Inventory turnover, English is Inventory Turnover Ratio It is a financial indicator that measures the ability of a company to generate sales income from inventory.The inventory turnover is calculated by removing the cost of sales in a certain period of time with the average inventory of the same period.Its value means that the company sells and replaces its inventory goods during the given period.

Usually a certain period of each finance year, but different companies can calculate the inventory turnover rate of monthly, quarterly or half a year according to actual use.At the same time, it is not limited to calculating the overall inventory turnover rate of the company, but also the inventory turnover rate of specific products to provide the company with more detailed operating capacity analysis.

The lower the inventory turnover rate, indicating that the company’s sales capacity has problems, and even stagnation may occur, which has a negative impact on the company’s operating income.The higher the inventory turnover rate, it means that the company’s sales capacity is strong and can effectively convert inventory into benefits.It is necessary to adjust the timely operation mode.

Bleak American broker:Transparent securities| | Futu Securities| | Microex Securities| | Tiger securities| | First securities| | Robinhood in| | American Langshang Daquan

Directory of this article

- How to calculate the inventory turnover rate?

- How to calculate Apple’s inventory turnover rate?

- What is the investment guidance significance of inventory turnover?

- Join investment discussion group

- More investment strategies

How to calculate the inventory turnover rate?

The calculation method of inventory turnover is to divide the sales cost of the product (COGS), which is except for the average inventory (AVERAGE Inventory), that is,:

Inventory turnover rate = sales cost / average inventory

Inventory Turnover Ratio = COGS / AVERAGE Inventory

in:

According to different types of companies, COGS can include material costs, direct or indirect costs that are directly or indirect in production products.For listed companies, it can be found in its financial report.

Inventory refers to all assets in the company’s inventory, including raw materials, products, and goods to be sold, and the average inventory refers to the average value of the initial inventory and the final inventory at a certain period of time.For listed companies, it can be found in the balance sheet in its financial report.

In actual use, a specific cycle is usually used as the year of each financial year.You can get the relevant values from the company’s financial report, such as COGS and the initial and final inventory.

For the internal enterprise, COGS and average inventory in different periods can be used to calculate the inventory turnover rate, especially seasonal consumer goods companies, such as skiing board manufacturing companies.Adjust the inventory reserves of the product.You can also choose the inventory turnover rate of certain types of specific products sold by the company to calculate the value of the product continued to be sold.When it is used inside the enterprise, the parameter value of calculating the inventory turnover rate needs to be provided according to the internal account book of the enterprise.

how Calculate Apple’s inventory turnover rate?

This chapter will be released by Apple in September 2021 10-K financial report Calculate the instance:

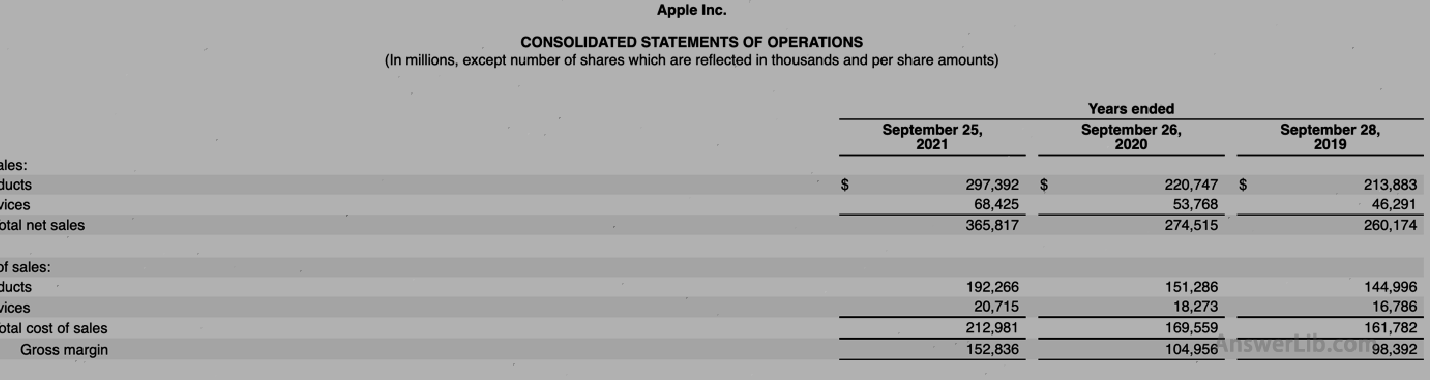

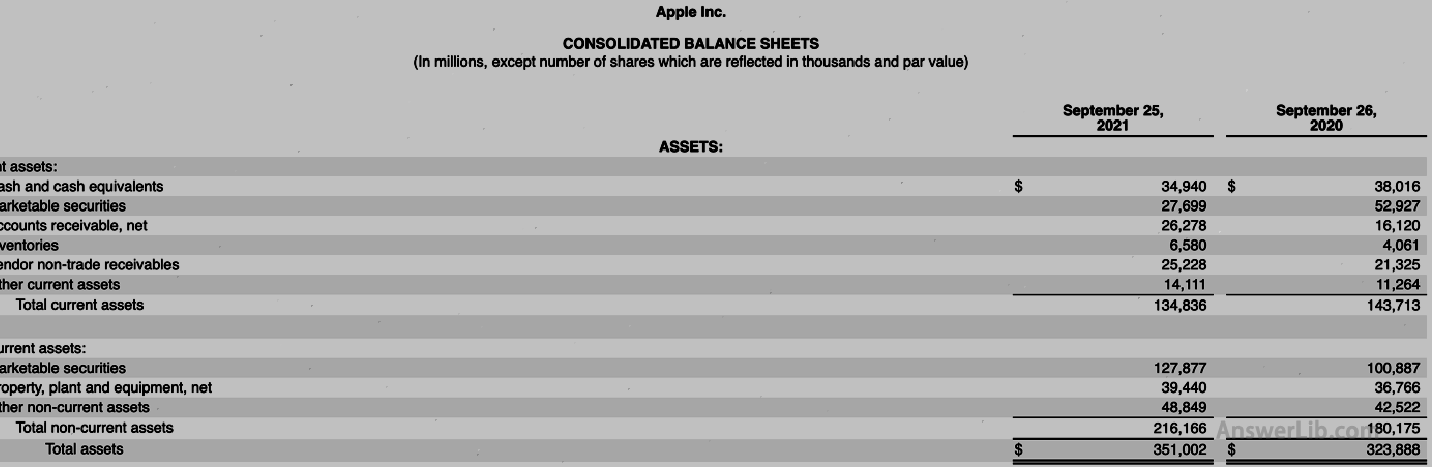

AAPL Financial Report The profit and loss sheet and the balance sheet are shown below:

Profit table:

Asset liabilities:

It can be seen from the financial statements that the sales cost of Apple’s 2021 financial year is $ 212,981 m, and the inventory at the beginning of the period is the end of the last financial year, $ 4,061 m, and the final inventory is $ 6,580 m.

So the average inventory is:

Average inventory = (Period Inventory Volume + Final Inventory) / 2

= ($ 4,061 m + $ 6,580 m) / 2

= $ 5,320.5 m

Inventory turnover rate = sales cost / average inventory

Inventory Turnover Ratio = (Cost of Goods Sold) / (Averse Inventory)

= $ 212,981 m / $ 5,320.5 m

= 40

In other words, Apple completed sales and replacing its inventory products 40 times during the 2021 financial year.

What is the investment guidance significance of inventory turnover?

When using the inventory turnover rate to measure the company’s operating ability:

- Too low inventory turnover means that the company cannot sell its inventory products in time, resulting in a large backlog of inventory products, and the company’s operating profitability is poor.

- The higher inventory turnover means that the company’s sales capacity is strong, the inventory replacement speed is fast, the holding cost is low, the corresponding profitability is better, and the overall operating ability is at a good level.

- However, excessive inventory turnover rate indicates that the company’s inventory is not enough to meet the demand for sales, which will make the company’s operating capacity be dragged down due to insufficient inventory.It may miss some opportunities that can develop rapidly and expand scale.

When using the inventory turnover rate to measure different companies, different advantages and disadvantages will occur due to different industries, such as companies that produce or sell rotten products, such as flowers, fresh food, etc.Rest, and for companies such as large equipment such as excavators, lower inventory turnover rates are not necessarily unsatisfactory in sales.

When the company uses the inventory turnover rate within the company, it can be classified according to time or product types, so that the company formulates more detailed operating strategies:

- When calculating the inventory turnover rate according to time, the company’s inventory can be adjusted according to different seasons to achieve the most ideal inventory turnover rate.This is particularly applicable to companies that produce or sell seasonal products.Essence

- When calculating the inventory turnover rate based on the product type, you can determine the consumer’s attitude towards goods according to the high or low inventory rate of the inventory rate in the same period.Low goods show that consumers do not accept this product, then the company can use this to adjust the inventory of different products to maximize the income.For companies such as department stores with a large number of different types of products, it is very suitable for adjusting the inventory turnover rate to adjust the inventory of different products, and even its display location.