Fed The full name is “US Federal Reserve System”, in fact US Central Bank, English is called Federal Reserve, Referred to as FED.

The Federal Reserve is an independent institution jointly established by multiple member banks.It was authorized by the US Congress in 1913.The main role is to stabilize the US financial system through some list of interest rate-related monetary policies and manage the supply of US dollars, including circulation of circulation in the circulation of circulation inThe amount of currency in the market and the amount of currency that can be used in banks at any time.

The regulation of the Fed’s various policies will cause a series of economic changes in the actual economic environment.The understanding of the Federal Reserve can help investors better manage personal assets.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- What is the Federal Reserve?

- What are the main duties of the Federal Reserve?

- What are the Federal Reserve’s monetary policy

- Federal Reserve’s institutional settings

- The history of the Federal Reserve?

- What is the difference between the Federal Reserve and general commercial banks?

- More macroeconomics

What is the Federal Reserve?

The Federal Reserve, the full name is the “Federal Reserve System”, the English name: The Federal Reserve System or The Federal Reserve (FED.

The Federal Reserve is actually the Central Bank of the United States.It was authorized by the U.S.Congress in 1913.At the same time, the Federal Reserve Act was promulgated.The main policies related to interest rates to regulate the domestic currency in the United States, stabilize market prices, help maximize employment rates, and at the same time ease long-term interest rates to help build a healthy development US financial environment.

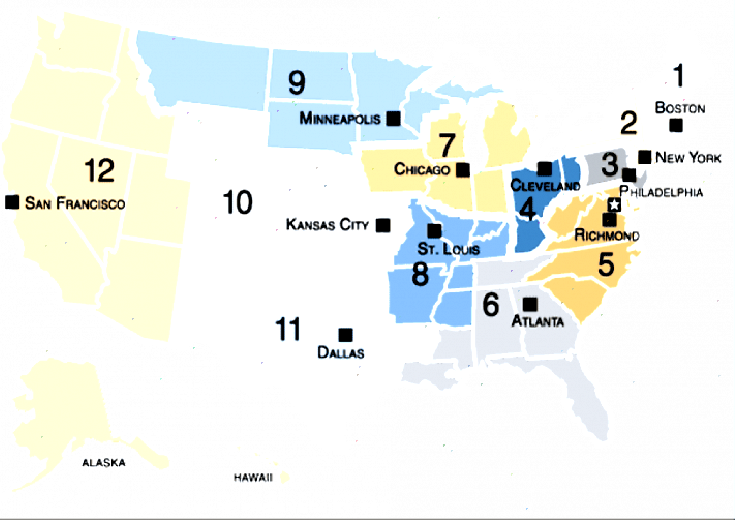

The Fed is not a subsidiary of the US government, but an independent financial institution.The Federal Reserve Board is formed by 12 regional federal reserve banks distributed in different regions of the United States.

These 12 federal savings committees are located in: Boston, New York, Philadelphia, Cleveland, Richman, Atlanta, Chicago, San Louis, Minnezos, Kansas City, Dallas and San Francisco.

Members with the highest decision-making power include the composition of the seven MEmbers of the Board of Governors and the Presidents of the Federal Reserve Banks of 12 federal reserve banks.that power.

In addition, the Fed is an independent institution.Its decision does not need to be approved by the president or legislature.The term of office of management personnel is longer than the term of office of the president and Congress.Disturbance of distribution.

What are the main duties of the Federal Reserve?

The Fed is important for the US economy and even the global economy.Don’t forget that the US dollar is a global reserve currency.Any Federal Reserve’s regulating economy will have a profound impact on the global economy.

The important responsibility of the Federal Reserve is:

- Stabilize the price of goods and control inflation;

- Guarantee employment rate;

- Maintain moderate long-term interest rates;

- Maintain the stability of the banking system;

In the continuous development of its establishment, its responsibilities are also expanding.At present, in addition to the main three responsibilities, it also includes:

- Supervise and regulate the business system of the banking industry;

- Maintain the stable development of the financial industry;

- Provide financial services for deposit institutions, US governments and foreign official institutions.

In order to fulfill the above responsibilities, the Federal Reserve affects the market interest rate (Credit) and formulate Federal Funds Rate to affect the flow of funds in the market.

Credit on the market can be used to buy goods and services.Therefore, increasing credit capacity can stimulate the economy, and shrinking credit capacity can cool down the overheated economic activities.The high and low interest rates of federal funds will directly affect the interest rates of banks when borrowing funds to go out, such as the consumer rate of credit cards, and the interest rate of loans, which will play a certain role in guiding market funds.It plays a role in stimulating consumption, and raising the federal fund interest rate can play a smooth level of inflation.

At the same time, the Federal Reserve ensure that all banks in the United States have sufficient funds to cope with the user’s withdrawal requirements by making a deposit reserment rate rate to ensure that all banks in the United States have to collect savings account deposits.

Let’s introduce these monetary policy “Monetary Policy”:

What are the Federal Reserve’s monetary policy

When performing the above duties, the Fed often uses the following three monetary policies (Monetary Policy):

- Federal Funds Rate

- Buy/sell US Treasury(Bond) or MBS (Mortgage-Backed Security)

- Establish a deposit reserve (Reserve Requirement)

Let’s take a look at how these Fed’s monetary policy can fulfill the above functions:

Stabilize the price of goods and control inflation

The Federal Reserve controls the market’s currency circulation through different federal fund interest rates, as well as purchasing/selling US Treasury bonds and MORTGAGE-BACKED Security.

When consumers’ consumption capacity is weak, the Fed will stimulate consumption by reducing the interest rate of federal funds.After reducing the interest rate of federal funds, the interest rates of mutual borrowing between banks will also decline.The interest rates of loans will be reduced accordingly.Therefore, consumers can receive more money with lower interest rates to make more consumption and investment.After stimulating consumption, prices will rise.

When prices rise too fast, the Fed will regulate the interest rate of federal funds.When the Federal Reserve raises federal funds interest rates, the interest rate of borrowing between banks between banks will increase, and this will convert this part of growth to a credit card that borrows it to users.As a result, consumer interest rates, loan interest rates, etc., consumers will reduce borrowings and consumption due to rising interest rates, and the level of price will begin to decrease accordingly.

When the Federal Reserve adjusts the federal fund interest rate to achieve the purpose of regulating prices, this goal will be achieved by purchasing or selling U.S.Treasury bonds.For example, after increasing the federal fund interest rate, commercial banks will reduce the borrowing of the Federal Reserve to reduce costs.The Fed cannot effectively absorb excess cash on the market to control prices, so it will absorb funds by selling national debt to help control prices to rise.On the contrary, the Fed can also increase capital to the market, stimulate consumption, increase prices, For short-term economic regulation.

Keep a reasonable employment rate

In addition to maintaining a stable inflation rate, the Fed needs to maintain a reasonable employment level and low unemployment rate.

The Federal Reserve through monetary policy, such as reducing federal funds interest rates, repurchase national bonds and other policies, providing funds to the market, promoting consumption, increasing demand for goods and services, stimulating the development of the industry, and strengthening the needs of the staff of the waiter, thereby promoting promotionThe role of employment rate, and after the economy enters the stable period, the Fed continues to use its currency adjustment tools to maintain the US economic environment to develop at an average of about 2%of the inflation rate.The stable inflation rate can make people think that the current economic environment is the current economic environment isFor security, it will further stabilize the development of the market, gradually increase employment rates and reduce unemployment rates.

Maintain moderate long-term interest rate

When the Federal Reserve stabilizes prices through a variety of regulatory tools, it can provide a moderate long-term interest rate for the market.Therefore, in general, the goal of stabilizing prices and maintaining moderate long-term interest rates is consistent.

Maintain the stability of the banking system

The original intention of the Federal Reserve was to establish a bank system worthy of customer trust.

Before the Federal Reserve was established, several severe bank crowding had occurred several times.The so-called bank extrusion was because under the influence of some factors, a large number of savings customers went to the bank to withdraw cash.When the bank did not have enough cash reserves, customers could not occur.The situation of withdrawal of withdrawals caused the bank’s panic.

The Fed officially established under this circumstances and promulgated the Federal Reserve Act, stipulating that the US banking institutions must hold the requirement in order to meet the needs of customers’ withdrawals.The interest rate borrowed funds from other banks to maintain the amount of bank funds at one time, reduce or prevent the occurrence of crowding, and the Federal Reserve can become the last lender when unavoidable crowding, thinking that the savings account provides a trusted banking system.

Federal Reserve’s institutional settings

The Federal Reserve is mainly composed of three parts:

- Board of Governors

- 12 federal reserve banks

- Federal Public Marketing Committee (FOMC)

Council

The Fed’s Council, English is Board of Governors, consisting of seven members.The council is responsible for supervising the operation of 12 reserve banks, participating in the formulation of national monetary policy, and supervising and supervising the entire US banking system.

The members of the council are appointed by the president.After being confirmed by the Senate, the term of office is 14 years and cannot be re-elected.The re-election is the term of the new directors from the date 1 on February 1 on February.

The chairman of the council, also known as the “Federal Reserve Chairman”, is appointed by the president from the current director.The term of office is four years.It can be re-elected according to the president’s choice until the term of office expires.In 2022, the Fed Chairman was Jerome H.Powell.

12 Federal Reserve Banks

The “Federal Reserve Act” divides the United States into 12 regions according to the American population distribution, consisting of 12 federal reserve banks in 12 regions.Each bank serves a member bank in its area.Supervision and extensively participate in economic activities in its jurisdiction.

Each federal reserve bank is composed of nine directors.One of them is the chairman, one is the vice chairman, and the chairmanship is 5 years.It can be re-elected.

| Regional number | Federal Reserve Bank | Current chairman |

|---|---|---|

1 | Kenneth Montgomery | |

2 | John C.Williams | |

3 | Patrick T.Harker | |

4 | Loretta j.Metter | |

5 | Thomas Barkin | |

6 | Raphael bostic | |

7 | Charles l.Evans | |

8 | James B.Bullard | |

9 | Neel kashkari | |

10 | Esther George | |

11 | MEREDITH BLACK (Acting) | |

12 | Mary C.Day |

Fed’s Open Marketing Committee (FOMC)

The Fed’s Open Marketing Committee, English is Federal Open Market Committee, referred to as FOMC.The “Federal Reserve Conference” that everyone has talked about the discussion refers to the FOMC meeting.The FOMC meeting can be said to be the main meeting of the Federal Reserve members to formulate US monetary policy, which is essential for the economic trends of the United States and the world.

Some participants in the FOMC Association mainly include 7 members of the council and the president of 12 federal reserve banks.All participants can participate in the discussion and evaluation of economic and policy choices.However, only 12 members of the Fed’s Open Marketing Committee at the time could vote for the final determined monetary policy.

Twelve FOMC conference members include 7 members of the council, the president of the New York Federal Reserve Bank, and the other four presidents of reserve banks in the New York.They are mainly rotated by the presidents of the 11 federal reserve banks.

The Fed’s Open Market Committee usually has eight official meetings in Washington, DC, eight telephone consultation meetings, and can hold other meetings when needed.

In 2022, the Federal Reserve’s FOMC meeting schedule is as follows:

| FOMC meeting schedule |

|---|

| January 25th to 26th |

| March 15th to 16th |

| May 3 to May 4 |

| June 14th to 15th |

| July 26th to 27th |

| September 20th to 21st |

| November 1st to 2nd |

| December 13th to 14th |

The history of the Federal Reserve?

Before the Fed was established, the United States set up two “national banks”.Essence

In 1791, the then President George Washington issued a 20 -year currency issuance right to the then National Bank of the National Bank-the United States First Bank of the United States, in exchange for the bank’s support for the government.The subscription of the Bank of America’s funds, the Bank of America provides a loan to the government.Therefore, the Bank of America has become the only fiscal agent of the federal government.Bank of America is also engaged in commercial banking business.However, some other states, especially the autonomous prefectures in the west and south, believe that the operation model of the United States Bank is essentially to take care of the interests of a small number of elites and rich people to harm the interests of most ordinary people.The bank obtained a license again.This time, as a government’s financial support, a single bank did not worry about all the American people.The right to issue the currency was in the hands of a few people and violated the spirit of the US Constitution, so it failed.

In 1816, President James Madison established the Second Bank of the United States.Its successor Andrew Jackson opposed the central bank’s system, so the government’s funds were drawn out of the Second Bank of the United States so that it made.80%of the Assets of the Second Bank of China Bank are privately owned.During the same period, the development of the United States was influenced by the external countries.The economic war with Britain and the regional conflict with Canada, which caused the U.S.Second Bank to play well.The central bank’s role in maintaining the federal economy was to promote the status of the central bank in 1836.

From 1837 to 1862, the United States did not have a formal central bank to form a free bank.In 1846, an independent national treasury system was established to manage government assets, but the system ended in 1921.

In 1863, the federal government awarded the State Banking Law to establish a national banking system, but the imperfect system caused a series of bank panic in 1873, 1893 and 1907.The severe bank panic that occurred prompted legislators, bankers and economists to clarify the importance of establishing and improving the banking system.

On December 23, 1913, the federal government awarded the Federal Reserve Law, which announced the establishment of the Federal Reserve.

According to the historical summary of the development of the banking industry in the past, the federal reserve system needs to establish a balanced reserve bank distribution point based on the distribution of population.People who are jointly served together and the Fed as an independent institution.The order issued by the Fed does not need to be approved by the US President or Congress, but at the same time, it is supervised by the president and Congress to ensureA small number of people.At the same time, through the regulation of the federal reserve system, it plays a role in stable prices, increasing employment rates, and maintaining moderate long-term interest rates.In the 1930s, the US Great Depression and the financial crisis in the early 21st century, the Federal Reserve has all all the Federal Reserve.Helping the federal government to survive the crisis and quickly introduce the economic environment into the track of recovery after the crisis, so the Fed’s duties have been expanded.

What is the difference between the Federal Reserve and general commercial banks?

The Federal Reserve is composed of 12 major federal reserve banks and several member banks.Banks in the federal reserve system can promote the auction of U.S.Treasury bonds and become the bank of the federal reserve system.It can be called a national bank.

| Fed | General commercial bank |

|---|---|

Central bank | Non-central bank |

Formulate U.S.Monetary Policy | Do not specify US monetary policy |

Management is designated by the US President and Congress | Management specifies itself |

Composed of members of the Federal Federal Reserve System | Managed by independent companies or personalities |

Management has a strict term rotation system | According to the bank’s own banking system, the term of the manager of the manager |

Serving the federal government and the public | Serve the people |

The operation of the federal reserve system is supervised by the US President and Congress | The operation of general commercial banks is supervised by many financial institutions such as the Federal Reserve |

More macroeconomics

- What is the national financial status index?

- What is the Buffett index?Buffet indicator

- What is the U.S.Treasury volatility index?Move index

- What US dollar index?US dollar index

- What is a bank deposit reserve?Bank reserves

- What is an open market operation?Open Market Operations

- What is the reserve balance interest rate?Interest on Reserve Balances

- What is personal consumption expenditure index?PCE Price Index

- What is overnight reverse repurchase?On Reverse Repurchase

- What is unemployment rate?UNEMPLOYMENT RATE