Cash ratio, English is Cash Ratio, Sometimes it is also called “Cash asset ratio”, English is Cash Asset Ratio It is to measure the ability of a listed company to use its cash and cash equivalents to repay short-term liabilities.

The cash ratio is valued by the company’s cash and cash equivalent compared to short-term liabilities.

Cash usually includes currency, coins, including check accounts, checks, and bank drafts; cash equivalents usually include commercial bills, securities, currency market funds, and short-term government bonds such as Treasury vouchers.

Short-term liabilities usually include debts such as short-term debt, account payable, liabilities and other debt, etc.The debts that are repaid within one year.

Although under normal circumstances, financial analysts rarely use the cash ratio to analyze the financial health status of a company, because few companies will use only mobile cash and cash equivalentEssence

Because considering cash and cash equivalent, if a company’s cash ratio is less than 1, it does not necessarily mean that the company’s financial status has problems.If the company’s cash ratio is much greater than 1, it may indicate that the company does not use reasonablyIts migrant assets to expand the company’s expansion may mean that the company’s operating model has a certain problem.

Bleak American broker:Transparent securities| | Futu Securities| | Microex Securities| | Tiger securities| | First securities| | Robinhood in| | American Langshang Daquan

Directory of this article

- How to calculate the cash ratio?

- Calculate Apple’s cash ratio?

- What is the investment guidance significance of cash ratio?

- What are the limitations of cash ratio?

- What are the differences between cash ratio and flow ratio and speed ratio?

- Join investment discussion group

- More investment strategies

How to calculate the cash ratio?

Calculating the cash ratio is the sum of the company’s cash and cash equivalents (Cash Equivalents), which is calculated by the company’s current liabilities, that is,:

Cash ratio = cash and cash equivalent / liabilities

Cash ratio = cash and cash equivalents/ current liabilities

in:

Cash refers to the sum of money, including currency, coins (coins), checking accounts, checks, and banks.

Cash equivalent refers to short-term government bonds such as Commercial Paper, Marketable Securities, Money Market Funds, Treasury Bills, etc.Essence

Liquid liabilities are added to the company’s short-term debt (SHORT-TERM DEBT), accounts payable, and liabilities and other debt (account), that is,:

Liabilities = short-term debt + account payable + liabilities and other debt

Current Liabilities = Short-Term DEBT + Accounts Payable + Accrumd Liabilities and Other DEBTS

In actual calculations, you can directly find the total amount of cash and cash equivalents in the Balance Sheets in the company’s financial report.

Calculate Apple’s cash ratio?

This chapter will be released by Apple in September 2021 10-K financial report Calculate the instance:

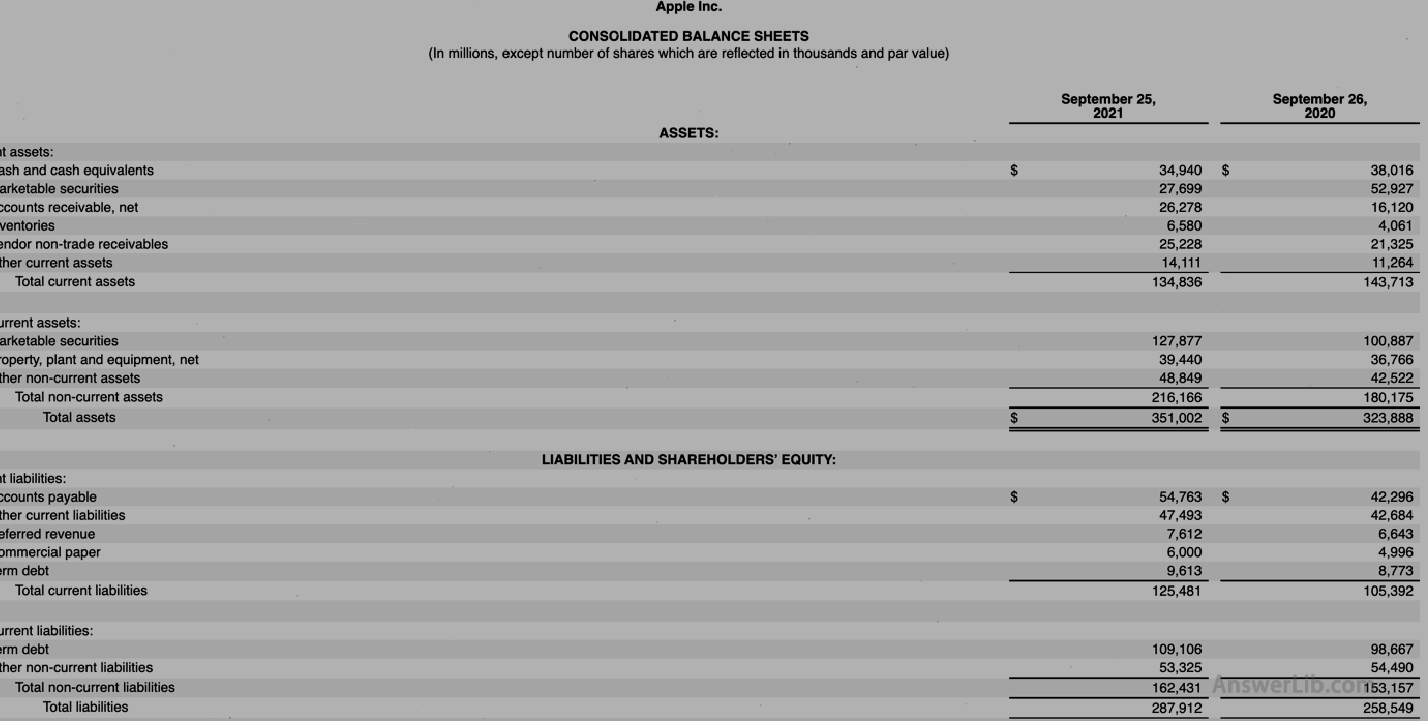

AAPL Financial Report The balance sheet in the middle is shown below:

You can find it from the data table:

Cash and Cash Equivalents | $ 34,940 m |

Short-Term DEBT | $ 9,613 m |

Accounts Payable | $ 54,763 m |

Liability and other debts | $ 47,493 m |

So the cash ratio of Apple’s 2021 Financial Year is:

Cash ratio = (cash+cash equivalent)/ liabilities;

Cash Ratio = Cash and Cash Equivalents / Current Liabilities;

= Cash and Cash Equivalents / (Short-Term DEBT + Accounts Payable + Accrued Liabilities and Other DEBTS)

= $ 34,940 m / ($ 9,613 m + $ 54,763 m + $ 47,493 m)

= $ 34,940 m / $ 111,869 m

= 0.31

That is, Apple’s cash ratio in the 2021 financial year is 0.31.

What is the investment guidance significance of cash ratio?

When using a cash ratio to analyze a listed company, the cash ratio is usually compared with 1:

Cash ratio <1 | It is usually normal; However, if the ratio is very small, the closer to 0, it means that the company’s cash flow is very scarce. If a company has maintained a very low value in the operation process of many years, it shows that the company’s operating profitability is very low, and the cash flow of stable growth can be generated to increase the cash ratio; |

Cash ratio = 1 | It shows that the current cash flow held by the company is sufficient to deal with the company’s liabilities.Generally speaking, it is a better situation; |

Cash ratio> 1 | It shows that the company’s current cash flow is greater than the amount of liabilities.Although the company has enough ability to repay short-term debt, it may also mean that the company does not reasonably use its cash flow in the company’s scale expansion, especially when the company’s cash ratioOver 1 time; |

What are the limitations of cash ratio?

- The cash ratio usually can only evaluate the financial status of a certain time point, because a normal-operated company, the holdings of its cash and cash equivalents will continue to change with the changes in receivables;

- The cash ratio cannot accurately evaluate whether a company’s operation is in a healthy state, because the cash ratio only considers the company’s cash and cash equivalents, and the asset composition of a company is often composed of a variety of ingredients, such as there are there are there are there are there are, there are, there are, there are, there are, there are, there are, there are, there are, there are, there are, there are, there are, there are, there are, there are, there are, there are, there are, there are.Price securities, accounts receivable and inventory, etc.;

- The cash ratio is the same as other financial ratio.It cannot be used to measure companies in different industries.Because of companies with different operating models, the holdings of their cash and cash equivalents have different requirements.Industry companies’ operating health status.

What are the differences between cash ratio and flow ratio and speed ratio?

As the financial data of the asset-liquidity of the company, the cash ratio, Speed ratio and Flow ratio Both the company’s mobile assets are analyzed compared with mobile liabilities, but the three use different types of liquid assets, thereby obtaining different evaluation results.

| Cash ratio Cash Ratio | Speed ratio Quick ratio | Flow ratio Current Ratio | |

|---|---|---|---|

Calculate the molecule in the formula | Cash and cash equivalents | Cash and cash equivalents Securities accounts receivable | Cash and cash equivalents Securities accounts receivable Current inventory Prepaid fee |

Calculate the denominator in the formula | Short-term debt accounts payable Liabilities and other debt should | Short-term debt accounts payable Liabilities and other debt should | Short-term debt accounts payable Liabilities and other debt should |

Numerical | The company only uses the ability to repay short-term liabilities to repay short-term liabilities with the holding of cash and cash equivalent | The company’s ability to repay short-term debt can be repaid for short-term debt in 90 days. | The company’s ability to repay short-term debt can be repaid for short-term debt in one year. |

usage frequency | The most conservative financial liquidity evaluation value is rarely used | The more conservative financial liquidity evaluation value; More commonly used | The most complete financial liquidity evaluation value of the coverage; The frequency of use is lower than the speed ratio |