Capital asset pricing model, English is Capital Asset Pricing Model, referred to as CAPM, is a financial computing model that measures the relationship between investors’ expected income and investment risks when investing in investment.

In the 1960s, the CAPM model was written by the famous economist and scholar William F.Sharpe in its work “Portfolio Theory and Capital Markets” Proposed in.

CAPM’s calculation method is to add risk-free income and risk premium in investment, and its numerical represents the expected income of investors at the time of investment.During the calculation process, the main influencing factor is to calculate the β coefficient in the formula, that is, the system risk factor.

System risk refers to the inherent risk of the entire securities market, rather than risks only for specific industries.System risks are affected by factors such as national interest rates, economic development or recession, and war.risk.The opposite non-system risk refers to the risks existing in specific industries or companies, which are usually affected by the industry’s strike, raw material shortage or the company’s operations.

CAPM values are often used to calculate financial indicators such as the weighted average capital cost (WACC) value and future cash flow to the present value.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- How to calculate capital asset pricing models?

- How to calculate Apple’s capital asset pricing model?

- What are the investment guidance significance of capital asset pricing model?

- What are the limitations of capital asset pricing model?

- Join investment discussion group

How to calculate capital asset pricing models?

The calculation method of the CAMP model is to add the zero risk income of the investment to the risk premium, which can be expressed as:

in:

The full name is Expected Return on a Security, which refers to the return of investors to stocks;

The full name of RRF is RISK-Free Rate, which refers to zero risk return.Zero-risk interest rates are usually matched with the national bond interest rates of the country where investment are located.The bond term should also correspond to the time limit of investment, but in the investment field, 10 years of national bond interest rates are usually used as zero risk interest rates, because 10 years of national bonds are usually usually national bonds are usually national bonds.There are types of bonds with the highest quotations and the strongest liquidity.In the United States, the 10 -year national bond interest rate is used as a zero-risk interest rate value.The current ten-year Treasury bond yield is 2.74% 【source】 Essence

The full name of the RM is Expected Return of the Market, which refers to market expectations.In the US investment market, the average return rate of the Standard Pur 500 is usually used as the market expectation return rate.According to the historical return rate of the S & P 500, the average return rate is 10%floating up and down, so 10%are usually selected as 10%as a 10%as a 10%as a 10%as a 10%.Market expects return.

(RM -RRF) is called a risk premium.English is the Market Risk Premium.It refers to an additional return of investors in other than risk interest rates and is a return that must be provided by compensating investors when investing in risk products.The greater the fluctuation of the stock, the higher the investment risk, the higher the return rate of investors, the higher the risk premium.

The β coefficient is the system risk coefficient of the stock market relative to the entire stock market.It is calculated by historical stock income through a specific calculation method.It is the sensitivity between measuring the stock risk and the overall market fluctuations.Its value significance lies in:

- β <0: stock investment risk has a negative effect on market fluctuations;

- β = 0: Stock investment risk is not affected by market fluctuations;

- 0 <1: Stock investment risk and market fluctuations have a positive relationship, and the sensitivity of influence is low;

- β = 1: The stock investment risk is equal to the market volatility;

- β> 1: Stock investment risk is highly sensitive to market fluctuations;

- From the β coefficient, it can also be seen that the investor’s expected return on the stock, the higher the β value, indicating that the higher the expected return on the stock.

how Calculate Apple’s capital asset pricing model?

This chapter will use Apple’s relevant data for example calculation.

The current yield of 10 -year national bonds in the United States is 2.74%, so RRFIt is 2.74%

The average return rate of Standard 500 is 10%, so RM = 10%

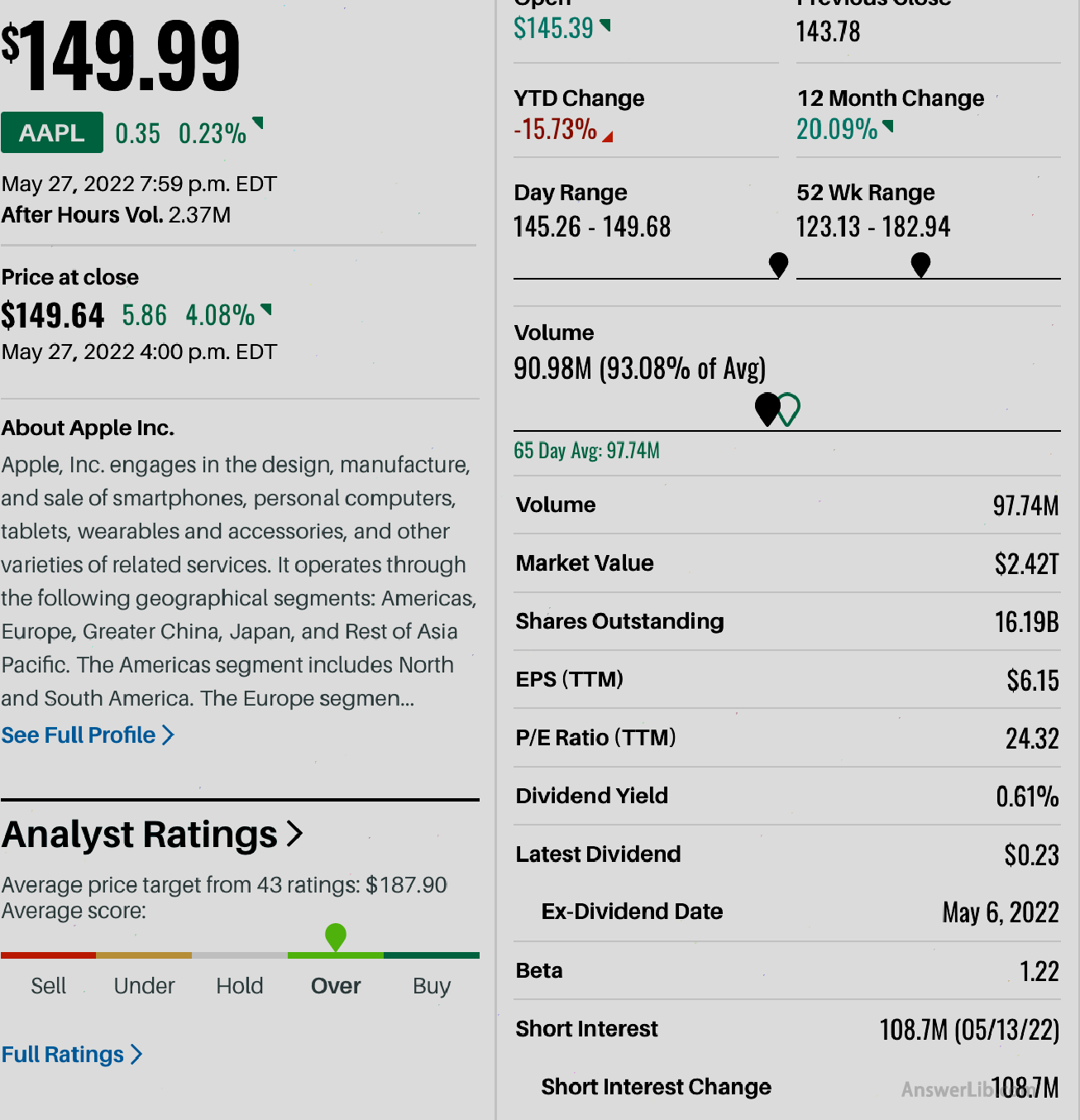

Apple’s current coefficient can be obtained from the data of Baron Weekly, β = 1.22

so,

RRF + β (RM – RRF)

= 2.74% + 1.22 (10% -2.74%)

= 11.60%

Therefore, Apple’s current CAPM value is 11.6%.

What are the investment guidance significance of capital asset pricing model?

CAPM is used in the financial industry to calculate a variety of financial indicators, including calculating the weighted average capital cost (WACC) and calculating future cash flow to present value (DCF).

WACC is a financial value that measures the high and low financing cost of the company.When used in WACC, CAPM is calculated as a equity cost RE for the calculation formula of WACC:

WACC = (E/V × Re) + (D/V × RD × (1−TC))

CAPM will affect the cost of stock investment in the formula.The higher the CAPM value, the higher the company’s financing through the issuance of stocks.As a result, the higher the final WACC value.

When investors calculate the future cash flow rate of shareholders, they need to use CAPM as a discount rate for calculation, that is, the value of the cash flow discount calculation formula “R”.When the CAPM value is higher, the lower the DCF value, the lower the value of the DCF valueIt shows that as shareholders’ investment time, the lower its future revenue is the lower the current value.The formula of the cash discount model is as follows:

DCFN= CF (1+P)1/ (1+r)1+ CF (1+ P)2/ (1+r)2+ CF (1+ P)3/ (1+r)3+…+Cf (1+p)N/ (1+r)N

Among them, CF represents the future cash flow, and P is the growth rate of the company’s cash flow.

What are the limitations of capital asset pricing model?

The limitations of CAPM are the vagueness of its value.Its risk-free interest rates and market expectations have average value, so it is difficult to make more accurate evaluation values for a particular moment.In actual assessment, there may be a large difference between risk-free interest rates and the current ten-year bond interest rates, or the market expects return rate is largely different from the current Standard 500 yield, which may cause errors in the evaluation results.

The β value also has a certain range of errors.Because the β value is calculated based on historical stock income, the volatility of the stock price is usually very large, and it is difficult to have a more found law.Therefore, it is difficult to calculate the β value.Accurate and appropriate CAPM value.

Second, the CAPM value considers the non-system risk value, instead of considering the specific risk value in specific industries, and the individual risk characteristics of a specific company.ThereforeThe effect of business model on investment income.