Reserve balance interest rate, English is I nterest O N R Eserve B Alances, referred to as IB, is Fed Interest rate regulation tools implemented on July 29, 2021, replaced the previous legal reserve interest rates (IORR) and excess reserve interest rates (Ioer).

IORB has been set up by the Federal Reserve for financial institutions The upper limit of the interest rate corridor EssenceAnd the lower limit of the interest rate corridor is caused by it Overnight repurchase profit Rate.

The interest rate of the reserve is the interest rate paid by the Fed for the financial institution to store the reserve on the Federal Reserve.The Federal Reserve can better regulate the liquidity of the market in the market through this tool.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- The history of the reserve balance rate

- What is the significance of the interest rate of the reserve?

- How does the Fed control the upper limit of interest rates through IORB?

- How to query IORB historical data?

- The development history of IORB?

- More macroeconomics

The history of the reserve balance rate

Prior to 2008, the Fed will not pay interest for the reserve stored in the Federal Reserve in the Federal Reserve, but in the subprime mortgage crisis in 2008, the Fed and the US government both realized the importance of sufficient US dollar reserves.Provide sufficient liquidity support for the banking system.In order to obtain sufficient US dollar reserves, the U.S.Congress authorized the Fed in 2008 to pay interest for the bank’s deposit stored in the Federal Reserve in 2008, thereby expanding the bank’s deposit in the Fed.

At the same time, the Fed can also adjust the interest rate of valid federal funds by adjusting the interest rate of the reserve balance.Federal fund interest rates are the main tools for the Federal Reserve to complete the control of prices and promote employment tasks.Therefore, the interest rate interest rate of reserve has also become one of the important means for the Fed to complete its functions.

What is the significance of the interest rate of the reserve?

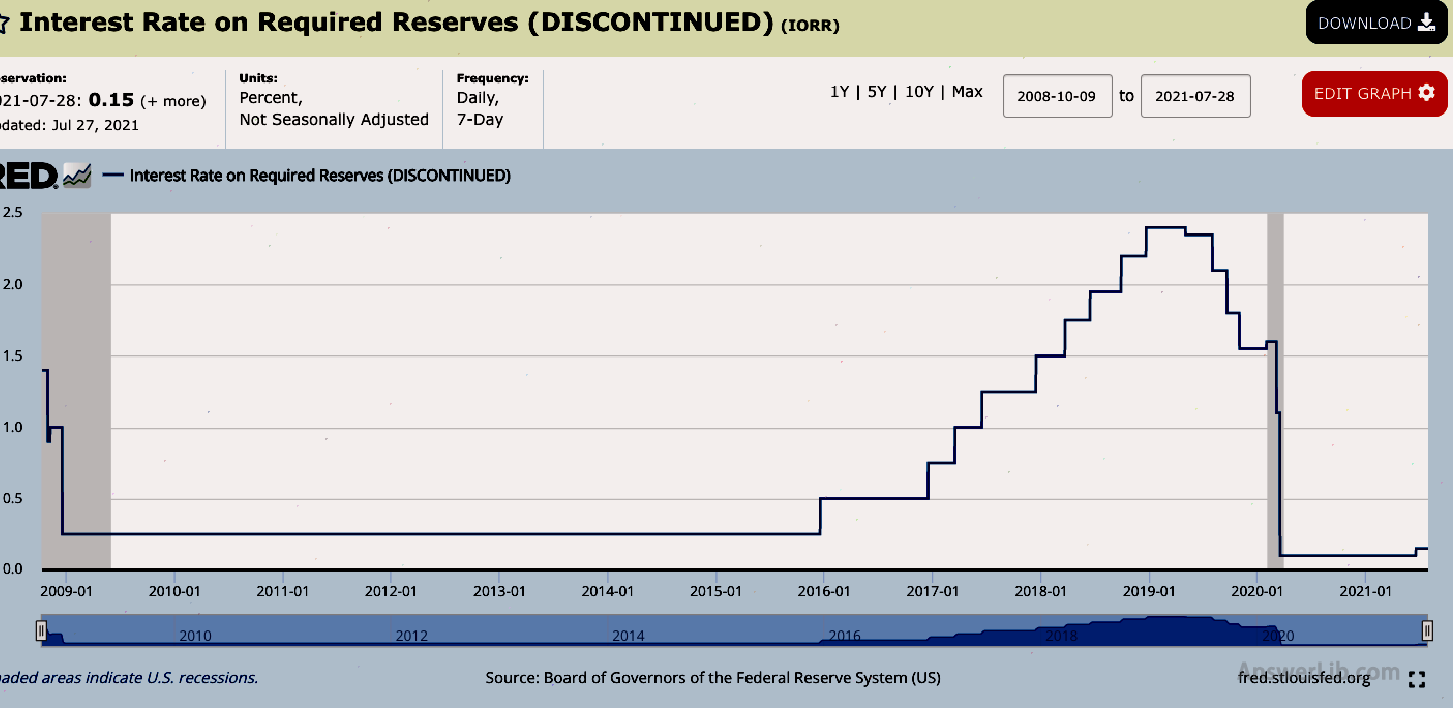

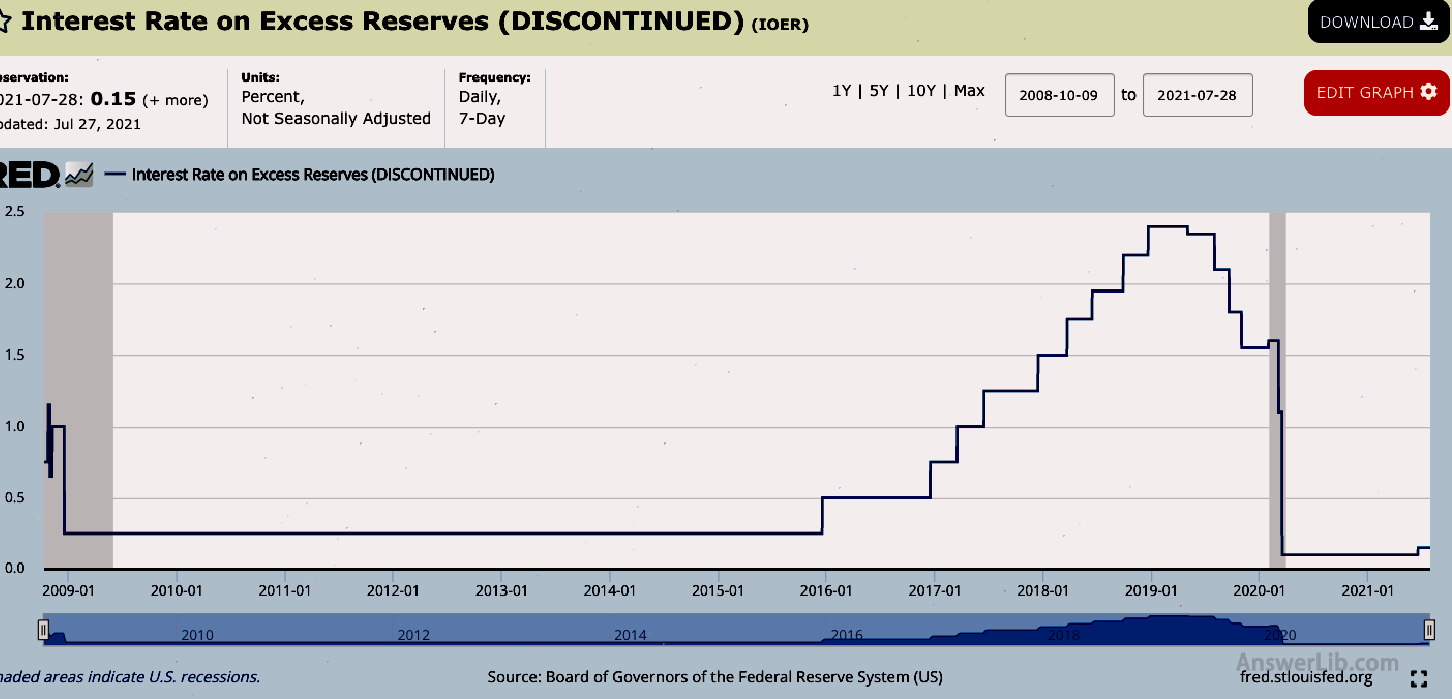

The predecessor of the reserve interest rate (IORB) is the legal reserve interest rate (IORR) and an excess reserve interest rate (IOER).

The purpose of the Fed’s preparation interest rate is to better regulate the market currency circulation, so that the Fed to implement various monetary regulation policies, and better complete its functions of controlling prices, increasing employment rates, and regulating long-term interest rates.

if Fed’s Open Market Committee(The Federal Open Market Community, referred to as FOMC) Inflation Increasing pressure, the Federal Reserve is sold through an open market operation (OMO) Government Bonds At the same time, increase the reserve interest rate to reduce the liquidity of the US dollar, as the liquidity of transactions with other banks will decrease.

Similarly, when FOMC believes that economic growth is slow or inflated, the Fed will purchase government bonds through OMO to reduce the reserve interest rate to increase the liquidity of the United States, because banks will have excess US dollar liquidity in this way.

Federal fund interest rate It is the most important short-term interest rate that affects other interest rates in economic development, and the balance rate of reserve is one of the important tools for the Federal Reserve to regulate federal fund interest rates.

When the Federal Reserve raises the reserve interest rate, banks will be more willing to increase the reserve of the Federal Reserve and earn interest, so that the amount of US dollar in the market will be reduced; when the Fed reduces the reserve, banks will reduce its Federal Reserve’s Reserve’s Reserve’s Reserve’sThe preparation amount is borrowed to other machines, business, or individuals, so that the US dollar circulation in the market will increase.

Prior to the 2008 subprime mortgage crisis, the Fed did not pay interest for the reserve stored in the Federal Reserve.Starting from October 6, 2008, the Fed has begun to pay interest on banks and deposit institutions to better maintain cash capacity in the Fed’s account.

By setting up the reserve balance interest rate, the Fed is more likely to absorb currency liquidity to the market, and then provide a reasonable liquidity increase to the market by purchasing government bonds or mortgage loans, instead of simply increasing liquidity in the banking system, because that’s that because that because that, because that’s that wayIt will cause excessive currency and cause excessive inflation.

After over the crisis, when the Federal Reserve ended the currency stimulus policy, it can better control the level of excess reserve and prevent the market from serious fluctuations in the market, so that the market can be more stable to normalized.

How does the Fed control the upper limit of interest rates through IORB?

The interest rate of the reserve is the interest rate that the bank can get when the bank deposits the money to the Federal Reserve.Federal fund interest rates are interest rates that banks can get money when they lend money to other banks.

Currently, the Fed sets the interest rate of the reserve balance to the upper limit of the federal fund interest rate corridor.This is because:

Federal funds interest rates will be adjusted according to the demand for mutual loans between banks.When the demand for mutual borrowing increases, the federal fund interest rate will increase.Conversely, if the demand decreases, the federal fund interest rate will decline.Therefore, by adjusting IORB to guide the market’s demand for borrowing, the Fed will regulate the federal fund interest rate:

- Raise IORB The bank will borrow money from other banks, and then deposit the interest difference between IORB and Federal Fund interest rates.As the demand for borrowing from other banks increases, the federal fund interest rate will increase;

- Lower IORB The bank lost the motivation to borrow money from other banks into the Federal Reserve.As the demand for borrowing from other banks decreases, the federal fund interest rate will decline;

It can be seen that at present, IORB is located in the upper limit value in the interest rate corridor set by the Federal Reserve for the banking industry.

How to query IORB historical data?

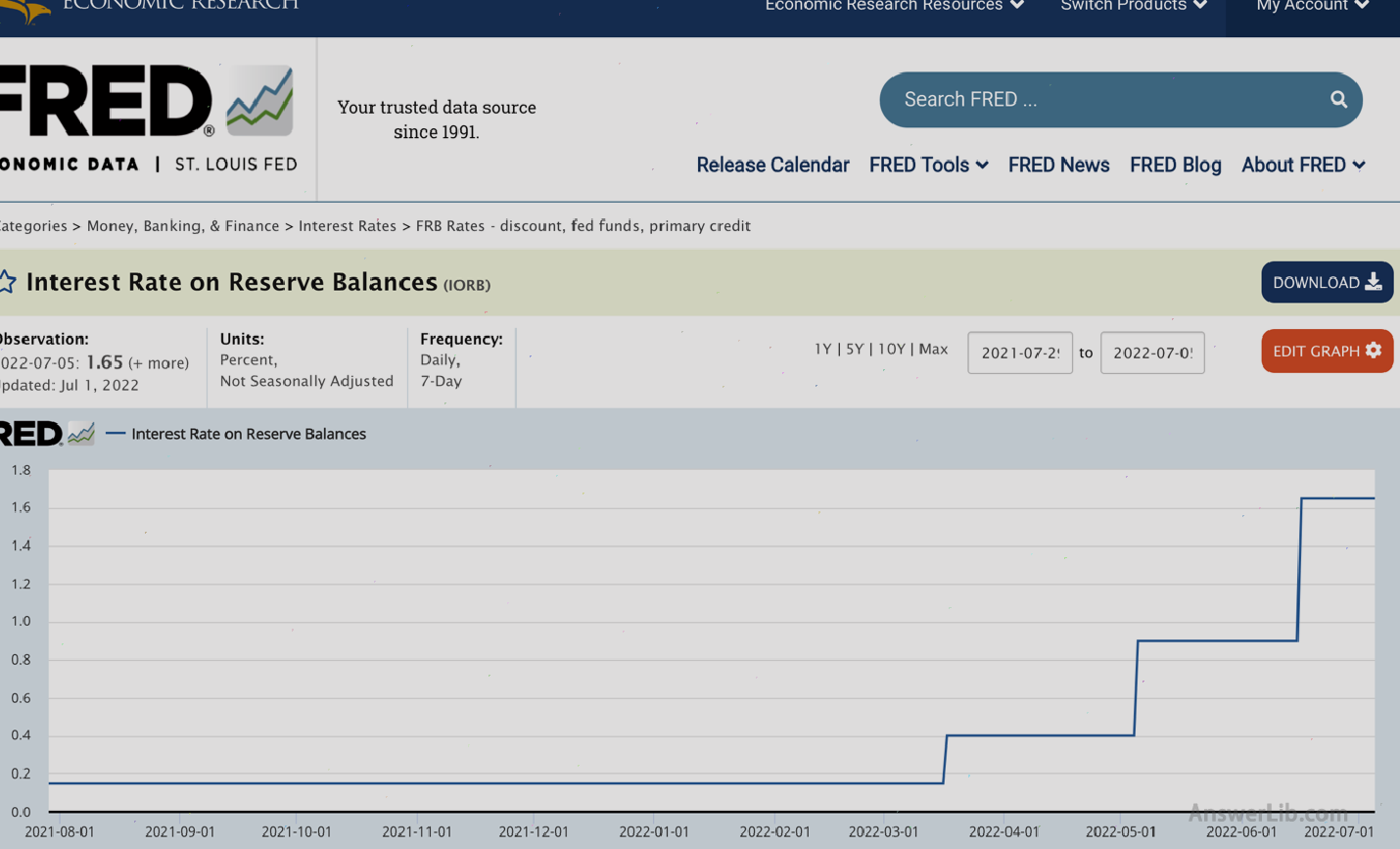

Since IORB was implemented on July 29, 2021, it can only be found in historical data starting from July 29, 2021.The user can pass St Louis fed Check the historical data of IORB.As of July 1, 2022, IORB interest rate value was 1.65%.

If the user needs to check the previous legal reserve interest rate and excess reserve interest rate, you can also view it to the relevant portal, but the data update stopped in July 2021.

The development history of IORB?

In 2006, Congress authorized the Federal Reserve to pay interest for certain categories of reserve deposits in the “Financial Services Regulatory Relief Act”, which took effect on October 1, 2011, and took effect on October 1, 2011[source]Essence

However, in 2008, the subprime mortgage crisis in the United States caused a large-scale financial crisis.The reserve interest rate was implemented in advance.From October 6, 2008, the legal reserve interest rate (IORR) and excess reserve interest rate (Ioer) were implemented.EssenceTherefore, since 2008, the United States has provided interest on the reserve of banks in the Federal Reserve.

The IOR here is the deposit interest rate that the bank can get the legal reserve amount when it is deposited to the Federal Reserve.Ioer is the deposit interest rate that the bank can get more than the US dollar to the Federal Reserve.At the beginning, the statutory reserve interest rate value is higher than the excess reserve interest rate value.But since January 2009, the value of IOR and Ioer is basically the same.

Here, before March 24, 2020, the Federal Reserve’s requirements for the reserve ratio of banks have the ratio of the bank’s cash occupied by banks or the Federal Reserve.However, since March 24, 2020, the Federal Reserve has reduced the bank’s reserve rate to 0.Since there is no reserve requirements, it is meaningless to distinguish IORR and Ioer.

Therefore, starting from July 29, 2021, the Federal Reserve uses a unified interest rate interest rate (IORB) to replace the previous IORR and Ioer.

More macroeconomics

- What is the national financial status index?

- What is the Buffett index?Buffet indicator

- What is the U.S.Treasury volatility index?Move index

- What US dollar index?US dollar index

- What is a bank deposit reserve?Bank reserves

- What is an open market operation?Open Market Operations

- What is the reserve balance interest rate?Interest on Reserve Balances

- What is personal consumption expenditure index?PCE Price Index

- What is overnight reverse repurchase?On Reverse Repurchase

- What is unemployment rate?UNEMPLOYMENT RATE