P / Ery of Growth English is Price/Earnings-TO-GROWTH RATIO, referred to as PEG RATIO, which is a financial indicator that measures whether the company’s stock price is overestimated, underestimated and estimated the future growth of the company.The calculation method of the PC growth rate is the company’s P / E ratio(P/E Ratio) Except for expectations Earnings per share growth rate.

Generally speaking, the P / Ery growth rate of greater than 1 indicates that the current stock price of the company is overvalued, and the P / Ery growth rate of less than 1 indicates that the current stock price is underestimated.With company indicators, Peter Lynch believes that the P / Ery of the growth company should be close to the value 1.

The price-earnings growth rate solves the biggest weakness of the P / E ratio calculation, that is, it is impossible to evaluate the company’s future growth.

Therefore, compared to the price-earnings ratio, PEG can be said to be a better financial indicator.

However, there are still certain restrictions in the PSI growth rate.For example, the company must have a historical growth rate per share to calculate the P / Ery growth rate.At the same time, for companies with too much growth rate fluctuations, Poems cannot be used by Picengus.The growth rate is accurate valuation.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- How to calculate the price-earnings growth rate?

- How to calculate Apple’s price-earnings growth rate?

- What is the significance of investment guidance?

- What are the limitations of PC growth rate?

- More macro data

How to calculate the price-earnings growth rate?

The calculation method of the PC growth rate is the current company’s current company P / E ratio and Earnings per share The growth rate is eliminated, that is:

P / Ery growth rate = P / E ratio / earnings per share income growth rate

PEG = PE RATIO / EPS Growth Rate

Among them, the calculation method of the price-earnings ratio is to remove the current stock price with the income per share, that is,:

P / E ratio = stock price / earnings per share

Pe ratio = stock price / EPS

The growth rate per share is estimated to be estimated that the company’s average income growth rate per share in the next 3 to 5 years can be used as a reference for the company’s average income growth rate per share in the past 5 to 10 years.

When calculating the income per share, we use Diluted EPS to calculate, because the company usually issues potentially diluted stocks to shareholders and employees, and uses the number of diluted circulation shares to calculate the income per share.Shareholders can get more practical investment income.

Related Reading: What is dividend?How to calculate the dividend rate?

The above formula does not consider the influence of dividends.The following adjustment of the P /-Adjusted PEG Ratio (PEGY RATIO), adjust the effect of the price-earning growth rate: The impact of the dividend:

Adjust the price-earnings growth rate = price-earnings ratio / (earnings per share income growth rate + dividend rate)

Pegy Ratio = Pe Ratio / (EPS GROWTH RATE + DIVIDEND YIELD)

Among them, the calculation formula of dividend rates is as follows:

Dividend rate = annual dividend / current stock price

DivIDEND YIEELD = Yearly Dividend / Stock Price

After calculating the dividend yield and the Earnings Growth Rate per share, you need to bring the percentage value directly into the company’s calculation and adjust the PTC growth rate.For example, if the calculated dividend rate is 2%, The growth rate per share is 8%, and you need to bring 2 and 8 directly into the formula instead of 2%and 8%.

For example, the current stock price of the company A is $ 100, the company’s earnings per share EPS = $ 5, and the growth rate of earnings per share EPS Growth = 8%.

So,

Pe Ratio = stock price / EPS = $ 100 / $ 5 = 20

Simple PEG: PEG = PE RATIO / EPS Growth = 20/8 = 2.5

Adjust PEG: Pegy = PE RATIO / (EPS Growth + DIVIDEND YIELD) = 20 / (8 + 2) = 2

It can be seen that for listed companies with dividends, PEGY is more accurate.

How to calculate Apple’s price-earnings growth rate?

This chapter will be released by Apple in September 2021 10-K financial report Calculate the instance:

From AAPL Investment portal website It can be learned that Apple’s latest stock price is $ 137.35

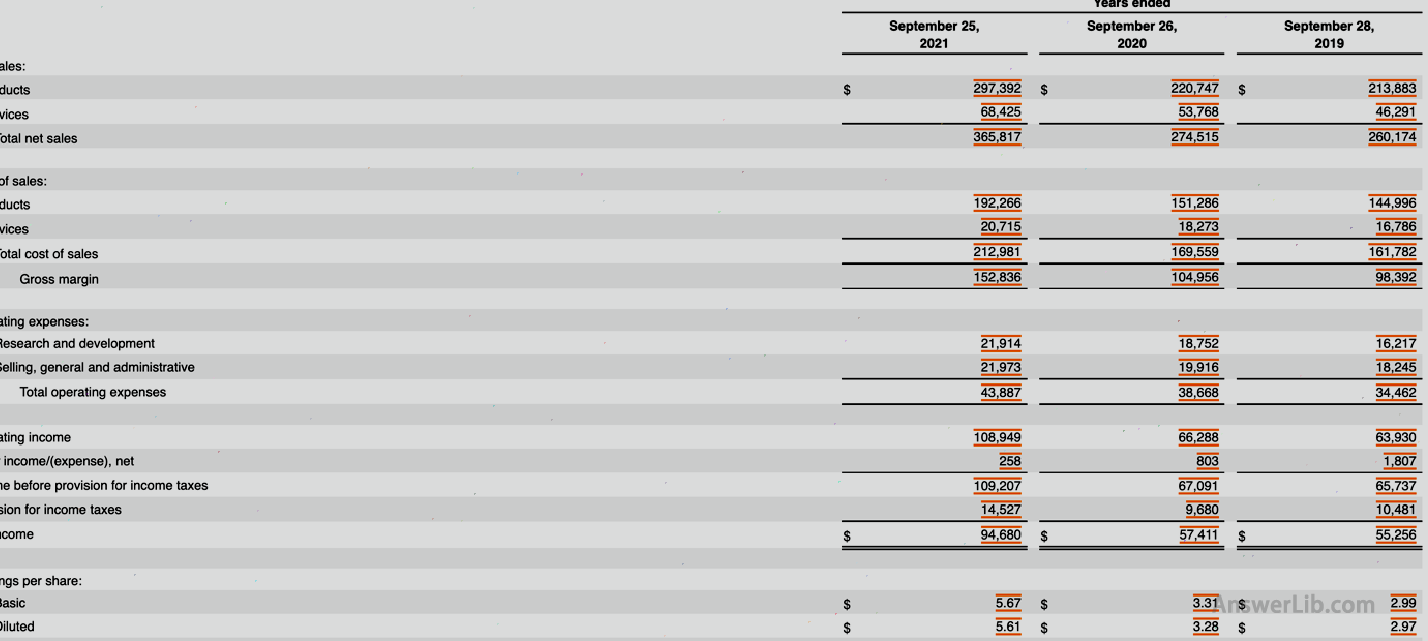

Published from Aapl 10-K financial report Diluted EPS can be obtained in the past: Diluted EPS:

So the current price-earnings ratio of Apple Corporation is calculated:

P / E ratio = current stock price / earnings per share = $ 137.35 / $ 5.61 = 24.48

Below, let’s calculate the growth rate of Apple’s earnings per share.Apple’s dilution of dilution per share in the past few years is listed as follows.These data can be obtained from AAPL’s 10-K financial report over the years:

| years | Dilute the income per share | growth rate |

|---|---|---|

2013 | $ 5.68 | |

2014 | $ 6.45 | 13.56 % |

2015 | $ 9.22 | 42.95 % |

2016 | $ 8.31 | 9.87 % |

2017 | $ 9.21 | 10.83 % |

2018 | $ 11.91 | 29.32 % |

2019 | $ 2.97 | 75.06 % |

2020 | $ 3.28 | 10.44 % |

2021 | $ 5.61 | 71.04 % |

Average growth rate | 11.65 % |

Based on the income of each share of the previous years, we can calculate the growth rate of the corresponding dilution earnings per share.Therefore, the average income growth rate per share was 11.65%.

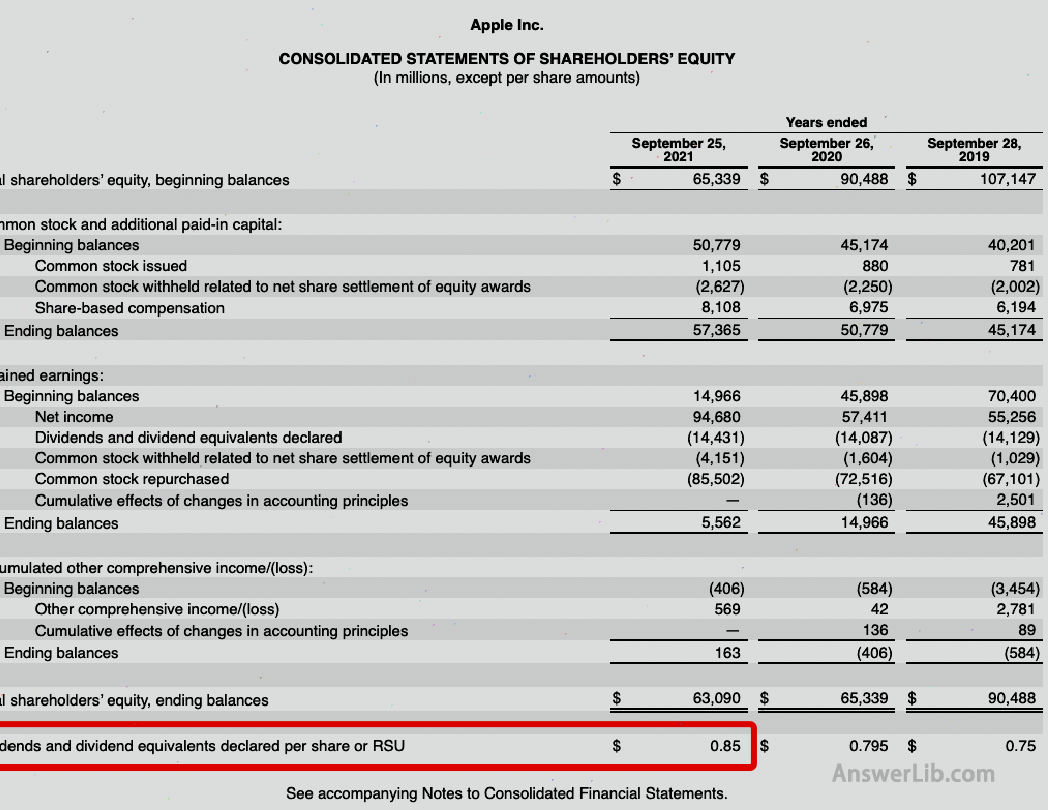

Due to Apple’s dividend, we will calculate the dividend yield.You can find annual dividends from the Statements of Shareholders ’Equity in AAPL’s 10-K financial report.

Therefore, the annual dividend of 2021 was $ 0.85.

A dividend rate = annual dividend / current stock price = $ 0.85 / $ 137.35 = 0.62%

Therefore, Apple’s adjustment of the increase in the growth rate of profitability is:

Adjust the price-earnings growth rate = price-earnings ratio / (earnings per share income growth rate + dividend rate)

= 24.48 / (11.65 + 0.62) = 1.995

Note that when the growth rate and dividend rate of earnings per share are substituted into the formula, it is necessary to use the value without a percentage of%.

What is the significance of investment guidance?

The PC growth rate is one of Peter Lynch’s most happy indicators to measure the company’s intrinsic value.Investors often use the PC growth rate to measure whether the company’s stock price is overestimated or underestimated.

- When the growth rate of PCAC is greater than 1, the company’s stock price is overestimated;

- When the growth rate of PCAC is equal to or less than 1, the company’s stock price is underestimated;

Peter Lynch believes that the company’s reasonable P/E value should be close to the growth rate of its earnings per share.Therefore, high-growth companies can have a higher P/E value, and P/E of low-growth companies should also be lower.

At the same time, the growth rate of P / Ery can also be used to compare different companies in the same industry, but the company that needs to be compared with a similar development period, otherwise there will be a large assessment deviation.

What are the limitations of PC growth rate?

When the company’s stock price is evaluated, because the calculation formula needs to use the growth rate of earnings per share, and the growth rate of each share revenue depends on the historical value.ThereforeOr a company that is often negatively yields per share.

For companies with too much growth rate fluctuations, because they cannot accurately measure the average value in excessive benefits fluctuations, they cannot accurately predict the growth rate per share in the future.As a result, the price-earnings growth rate cannot be used to measure such companies.The stock price is high and low.

Because the income growth rate per share used by the PC growth rate is valuation, in addition to referring to the previous historical values, it also includes investors’ subjective understanding of the company.Different investors may propose different expectations of the same company per share per share per share.The income growth rate, that is, different investors may calculate different P / Effect growth rates for the same company.

More macro data

- What is the national financial status index?

- What is the Buffett index?Buffet indicator

- What is the U.S.Treasury volatility index?Move index

- What US dollar index?US dollar index

- What is a bank deposit reserve?Bank reserves

- What is an open market operation?Open Market Operations

- What is the reserve balance interest rate?Interest on Reserve Balances

- What is personal consumption expenditure index?PCE Price Index

- What is overnight reverse repurchase?On Reverse Repurchase

- What is unemployment rate?UNEMPLOYMENT RATE