Capital returns have been used, English is Return on Capital Employed, Abbreviation ROCE It is an assessment indicator that measures the profit efficiency of a listed company to generate profit efficiency.When calculating the use of capital returns, the company’s pre-interest tax removal of the company’s use of capital has been used by the company.

Among them, the pre-interest tax profit is the sum of the company’s net income, interest, and taxes.The use of capital is the remaining part of the company’s total assets to remove liabilities.The calculation method is relatively simple.All data can be found in the company’s financial reports.Essence

In general, the higher the return on capital, the higher the efficiency of the company’s capital to create profits.

From the use of capital returns, investors can see that the company uses its capital to generate profits.For example, when a company’s useful capital return is 0.1, it means that the company invested $ 100 every $ 100.You can earn a profit of $ 10.Therefore, investors often use this value to determine whether the company is worth investing.The higher the capital return rate of capital, the higher the investment value.

Bleak American broker:Transparent securities| | Futu Securities| | Microex Securities| | Tiger securities| | First securities| | Robinhood in| | American Langshang Daquan

Directory of this article

- How to calculate the capital return rate?

- How to calculate Apple’s ROCE?

- What are the investment guidance significance of the capital return rate?

- What are the limitations of the use of capital return?

- The difference and connection between ROCE and ROIC

- Join investment discussion group

- More investment strategies

How to calculate the capital return rate?

The calculation method that has used capital return is to compare the company’s pre-interest and tax profit with the company’s use of capital, that is:

Capital returns have been used = profit before interest tax / already used capital

ROCE = EBIT / CAPITAL EMPLOYED

in:

The profit before interest taxation is deducting taxes and pre-interest profits, that is, net income plus interest and taxes, that is,:

Profit of interest before interest tax = net income + interest + taxes

Ebit = net intertome + interest + taxes

Net income and taxes can be found in the company’s profit or loss table; interest costs can be found in the Statement of Cash Flows.

The remaining part of the company’s current total assets has been used to minus liabilities in the current total assets of the company, namely:

Capital = (total asset-flow liabilities)

Capital Employed = (Total Assets -Current Liabilities)

These two values can be found on the company’s balance sheets.

How to calculate Apple’s ROCE?

This chapter will be released by Apple in September 2021 10-K financial report Calculate the instance:

AAPL Financial Report The profit and loss sheet, the balance sheet and the cash flow sheet are shown below:

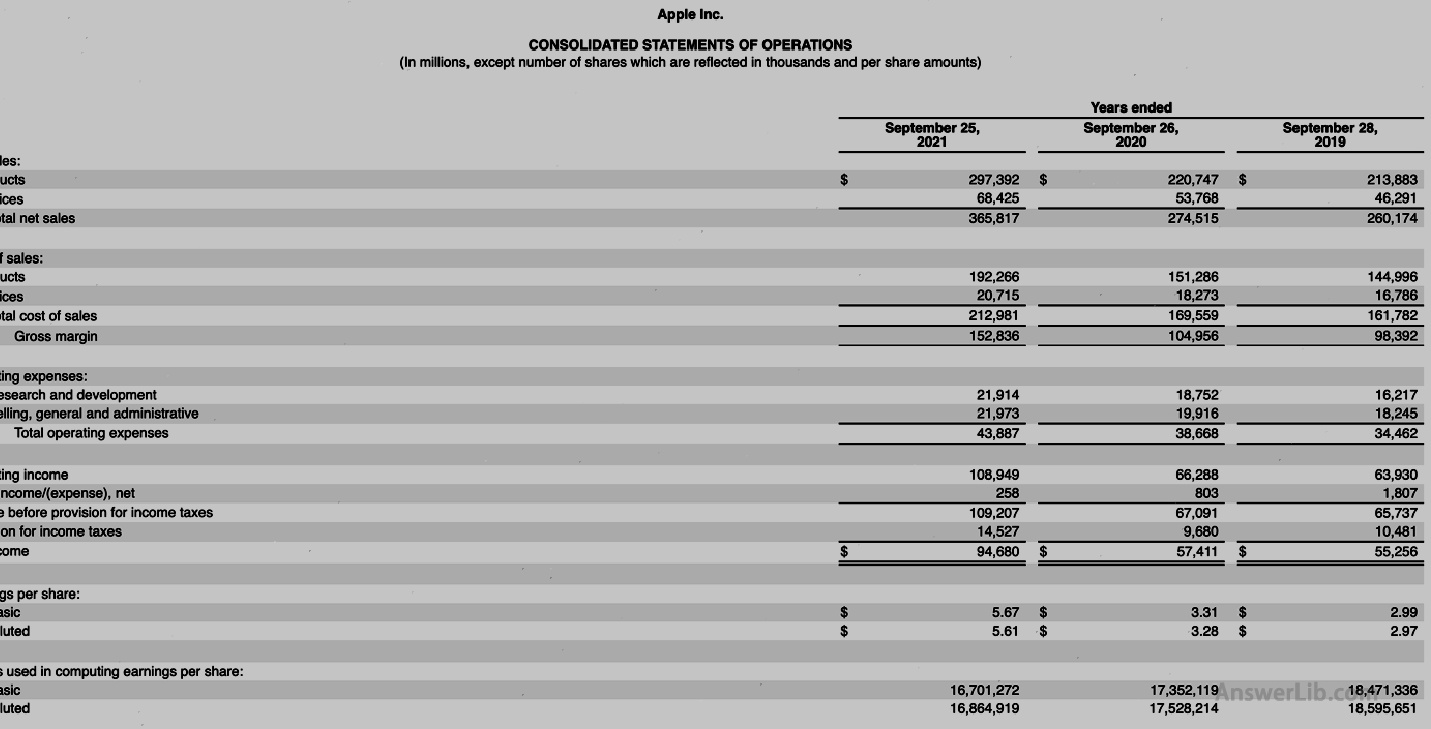

Statements of Operations:

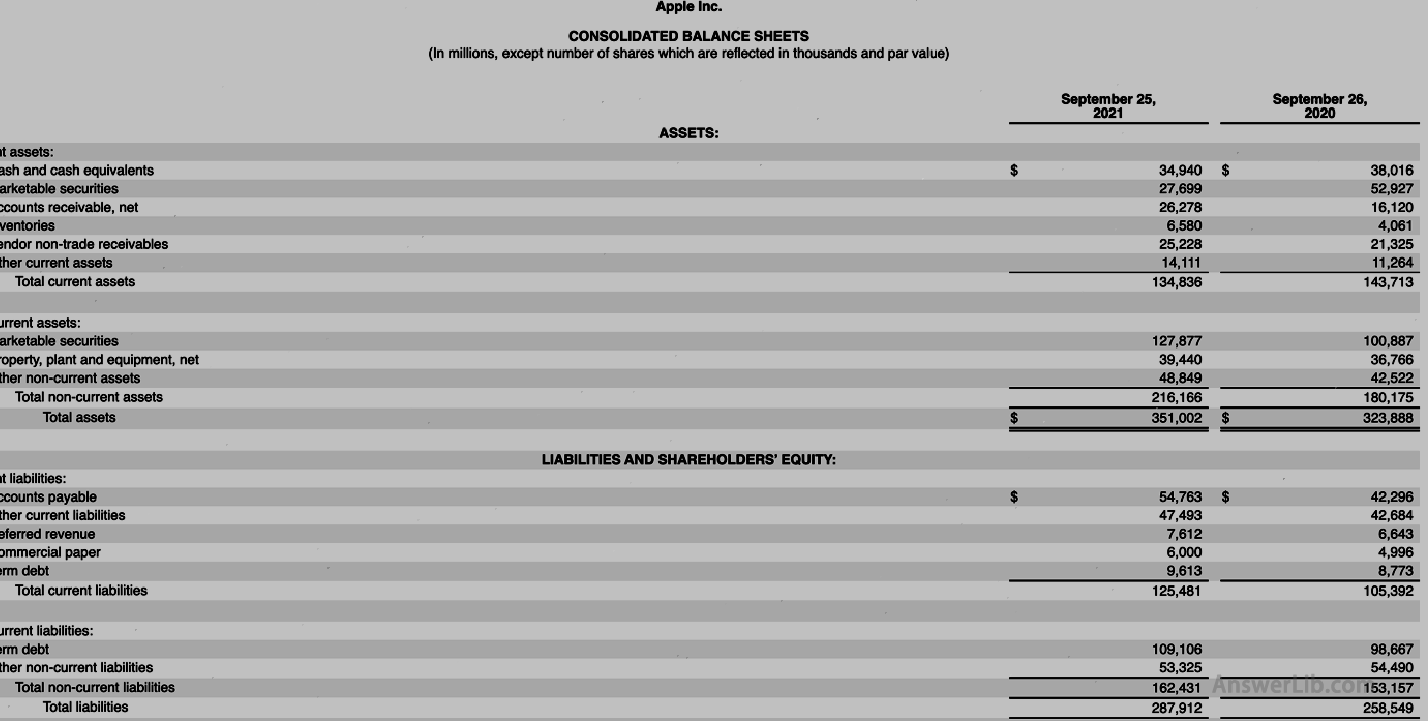

Balance Sheets:

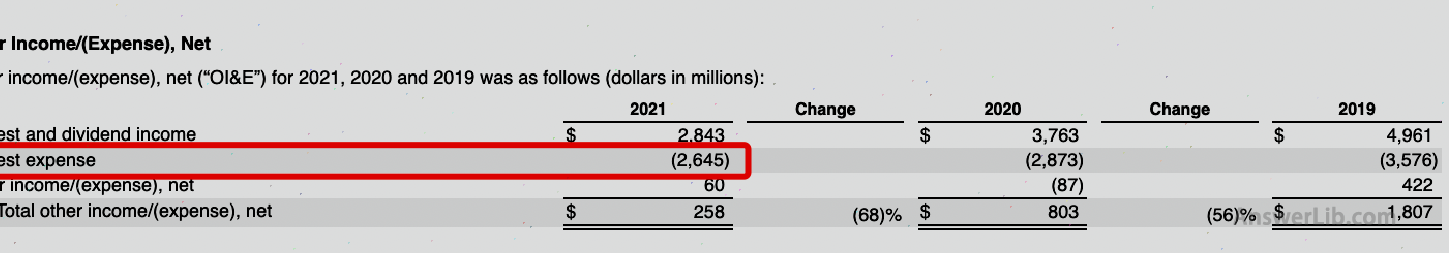

Other Income/ (Expense), Net

From the table, you can get the following important data:

Net income | $ 94,680 m |

Interest Internet | $ 2,645 m |

Tax and fee PROVISION for Income Taxes | $ 14,527 m |

Total Assets | $ 351,002 m |

Flow liabilities Total Current Liabilities | $ 125,481 m |

so:

Profit of interest before interest tax = net income + interest + taxes

= $ 94,680 m + $ 2,645 m + $ 14,527 m

= $ 111,852 m

Capital = total assets-liabilities

= $ 351,002 m – $ 125,481 m

= $ 225,521 m

Capital returns have been used = profit before interest tax / already used capital

= $ 111,852 m / $ 225,521 m

= 49.6%

Therefore, Apple’s capital return in the 2021 financial year is 49.6%, that is, Apple can get a profit of $ 49.6 for every $ 100 in mid -2021.

What are the investment guidance significance of the capital return rate?

In various financial indicators, the capital returns have used the capital that the company has used.This part is more targeted compared to the calculation indicators that use the total investment capital in other indicators, because it can show that the company is more realized from actual use from actual use.The ability to earn profits in capital.

The value that has been used with capital returns can intuitively show the proportion of the company’s use of its capital to earn profits.For example, when a company’s useful capital return rate is 0.1, it means that this company can earn $ 100 and you can earn every $ 100 and you can earn it.$ 10 profit.

In actual analysis and evaluation, the use of capital returns has played a better indicator of capital-intensive companies such as public institutional companies, telecommunications and communications companies, petroleum and natural gas companies, industrial industry companies, transportation industry companies, and manufacturing companies.Because the company’s equity and debt are considered in this indicator, when analyzing companies with large debt, it can get more objective and accurate evaluation results compared to indicators such as equity returns.

When evaluating different companies in the same industry, the higher the company’s return on capital, it shows that the better its profit earning the ability, the higher the investment value.

When evaluating a company’s different periods of capital returns, companies with a stable or rising overall trend are better than companies with a decline in overall trend.

What are the limitations of the use of capital return?

When using the capital return rate to evaluate a company’s financial status, it is often only learned that the company’s current operating status and the past operating development process can only be learned, and in the process of calculation, there is no risk factors, so it is difficult to correct this indicator from this indicator.The company’s future profitability is estimated.

On the other hand, because in the calculation of the return on capital, all assets are considered in the denominator, including cumulative depreciation, so as the company’s development, the nurse value will continue to decrease.When the enterprise fails to buy new assets through the purchase of new assetsWhen updating fixed assets, the company’s use of capital return will increase, but this elevation does not necessarily mean that the profitability of the company increases.

The difference and connection between ROCE and ROIC

ROCE is very similar to ROIC, and it is used to measure the company’s ability to use capital to create profits.Let’s compare the difference between the two:

| Capital returns have been used ROCE | Input capital return rate ROIC | |

|---|---|---|

molecular | EBIT Ebitit | Profit after tax Nottat |

Maternal | Make use of capital = Total Assets -Liabilities | Investment capital = Investment liabilities+total shareholders stock |

Applicable scene | Comprehensively evaluate the company’s ability to obtain profits from all its assets | You can get more fine capital return evaluations, make a more accurate evaluation of the company’s operating conditions |

the difference | The capital has taken into account the total capital owned by the company, and the numerical evaluation is more comprehensive than ROIC Relative to ROIC, ROCE considers the company’s intangible assets and cash assets | Investment capital returns have considered the liability capital and shareholder capital used by the company to invest, and the numerical evaluation is more fine than ROCE. The potential return of investors is more effective than ROCE |

The same | It is used to measure the company’s profitability | |