Marketing rate, English is Price-TO-Sale Ratio, Abbreviation P/s ratio EssenceThe marketing ratio is proposed by the investment master and writer Kenneth Fisher that its purpose is to exclude the impact of the company’s profit or cost, and judge that the company’s stock is good or bad with the market-recognized data, making the evaluation more open and transparentAnd more guiding significance.

The marketing rate does play its own value in evaluating the value of a stock, but is it reasonable and practical.As an investor, what information does it need to know about the market sales ratio?

Similar marketing rate is similar to P / E ratio, But the two are also very different.The marketing ratio is suitable for evaluating non-profit, or negative profitable companies, or in a growing period.The price-earnings ratio is suitable for companies that are relatively stable in operation.

As the basic analysis data of the company’s stock, investors can follow Futu Moomoo Easily query the market sales rate.Futu Moomoo provides an activity of account opening, such as gold, you can view it Futu Moomoo reward Essence

The following is from Futu Moomoo Get in APP Apple stock of Marketing rate information:

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- What is the market sales rate?How to calculate?

- If the market sales rate is found from Futu Moomoo?

- The advantages and disadvantages of the use of market sales rate

- Which listed companies are suitable for the marketing rate?

- What are the types of market sales?

- Comparison of market sales ratio in different industries in the United States

- How much is the best marketing rate?

- The difference between marketing ratio and price-earnings ratio and P / E ratio

- common problem

- More company valuation

What is the market sales rate?How to calculate?

The calculation formula of the market sales ratio is: the valuation of the company’s shares is except for sales per share, or the total market value is divided into total.

Marketing ratio = stock price per share / sales per share

P / s ratio = stock price per share / annual sales per shanre

All the data in the formula are public data from listed companies, which can be obtained from various trading platforms, stock market websites, such as Google Finance and Yahoo Finance.

for example:

Company A’s stock price is $ 205.25, the stock market income is $ 70.69B, and the number of market circulation shares is 2.85B.

The company’s P/S value is: $ 205.25/($ 70.69b/2.85B) = 8.27 (times).

Generally speaking, the smaller the market market, the more worth investing, because this means that the stock valuation is lower and the cost of making money is lower.

Stock income is not as easy to manipulate as the company’s profitability.Therefore, the market sales ratio (P/S Ratio) can better reflect the company’s stock performance than P/E Ratio.

However, the actual application is not that simple, and often needs to consider many influences.For example, combined with Profit Margin to comprehensively evaluate the investment value of a company.

If the market sales rate is found from Futu Moomoo?

- Enter the Futu Moomoo APP and find the stock that is interested in from WatchList.Here

- After entering the individual stock page, in the top options, find the [Analysis] option

![After entering the individual stock page, in the top options, find the [Analysis] option](https://www.howlifeusa.com/wp-content/uploads/2021/07/After entering the individual stock page, https://www.howlifeusa.com/ps-ratio/in the top options, https://www.howlifeusa.com/ps-ratio/find the [Analysis] option-1.png)

- Select the [Fundamental] option, and select [PS] at the same time

The PS here refers to PS Ratio.

The advantages and disadvantages of the use of market sales rate

A.Advantages

- There will be no negative value on the market market.

- More stable, it is not easy to be manually manipulated

B.Disadvantages

- It cannot reflect the cost change, but the cost is one of the important factors that affect the value of the enterprise

- It can only be used for comparison in the same industry.Comparison of the market sales ratio of different industries is meaningless

- As a method of valuation, the marketing rate does not take into account companies with high debt levels, because such companies eventually need higher sales to repay debt, at this time, the market sales ratio cannot reflect enough guiding significance.

The marketing ratio does not consider the debt on the company’s balance sheet.For companies with debt, a part of their stock income will be used to repay debt, leading to a reduction in shareholders’ income.The calculated marketing ratio is less than the actual value.

Or another way of understanding is: when the market sales rate of the two companies is the same, companies without debt will be better than companies with debt.This means that when evaluating the company’s shares, investors should not only be based on the market sales ratio, but should be considered in combination with multiple indicators.

Which listed companies are suitable for the marketing rate?

There is no consideration in the calculation of the market sales ratio, so it is particularly useful when valuations with less profit or no profit.

At the same time, the price-earnings ratio is also considered an effective indicator of cyclical companies that evaluate the initial creation, have potential high-growth, or may not achieve profitability every year.

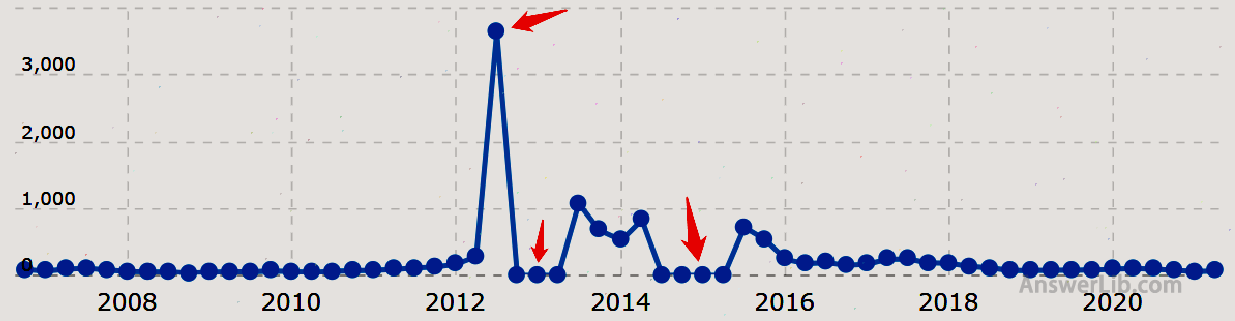

For example, in the early days of Amazon’s entrepreneurial, there was no profit, but there was a continuous Revenue.At this time, if the P/E Ratio is used to analyze it, it is often difficult to see its operation.Its P/E Ratio is as follows:

Data Sources:Macrotrends

It can be seen that from 2012 to 2013, the price-earnings ratio appeared extremely high (close to 4000), but in most years, the price-earnings ratio was zero.Therefore, using P/E Ratio to describe Amazon’s operating conditions is actually not accurate.

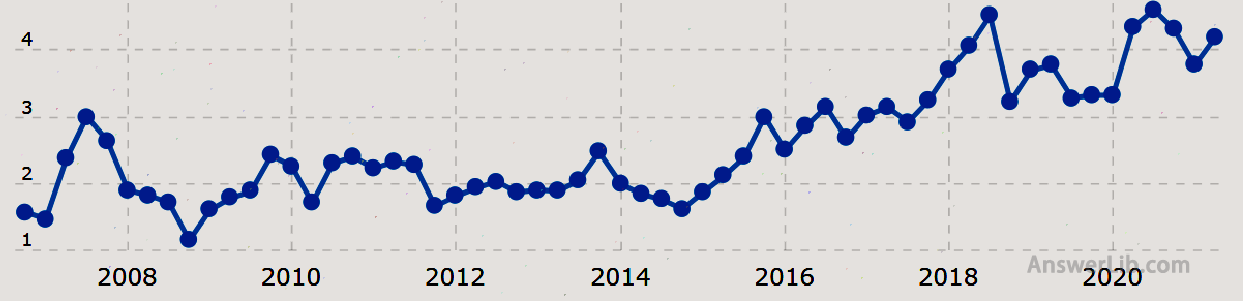

However, if the use of market sales (P/S Ratio) can often better evaluate it, Amazon’s P/S Ratio is as follows.During 2012 ~ 2013, there was no extreme point on the above.Therefore, the market sales ratio can better evaluate the initial stage of the enterprise than the profitability, or in other words, enterprises have no profit or too small profit.

Data Sources:Macrotrends

If a family has no profit or even losing money in the past year, unless the company is about to go bankrupt, the market sales ratio can better evaluate the company’s shares compared to other companies in the same industry.

For example, the company’s market sales rate is 0.7, and the average marketing rate of its peers is 2.0.Then, if the company can reverse the situation or continue to operate with benign, as the market sales ratio and their peers are getting higher and higher, its stock price will rise significantly.

For another example, in the height of semiconductors, only a few companies can generate benefits in a few years, but this does not mean that semiconductor stocks are worthless.

In this case, investors can use the marketing ratio instead of the P/E Ratio to determine how much they pay for their company’s $ one dollar rather than one dollar earnings.

What are the types of market sales?

The marketing rate usually refers to TTM P/S, but sometimes use FORWARD P/S to predict the future situation of a company.

1.TTM marketing rate

TTM marketing rate, English is the Trailing Twelve Month P/S Ratio, expressed the market sales rate in the past twelve months.

This is the most commonly used market value value.It uses the sales of sales, the number of circulation stocks, and the stock price of the past 12 months to calculate the status of the company’s stock.

2.Long-term marketing rate

Long-term marketing rate, English is FORWARD P/S Ratio.

The marketing ratio calculated using forecast future sales or stock price is called the long-term market sales ratio.This has certain guidance significance, but the accuracy of prediction is difficult to guarantee, because there are many factors that affect the stock price, so predictive valuations and sales have errors.

Comparison of market sales ratio in different industries in the United States

As of January 2021, the market sales rate of various industries in the United States:

Industry name | TTM marketing rate |

|---|---|

| advertise | 1.16 % |

| Aerospace/Defense | 1.61% |

| air freight | 0.94% |

| apparel | 1.60% |

| Car and truck | 2.71% |

| car parts | 1.37% |

| Bank (Finance Center) | 3.13% |

| Bank (area) | 3.74% |

| Drink (wine) | 4.37% |

| Drink (soft) | 4.32% |

| broadcast | 1.03% |

| Brokerage and Investment Bank | 2.05% |

| Architectural material | 1.68% |

| Commercial and consumer services | 2.51% |

| Cable TV | 2.60% |

| Chemistry (foundation) | 1.05% |

| Chemical (diversified) | 1.18% |

| Major in Chemistry) | 2.73% |

| Coal and related energy | 0.64% |

| Computer service | 1.11% |

| Computer/peripheral equipment | 4.83% |

| Architecture | 1.80% |

| Diversification | 2.29% |

| Drug (biotechnology) | 8.09% |

| Drug (pharmaceutical) | 4.91% |

| educate | 2.48% |

| Electronic equipment | 3.33% |

| Electronic products (consumers and office) | 1.36% |

| Electronics (general) | 2.39% |

| Engineering/architecture | 0.77% |

| entertainment | 6.24% |

| Environment and waste services | 2.72% |

| Agriculture/Agriculture | 0.97% |

| Financial services (non-bank and insurance) | 3.26% |

| food processing | 1.71% |

| Food wholesaler | 0.38% |

| Furniture/home furnishings | 1.08% |

| Green and renewable energy | 8.13% |

| Health products | 6.94% |

| Healthcare support service | 0.55% |

| Healthcare information and technology | 6.78% |

| construction | 1.03% |

| Hospital/medical institution | 0.84% |

| Hotel/game | 5.54% |

| household items | 3.70% |

| Information service | 9.94% |

| Insurance (general) | 1.49% |

| Insurance (Life) | 0.74% |

| Insurance (property/accident) | 1.23% |

| Investment and asset management | 4.54% |

| mechanical | 2.68% |

| Metal and mining | 2.57% |

| Office equipment and services | 0.85% |

| Petroleum/natural gas (comprehensive) | 1.10% |

| Petroleum/natural gas (production and exploration) | 1.77% |

| Petroleum/natural gas delivery | 1.07% |

| Oilfield service/equipment | 0.45% |

| Packing and container | 1.15% |

| Paper/forest product | 0.74% |

| strength | 2.49% |

| Precious metal | 4.64% |

| Publishing and newspaper | 0.83% |

| Real estate investment trust | 7.47% |

| Real estate (development) | 3.46% |

| Real estate (general/diversified) | 6.22% |

| Real estate (operation and service) | 1.18% |

| entertainment | 3.16% |

| Reinsurance | 0.73% |

| Restaurant/catering | 4.06% |

| Retail (car) | 0.86% |

| Retail (building supply) | 1.84% |

| Retail (distributor) | 1.06% |

| Retail (general) | 0.81% |

| Retail (grocery and food) | 0.21% |

| Retail (online) | 4.52% |

| Retail (dedicated line) | 0.81% |

| Rubber tires | 0.31% |

| semiconductor | 6.71% |

| Semiconductor equipment | 5.03% |

| Shipbuilding and ocean | 1.12% |

| shoe | 4.93% |

| Software (entertainment) | 8.11% |

| Software (Internet) | 14.85% |

| Software (system and application) | 11.40% |

| steel | 0.70% |

| Telecom (wireless) | 2.46% |

| Telecommunications equipment) | 3.29% |

| Telecom (service) | 1.41% |

| tobacco | 3.83% |

| transportation | 1.26% |

| Transportation (railway) | 6.75% |

| Truck transportation | 2.16% |

| Practical program (general) | 2.40% |

| Public cause (water) | 7.04% |

| General market | 2.64% |

How much is the best marketing rate?

According to the initial definition of the market sales ratio, the lower its value, the better.& nbsp;

The smaller the market sales ratio, it means that investors can pay less money than the profit income of the unit to buy stocks, and the higher the investment value of the stock.

Based on Kenneth Fisher’s suggestion

Kennes Fisher is the founder of the marketing rate, and Kenneth Fisher has the following suggestions for the P/S Ratio of a listed company.

For non-periodic and technology stocks: & nbsp;

- Best situation: P/S value ≤ 0.75

- Investment worth investment: 0.75

For periodic stock:

- Best situation: P/S value ≤0.4

- Investment worth investment: 0.4

It can be obtained in combination with market historical data

- P/S is generally considered to be an excellent market sales rate

- P/s is a relatively good marketing rate within a range of 1 to 2

- P/s higher than 4 market sales rate is usually considered unfavorable

Like most stocks to measure data, it is one of many evaluation indicators.When using its evaluation stock index, other indicators are still required.

In addition, the most important thing is that P/S Ratio needs to compare each other in the same industry, because the overall operating situation of different industries is different, and the cross-industry comparison is meaningless.

For example, Wal -Mart’s market sales rate is 0.55, while Microsoft is 5.85.If it is judged based on the excellent marketing rate of less than 1, it indicates that Wal -Mart is undervalued and Microsoft is greatly overvalued.

However, if you look at the net profit margin further, you can explain this difference: Microsoft’s net profit margin is 28.45%, while Wal -Mart is only 3.23%.Microsoft’s higher profitability is reflected in its stock price, and at the same time, the market sales rate is high.

The difference between marketing ratio and price-earnings ratio and P / E ratio

1.P/E ratio (P/E Ratio)

Net rate yes Company stock price and Profit The ratio.

It is mainly considered by the company’s operating conditions, which is suitable for valuations for consumer goods industry companies such as food, medical care, and public services.

These industries are relatively affected by the market economy, and product prices will not fluctuate greatly.The company’s performance and profit are relatively stable.The P / E ratio can accurately reflect its operating situation and stock price value.

The price-earnings ratio is not only suitable for companies in the same industry, but also for comparison between different industries.

2.Marketing rate (P/S Ratio)

Marketing rate yes Company stock price and Per share income The ratio.

The company’s operating situation is mainly considered, and profitability and asset holdings are not considered.Therefore, it is suitable for the value-free, negative profitable company, or the value measurement of the company.

It is only suitable for companies in the same industry.

3.Municipal net ratio (P/B Ratio)

Net rate yes Company stock price and Net assets per share The ratio.

The company’s net assets are tangible assets after the company’s total assets subtract the liabilities, which mainly consider the company’s assets.

Suitable for valuations of banks or financial services companies, because the higher the net assets of such companies, the higher the ability to create value, the company’s stock price will rise, and the relationship between each other will be very good.A reflection.

common problem

Question 1: What is the English market rate in English?The marketing rate is: Price-TO-Sale Ratio, referred to as P/S Ratio.The calculation formula of the market sales ratio is: the valuation of the company’s shares is except for sales per share, or the total market value is divided by total income.

See More

The marketing rate calculation formula is as follows: market sales ratio = stock price per share / sales per share

See More

According to the initial definition of the market sales ratio, the lower its value, the better.The smaller the market sales rate, indicating that investors can pay for stocks with less profit income than units to buy stocks, the higher the investment value of the stock.

See More

Municipal net ratio is the ratio of the company’s stock price to the profit per share.It is mainly considered by the company’s operating conditions, which is suitable for valuations for consumer goods industry companies such as food, medical care, and public services.

The marketing ratio is the ratio of the company’s stock price to the income per share.The company’s operating situation is mainly considered, and profitability and asset holdings are not considered.Therefore, it is suitable for the value-free, negative profitable company, or the value measurement of the company.

See More

More company valuation

- Julian Roberts – Julian Robertson: Father of Tiger Baby

- Explore the 24 first-level dealers of the Federal Reserve

- Important Finance and Investment News

- What is a corporate value multiple?Enterprise Multiple

- What is preferred stock?Preferred stock

- What is the operating leverage coefficient?Degree of Operating Leverage

- What is debt repayment payment rate?DEBT Service Coverage Ratio

- What is capital expenditure?Capital Expendital

- What is the capital asset pricing model?Capital Asset Pricing Model

- What is financial leverage coefficient? Degree of Financial Leverage