Cash flow sheet English is Cash Flow Statement, which shows that a company’s financial statements of their cash income and expenditure are in a certain period of time.

By analyzing the cash flow statement, and the analysis of the profit statement and the balance sheet, the company’s current and historical operations can be understood.For the company’s inside personnel and external investors, the cash flow statement, and Balance sheet and Profits Become the most important financial statements.So, what data are reflected in the cash flow table and how to use it to analyze the company’s operation?

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- What is a cash flow sheet?

- What are the types of cash flow?

- What are the calculation methods for cash flow?

- The importance and limitations of the cash flow statement

- What are the components of the cash flow sheet?

- How to understand the cash flow sheet?

- How to use the cash flow sheet for investment analysis?

- Where can I view the company’s cash flow sheet?

- What is the relationship between cash flow statement and balance sheet and profit statement?

What is a cash flow sheet?

The cash flow sheet English is Cash Flow Statement, referred to as CFS.The cash flow statement lists in detail the company’s cash, cash equivalent and limited cash flow during a certain period of time.The company’s ability to use its cash by flowing and outflow can also reflect the company’s short-term and long-term long-termOperational capability.

Among them, the explanation of several concepts is as follows:

- Specific periods generally refer to the company’s accounting period (Accounting Period);

- Cash Equivalents is a project on the company’s balance sheet.It said that the company’s assets that can be converted into cash in the short term (usually 90 days) can be converted to cash.These high-liquid short-term investment in bonds, etc.;

- Restricted cash refers to cash held for specific purposes.The use of cash will be limited, such as not to reduce debt and investment.The reason for restricting the use of cash is usually disclosed in the note of financial statements.

When making the cash flow sheet, all the company’s cash flow is usually divided into three types of calculations, which are:

- Cash Generated By Operation Activities for operating activities

- Cash Generated By Investing Activities for investment activities)

- Cash Generated By Financial Activities for financing activities)

When it is reflected in the cash flow sheet, all cash flows are reflected in the flow cash flow and negative cash flow according to the flow of cash flow and the negative cash flow.

- Positive cash flow is the cash flow obtained by the company in the table of counting the table, and it is displayed in “+” or normal numbers;

- The negative cash flow is the cash flow of the company’s expenditure within the table of counting, and it is represented by “-” or “() or the amount of the amount.

What are the types of cash flow?

As described above, cash flows used to make cash flow sheets are usually divided into three categories: Operating Activities for business activities, Investing Activities for investment activities, and cash for financial activitiesFINANCING Activities.

1.Cash Generated By Operation Activities for business activities)

The cash flow for operating activities is Cash Generated By Operating Activities.This part of the cash flow lists in detail cash flow that the company is used for its conventional business and expenditure.Including income obtained through the sale of goods or providing services, as well as the cost expenditure required for production products, all employee salary expenditures, land rent expenditures, etc.At the same time, according to the principle of accounting in the United StatesCash flow for business activities

2.Cash Generated By Investing Activities for investment activities)

The cash flow for investment activities is Cash Generated By Investing Activities.This part of cash flow mainly includes cash flow generated when the company sells or purchases tangible or intangible assets.The types of assets include land, property, factory, equipment, vehicles, patent rights, franchise rights, etc.

Among them, expenditures for buying properties, plants (Plant) and equipment (sometimes collectively referred to as PPE) and other fixed asset expenditures have become capital expenditures.The company’s cash flow is more special.The growth of capital expenditure indicates that the company is entering the expansion stage.Although the value of the company’s cash flow will decrease, the decline in specific analysis does not mean that the company’s management cash capacity declines.Essence

3.Cash Generated By Financial Activities for financing activities)

The cash flow for financing activities is Cash Generated By Financing Activities.This part of cash flow mainly includes cash flow involving investors, banks and creditors, including investment cash flow from investors or banks, loan cash flows, dividends paid to shareholders, share capital repurchase cash flow, repayment debt, loan, etc.Cash flow, etc.

What are the calculation methods for cash flow?

When calculating cash flow, the Direct Cash Flow Method and indirect cash flow method are mainly used.

Direct Cash Flow Method

Direct calculation method By recording and calculating all income and expenditures, and then classify all cash flow classifications to make the cash flow sheet, you can also calculate the table by the initial balance and end balance of various assets and accounts.The most commonly used watchmaking method for small companies.

Indirect Cash Flow Method)

The indirect calculation algorithm is to adjust the net income by increasing or minusing the differences generated by non-cash transactions, and then calculate the table making.For some companies with complex or large-scale structural or large-scale, the direct calculation method cannot accurately reflect the company’s entire assets and cash, so the number needs to be adjusted to make a cash flow table that is more in line with the company’s situation.When using an indirect calculation algorithm, professional accountants use some templates to make cash flow sheets with the help of profitable statements and balance sheets.

The importance and limitations of the cash flow statement

The importance of cash flow sheet

The importance of the cash flow statement to a company is:

Show the current operational ability

According to the various amounts displayed by the current cash flow statement, you can view the company’s current operating capabilities under the current operating model, and learn more about the company’s current operating capabilities.

Reflecting the company’s current stage

After comparing with past cash flow sheets, it can be analyzed that the company is currently in a period of rapid rising or stable development, or operating problems.The company’s development has stagnated or even retrogs.

Provide guidance for the operating model

According to the cash flow data of various departments in the cash flow sheet, combined with the previous cash flow table comparison, we can find that in the company’s operation, the income and expenditure of each department can be found.Operation methods, control costs or increase income to improve the company’s operating capabilities as a whole.

It helps to judge the company’s investment value

Outsider investors or loan lenders can judge public cash holdings and assets according to the data provided by the cash flow statement, thereby judging the company’s future development, anti-risk capabilities, and repayment of debt capabilities.

The limitations of the cash flow statement

Although the cash flow statement is one of the most important financial statements, it also has its limitations when used, which is mainly reflected in:

Provide information limited

No matter which calculation method is used to obtain the cash flow statement, the information expressed by the expression is still limited to the cash held by the current company, but for a company, the cash held by a company is part of the assets.If you need to accurately analyze the operation of a company’s operations, Ability and status quo still need to analyze in-depth analysis in conjunction with other financial statements such as profit statements, assets and debt forms.

Report data refers to the unknown of development process indications

The main content reflected in the cash flow statement is the cash situation currently held by the company, and for companies that need to develop rapidly or need to invest a lot of research funds, the results displayed in the short-term cash flow statement may not be ideal, or even may even be or even possible.A negative value appears.However, these investment expenditures may bring a lot of value returns.If you only look at the results data of the current cash flow table, you cannot make the company’s development process the most accurate judgment.

What are the components of the cash flow sheet?

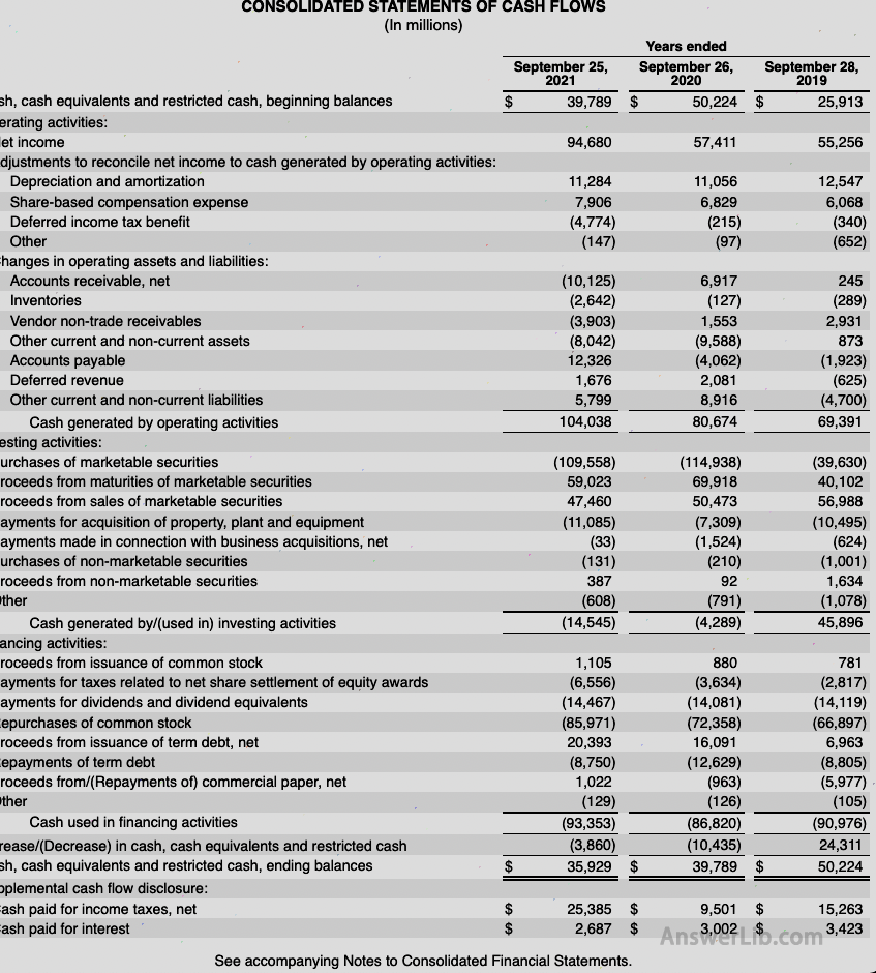

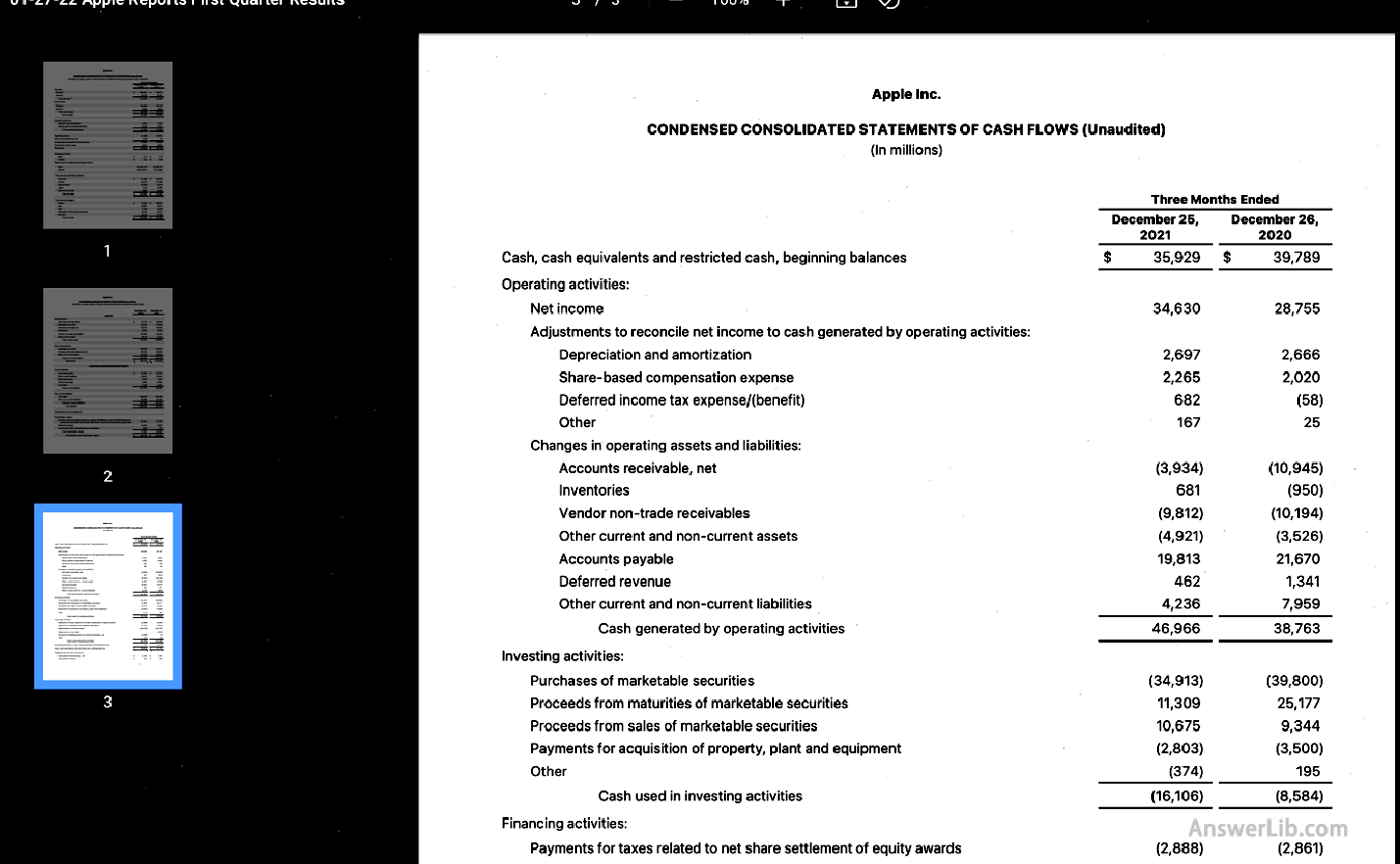

Taking the cash flow statement released by the SEC as an example, this is a cash flow statement made by indirect computing.

*According to the operation of different companies and operation content, sub-projects under various categories will be different.

*In this table, all income items are normal numbers, and all expenditure items are “()” numbers, so you need to subtract it when calculating.

The content of the cash flow sheet indirectly calculated is usually contained in:

Initial cash volume (Cash, Cash Equivalents and Restricted Cash, Beginning Balances)

The first column lists the initial cash volume, indicating that the cash volume of the company’s cash before the cash flow table cycle is used to compare with the current cash flow balance amount to analyze the company’s cash flow growth or decrease amount.

Operating Activities

This column lists all cash flow changes for the company’s business activities.The table is marked with “Operation Activities”, which contains many small items:

Net Income (Net Income)

The net income English is Net Income.This value can be obtained directly from the asset profit and loss statement or profit statement.

Adjustments to reconcile network to cash generated by operating activities

Adjust net income to cash flow generated through business activities, mainly includes the following parts:

- Depreciation and amortization-depreciation and amortization fee

- Share-Based Compensation Expense-

- DEFERRED Income Tax Benefit -Defendive income tax benefits

Changes in Operation Assets and Liabilities

Changes in operating assets and liabilities are Changes in Operation Assets and Liabilities.According to the adjustment of the actual business assets and liabilities, the adjustment content that the company needs to make is:

- Accounts Receivable -Accounts receivable

- Inventories-inventory

- VENDOR NON-TRADE Receivables-Non-trade receivables from suppliers

- Other Current and Non-Current Assets

- Accounts Payable – Accounts payable

- Deferred revenue-deferred income

- Other Current and Non-Current Liabilities

Cash Generated By Operating Activities generated by operating activities)

The amount of cash flow used to operating activities after the above-mentioned part is adjusted.

Investing Activities

This column lists all the cash flow changes for the company’s investment activities.The table is marked with “Investing Activities”.The small items contained in it are as follows:

- Purchase of Marketable Securities -Buy Various Securities

- Proceeds from Maturities of Marketable Securities

- Proceeds from Sales of Marketable Securities

- Payments for Acquisition of Property, Plant and Equipment-the cost of buying property, plant and equipment

- Payments Made in Connection with Business

- Purchase of non-marketable securities

- Proceeds from non-Marketable Securities

Cash Generated By or Use in Investing Activities)

Cash generated by investment activities/use

The cash flow used to invest in investment activities after calculating the above project expenses, and the amount is equal to the sum of all income of this section to minus the sum of all expenditures.

Financial activity (Financing Activities)

This column lists changes in cash flow for the company’s financial activities.The table is marked with “Financing Activities”, which includes the following items:

- Proceeds from ISSUANCE of Common Stock-ordinary shares issuance income

- Payments for Taxes Related to Network Settlement of Equity Award

- Payments for DIVIDENDS and DIVIDEND EQUIVALENTS

- Repurchase of Common Stock

- PROCEEDS FROM IsUnce of Term DEBT, Net -Net-issued regular bonds

- Repayments of Term Debt-repay the time debt

- Proceeds from/(Requayments of) Commercial Paper, Net -Net -Commercial Bonds

Cash flow generated by financial activities (Cash in Finance Activities)

The cash flow generated by financial activities is Cash Use in Financing Activities.The amount of cash flow used in the current period of the project expenses for financial activities is equal to the sum of the sum of all income of this section to minus the sum of all expenditures.

The change value of cash flow (increase or decrease in cash, cash equivalents and restricted cash)

The current cash flow increases or reduced amounts of current cash flows obtained by calculating the amount of cash flow in business activities, investment activities, and financing activities.

In the current company’s cash flow (Cash, Cash Equivalents and Restricted Cash, Ending Balances)

In the current period, the cash flow held by the company is Cash, Cash Equivalents and RESTRICTD CASH, Ending Balances,

The end balance of the current period of the initial period of the table and the current period of cash flow increases or reduces the amount of calculation.

Supplementary cash flow disclosure

Replenishing cash flow disclosure English is the Supplemental Cash Flow Disclosure.This item is a supplement to the cash flow data in the table, which generally includes:

- CASH PAID for Income Taxes, Net-net cash amount used to pay income tax

- Cash Paid for Interest-cash for paying interest

How to understand the cash flow sheet?

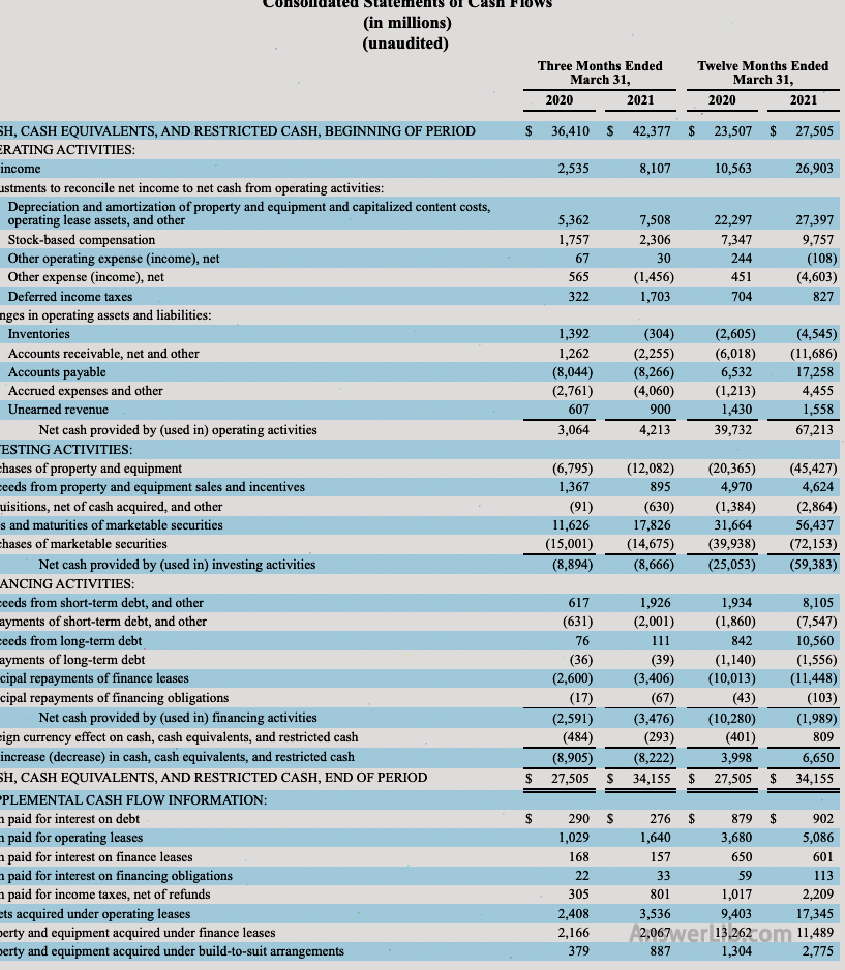

The following is the previous years and this year’s cash flow statements released by Amazon on March 31, 2021.This section will further explain how to understand how to understand the cash flow statement based on this Amazon’s cash flow statement.

For quarterly data

In the first quarter of 2020, cash flow was $ 36,410M, and 2021 was $ 42,377m.

- In terms of income generated by operating activities, the first quarter of 2021 increased from the same quarter in 2020, and increased from $ 3,064m to $ 4,213m.

- For investment expenditures, the first quarter of 2021 decreased compared with the same quarter in 2020, from $ 8,894M to $ 8,666M

- For financing expenditures, the first quarter of 2021 increased from the same quarter in 2020, and increased from $ 2,591M to $ 3,476M

As a result, in the first quarter of 2020 and the first quarter of 2021, Amazon’s cash flows decreased by $ 8,905m and $ 8,222m, respectively.

For all year data

At the beginning of 2020, the cash balance was $ 23,507m, and the $ 27,505M in 2021.

- In terms of income generated by business activities, it has increased significantly from 2020 in 2021, an increase of $ 39,732M to $ 67,213M

- The expenditure for investment, increased by 2021 compared with 2020, increased from $ 25,053M to $ 59,383M

- For expenditure for financing, in 2021, it decreased significantly compared with 2020, from $ 10,280m to $ 1,989M

As a result, in 2020 and 2021, Amazon’s cash flow increased by $ 3,998m and $ 6,650M, respectively.

How to use the cash flow sheet for investment analysis?

Comparing the data provided in the cash flow statement, compared with the previous cash flow statement, or combined with other data, can perform multiple investment analysis indicators, including:

Growth and decrease in cash flow

The growth of cash flow is usually considered to be better, but if the company is found in the details that the company is selling a large amount of assets to increase cash flow, it may indicate that the company’s operating conditions have problems.

If the cash flow has decreased, it is usually worried, but if the company has invested more cash in the details to develop or purchase equipment, it may indicate that the company is entering the stage of rapid development.

Cash Flow Margin Ratio (Cash Flow Margin Ratio)

The cash flow sales ratio English is Cash Flow Margin Ratio.This indicator compares the company’s cash flow obtained by operating activities compared with the net sales or net income provided by the profit statement, that is,:

Cash Flow Margin Ratio = Operating Cash Flow/Net Sales

The ratio of the ratio means that the amount of cash that the company can generate every $ 1, the higher the value, the better.

Free Cash Flow

Free cash flow English is Free Cash Flow.Free cash flow is obtained from the cash income obtained by business activities to minus the income of capital expenditure, that is,

Free Cash Flow = Operating Cash Flow – Capex

This indicator shows the company’s efficiency of obtaining cash by operating the company, and investors will use this value to determine the company’s ability to pay dividends or stock repurchases.

Cash flow coverage rate

Cash flow coverage English is Cash Flow COVERAGE RATIO.The cash flow coverage will be obtained by the ratio of cash flow obtained by operating activities.

Cash Flow COVERAGE RATIO = Operating Cash Flow / Liabilities

The value indicates whether the company has sufficient cash flow to repay the debt.The higher the ratio, the better.

Liquid liability coverage (Current Liability Ratio)

The liability liability coverage English is Current Liability Ratio.The calculation method of this indicator is to compare the cash flow obtained through the operation compared with the liabilities, that is,:

Current Liability COVERAGE RATIO = Operating Cash Flow / Current Liability

If the ratio is less than 1, it means that the company’s current cash flow cannot pay its short-term mobile debt, which may have risk of bankruptcy, so the higher the index value, the better.

Price to Cash Flow Ratio (Price to Cash Flow Ratio)

The ratio of the stock price to the cash flow ratio is Price to Cash Flow Ratio.The calculation method of this indicator is the stock price of each share.

Price to cash Flow Ratio = Share Price / Operating Cash Flow Per Share

This value is used to measure whether a stock is underestimated.At the same time, compared to the P/E ratio Price-Toarnings (P/E), the value has a higher credibility, because cash flow is more difficult than returns than income, which is more difficultBeing artificially modified.

Cash Flow to Net Income

The cash flow income ratio English is Cash Flow to Network.The calculation method of this indicator is the ratio of cash flow to net income.The calculation formula is as follows:

Cash flow to net income = cash flow / net income

When the indicator is close to 1, it means that the financial statement reported by the company is more credible and has not been manpicable and other operations.An analyst of the company often uses this value to determine the authenticity of the company’s financial statements.

Where can I view the company’s cash flow sheet?

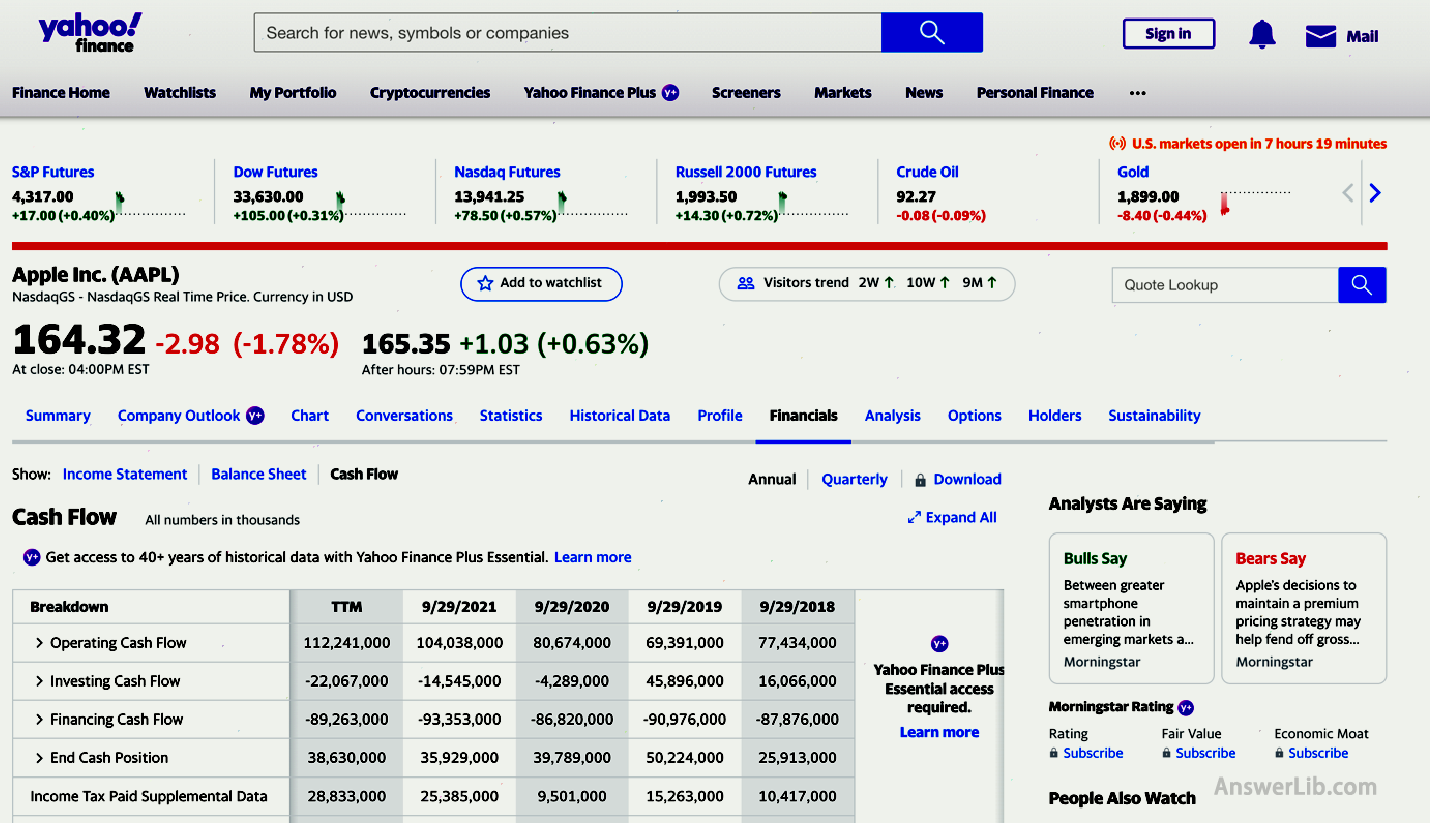

Investors can check to the company’s cash flow sheet from the official data websites and third-party data websites such as MarketWatch.com, Yahoo Finance, MORNINGSTAR, MSN MONEY, REUTERS.The

Method 1: Check the official data website

- Enter on Google search page: Investor Relations Site: Apple.com Enter the official page

- Drop the page to the Financial Data section, click the Financial statements connection of the corresponding cycle

- In the pop-up box, Chapter 3 is the current cash flow form of Apple

Method 2: Through third-party financial website

Take Yahoo Finance as an example, log in Main site Enter the company name at the search box on the top of the page.

- After entering the company’s data page, click Financials in the data bar, and click the Cash Flow to view the cash flow statement in different periods.

What is the relationship between cash flow statement and balance sheet and profit statement?

Together with the cash flow statement and the balance sheet, and the profit statement, the basic data statement reflecting a company’s financial status.

- When the financial situation of a company needs to be comprehensively analyzed, the different data of the three must be combined to obtain a complete financial status analysis.

- When the financial statement statement is correct, the change value of a company’s net cash flow should be equal to the amount of cash in the balance sheet during the period of two tables.Or a reduction value, its value should be equal to the difference in the cash part in the balance sheet of 2021 and 2020.

- If the cash flow sheet is used to use the indirect calculation algorithm, the profit statement can represent how the cash flow grows or decreases through the business, and the balance sheet can represent how different transactions affect different cash flows, such as account receivables, such as accounts receivable, Calculate accounts and inventory.Therefore, professional accountants will use the data to make the cash flow sheet through the data in the preliminaries and the balance sheet.