Stock repurchase, English is Share Repurchase, or Buyback It means that listed companies directly purchase their own companies from the market or buy their own companies through the investment bank, so that the number of stocks circulating in the market will become less, thereby increasing the value per share, thereby indirectly increasing the stock price.

Listed companies usually give stock repurchase for different purposes.For example, the stock price is enhanced by stock repurchase to give back to the existing shareholders, or stabilize the decline in stocks through stock repurchase.All stock repurchases in the company will be publicized in each financial report 10-Q financial report, and the stock repurchase in the fourth quarter is announced in the company’s 10-K financial report middle.

Stock repurchase can usually help the company increase the stock price and increase the number of financial indicators such as earnings per share and price-earnings ratio by reducing the number of circulating shares to optimize the company’s evaluation value.But on the other hand, repurchase stocks may cause investors to have a negative investment psychology, such as the company’s cash that cannot use surplus to make reasonable investment.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- How to check the company’s stock repurchase?

- Check Apple’s stock repurchase?

- Why should the company repurchase stocks?

- What impact does repurchase stocks affect the company?

- Join investment discussion group

How to check the company’s stock repurchase?

Listed companies will publish their stock repurchase information in their quarterly or annual reports in each financial quarter.

In the first to third quarter of the financial year, it is published in 10-Q report Among the ITEM 2 part of Part II.

The stock repurchase information in the fourth quarter of the financial year was released in the 10 -K statement, located in the Item 5 part.

In the stock purchase return form, the company will publicize the time period of stock repurchase, the number of repurchase, and the price per share.

Investors can view the company’s financial report through the following ways:

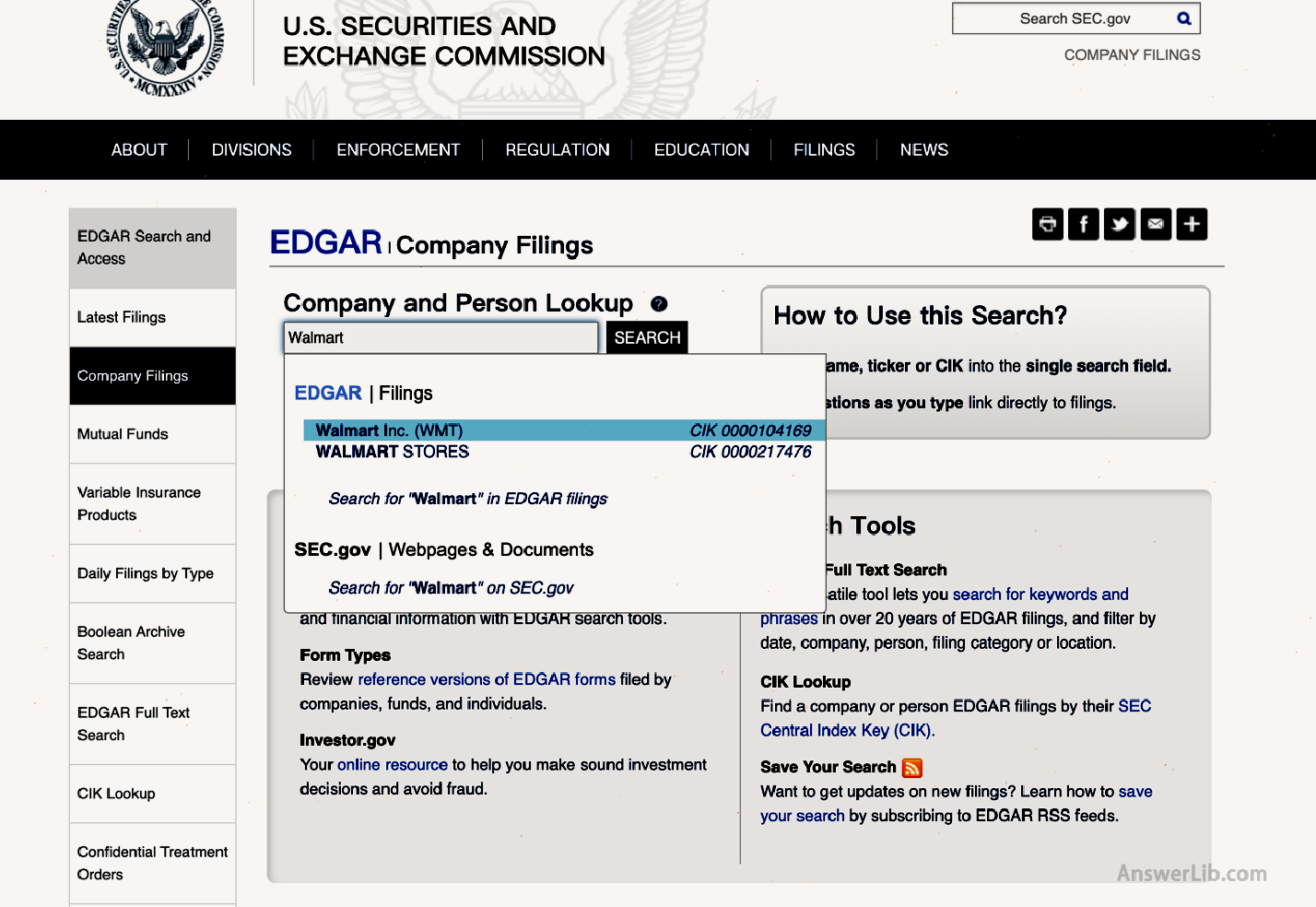

step one: Search “EDGAR” in Google and find “EDGAR -SEC.GOV” in the search results to enter the SEC official website.Or directly enter the US Securities Regulatory Commission EDGAR homepage Essence

Step 2: Find the “Company Filings Search” menu on the left menu bar on the homepage of the US Securities and Exchange Commission.Click to enter to enter the company to search for the page.

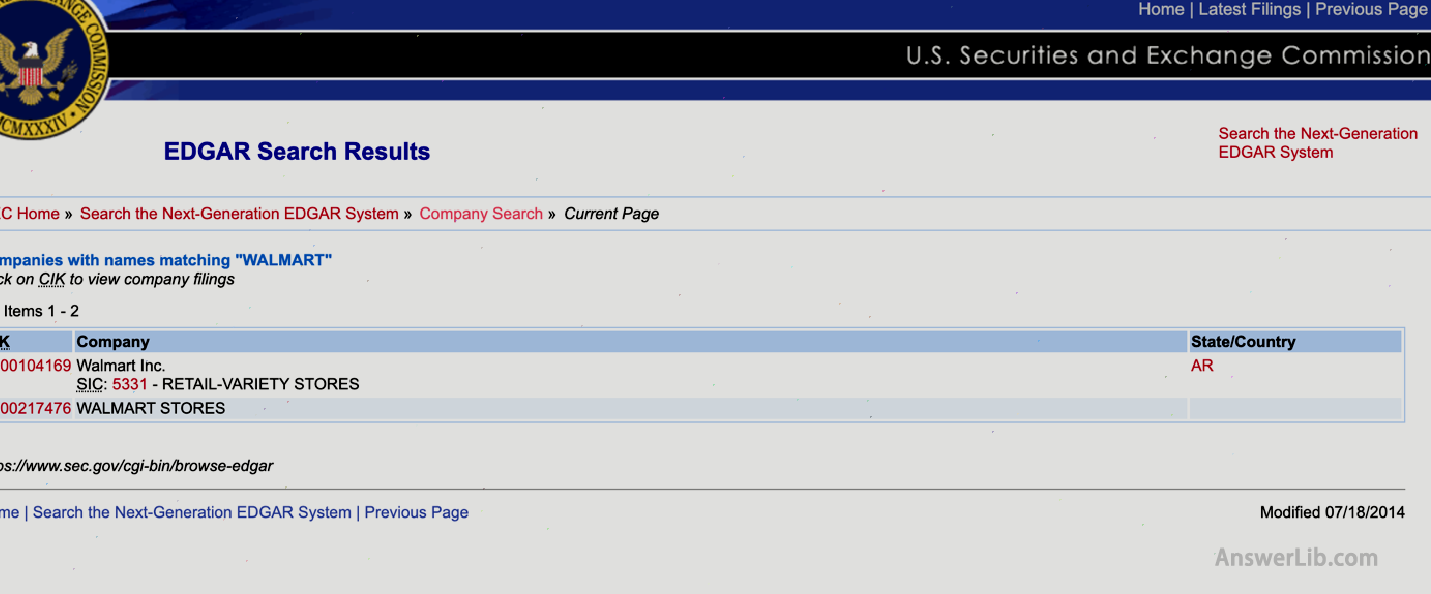

Step 3: In the search bar in the middle of the page, you can search for the target company by entering the company name or stock code.Here is an example of searching Walmart as an example:

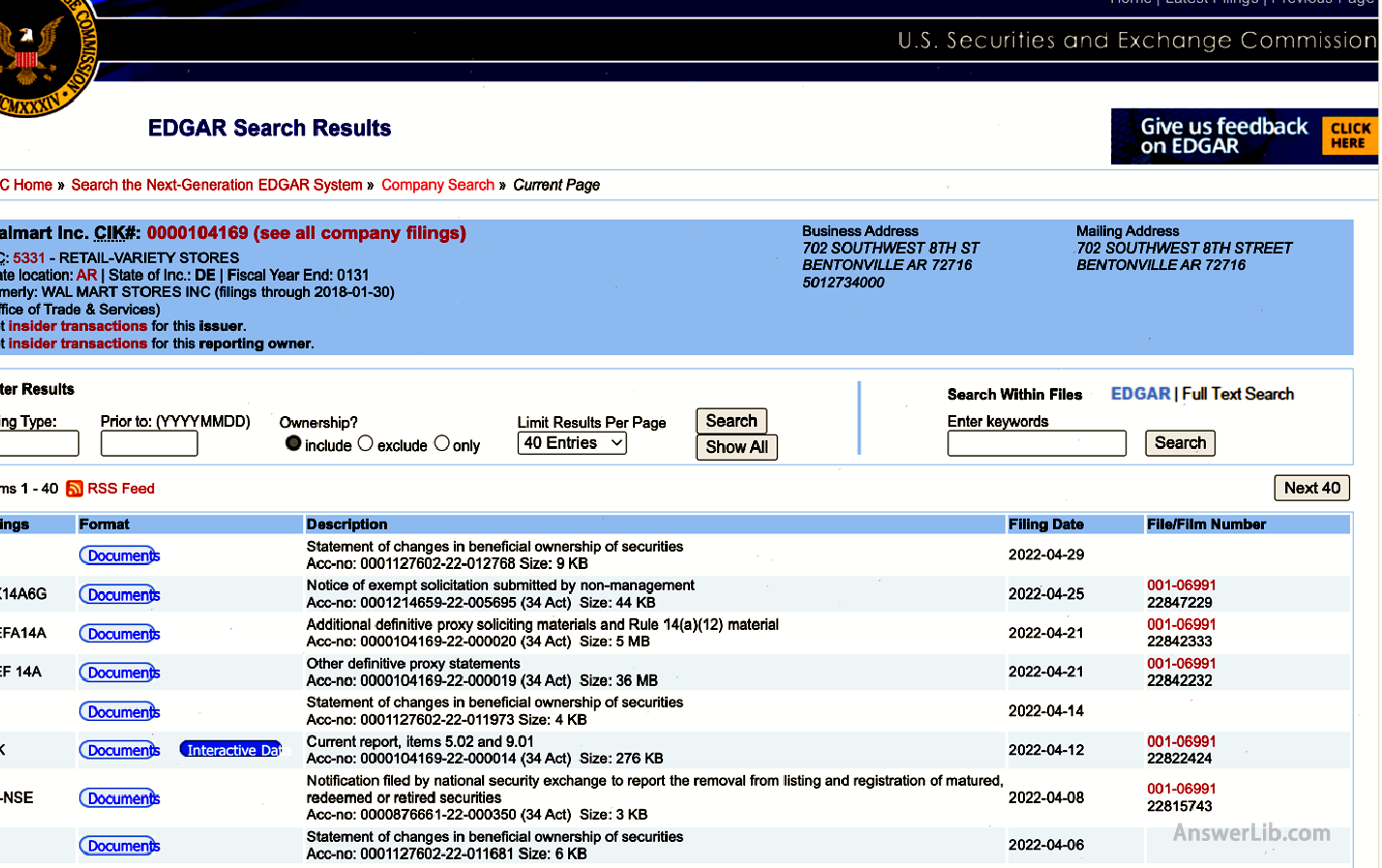

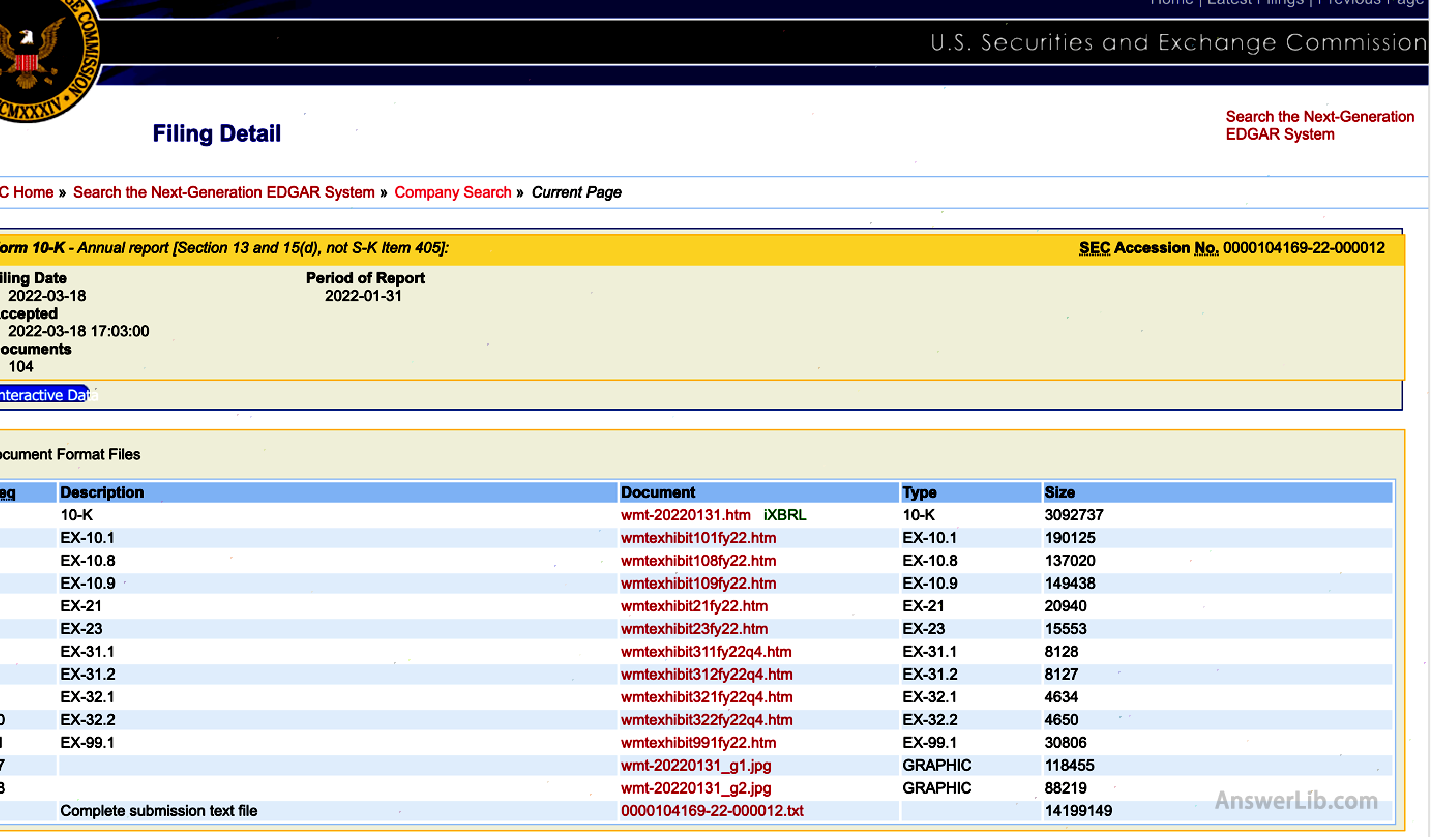

Step 4: Enter the link of the target company to enter its information form page:

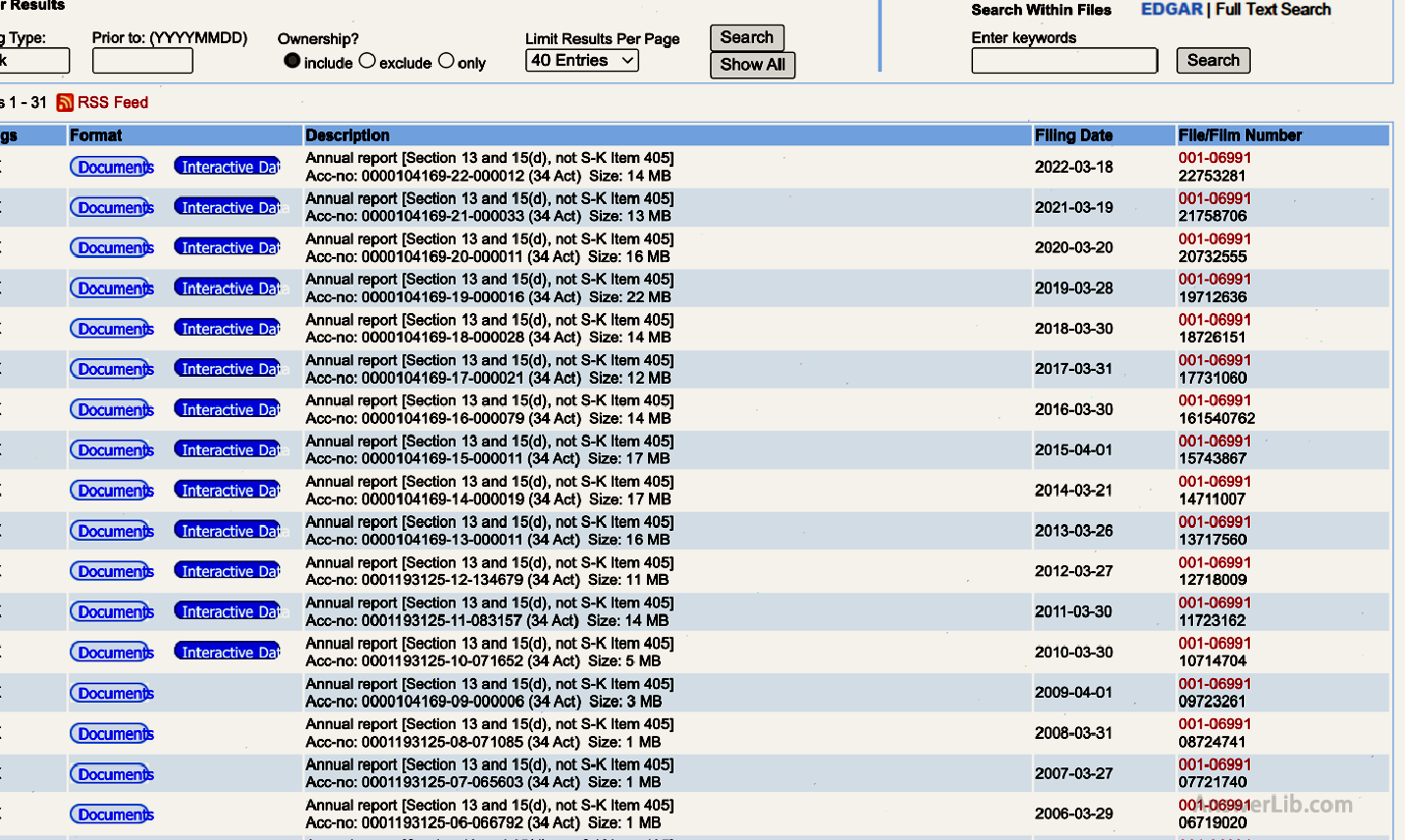

Step 5: In the information form page, it contains all the financial reports submitted by the company.When a specific financial report is required, you can enter 10-K in the fast search bar aboveSpecify the financial report submitted by the company:

Step 6: Click the “10 -K” connection of the year you need, you can enter the link page of a variety of files, and click the “FORM 10 -K” at the top to view the 10 -K table of the year:

Check Apple’s stock repurchase?

This chapter will be released by Apple in September 2021 10-K financial report For example query:

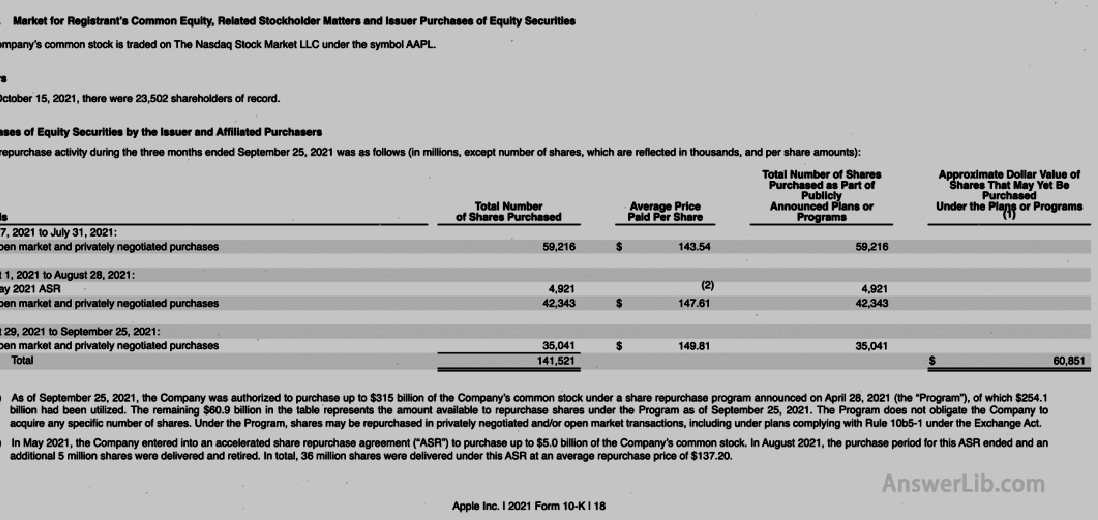

After entering the 10-K financial report, pull the page to the ITEM 5 part to see the stock repurchase of Apple in the fourth quarter of its financial year:

From the data table, it can be seen that Apple’s time in the fourth quarter of the 2021 Financial Year is the time to repurchase the stock repurchase.

From June 27th to July 31st, August 1st to August 28th, August 29th to September 25th.

in,

- For the first time, it purchased 59,216k stocks from the price of $ 143.54 per share;

- The second time I bought 42,343K stocks from the price of $ 147.61 per share, and at the price of an average of $ 137.20 per share, the shares of 4,921k stocks were purchased by the “accelerated share repurchaser” (ASR).Items

- The third time I bought 35,041K stocks from the price of $ 149.81 per share.

The company’s stock repurchase is to use cash to buy their own stock share from the open market.These shares will be canceled after purchasing, or deposited into the company’s asset library, and no longer have the right to obtain dividends and the right to vote for corporate affairs.The operation was completed by the company through its securities agent.

Accelerating stock repurchase ASR is a investment strategy of a one-time repurchase of stocks in a listed company.

The basic repurchase process signed a long-term contract with the intermediary investment bank for the listed company.At the designated date, a certain amount of company shares are purchased from the bank at the designated price.The number of stocks is usually very large.The intermediary investment bank then borrowed a large number of stocks from the common funds, insurance companies or pension institutions, and remitted these shares to companies that signed the contract at the designated date.

Because the company usually thinks of ASR when its stock price is underestimated, it will sign a long-term contract with an agent bank with an intermediary bank.When delivery, the intermediary bank can earn considerable benefits from the difference, but at the same time, it also faces the risk of the stock price without rising during the performance day.

The total number of stock repurchases is: 141,521K shares, the total amount is about $ 60,851M

Why should the company repurchase stocks?

The main purpose of the company’s stock repurchase is the following points:

1.Increase the benefits of shareholders at low cost

When the company has surplus cash to be assigned to shareholders, it can adopt two ways to increase dividends or stock repurchase.However, increasing dividends will cause corresponding taxes, and repurchase stocks will not be, so some companies will use stock repurchase instead of increasing dividends to allocate surplus cash to shareholders.

2.Control or reduce investment capital

The initial purpose of the company’s issuance of shares is to raise equity capital to help their companies expand, but if the company has expanded to a certain scale and the rise space is very limited.Financial burden, at this time, repurchase stocks will be used to control the number of circulating shares, thereby reducing dividend expenditures.

For example, Apple, Disney, etc.have developed to a certain scale and are constantly compressed.Therefore, in recent years, a large number of stocks have been repurchased to control investment capital.

3.Stable stock price

In contrast to the former, the situation of stock repurchase in order to stabilize the stock price usually occurs in companies that have declined.When the company’s development has declined or encounters an economic crisis, it may take reduction of dividends to control capital expenditure, but cutting dividends may cause negative emotions of shareholders, and there may be a large number of selling ones, and the stock price has fallen sharply.Therefore, the company will use a certain amount of stocks to reduce investment capital expenditure.At the same time, it can also stabilize the emotions of shareholders and maintain the relatively stable stock price.

4.Adjust the stock price

When the company believes that the current stock price is seriously underestimated, they will purchase some stocks at a low price.After the market adjustment, the stock price will be upgraded to the company’s considering value.

This situation usually occurs when the stock price is seriously undervalued due to factors such as short-term investment failure, negative news influence, or generally viewing emotions in the market, and will use stock repurchase to adjust the stock price.

5.Cancel off the dilution of shareholders’ income

Some companies will issue stock options to employees to provide benefits and retain talents.As the amount of issuance increases, this will increase the number of circulating shares and dilute shareholders’ income.Therefore, the company will offset this dilution by repurchasing stocks.

What impact does repurchase stocks affect the company?

Sometimes repurchase stocks bring more benefits to the company, but sometimes it may cause certain disadvantages, and it will have a positive or negative impact on the company’s development.

1.Positive impact

- Enhance the stock price: When the stock repurchase, the number of shares circulating in the market decrease accordingly.If the total income remains unchanged, the income (EPS) per share will increase.From the outside world, the stock will become more valuable, soAttracting more investors, the stock price will increase.

- Tax benefits: dividend income needs to be paid, and the stock price rises will not be taxed.When the company repurchases the stock, the value of the remaining stocks held by shareholders will rise, and the increasing income does not require taxation.

- More flexible shareholders ‘feedback method: When the company hopes to increase shareholders’ income, it can increase dividends or repurchase stocks, but after increasing dividends means that they need to pay higher dividends in the future, because reducing dividends will cause negative emotions of shareholders.In the endIt may lead to a decline in the stock price.Therefore, some companies will use the combination of dividends and repurchase stocks to increase the benefits of shareholders.In this way, companies can more flexibly adjust the benefits of shareholders they can pay.

- Improve the overall economic environment: When stock repurchase causes the stock price to rise, consumers’ investment confidence and desire for consumption will increase to a certain extent, and then it will drive the overall economic environment to improve the improvement.

2.Negative impact

- Sometimes stock repurchase may also cause a decline in the stock price because the shareholders will believe that the company does not have other profit opportunities, which means that the company’s profitability has a upper limit.The stock price fell.

- On the other hand, if the company repurchase stocks through loans, this will affect the company’s credit rating.Because the company’s loan interest is exempted from taxation and consumes its reserves cash, some companies will take such measures to avoid taxes when the economic environment is not conducive to their development.The stock repurchase of loans is repurchased to reduce the company’s credit rating.