rate of return, English is Earnings yield It is a financial analysis indicator that measures the profit of the company’s stock price per unit.The calculation method of the yield is that the company has been in the past 12 months Earnings per share, That is, EPS TTM, except at the current stock price, calculates the earnings obtained by the company’s dollar from the US dollar in each unit in the stock.For example, when a company’s yield is 8%, it meansProfit.

In practical applications, yields are usually used to measure whether the stock valuation is too high or too low.The lower yield means that the stock price may be overestimated, and the high yield indicates that the stock price may be underestimated.

It can be seen from the calculation formula that the yield is equal to the value P / E ratio(P/ E RATIO) The countdown, because the calculation method of the price-earnings ratio is divided by the share price per share, so the significance of the indication of the two is the opposite.The yield represents the amount of profit that investors can earn from the unit’s stock price, and the P / E ratio represents the amount of investors who need to invest in the stock to obtain the profit of each unit.

Bleak American broker:Transparent securities| | Futu Securities| | Microex Securities| | Tiger securities| | First securities| | Robinhood in| | American Langshang Daquan

Directory of this article

- How to calculate the yield?

- How to calculate Apple’s yield?

- What is the investment guidance significance?

- What are the limitations of yields?

- Join investment discussion group

- More investment strategies

How to calculate the yield?

When calculating the yield of a company, two values are required: in the past 12 months Earnings per share EPS TTM, and the current stock price, when calculated, the income per share is divided by the share price per share, that is,:

Return = earnings per share in the past 12 months / current stock price

Earning yield = EPS TTM / Stock Price

in,

EPS TTM can pass the company’s 10-K Financial report And the Diluted EPS computing in 10-Q’s financial report is obtained.

The current stock price per share can be on multiple financial platforms, such as, for example, tradingEconomics Or find it on the financial portal website of a listed company.

Another yield is proposed by Joel GreenBlatt.

Joel GreenBlatt = Pre-tax income / corporate value

Earning yield (Joel GreenBlatt) = Ebit / Enterprise Value

in:

The profit before interest taxation is deducting taxes and pre-interest profits, that is, net income plus interest and taxes, that is,:

Promoting profit before interest tax = (net income + interest + taxes)

EBIT = (Net Income + Interest + TAXES)

The calculation method of corporate value is to add the company’s current market value, the company’s priority stock value, the company’s current total liabilities, and the equity of some minority shareholders, and then minus the company’s current cash and cash equivalent value, that is,:

Corporate value = market value + preferred shares + total debt market value + minority shareholder equity-cash and equivalent

EV = Market Value + Preferred Shares + Total Value of Debt + Minority Interest -Cash and EQUIVALENTS

how Calculate the yield of Apple?

This chapter will be released by Apple in September 2021 10-K financial report Calculate the instance:

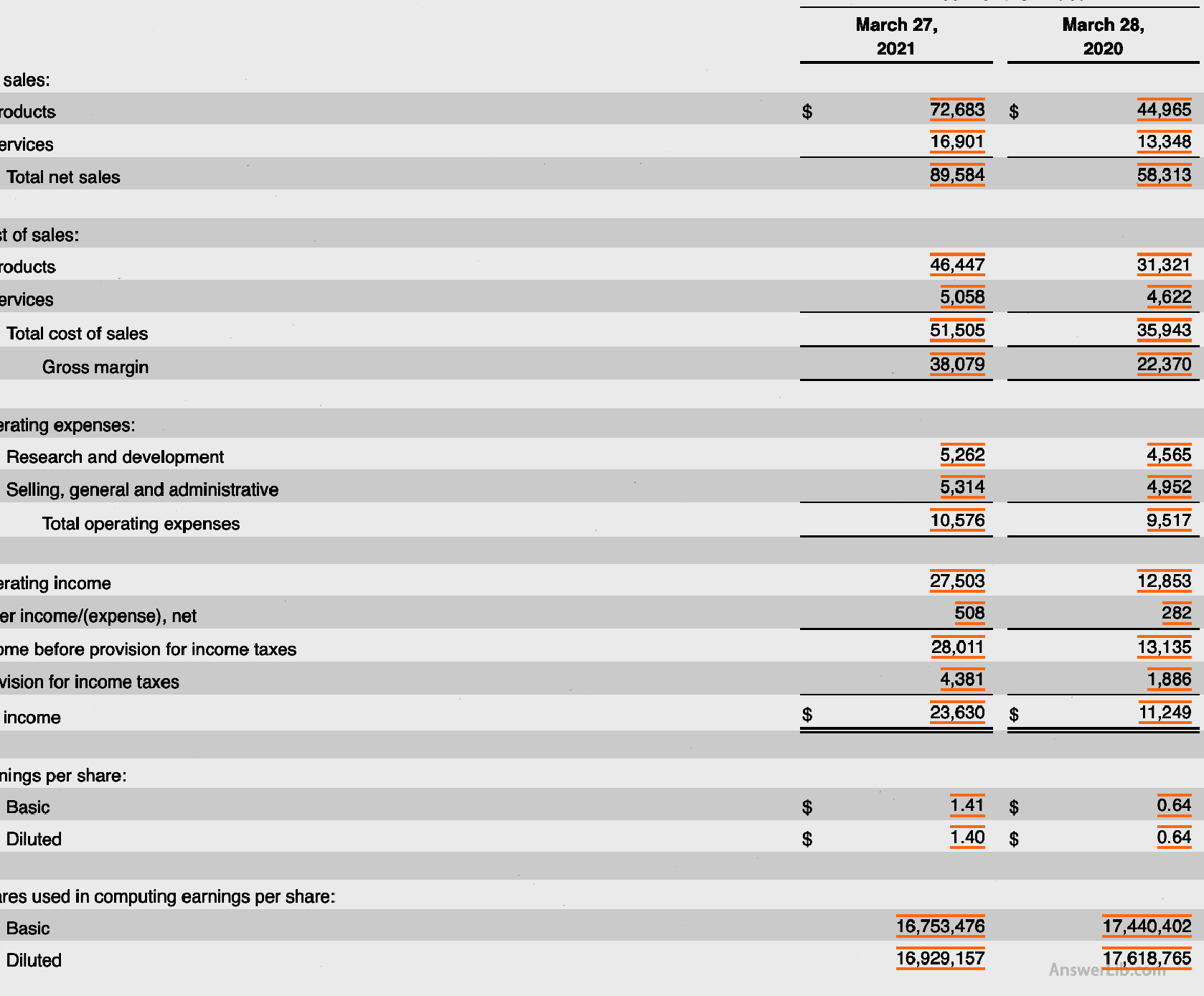

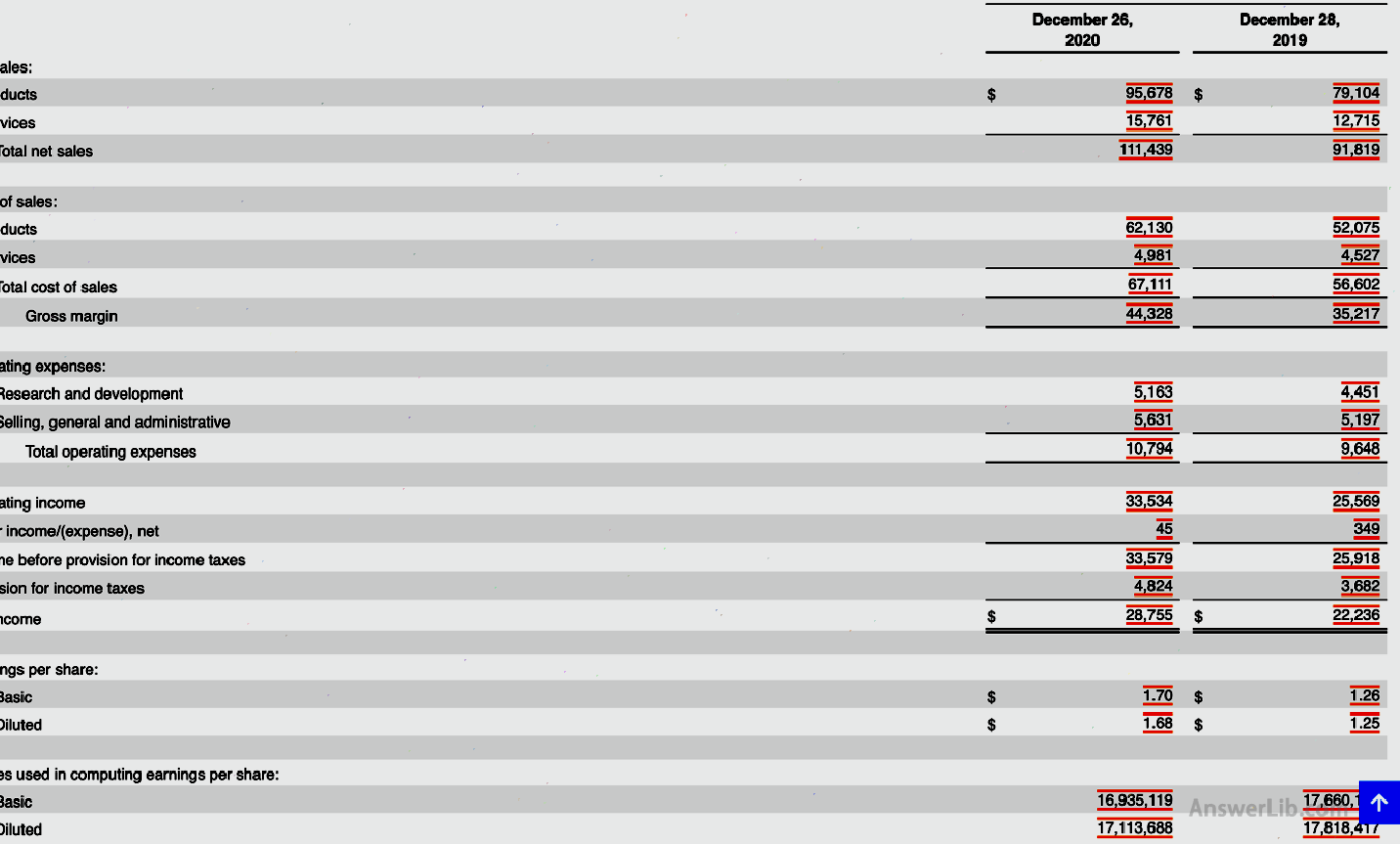

AAPL Financial Report History of history per share is shown below:

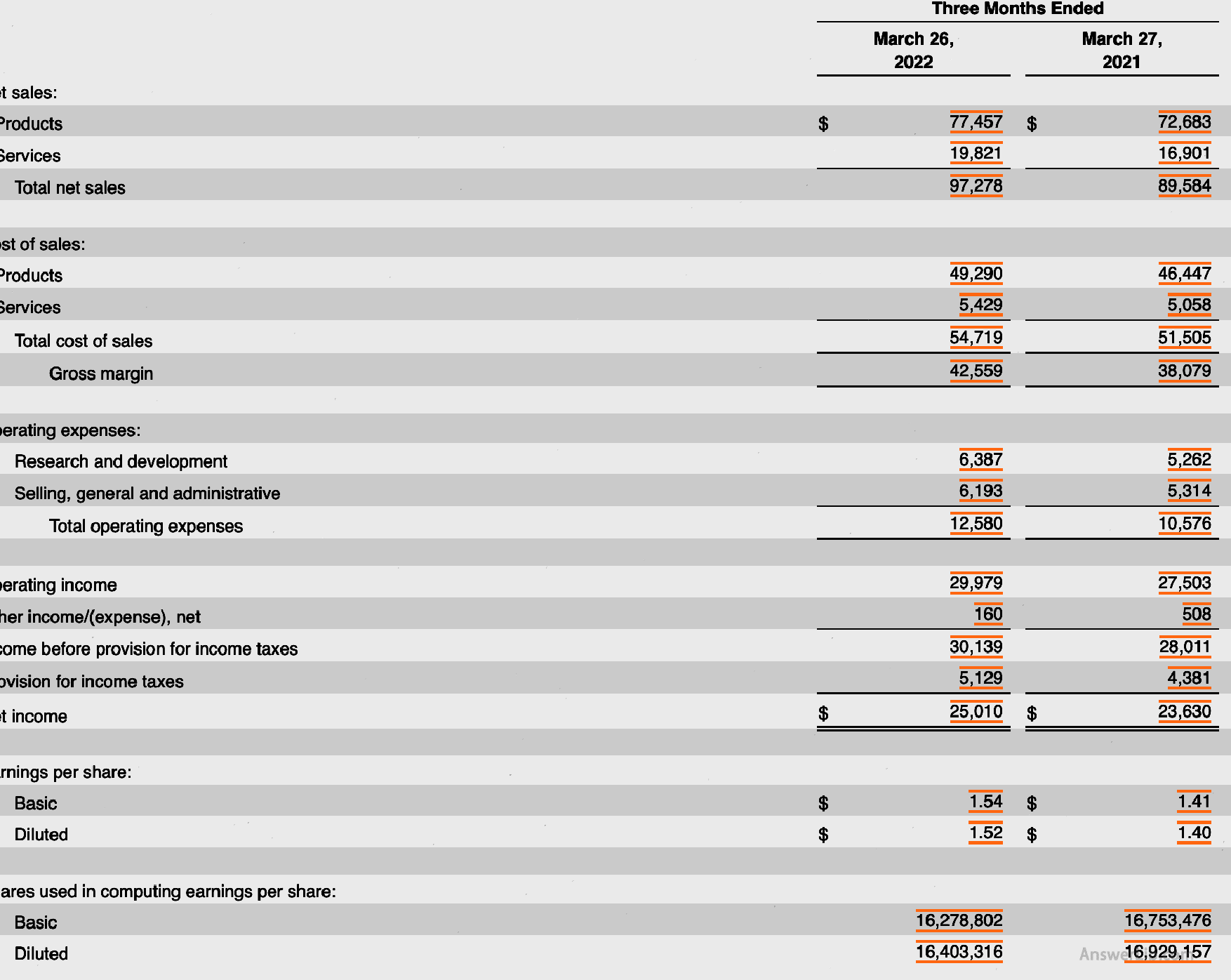

The income per share in the first quarter of 2022 is: $ 1.54

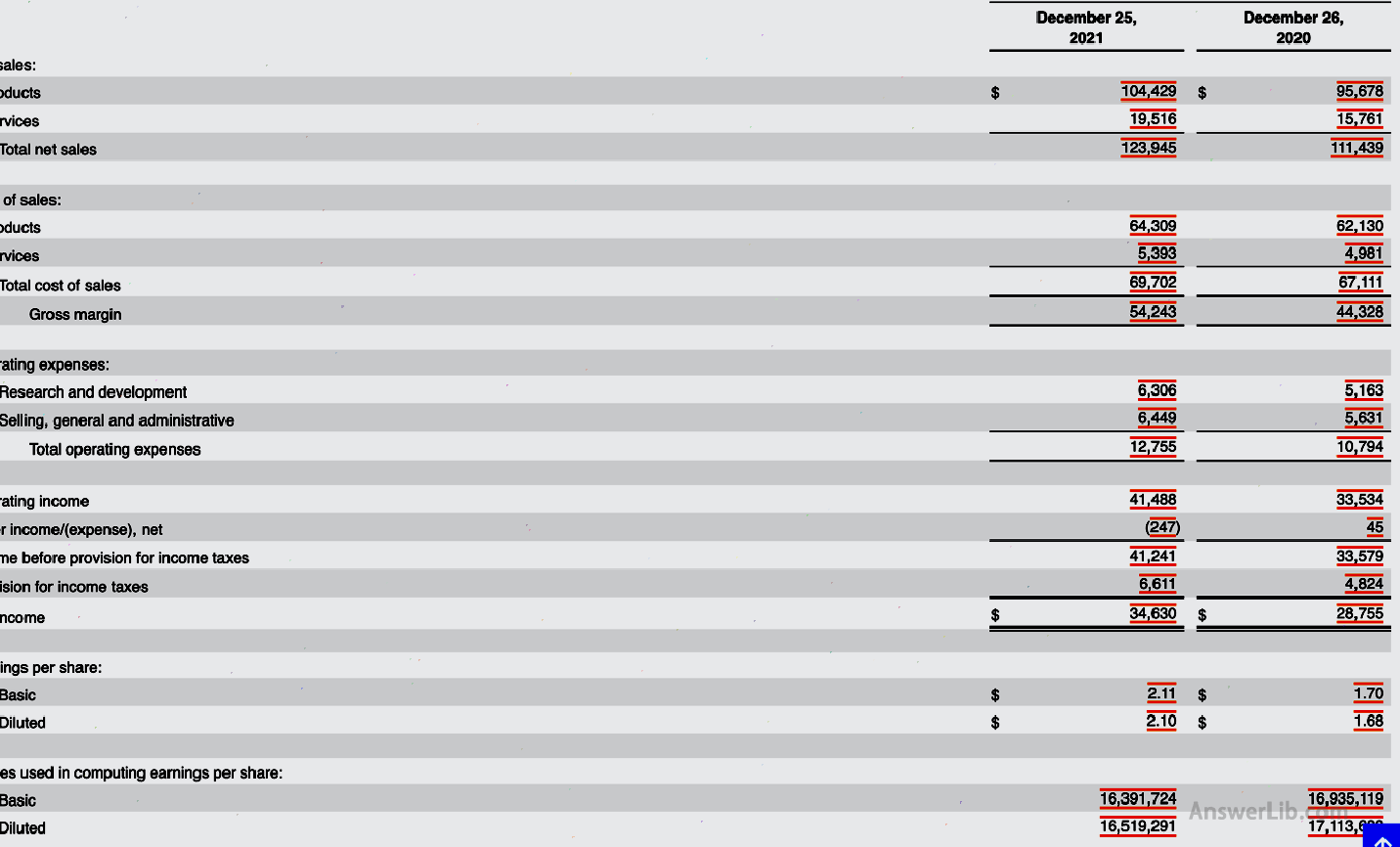

The income per share in the fourth quarter of 2021 is: $ 2.11

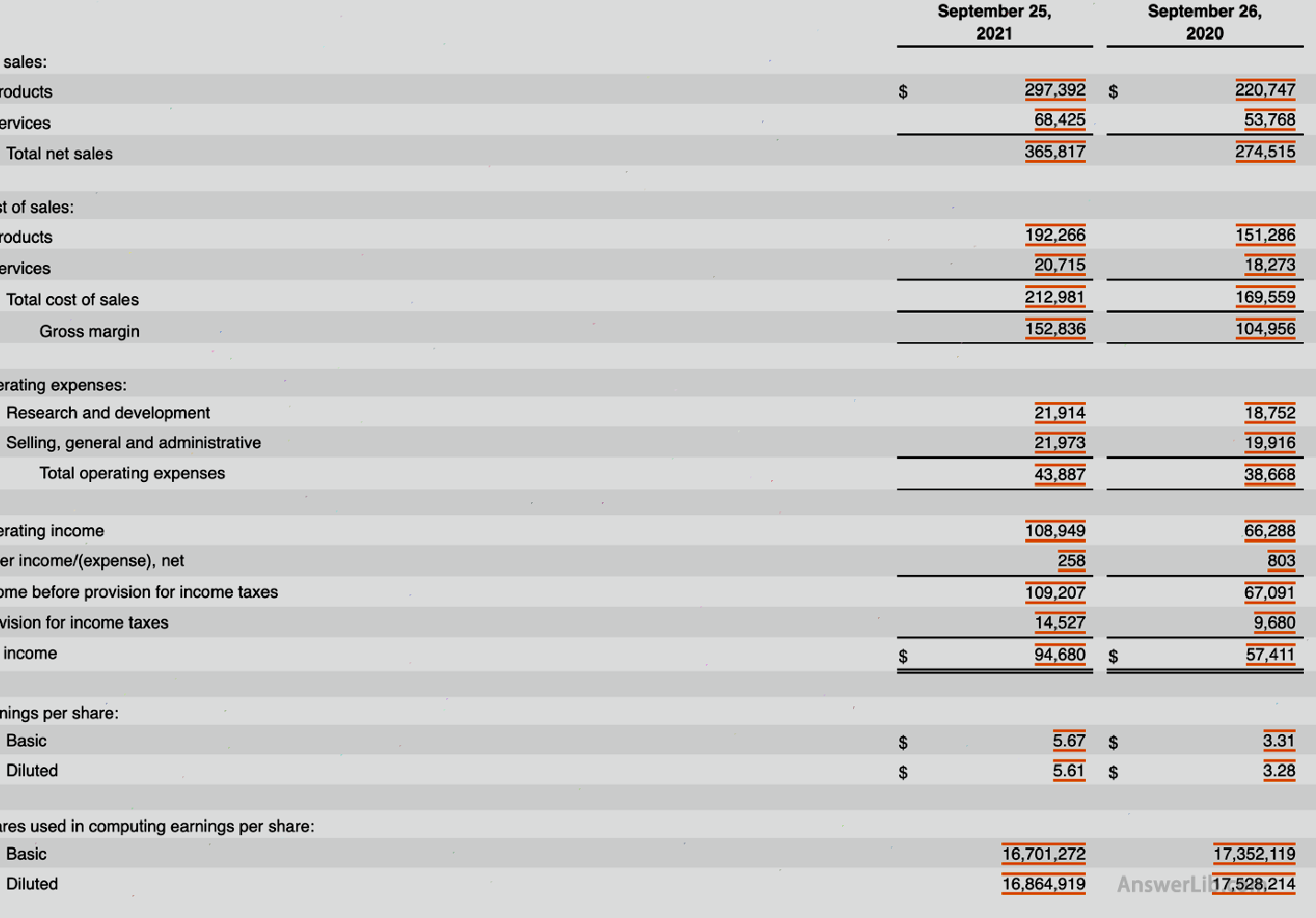

The income per share in 2021 is: $ 5.67

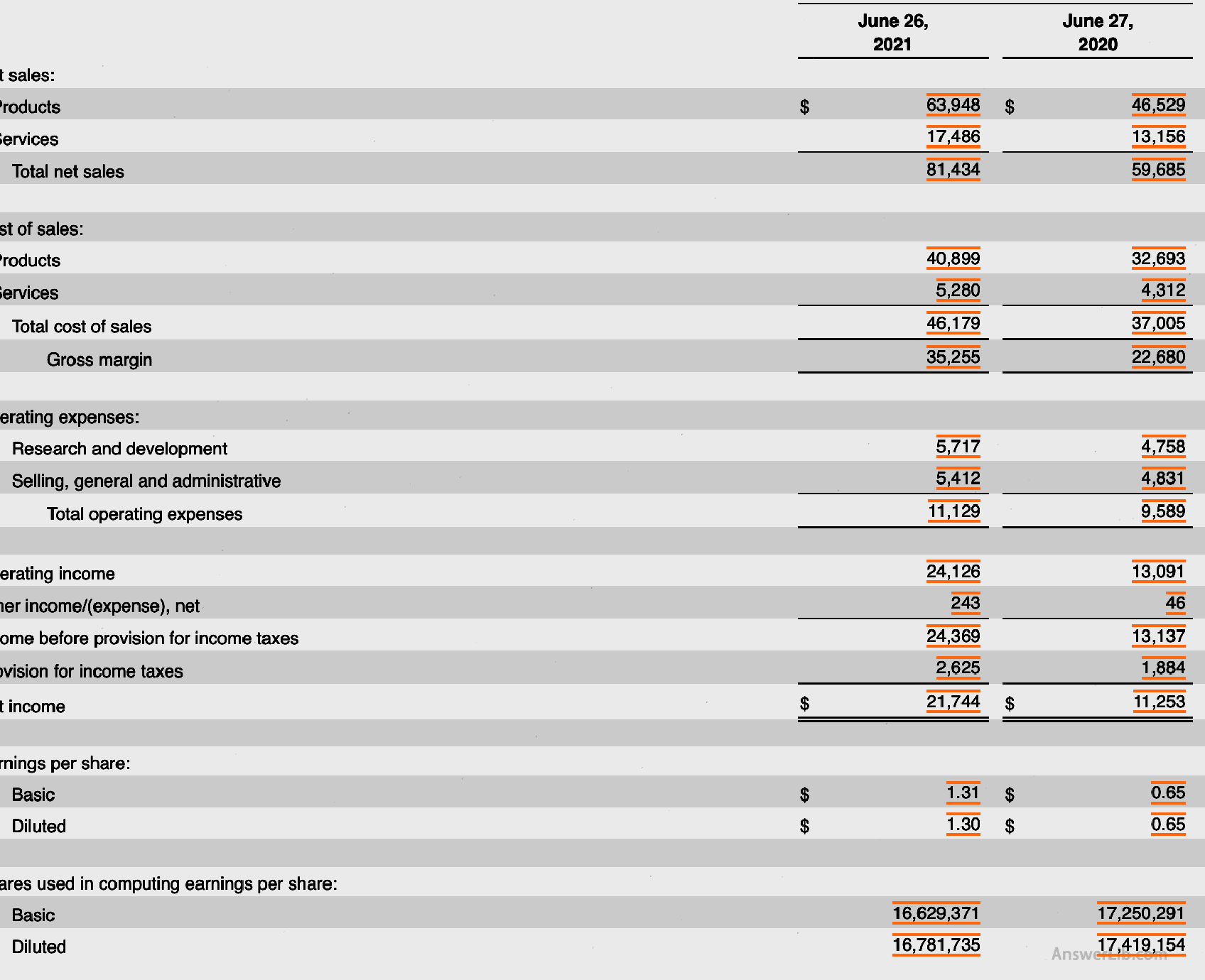

The income per share in the second quarter of 2021 is: $ 1.31

The income per share in the first quarter of 2021 is: $ 1.41

The income per share in the fourth quarter of 2020 is: $ 1.70

Because the annual financial report is the first three quarters of the financial report and the fourth quarter financial report, the annual income of the third quarter of 2021 is:

2021 Eap per share -Earlier per share in the second quarter of 2021 -Earlier per share in the first quarter of 2021 -the 4th quarter of 2020 earnings per share

$ 5.67 – $ 1.31 – $ 1.41 — $ 1.70 = $ 1.25

So Apple’s latest EPS TTM:

2022 In the first quarter of earnings per share + 2021, the 4th quarter of 2021, earnings per share + 2021, the third quarter earnings per share + 2021 second quarter of earnings per share

$ 1.54 + $ 2.11 + $ 1.25 + $ 1.31 = $ 6.21

From Apple Shareholder page You can find Apple’s latest stock price.Apple’s latest stock price is: $ 137.59

As a result, Apple’s current yield is:

Return rate = earnings per share / stock price for the past 12 months

Earning yield = EPS TTM / Stock Price

= $ 6.21 / $ 137.59

= 0.0451 = 4.51%

≈ 5%

That is, the current stock price of Apple has a revenue of $ 0.05 per $ 1.

What is the investment guidance significance?

In the calculation formula of the yield rate, EPS is a established value, and the stock price per share is a continuous floating value.Therefore, investors will use the yield to measure the current stock price of the listed company is overestimated or underestimated.

When the yield is low, it means that the current stock value as a denominator is high, and the stock price of listed companies may be overestimated.On the contrary, when the yield is high, it means that the current stock value as a denominator is low, and the stock price of listed companies is underestimated.

Generally, investors are more willing to study companies with higher yields, because the company’s stock price is low and investment risks are low at this time.After further analyzing the company’s profitability, they can be considered as an investment target.

In the analysis of the company’s historical data trend, the yields that are overestimated will gradually decrease, because when the stock price is overestimated, its income usually cannot grow.Therefore, the yield will gradually decreaseEssenceWhen the stock price starts to fall and the company’s income remains unchanged or gradually increases, the yield will gradually increase at this time, and it is also the situation that most investors are more willing to consider participating in investment.

But in general, more financial data still needs to analyze the fund’s fundamentals to determine whether its current stock price has a good possibility of rising possibilities and space for the profit obtained.

What are the limitations of yields?

The calculation method of yield ratio is relatively single, so it is difficult for investors to find the company’s specific use of the company from the yield, because most companies will use part of the income as reinvestment, so the yield cannot completely reflect the investmentIn the end, the profit and profit can be obtained.

Although the low yield means that the company’s stock price is increasing, it does not necessarily mean a bad investment, because some companies with high growth potential will usually be overestimated, and in subsequent development, and in subsequent developmentInvestors can still get good benefits.

It is difficult to predict the company’s future development from the rate of return, because the non-normal operating income per share is not excluded in the income per share.For example, when the company believes that the development prospects are not good and the assets are sold in large quantitiesIt will also increase.It is difficult to conclude that if the company’s fundamental analysis is not based on the fundamental analysis of the company, whether the company will be a good investment.