net Net operating capital, English is Net-net working capricity, Abbreviation Nnwc It is a financial indicator that measures the remaining asset value of a listed company in the asset settlement.

The concept of net operating capital comes from the Net-Net investment strategy proposed by the investment master Benjamin Graham.Even if the company can use the circulation assets immediately used by the company to measure the value of a company to seek the cheapest investment object.

In the NET-Net concept, there are two indicators, one is net operating capital, the most conservative company asset valuation method, and the other is the value of net current asset value (NCAV).Simple asset estimation methods for net operation capital.

When calculating net operating capital, adjust the company’s mobile assets a certain proportion, and then subtract the total debt.When the net operating capital is divided into the current circulation stocks, you can get the net-net Working Capital Per Share.

Compared with the current stock price of net operating capital per share, if the current stock price is closer to net operating capital per share, in the Net-Net investment strategy of Benjamin Graham, the cheaper this stock is, it is an investment worth considering investment.Object.

Bleak American broker:Transparent securities| | Futu Securities| | Microex Securities| | Tiger securities| | First securities| | Robinhood in| | American Langshang Daquan

Directory of this article

- How to calculate net operating capital?

- How to calculate Apple’s net operating capital?

- What is the significance of investment in net operating capital?

- What are the limitations of net operating capital?

- What is the difference between NNWC and NWC?

- Join investment discussion group

- More investment strategies

How to calculate net operating capital?

The calculation concept of net operating capital is to reduce the company’s mobile assets off the total liabilities, but for mobile assets, it will make a certain proportion of adjustments, because Benjamin Graham believes that the company’s cash and short-term investment (for example, securities)It is the current asset that can reflect the value of the company, but the account receivable is because of future income, so it is necessary to make a proportion adjustment in terms of value, and 75% -90% will be adjusted.For inventory, Graham believes that inventory is usually unable to refund quickly.If it continues to be discounted, it will generally be sold at a discount.Therefore, when calculating the company’s mobile assets, the inventory value needs to be converted to 50%to 75%, that is::

Capital Capital = Cash + Valid Securities + (75%~ 90%) X receivables + (50%~ 75%) X inventory-preferred shares-total debt-total debt

Nnwc = Cash + Marketable Securities + (75%~ 90%) x accounts ReceIVABLE + (50%~ 75%) x Inventories -Preferred Stock – Total Liabilities

When calculating, investors will choose the final adjustment ratio based on their own understanding of the company’s operations, but the general calculation method is to use a fixed adjustment value to calculate the net operating capital, simplify the calculation process, and obtain a more moreConservative calculation value.The adjustment ratio of accounts receivable is set to 75%, and the adjustment ratio of inventory is set to 50%.

Right now:

Capital Capital = Cash + Property + 75% X Credit Credit + 50% X Inventory -Preferred Stocks – Total Liabilities

Nnwc = Cash + Marketable Securities + 75% x Academ ReceIVABLE + 50% x Inventories -Preferred Stock – Total Liabilities

Calculating the net operating capital, you can calculate the net operating capital per share.The English is Net-Net Working Capital Per Share, referred to as NNWCPS.The calculation method of the value of net operating capital per share is to divide the net operating capital with the current dilution of circulation shares, that is:

Capital value of net operating capital per share = net operating capital / diluted circulation shares

Nnwc Per Share = nnwc / Diluted Shares Outstanding

All relevant data of calculating net operating capital can be found in Balance Sheets, the balance sheet in the company’s financial report, and the number of diluted shares can be found in the company’s comprehensive operating statement.

how Calculate Apple’s net operating capital?

This chapter will be calculated by using the 10-K financial report released by Apple in September 2021:

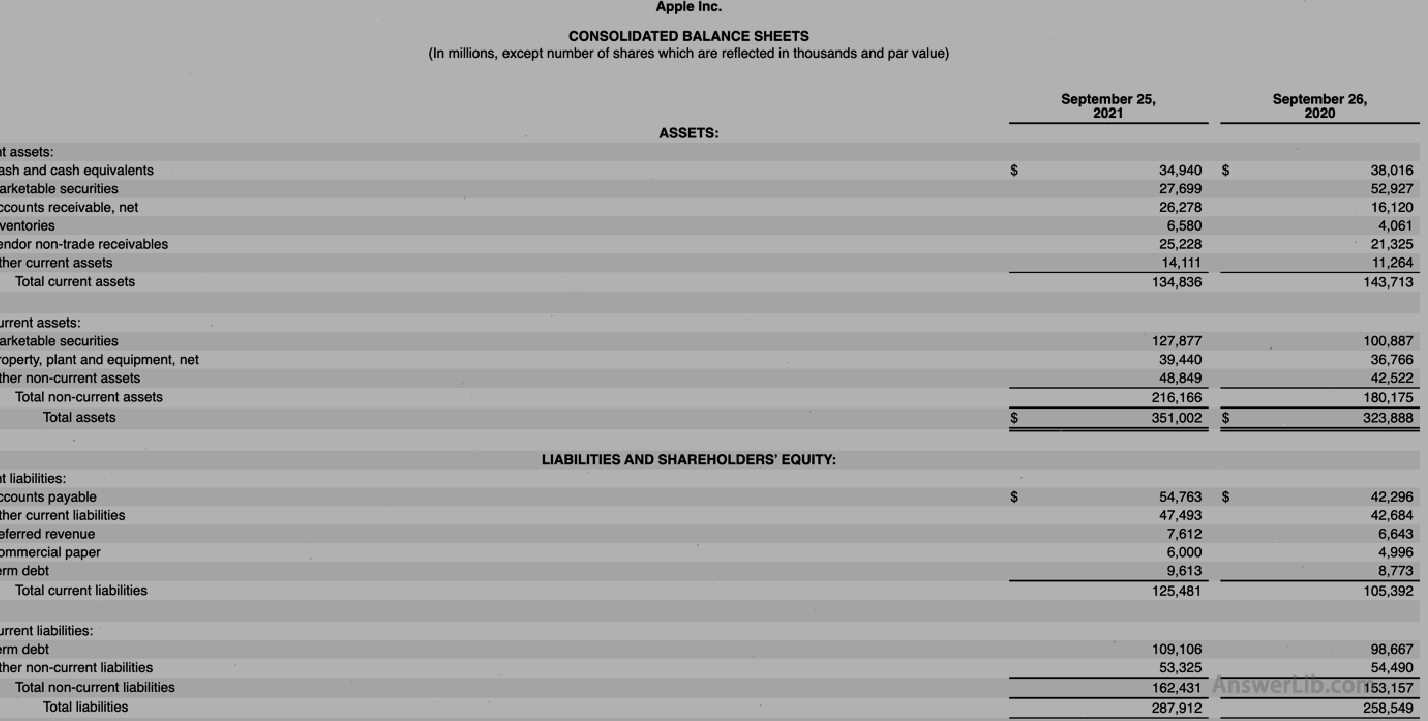

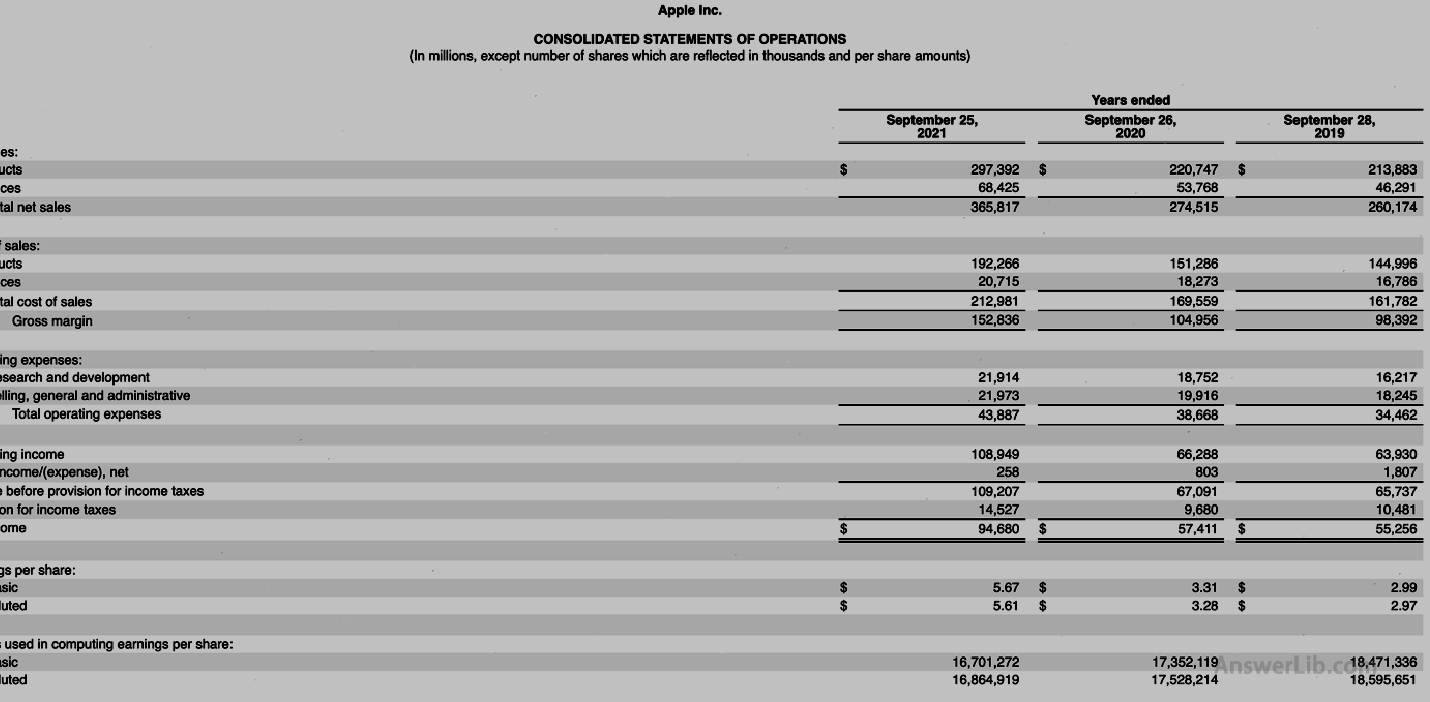

AAPL Financial Report The balance sheet and comprehensive business reports are shown below:

It can be seen from the financial statements that Apple’s 2021 Financial Year:

cash | $ 34,940 m |

Short-term investment (securities) | $ 27,699 m |

accounts receivable | $ 26,278 m |

in stock | $ 6,580 m |

total liability | $ 287,912 m |

Preferred shares | none |

Dilute circulation stocks | 16,864,919 |

The calculation method of using more common net operating capital is:

Net Operating Capital = Cash + Property + 75% X Credit Credit + 50% X Inventory -Total Monitor

= $ 34,940 m + $ 27,699 m + 75% x $ 26,278 m + 50% x $ 6,580 m — $ 287,912 m

= – $ 202,276 m

It can be seen from the above calculations that the net operating capital of Apple’s 2021 financial year is negative.Below we will calculate the net operating capital per share.

Nnwcps = nnwc / dilutem outstanding shares

= – $ 202,276 m / (16,864,919 x 1000) shares

= – $ 11.99

What is the significance of investment in net operating capital?

In Benjamin Graham’s Net-Net investment strategy, net operating capital means that when the company liquidates, all current circulation assets are converted into cash valueThe minimum assets distributed for shareholders.

After using net operating capital to calculate the value of net operating capital per share, compared with the company’s current stock price, Benjamin Graham believes that it should find stocks with a stock price below the value of net operating capital per share.

What are the limitations of net operating capital?

first, net In the calculation of net operating capital, long-term assets are not considered, so the company’s long-term development trend cannot be estimated.

Secondly, when using net operating capital, in essence, investors need to have a very deep understanding of the company in order to determine the final value conversion ratio.When calculating the minimum value, there are often deviations.

Finally, because the operating model of companies in different industries is different, according to the inventory holdings and the proportion of accounts receivables, the net operating capital will be relatively large, so the use of net operating capital will evaluate the investment of companies in different industry companies.Value will also increase the deviation of results.

What is the difference between NNWC and NWC?

The net operating capital and net operating capital (NWC) are essentially measure the holding level of a company’s mobile funds.

But there are relatively obvious differences in actual calculation and use:

| Capital Capital Nnwc | Net operating capital NWC | |

|---|---|---|

Calculation formula | The price of different proportions of liquid assets after different ratio-total liabilities | Liquid assets-mobile liabilities |

Index indication meaning | When liquidation occurs, the company’s remaining value after liquidation | The company uses its assets to repay the current short-term liabilities |

Applied to | Investors looking for the cheapest stocks; It is necessary to understand the most conservative value that ordinary shareholders can get if the company liquidates; | Measure the company’s repayment of short-term debt capabilities |