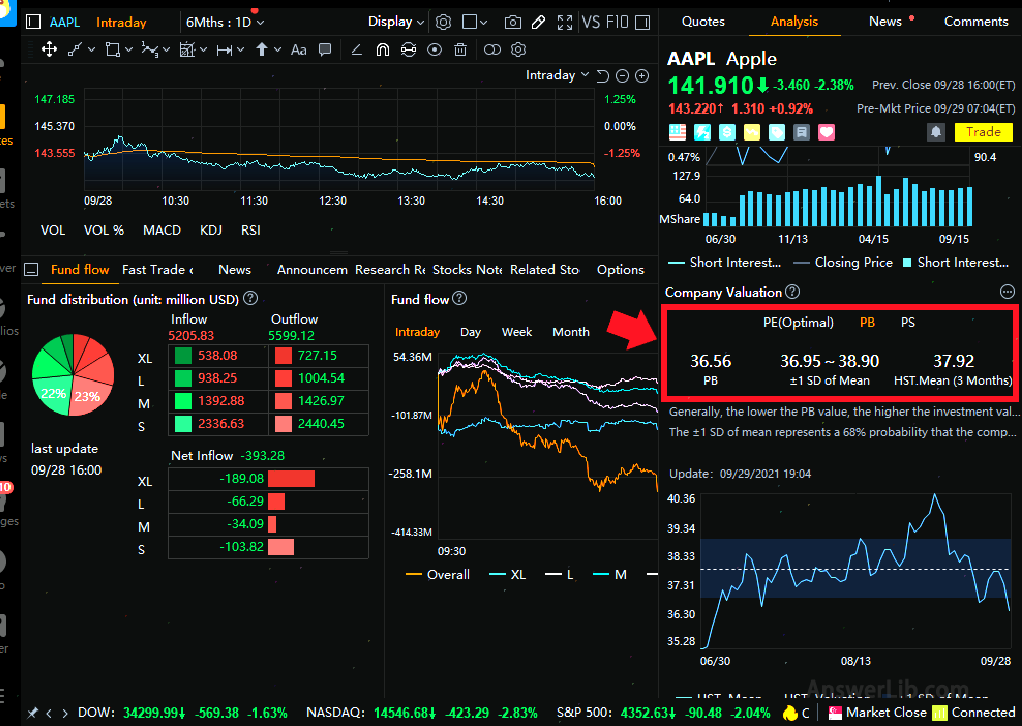

Therefore, value investors often need to investigate the fundamentals of listed companies, and at the same time, analyze some data of stocks, such as P / E ratio, market sales ratio, debt equity ratio, and so on.These data can often be found in major securities firms, for example, Futu Moomoo It provides important information such as financial statements and price-earnings ratios of each stock.

For the first time, the concept of value investment was first proposed by Benjamin Graham and David Dodd, a Professor of Columbia Business School.The traditional opening of the liquidation gold judgment point.

Benjamin Graham ( Image Source.

David Dodd ( Image Source.

Subsequently, in 1949, Graham mentioned this concept again in other works and popularized it, and was recognized by many elites in the investment community.

Among them, the students of Graham, the recognition and observance of the famous investment master Warren Buffett.In the future investment path, the personal characteristics are added based on the preliminary concept of value investment and obtained a lot of money.Personal income.

Warren Buffett( Image Source.

What are the key points of value investment?

How to judge whether the price of the stock is lower than the internal value of the stock, and whether it is decided to purchase the value of value investment.

To determine whether the stock price is lower than the internal value of the stock requires a large amount of data analysis, not only analyzes the own situation (fundamental analysis) of the stock company, but also analyzes its development in the industry.Among themFinding the most useful data in these complicated data is the embodiment of personal ability.

Whether to decide to buy this is the biggest difference between value investors and ordinary investors: In traditional financial investment, market conditions will often be linked to the emotional atmosphere of investors.When the price rose, most investors followed the tide, and with their optimistic emotions, they added their positions.

Many values investors get such an amazing income is that they insist on their own analysis and judgment.When they think that the stock price is lower than the internal value of the stock, when the stock price really experiences its own value or even exceeds that, the valueInvestors’ income is very objective.

The hardest point of value investment is to judge the timing of starting.Although it is also purchasing discount products.As a physical consumption, there are similar products in the market for price reference.Merchants will give discount previews, or for example, for example, anti-season promotion, etc., buyers can be available.It is most favorable to judge when you buy it.

However, in the financial investment industry, there are many fluctuations in the stock price of a company, and there are usually no obvious instructional warning.Therefore, it is usually the top value investors who can be worshiped by people who are worshiped as masters.

What are the targets of value investors?

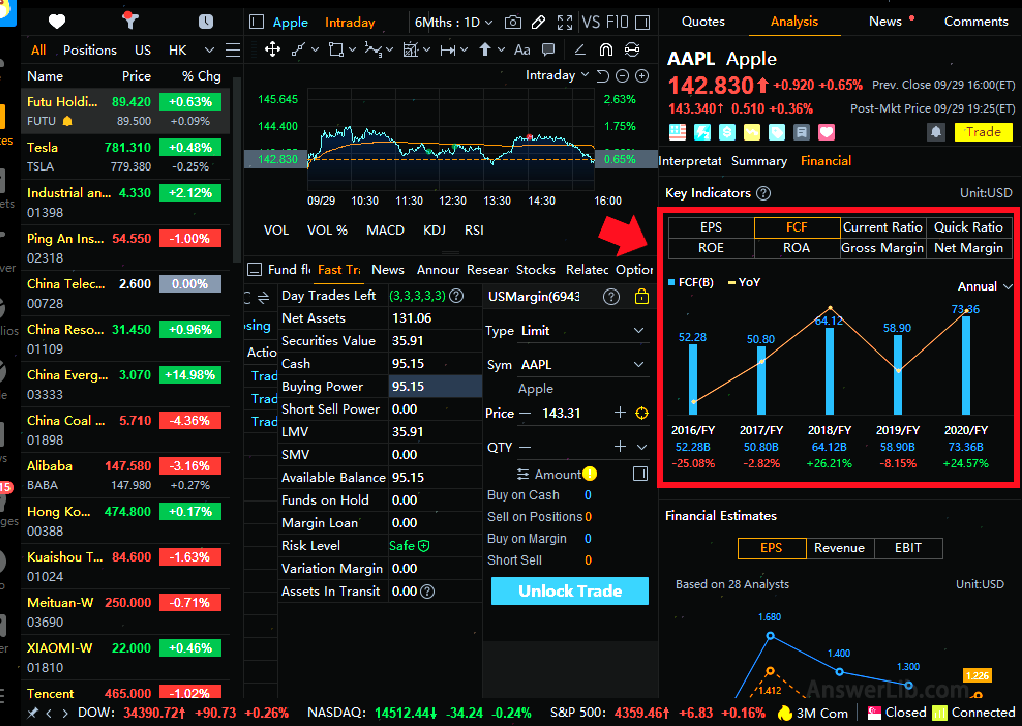

Analysis of the company’s financial situation is the most job done by value investors.When analyzing, they usually pay attention to data such as financial statements, price-earnings ratio, net net ratio, debt equity ratio, free cash flow, and PEG ratio.

1.Financial statement

The financial statements must be submitted to the US Securities and Exchange Commission every quarter and every year ( SEC) Data table, investors can find it on the SEC website or on the listed company website.

The financial report shows the company’s operating performance in the season or that year.In addition to common data, value investors will also pay attention to the annotations in the report.Some unconventional financial conditions, such as the company encounters unexpected accidents, to explain some data in the report more clearly, in order to better understand the business conditions and business performance of the target company.

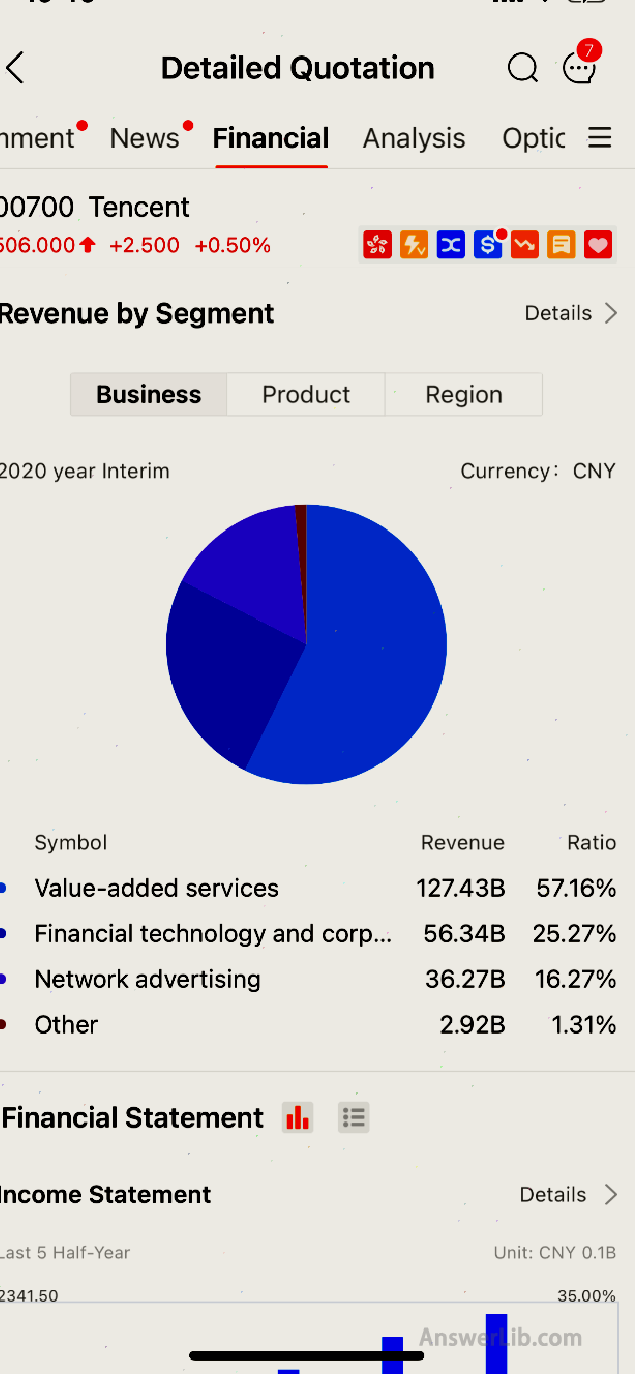

exist Futu Moomoo Among them, you can easily find the financial statements of a listed company.Below is a screenshot of the Futu Moomoo mobile version:

If you are using Desktop, you can click F10 on each stock page, and you can check the financial statements of the listed company.

2.P / E ratio

P/E ratio, English is Price-TO-Earnings Ratio, referred to as P/E value.The price-earnings ratio shows the current market is willing to pay for stocks.Value investors will use this value as the basis for judging whether the current stock price is overestimated or the trough of low valleyone.

If the price-earnings ratio is high, it may mean that the price of the stock is high or overvalued.On the contrary, the low price-earnings ratio indicates that the current stock price is relatively cheap.

Therefore, for value investors, the lower the price-earnings ratio, the more likely the company will be regarded as a value stock.

However, the price-earnings ratio also has its own restrictions as an analysis reference value, and the price-earnings ratio can be used to compare different companies in the industry.It is meaningless to compare the cross-industry companies.Essence

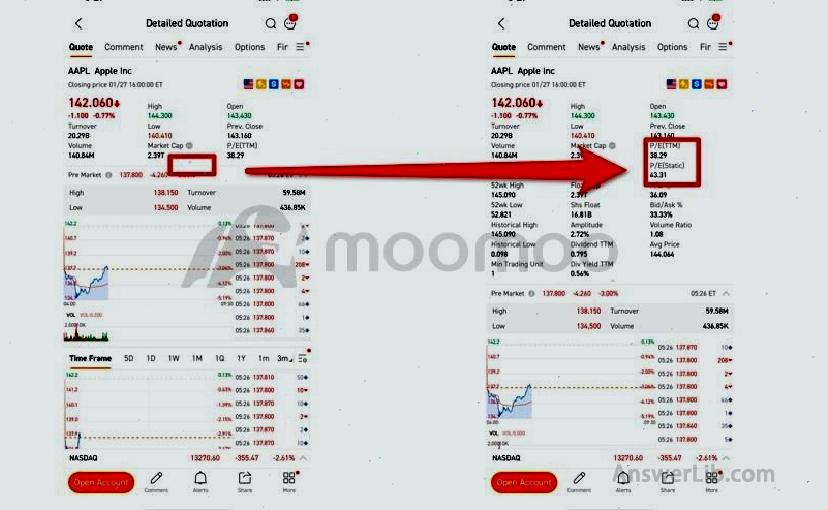

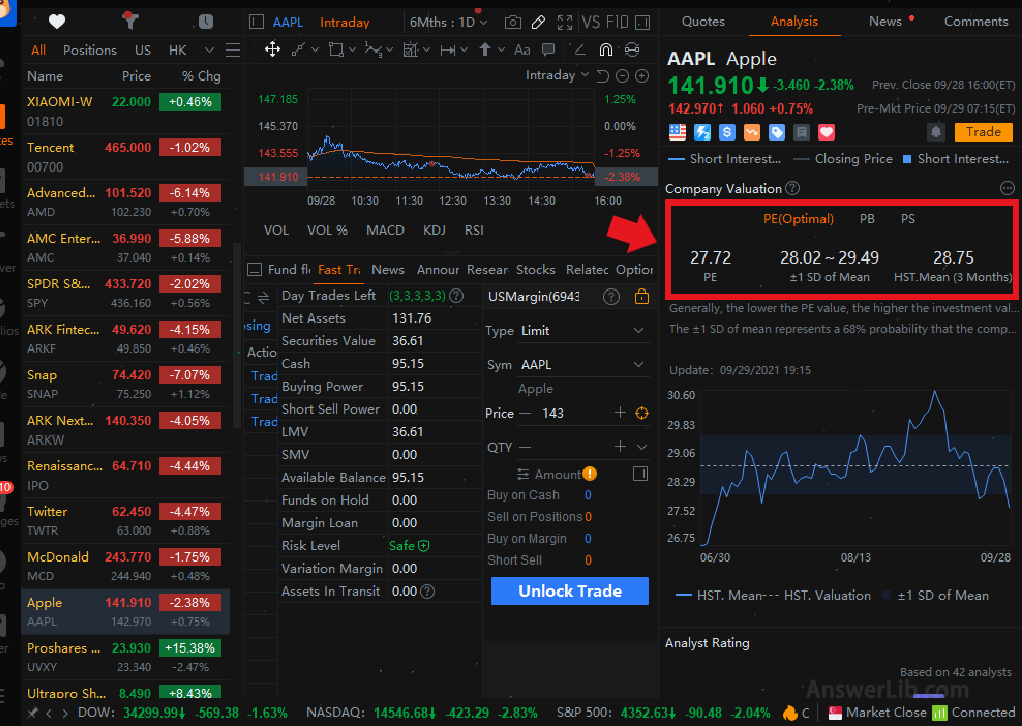

You can Futu Moomoo It is easy to find the P/E value of the listed company:

If you use it Futu Moomoo The computer version can also find the P/E ratio of the stock stock (P/E Ratio) of the listed company:

Reading in-depth:What is the P/E RATIO: Is the low-priced stock cheap?

2.Municipal net rate

Municipal net rate, English is Price-TO-Book Ratio, referred to as P/B value, which reflects the difference between the market value of the company’s stock and its book value.

Generally speaking, the larger the ratio, the higher the market value, the lower the ratio, and the lower the market value.

For value investors, they also hope to find companies with market value lower than book value.When they are analyzed by other data, they determine that the current market value is too low, and they will buy them.When reflecting real value, value investors will benefit.

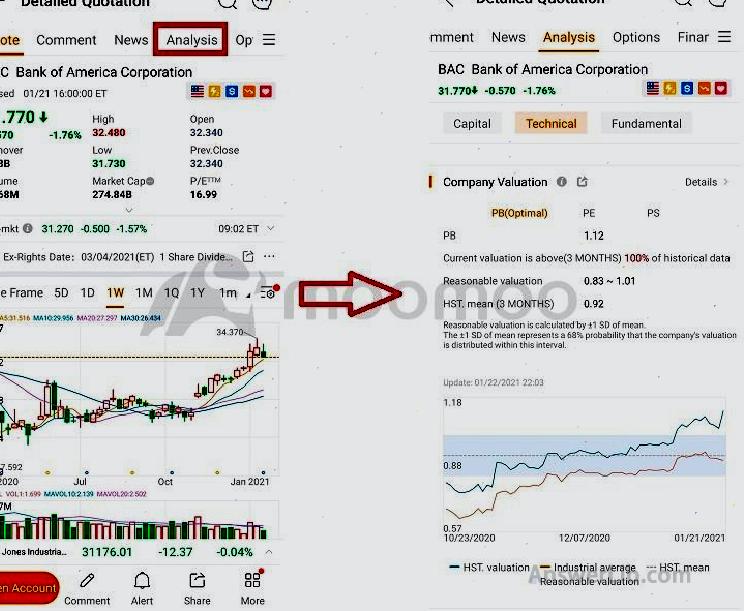

You can Futu Moomoo It is easy to find the P/B value of the listed company:

If you use it Futu Moomoo The computer version, you can easily find the city’s net ratio (P/B Ratio):

Reading in-depth:What is a net ratio (P/B RATIO)?How to use to evaluate stock value?

3.Debt share capital ratio

The proportion of debt equity, English is the DebT-TO-Equity Ratio, referred to as the D/E value, which shows the ratio between the debt and its shareholders’ equity generated by financing and its shareholders.

The higher the D/E value, it means that the amount of financing obtained through debt is higher than the amount of financing obtained through the sale of stocks, which means that in the company’s financing situation, the debt income is higher than the equity income.The investment of each shareholder has greater risks in both or short-term.

Because of the different industry characteristics, the D/E value is usually compared between the same industry to accurately determine whether the company’s current D/E value is reasonable.

4.Free cash flow

Freedom cash flow, English is Free Cash Flow, referred to as FCF, is the remaining disposable cash after expenditure cost generated by the company’s cash reduction cost.

This value shows the efficiency of the company’s cash that generates cash.It is one of the indicators of value investors estimated the possibility of the future income growth of the company.The possibility is high.If the stock price is low in the same period, it will become the target of value investors.

If you use Futu Moomoo You can find the free cash flow options of listed companies in the software.

Reading in-depth:What is free cash flow? How to use the market rate P/FCF valuation

5.PEG ratio

The PEG ratio is called Price/Earnings-TO-GROWTH RATIO, which measures the relationship between the current stock price and profit growth of the company’s stock.

By comparing the current income and expected income growth, it is better to understand that the stock price of the current stock is overestimated or underestimated.

Generally, the stock with a PEG value of less than 1 is considered to be underestimated because it shows that the current stock price is too low compared to the expected income increase, and it is usually the object that value investors pay more attention to.

Futu Moomoo’s advantages on value investors

For value investors, the operation information of more target companies is the main way for them to analyze and judge.As individual investors, they can be obtained through many channels.

Through some professional trading platforms, such as Futu Moomoo Wait, you can get almost all the information you need on a platform, simplify the data collection process.At the same time, open account opening and deposit can also get free US stocks.

exist Futu Moomoo, Investors can get:

- Real-time stock market data updates can understand the situation of the stock market in a timely manner, and analyze the dynamics of the target company in the same industry.

- Free secondary market data, timely real data of the secondary market, and understand the most accurate dynamics of the target company’s stock price.

- The daily updated stocks are short data, accurately understand the development dynamics of the target company in the market, avoid abnormal stock price caused by human operation, and affect their own judgment.

- Advanced and comprehensive data analysis tools, all the data values required at a glance, avoid the troubles of back-and -forth nuclear data, and more accurately judge the stock company’s stock.

- Artificial intelligence monitoring, during the long-term holding period, AI intelligent monitoring stock price trend, regularly check the value to understand the development dynamics of investment objects, save more time and energy.

- Provide global market data analysis to meet investment needs in different regions.

Futu Moomoo It also provides the following information exclusively to help value investors make better target choices and investment:

- The list of star institutions holds the experience of primary value investors to learn from the experience of masters.

- The market highlight planning list also brings more useful guidance to the primary value investors.

- The financial analysis report of visualization companies, visualization of traditional reports, and greatly simplifying data analysis and other tasks.

- Stock comparison tools, minimalist steps understand the value of the stock price relative to the company itself, as well as the development level in the same industry.

- The active community composed of 14 million users, as well as a wealth of investment courses to meet the rapid start of primary value investors, and the intermediate investors effectively improve.

Books about value investment

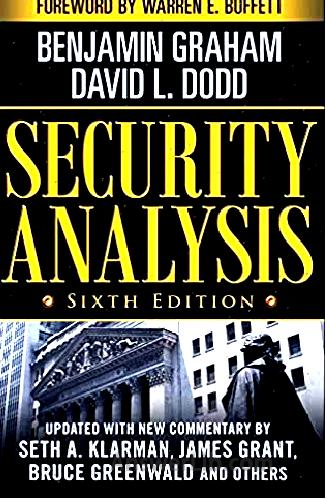

1.“Securities Analysis”/”Security Analysis”

Author: Benjamin Graham & David Dodd

Affiliate Link

The book was first published in 1934.It is one of the most influential books in the financial industry.The book brings more specific value investment concepts.· Graham’s proud student, the investment master Buffett’s order, is the position of its position in the history of financial books.

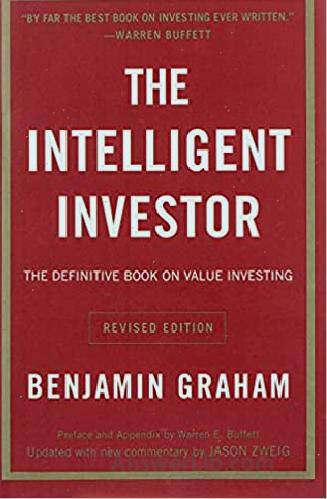

2.“The Intelligent Investor: The DEFINITIVE BOOK On Value Investing”

Author: Benjamin Graham & Jason Zweig

Affiliate Link

The Chinese translation of this book is “Smart Investor: Authoritative Book of Value Investment”.Since 1934, after Benjamin Graham proposed the concept of value investment, in this book published in 1949, it established the term “value investment”, which began a new investment in the financial investment communityStrategy.Benjamin Graham, the greatest investment consultant of the 20th century, taught and inspired people in the world to make reasonable value investment in the book.

3.“Berkshire Hathaway Letters to Shareholders”

Author: warren e.buffett

Affiliate Link

The book compiled every letter from the “stock god” Buffett from 1965 to 2018.Various guidance put forward by Buffett was called the “curriculum plan” by the world, and Buffett shared his experience and opinions in detail to shareholders.

4.“Beating the Street”

Author: peter lynch

Affiliate Link

In this book, the legendary fund has interpreted his investment strategy in detail, and provides exclusive suggestions on how to choose stocks, common funds, or combined with the two in combination.”The expert-level suggestions brought to form a successful investment strategy for yourself.

5.“The Dhandho Investor: The Low-Risk Value Method to High Returns”

Author: Mohnish Pabrai

Affiliate Link

Indian elite businessman Mohnish Pabrai lists various advantages and investment frameworks for value investment in this book.Successful experience allows readers to understand the Dhandho investment framework created by Mohnish Pabrai in a relaxed and funny reading experience.

6.“Invest Like A Guru: How to Generate Higher Return at Reduced Risk with Value Investing & NBSP; 1st Edition”

Author: Charlie Tian

Affiliate Link

This book is written by a successful value investor Charlie Tian based on his actual investment experience.Not only is it provided to readers’ successful guidance, but also describes his failure experience, thinking that readers provide more comprehensive investment guidance.The information contained in the book not only includes expert-level insights, but also provides many practical tools and operating methods with practical operating value.It is a guiding book that many entry-level value investors should not miss.

What are the world’s famous value investors?

1.Benjamin Graham

Graham was born in the United Kingdom, a professor and investor of economics, and the proposal of the value investment concept.History of important book: “Securities Analysis” and “Smart Investors”.

2.Warren buffett

Buffett is the most famous value investor today, and it is also the most famous business giant and charity in the United States.

Buffett is currently the chairman and CEO of Berkshire Hathaway.Buffett has shown his enthusiasm for investment since he was young.Later, the teacher came from Benjamin Graham to the extreme, and his many years of successful investment experience brought the title of “stock god” to Buffett.

His famous saying: “Better to Buy a Wonderful Business at a Fair Price Than A Fair Business at a Wonderful Price.”

3.Charlie Munger

Charlie Munger, the vice chairman of Berkshire Hathaway, is even more well-known as a partner of Buffett.Their cooperation creates a legend with the initial value return rate of up to 2,000,000%.

The reason why he is not as famous as Buffett is because he is a person who pays more attention to his footsteps.His investment style is the same as his life, focusing on his own rhythm, finding the goal he thinks worth investing, and insisting on it.

Even Buffett commented on him: “As his own music festivals move forward, and this kind of music has almost no one else listening.” For value investment, it is the most rare and important thing to do this.Looking at the “Special Observatory Company” currently emerging, the full name of English is that the Special Purpose Acquisition Companies (Spacs).It does not follow the current but insists on its own point of view.Compared with the purchase of multiple stocks most of the investors, The purpose of decentralizing risks, he is more inclined to find a few stocks he is familiar with.

4.Peter Lynch

Peter Lynch is a well-known American investor, common fund experience, and charity.

After Lynch’s strong interest in the investment field and his active schooling accomplishments, after he entered Magellan Fund in 1977, in more than ten years, Magellan Fund quickly became a popular fund with an amazing annual return of 29.2%per year.Under his management, Magellan Fund has increased assets from $ 18 million in 1977 to $ 14 billion, and the performance is regarded as “legend” by the industry.

Peter’s personal investment principle, “Invest in what you know” has become a guideline for many value investors.

5.SETH Andrew Klarman

Seth Andrew Klarman is the US billionaire, top investors, hedge fund managers and writers, and is also an active supporter of value investment concept.

Klarman is currently serving as CEO and investor and investment portfolio manager of Baupost Group.During the SETH Andrew Klarman investment process, it is famous for its investment concepts in accordance with Benjamin Graham’s investment concept, with an underestimation of value, formulated a reasonable and safe margin and profitable from price increases.

Since Klarman established the Baupost Group Fund for $ 27 million in 1982, he achieved a 20%composite investment return and currently manages $ 27 billion in assets.

6.Mohnish Pabrai

Mohnish Pabrai followed Buffett’s investment style.In 1991, the $ 30,000 of his 401 (K) account and US $ 70,000 of a credit card founded a IT consultation and system integration company Transtech, Inc.

In 2000, Pabrai sold the company to Kurt Salmon Associations for $ 20 million.Before the company was sold in 1999, under the inspiration of Buffett partnership, Mohnish Pabrai became the partner of Pabrai Investment Funds., Mohnish Pabrai has continuously expanded its investment field and investment business, becoming a successful value investor.

7.Joel GreenBlatt

Joel GreenBlatt is an American scholar, hedge fund manager, investor and writer, and is also a value investor.

GreenBlatt served as the chairman of the board of directors of Alliant Techsystems from 1994 to 1995 and became the founder of the New York Securities Auction Company.

In 2005, GreenBlatt published his own book “The Little Book that Beats The Market”

Affiliate Link

In the book, he introduced an investment strategy of “magic formula investment”, a kind of help investor find a “cheap and good company”, thinking that investors bring high capital return.

8.Bill Ackman

Bill Ackman, full name William Albert Ackman, is a well-known American investor and hedge fund manager, a radical value investor.The first criterion for his investment is “making a bold decision that no one believes.”

Some classic cases include MBIA bonds short-term MBIA during the financial crisis in 2007-2008, his agency struggle with the Canadian Pacific Railway Corporation, etc., and his investment style, investment style, and successful cases have always been controversial, but this still cannot stop some government officials, Hedge fund experience or retail investors praise him.

9.David Tepper

Successful businessmen, famous charity, founded the Apalusa Management Company, became one of the most successful hedge fund managers.David TEPPER’s investment strategy insists on a lot of research, and it takes a little luck.He believes that luck is the key to the success of an investor, but the premise of being able to get luck is that he is smart enough, can find and seize luck in time, and in the field of value investment, he insists on choosing the target object after a lot of research and analysis.After smart research, he can have luck to invest in a correct object.

10.Carl icahn

One of the most successful investors in Carl His Wall Street adopts the concept of value investment.

Compared to the corporate income of most investors in Wall Street, he is more concerned about the assets and potential productivity of the enterprise.

When deciding the investment goal, he usually takes: before investing, he does not do nothing if he studies his business potential, undervalued assets, the ability to pay attention to the company, and does not easily make decisions.The best ideas and other strategies such as big bets are carried out.In the end, the concept he insisted also brought him a lot of benefits.

What are the characteristics of value investment?

1.Don’t pay much attention to the short-term market market

Market market analysis is an analysis that most investors must conduct when choosing investment objects.For value investors, this work is almost ignored.They often only analyze the operating capabilities of the target company, company assets, and company’s assets, and they areIn the past performance, compared the current stocks and the company’s financial capabilities, and later judged whether its stock price was lower than the inherent value of the company’s stock.

2.Do not follow the waves

Value investors who are against the trend often give people an illusion of arbitrary and specialized.They will not continue to pay with everyone when everyone cheers the stock market, nor will they panic together when everyone’s frowning face for the stock market.Step up the withdrawal.

Value investors are almost influenced by the overall emotions of the market.They are always like an outsider watching the stock market market, or concentrating on their own research and analysis.They will focus on the stocks they are interested in and check the company’s operations without going.Care about the company’s purchase guidance in the environment, and then make some decisions that are different from the market trend, such as starting the position when everyone is not optimistic.

Successful value investors often have very good determination, and can focus on their target stocks without being influenced by the surrounding environment.

3.Need to have a strong psychological quality

Value investment is often a long-term investment.Unlike short-term investment, value investment values the returns brought by the company’s value after long-term operation, rather than obtain a small price difference in short-term shocks.

In the process of long-term investment, whether the company’s stock value increases is consistent with expectations, whether the value will shake the original investment confidence when the value will fluctuate or grow slowly, and whether it can insist on their own investment in the case of pessimism in the environment.Concepts, these will determine the success or failure of value investment.Looking back at the experience of value investment masters, we can see that they almost have a strong psychological quality to face all the situation during the holding of target stocks.Become an art of time and self-game.

4.Unscample

In traditional or most investment strategies, diversified distribution of its own investment assets is almost recognized as a way to reduce risk, and this is not strongly advocated in the value investment strategy.

But value investors do not use all the investment methods of all eggs in a basket.They will also invest in multiple stocks.They only choose a few target stocks from different industries or economic departments to achieve decentralized investment risks, but but it is not a result.The purpose of diversification.

Value investors will search for target stocks in several areas, and then invest, instead of diversifying funds into multiple recommended or optimistic stocks like most investors.

5.Set up the margin of safety

Safe margin, English is Margin of Safety, and is one of the key to the success of value investors.

Because value investment is a long-term investment.When choosing and determining goals, investment returns will not be reflected immediately, so they usually set up a safe margin based on their own investment style and risk tolerance capabilities, that is, the expected value of target stocks can be available.Accept error space.

In this way, if the price performance of the stock is not as expected, the setting of safe margins will allow investors to stop investing in time, withdraw funds to avoid losses.

What are the differences between value investment and in-depth value investment?

In-depth value investment, English is Deep Value Investing, which is proposed by Benjamin Graham, a teacher of Buffett;

Value Investment English is Value Investing, which is mainly proposed by Warren Buffett;

In terms of time relationship, deep value investment earlier than value investment.At the same time, the view of value investment comes from deep value investment.

- Benjamin Graham, the father of value investment, the earliest value investment concept in 1934, the investment standards of the stock are drawn on the company’s own value and its current stock value, and the price is compared.It is considered to be an investment target, which is the concept of deep value investment.

- Since then, the apprentice of Benjamin Graham, later investment master, introduced the company’s quality as an additional reference standard based on the concept of the instructor, that is, when the company’s stock price is lower than the company’s own value, only companies with good operation conditions can only be only good operating.It is worth investing, which has become the concept of value investment in the later mainstream.

The relatively simple metaphors of these two can be:

- In-depth value investment is only cheap, whether the quality is good or bad;

- Value investment not only buy cheap, but also buy cheap quality and good quality.

The difference between value investment and growth investment?

Value investment and growth investment can be said to be the two main force in the field of financial investment, each with its own characteristics.

A.Growth investment

- The stock price is higher than that of the market.Investors are more optimistic about companies with high price-earnings ratios, and hope that as the company continues to develop, it will benefit from selling higher prices in the future.

- The company’s stock price fluctuations have a larger fluctuation than the high market fluctuations, because the company’s high stock price is vulnerable to the influence of various negative messages of the market, and it has greatly fluctuated.

- Growth investment emphasizes the growth of the company’s foreign business.

B.Value investment

- The stock price is lower than the market, and investors are more optimistic about companies with low price-earnings ratios.The company’s value will be discovered and recognized by the market in the future, and high returns can be obtained through value-based equivalent.

- The company’s stock price fluctuates relatively smoothly, and the risk is relatively small.Because the value of the target company requires time, value investment is more suitable for long-term investors.

- Value investment is more deeper into the company’s intrinsic value.

More investment strategies

- Julian Roberts – Julian Robertson: Father of Tiger Baby

- Explore the 24 first-level dealers of the Federal Reserve

- Important Finance and Investment News

- What is Bollinger Bands?How to use the Bollinger belt?

- What is the application cumulative/allocation line? A/D Line

- What is the commodity channel index CCI?How to use the CCI indicator?

- What is a random shock index Stochastic ollator?

- What is the average trend indicator ADX?How to use the ADX indicator?

- What is a balanced transaction volume index?How to use the OBV indicator?

- What is a mobile average?MOVING AVERAGE