Cash ratio, English is Cash flow to debt ratio, Is it to measure a company Financial strength Important indicators show that the company earns the proportion of cash flow and debt through operations during the financial cycle.The operating cash flow here does not include the income obtained from loans or investment.Its calculation method is the ratio of the company’s operating cash flow into total debt, which can intuitively compare the ratio between the company’s cash flow earned by operating and the total debt that the company should repay.Overall, the larger the cash liability rate, the better Essence

If the cash liability ratio is greater than 1, it means that the company has enough cash to deal with the debt.The higher the ratio, the higher the company’s income after repaying the debt, the better the company’s operating ability.

On the contrary, when the cash liabilities ratio is less than 1, it means that the company’s income in the financial cycle is not enough to deal with all its debts.At this time, investors need to be vigilant.

Of course, various factors will affect the company’s cash liabilities.For example, some analysts will use EBIDTA or free cash flow instead of operating cash flow and calculate as molecular calculations, which will have different impacts on results and analysis.

Bleak American broker:Transparent securities| | Futu Securities| | Microex Securities| | Tiger securities| | First securities| | Robinhood in| | American Langshang Daquan

Directory of this article

- How to calculate the cash liability rate?

- Example of cash liability rate calculation

- What is the investment guidance significance of cash liabilities?

- More investment strategies

How to calculate the cash liability rate?

There is the most basic calculation method of cash liabilities, and there are three variants calculation formulas.

1.Basic calculation formula for cash liabilities

The basic calculation method of cash liabilities is::

Cash liabilities = operation cash flow / total debt

Cash flow to debt ratio = operating cash flow / topal debt

in:

- Operating cash flow, English is Operating Cash Flow.It is a cash flow earned by the company through operating activities.It can be found in the cash flow statement in the company’s financial report (Statement of Cash Flows).It is usually labeled as “Cash Generated By Operation Activities”.

- 总债务,英文是Total Debt,是公司的短期债务(Current-Term Liabilities) 与长期债务(Long-Term Liabilities) 之和,可以在资产负债表(Balance Sheets) 中找到,通常标注为“Total Liabilities”Essence

2.Variation Calculation Formula 1

Some analysts will use Ebidta as molecules to calculate using interest tax discounts:

Cash liability ratio = interest tax discount pre-amortization of profit / total debt

Cash Flow to Debt Ratio = EBITDA / TOTAL Debt

Profit (EBIDTA) before the interest tax depreciation and amortization is the sum of the company’s operating income and depreciation and amortization costs, that is,:

Profit of interest and taxation of interest taxation = operating income+depreciation and amortization

EBitda = Operating Income + depreciation & amortization

in:

- Operating Income (Operating Income) can be found in the company’s profit statement, which is generally labeled as “Operating Income”;

- The depreciation and amortization cost can be found in the company’s cash flow sheet, and is found in the Consolidated Statement of Cash Flows, which is generally marked as “Deposition and amortization”.

3.Variation Calculation Formula 2

Some analysts will use Free Cash Flow as a molecule to calculate the cash liability rate:

Cash liabilities = free cash flow / total debt

Cash Flow to Debt Ratio = Free Cash Flow / Total Debt

Freedom cash flow is the part of the cash flow that can be freely dominated by the company’s business cash flow, that is::

Freedom cash flow = operation cash flow-capital expenditure

Free Cash Flow = Operating Cash Flow – Capex

in:

- The operating cash flow can be found in the Statement of Cash Flows in the company’s financial report, which is usually labeled as “Cash Generated By Operating Activities “” “.

- Capital expenditure, English is Capital Expenditures, referred to as Capex, which can be found in the company’s Balance Sheets.It is usually labeled as “Property, Plant, and Equipment”.

3.Variation Calculation Formula 3:

Some analysts will use long-term debt (LONG-TERM LIABILITIES) as a denominator to calculate:

Cash liabilities = operation cash flow / long-term debt

Cash Flow to Debt Ratio = Operating Cash Flow / Long-Term Liabilities

in:

- Long-Term Liabilities can be found in the balance sheets, which is generally labeled “Total Non-Current Liabilities”.

Example of cash liability rate calculation

This chapter will be released by Apple in September 2021 10-K financial report Calculate the instance:

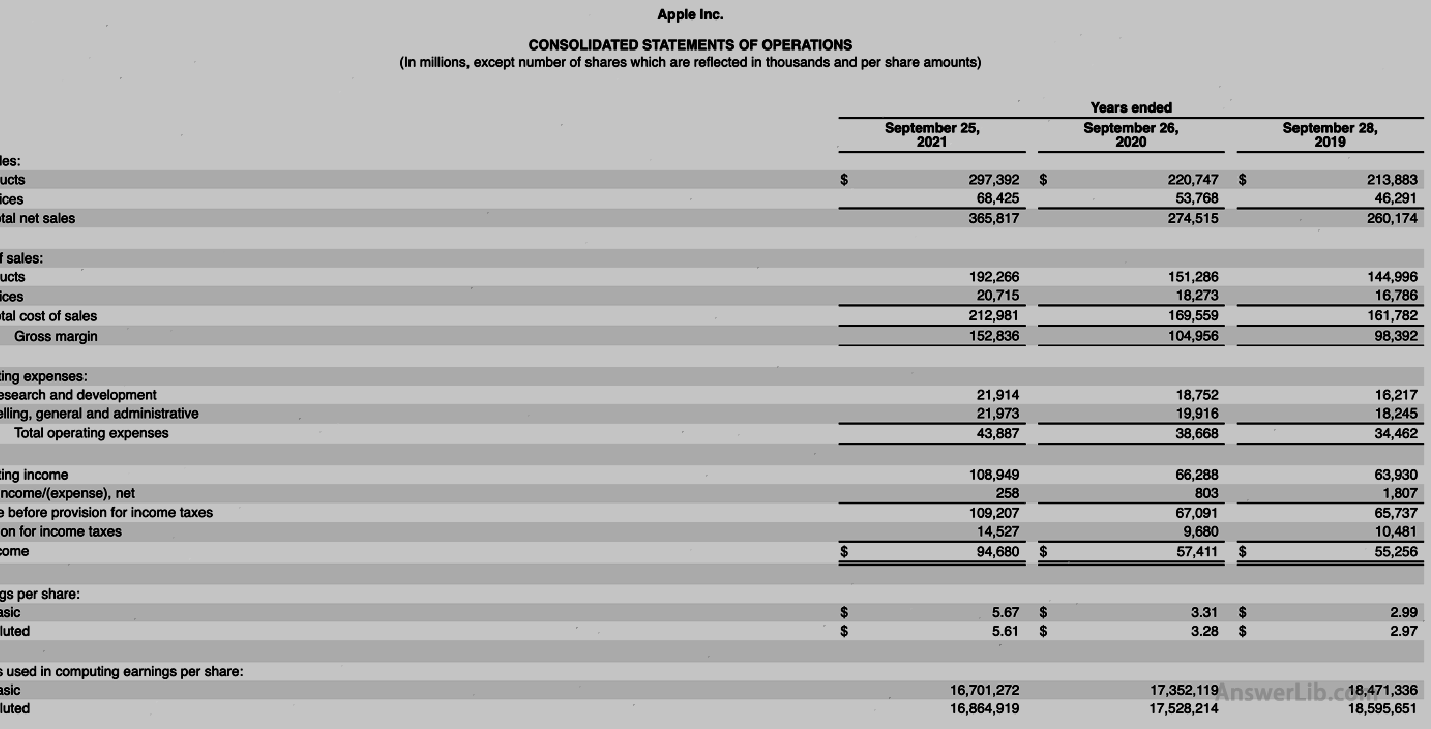

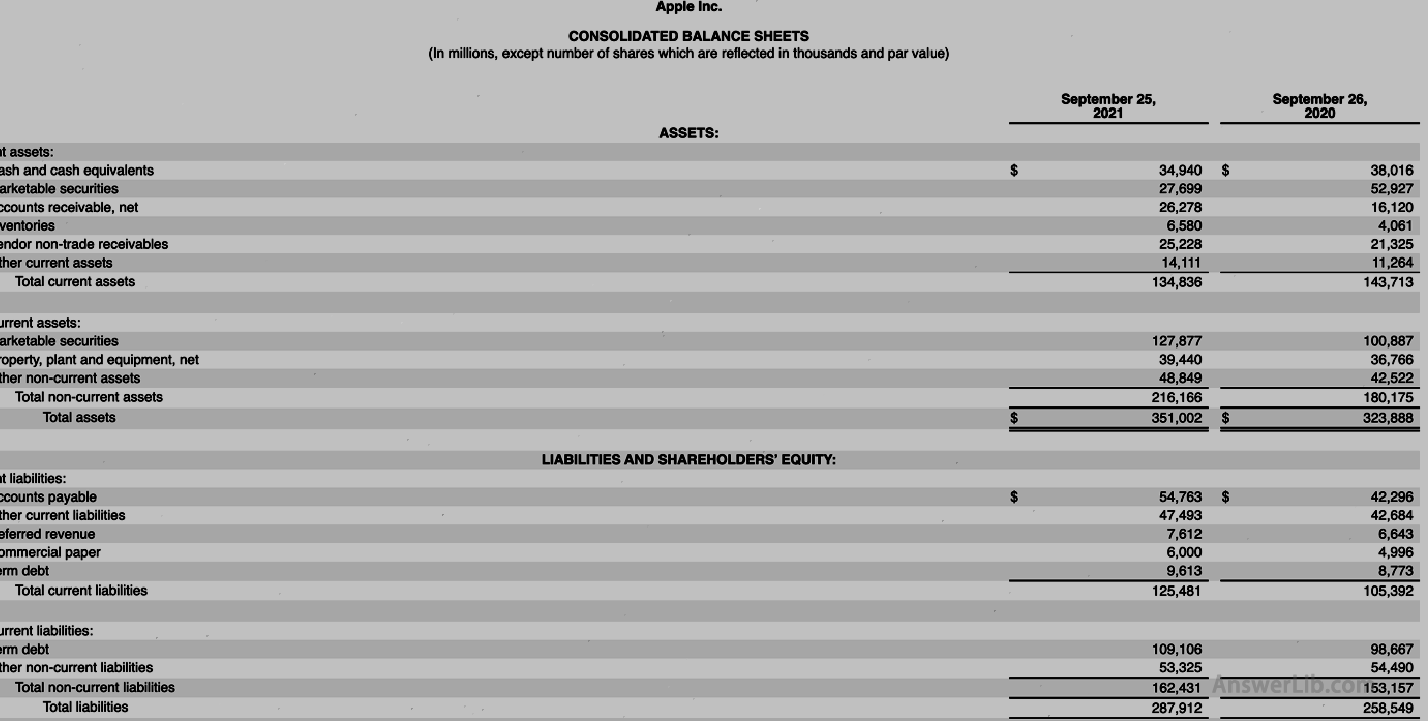

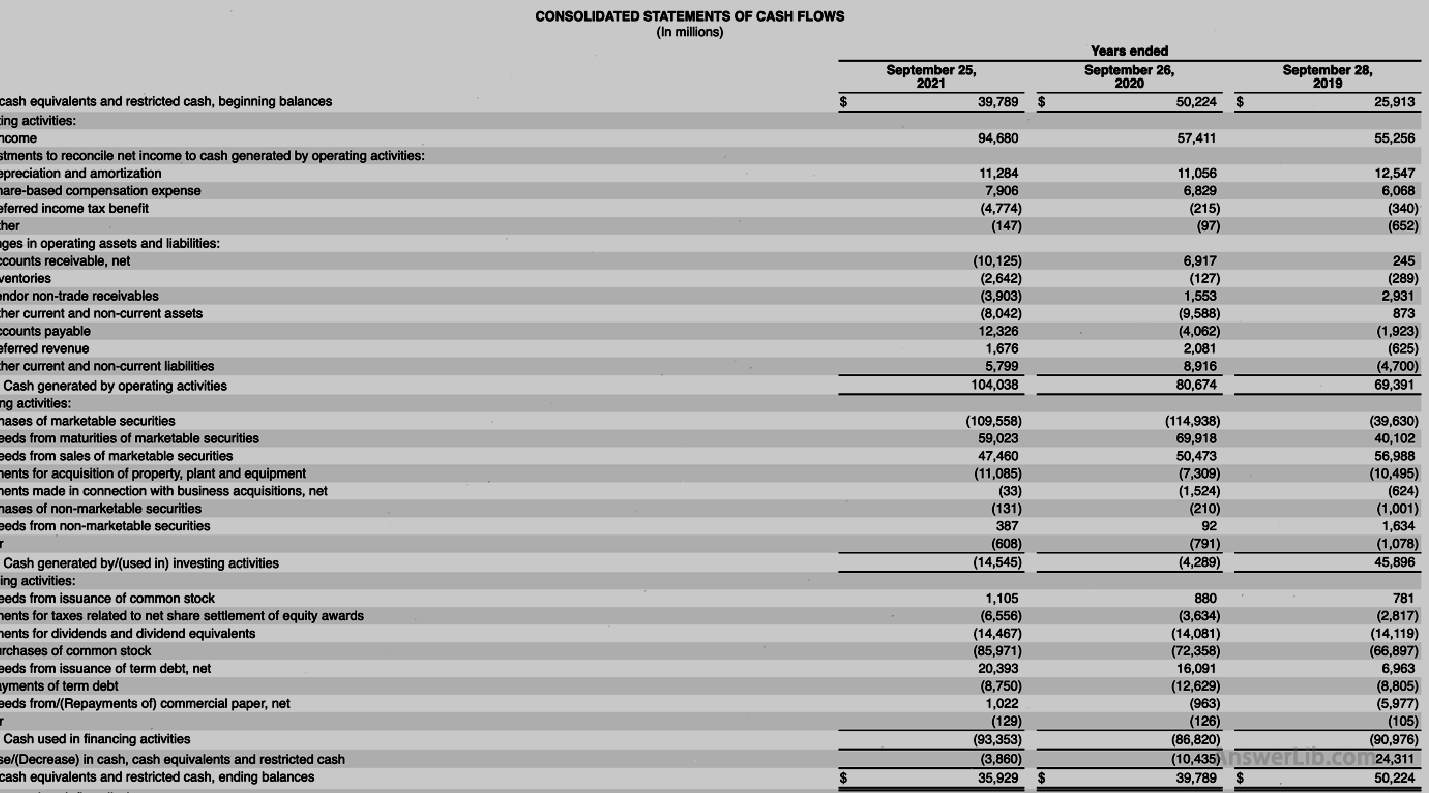

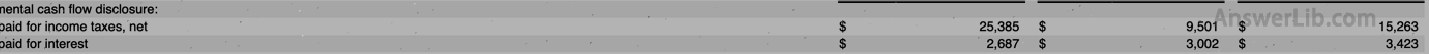

AAPL’s financial report middle Profits As well as Balance sheet, and Cash flow sheet As follows:

Profits (Statements of Operations) The

Balance sheet (Balance Sheets) The

Cash flow sheet (Statement of Cash Flows) The

Use the basic calculation formula:

Cash liabilities = operation cash flow / total debt

Cash flow to debt ratio = operating cash flow / topal debt

= $ 104,038 m / $ 287,912 m

= 0.36

Use variant calculation formula 1:

Cash liability ratio = interest tax discount pre-amortization of profit / total debt

= (Operating income+depreciation and amortization) / total debt

Cash Flow to Debt Ratio = EBITDA / TOTAL Debt

= (Operating Income + Depreciation & amortization) / Total Debt

= ($ 108,949 m + $ 11,284 m) / $ 287,912 m

= 0.42

Use variant calculation formula 2:

Cash liabilities = free cash flow / total debt

= (Business cash flow-capital expenditure) / total debt

Cash Flow to Debt Ratio = Free Cash Flow / Total Debt

= (Operating Cash Flow – Capex) / Total Debt

= ($ 104,038 m – $ 39,440 m) / $ 287,912 m

= 0.22

Use variant calculation formula three:

Cash liabilities = operation cash flow / long-term debt

Cash Flow to Debt Ratio = Operating Cash Flow / Long -TERM LIABILIES

= $ 104,038 m / $ 162,431 m

= 0.65

It can be seen that when calculating the cash-liability ratio, different results will be obtained when using different molecules and denominates.

What is the investment guidance significance of cash liabilities?

The use of cash liabilities can intuitively view the ability of enterprises to repay debt.The higher the ratio of this ratio, the better the company’s ability to repay debt.

When judging, the number is usually used 1 Come as a standard.

- When a company’s cash liabilities ratio is greater than 1, it indicates that the company’s business cash flow still has surplus after repaying the current total debt to continue to develop and use, which is a sign of a benign housing show company.

- When a company’s cash liabilities ratio is less than 1, it means that the company’s business cash flow during the financial cycle is not enough to repay all its debts, indicating that the company’s operations may encounter trouble.

The applicable scenario of another cash liability ratio is to calculate the time required for the company to repay all the debt.The calculation method is: use the number 1 to divide the cash liabilities rate, for example, the business cash flow of a company in the financial cycle is 50The total debt is $ 20 billion, so the calculated cash liabilities rate is: 50 /200 = 0.25, and then calculate 1 / 0.25 = 4 (year), which means that the company is currently in business cash flow.It takes about 4 years to repay all its debt.

In the market, different types of companies have different operating models.Therefore, different analysts may use different variants of cash liabilities to calculate to obtain a reference value that fits the company’s development model.

For example, the variant formula 1 mentioned in the previous article, uses ebidta as the molecule.

In this calculation formula, the inventory part of the enterprise is considered.When repaying the debt, this part of the asset can be turned into cash flow to repay the debt.In terms of cash flow, the value is higher, which is more beneficial to enterprises with large inventory, but in actual situations, inventory may not be sold quickly, so it does not have high liquidity like cash flow.

Variation formula two, use free cash flow as the molecule.

In this calculation formula, the cash flow removal of operating capital expenditure, so the calculation value is usually lower than the use of operating cash flow, indicating that the company’s ability to perform debt repayment obligations is low.For large-scale mature enterprises, this impact may not have serious evaluation differences, but for growth companies, because they are still in the stage of dependence on capital growth, if they use free cash flows to calculate the cash debt rate, they use free cash flows to calculate the cash debt rate, and the cash debt rate is used.It will have a more obvious negative effect on the evaluation of the enterprise.

Variation formula three, use long-term debt as a denominator.

When using variant formula three to calculate the cash liabilities rate, it is more favorable for companies with short-term debt in corporate debt, because the use of long-term debt computing cash liabilities will hide the company’s high-flow debt.

It can be seen that the calculation result of the use of different calculation formulas will cause large differences due to different enterprise operating models.Therefore, the cash liabilities rate is usually not used for evaluation between different enterprises, as well as different industries in different industries.Evaluation.

In addition, because the calculation method of the cash liabilities rate cannot reflect the changes that occur over time, when using the cash liabilities to evaluate a company, the cash liabilities ratio ratio of different periods shouldFinancial data to analyze and evaluate the company more comprehensive.