Personal consumption expenditure index, English is Personal Consumption Expendance Price Index (referred to PCE Price Index Or PCEPI is a financial index that tracks personal consumption expenditure per month by Bureau of Economic Analysis (BEA).

This PCEPI is slightly different in different US agencies.For example, the U.S.Economic Analysis Administration calls Implicit Price Deflator for Personal Consumption Expenditures (IPD for PCE) and Fed FOMC is called Chain-Type Price Index for Personal Consumption Expenditures (CTPIPCE).

Federal Reserve will measure consumer expenditure trends by tracking the personal consumption expenditure index and the level of inflation in the US economic environment as a reference value to adjust the monetary policy.The Fed’s attention to the personal consumption expenditure index is even greater than another financial index consumer price index CPI Essence

The calculation of the personal consumption expenditure index data for consumers to buy goods and services spent, and compare the results of the current period and the results of the results.Consuate and consumer decision-making considerations are considered to obtain a financial index that meets market changes.

Objects of personal consumption expenditure index include goods and services.Among them, the goods include durable goods and non-durable goods.When it contains all category products, it is called the overall personal consumption expenditure index.When the two major prices and energy types of food and energy are removed, they will obtain core personal consumption expenditure indexs of the Core PCE Price Index.

People can query the personal consumption expenditure index report on the BEA portal to understand the changes in the consumption level in the United States, and investors can adjust their investment strategies based on the PCE value.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- What is the significance of the personal consumption expenditure index?

- How is the personal consumption expenditure index calculated?

- What are the types of personal consumption expenditure index?

- How to check the historical data of PCE Price Index?

- What is the difference between PCE Price Index and CPI?

- More macroeconomic concepts

What is the significance of the personal consumption expenditure index?

As a financial index that is closely related to the people’s livelihood, the personal consumption expenditure index visually reflects the changes in consumer consumption power in the US economic environment.At the same time, consumer consumption accounts for a large proportion of the US economy, so tracking the personal consumption expenditure index can also learn about the development of the US economy.

The personal consumption expenditure index considers the products and services purchased by all families across the country.The scope is wider than the CPI, so it can show the changes in the consumption capacity of the US nationals more completely.

At the same time, for the core personal consumption expenditure index, because the food and energy data have been excluded, the fluctuation of the personal consumption expenditure index is greatly reduced, which can avoid the impact of some special events on the index, thereby avoiding the analysis of deviating analysisresult.

Board of Governers’ Board of Governers on February 17, 2000 (“Monetary Policy Report” (“Hamfrah Hawkins Report”, said in English that the Fed will use the Fed will use the Federal Reserve to useThe PCE index instead of the CPI index and as the main indicator to measure inflation[source]Essence

After the personal consumption expenditure index is tracked in the U.S.inflation trend, the Fed will adjust the monetary policy and interest rates based on the analysis results, which will directly affect the various financial strategies of consumers, producers and investors.

For example, when the PCE value rises steadily, it means that the overall U.S.economy is in a healthy development stage, but if it rises too fast, it may mean that excessive inflation will occur.At this timeHot, return to a relatively stable state of development.

If the PCE value decreases, especially the continuous decline, it means that consumers’ consumption power is declining, and the purchase volume and purchase amount are declining.This is a signal with a slowdown in economic development or even stagnation.To stimulate consumption and improve economic level.

Therefore, the current most important significance of the personal consumption expenditure index is to provide a financial index with reference value for the formulation of monetary policy for the Fed.

How is the personal consumption expenditure index calculated?

The statistical content of the PCE index contains all purchased products and services.

Among them, the purchase of goods will be divided into durable goods and non-durable goods.

- Durable products refer to products that have been used for more than three years, such as cars, electrical appliances, furniture and electronic products.

- Non-durable goods refer to goods with a life of less than three years, such as gasoline, clothing, groceries, cosmetics, health products and health-related products.

The “service” in the PCE index means that all services provided by enterprises to consumers, such as bank account maintenance services, financial services, entertainment services, and even care of back garden services.

When making personal consumption expenditure indexes, the US Economic Analysis Administration (BEA) will conduct extensive data collection, mainly from various institutions’ investigations of enterprises, including:

- Statistical reports issued by the U.S.Census and other government agencies;

- Report issued by administrative and regulatory agencies;

- Reports issued by private organizations from various industry associations;

After collecting the data, BEA will be calculated based on the Fisher-IDeal index model, so as to get the current personal consumption expenditure index value.

For the change rate of the PCE index, the personal consumption expenditure index adopts a chain index analysis method, that is, the value index value of the personal consumption expenditure index within two consecutive cycles measures its change rate.

Through the chain index analysis, consumers’ consumption habits and consumption strategies can be considered.For example, when a commodity price rises, consumers will choose another cheaper product to replace.This kind of consumption habits will beThe changes will be considered in the chain index calculation through a comparative cycle analysis method.

What are the types of personal consumption expenditure index?

There are two main types of personal consumption expenditure index:

- Overall personal consumption expenditure index (Chain-Type Price Index)

- Core Pce Index.

The overall personal consumption expenditure index refers to the index that calculates the personal consumption expenditure containing all products and services, especially foods and energy products.

Core personal consumption expenditure index refers to the personal consumption expenditure index that does not include food and energy products.The reason why the core personal consumption expenditure index is made, because food and energy products will have a large price floating due to financial investment, and some financial investment will affect the transaction volume of food and energy products.HoweverThe actual consumer fluctuations caused by the daily consumption of consumers, so the exponential fluctuations caused by them cannot accurately reflect the economic development trend, nor can they accurately measure inflation through the overall PCE.

Therefore, the Fed and other institutions are more measured by tracking the core personal consumption expenditure index.

How to check the historical data of PCE Price Index?

The user can Federal Reserve Economic Data Site Inquiry on the personal consumption index portal website Overall personal consumption index and Core personal consumption index data:

step one: Enter Federal Reserve Economic Data Site

Step 2: Enter in the search box: Chain-Type PCE Price Index, you can enter the personal consumption data information page:

Among them, the first is the overall personal consumption index, and the second is the core personal consumption index.

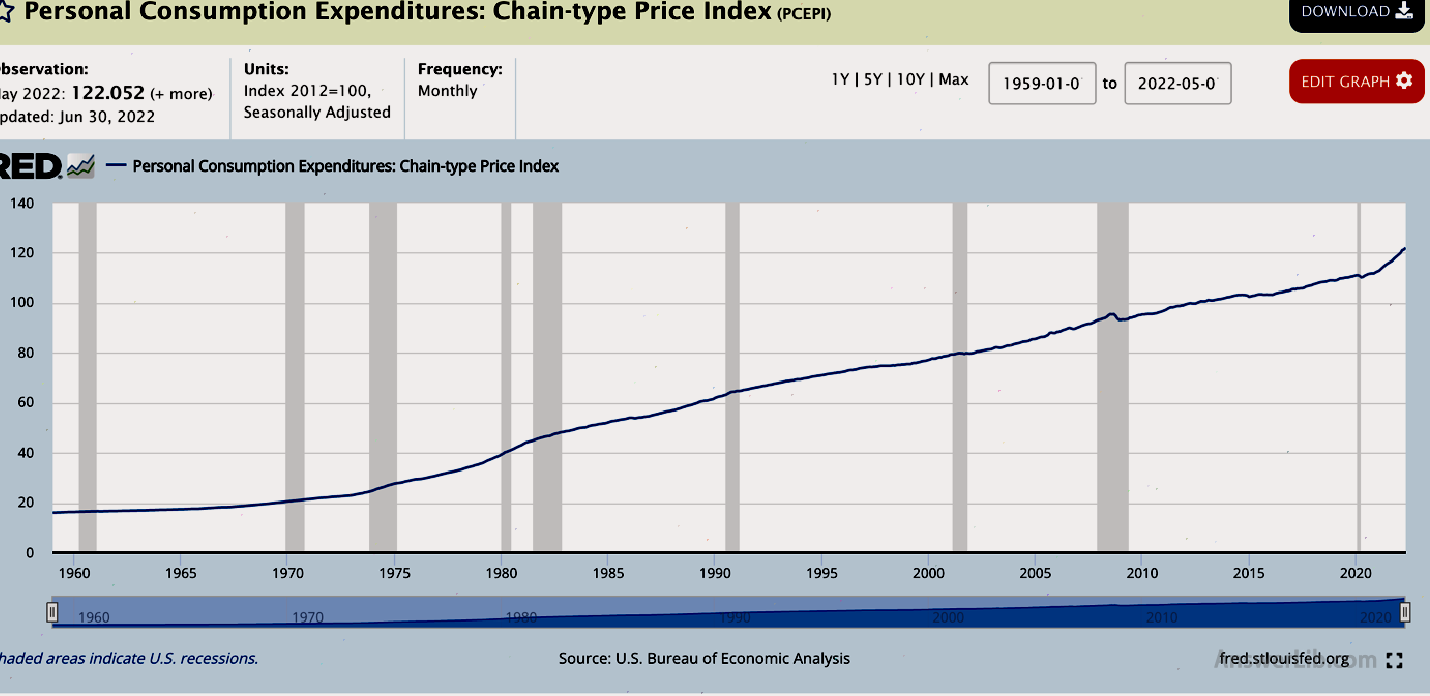

The following are the overall personal consumption index trend chart as of June 30, 2022:

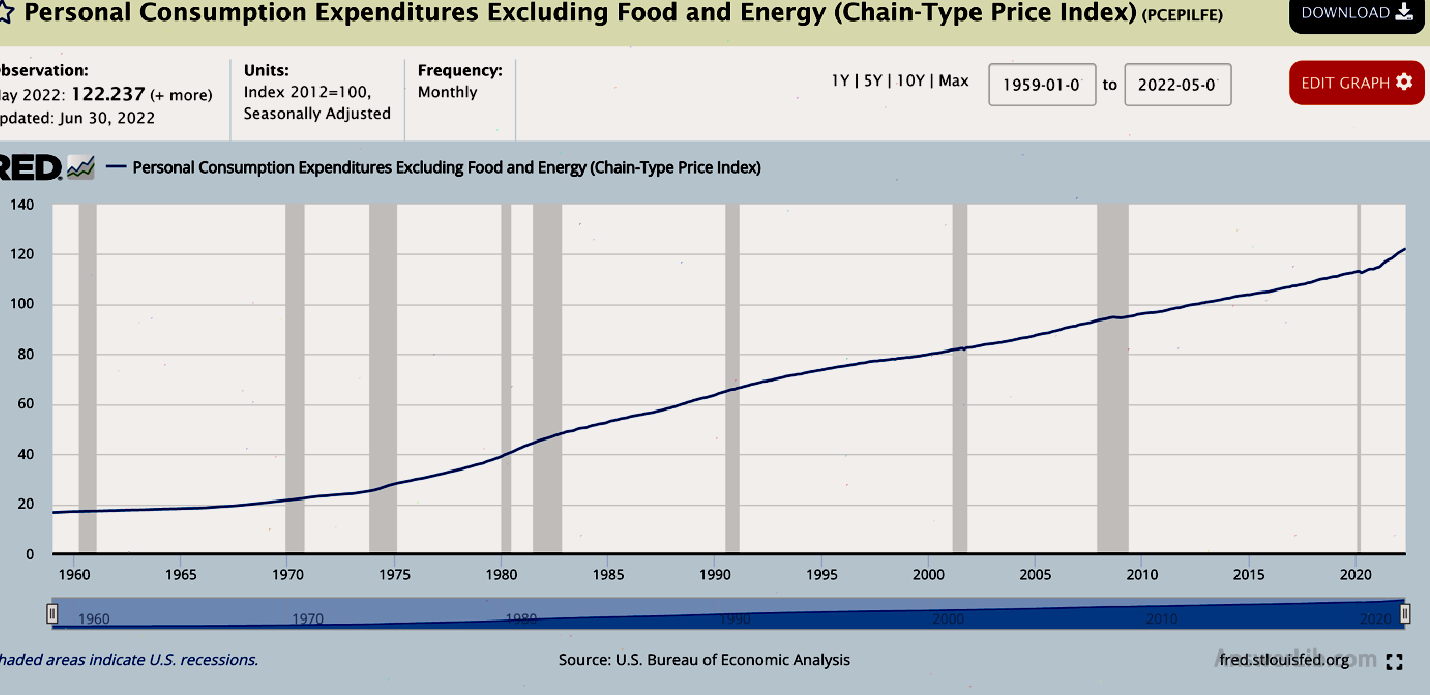

The following is the core personal consumption index trend chart as of June 30, 2022:

From the trend chart of the overall personal consumption index and core personal consumption index, it can be seen that during the 1970s, the 1980s, and the COVID-19 period in the early years and 2020, the index has significantly rising trends.ThisIt shows that in several economic crises, the consumption index has increased significantly, and it is an increase in overall, because the growth of the same situation has been presented after removing food and energy.

What is the difference between PCE Price Index and CPI?

CPI index Both and the PCE index are the most important financial indicators that measure the level of consumption.The Fed will track these indicators to understand the market consumption capacity, and to understand the change rate of inflation based on changes in the index, and then adjust the monetary policy and interest rates based on the analysis results.Many financial policies.

But there are more obvious differences between CPI and PCE, including:

- Data Sources: CPI uses consumer expenditures based on family surveys, and PCE uses consumer expenditures based on corporate surveys.

- Data adoption category: There are several obvious differences between CPI and PCE on the data admission category.First of all, CPI will consider the housing equal rental rents, and the PCE will not.Secondly, for the expenditure of medical scope, CPI only considers the medical cost of the family’s own expense, and the PCE will calculate the medical care costs purchased by the third-party representative family, such as the medical insurance costs purchased by employers for employees.

- Calculation: CPI uses statistical calculation methods based on the LaspeyRes index, which will not consider consumer consumption habits and strategic changes, while PCE uses the statistical calculation method based on the Fisher-IDeal index, which will change consumer consumption habits and consumer strategies to changeWaiting for factors, which are considered.

- Publishing agency: CPI was produced by the US Labor Statistics (BLS) and released monthly, and PCE was produced by the US Economic Analysis Administration (BEA) and released every month.

- The form of index report: CPI will publish classification statistics based on different categories.As a result, analysts can obtain more fine analysis results, and PCE does not provide classified data statistics results.

More macroeconomic concepts

- What is the national financial status index?

- What is the Buffett index?Buffet indicator

- What is the U.S.Treasury volatility index?Move index

- What US dollar index?US dollar index

- What is a bank deposit reserve?Bank reserves

- What is an open market operation?Open Market Operations

- What is the reserve balance interest rate?Interest on Reserve Balances

- What is personal consumption expenditure index?PCE Price Index

- What is overnight reverse repurchase?On Reverse Repurchase

- What is unemployment rate?UNEMPLOYMENT RATE