Flow ratio, English is Current Ratio, also known as the “operating capital ratio”.English is Working Capital Ratio.Speed ratio As well as Cash ratio There are similar places, but it is not exactly the same.

The calculation method of the flow ratio is used by the company Flow asset Except for it Current liabilities Essence

Moral assets usually include Cash and cash equivalents As well as Securities As well as accounts receivable As well as Prepaid fee and in stock Wait, these assets can usually be quickly converted into cash within one year.

Liquid liabilities refer to the company’s Short-term debt As well as accounts payable As well as Liability and Other debt Wait for debts that need to be repaid within one year.

In general, The flow ratio is greater than 1 It shows that the company’s ability to repay short-term debt is strong.

- When the company’s mobile ratio is less than 1, it shows that the company’s current mobile assets are not enough to pay their mobile debt, which is a dangerous signal.

- When the liquidity ratio is equal to 1, it means that the company’s current mobile assets can just repay its short-term debt, but there is no surplus asset to expand its business.

- When the mobile ratio is greater than 1, it means that the company’s current mobile assets are relatively sufficient, which is enough to repay its short-term debt, and at the same time, it has the ability to expand scale.

- However, when the rate of flow is greater than 3, it is usually considered that the company’s mobile assets are not used reasonably and effectively, and it will also be considered as a signal of the problem of enterprise operations.

Another indicator is often used together with the flow ratio “Capital Capital” It is measured the difference between liquid assets and liabilities.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- How to calculate the flow ratio?

- How to calculate the mobile ratio of Apple?

- What is the investment guidance significance?

- What are the limitations of the mobile ratio?

- Join investment discussion group

- More investment strategies

How to calculate the flow ratio?

When calculating the company’s mobile ratio, use the company’s current assets (Current Assets) except for the company’s current liabilities, that is,:

Liquid ratio = mobile assets/liabilities

Current Ratio = Current Assets / Current Liabilities

in,

When calculating the company’s mobile assets, the company’s cash and cash equivalents, Marketable Security, Accounts Receivable, Inventory (Prepaid), and PrepaidExpenses) Add, that is:

Liquid asset = cash and cash equivalent + securities + account receivable + current inventory inventory + prepaid fee

Current Assets = Cash and Cash Equivalents + Marketable Securities + Accounts Receivable + Inventory + Prepaid Expenses

When calculating liabilities, the company’s short-term debt (SHORT-TERM DEBT), accounts payable and liabilities and other debts (accounts) are added, that is::

Liabilities = short-term debt + account payable + liabilities and other debt

Current Liabilities = Short-Term DEBT + Accounts Payable + Accrumd Liabilities and Other DEBTS

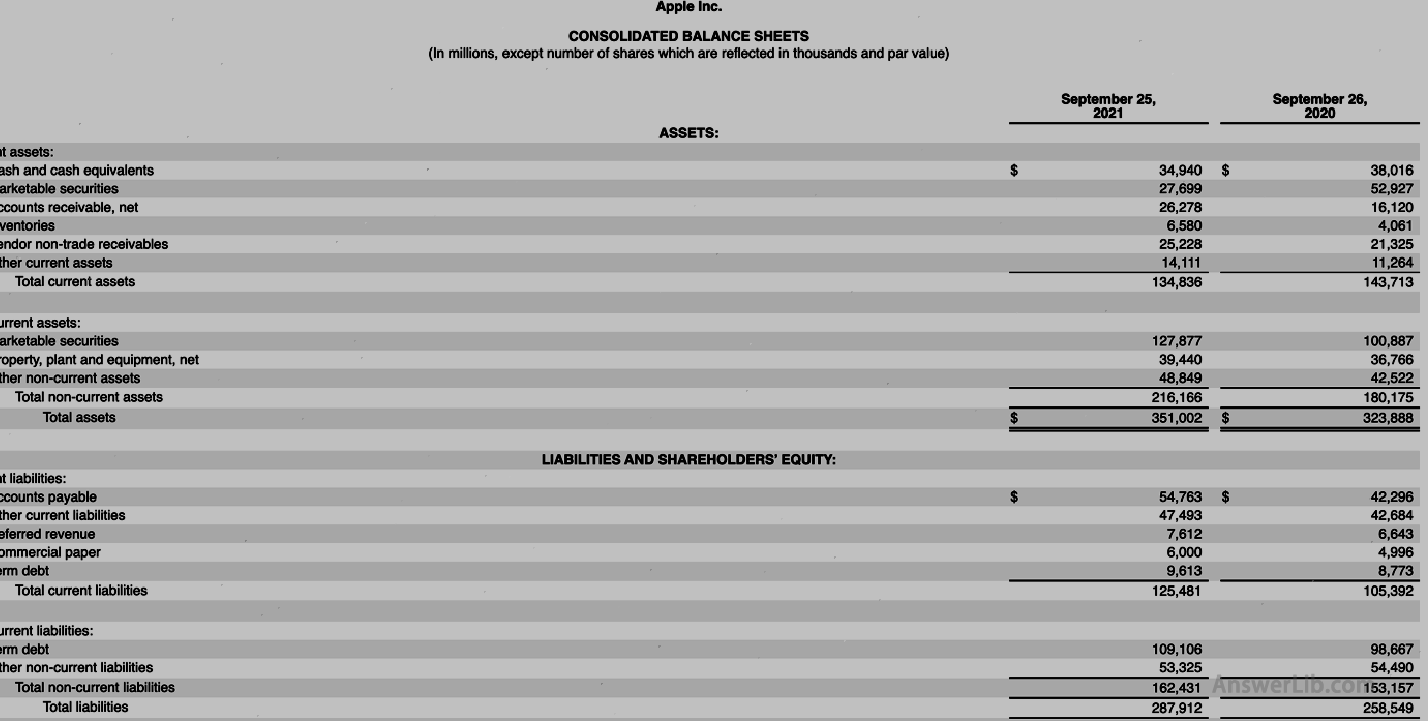

All these data can be found in the Balance Sheets in the company’s financial report.

how Calculate the mobile ratio of Apple?

This chapter will be released by Apple in September 2021 10-K financial report Calculate the instance:

AAPL Financial Report middle Asset-liability The table is shown below:

You can find it from the data table:

Cash and Cash Equivalents | $ 34,940 m |

Marketable Securities | $ 27,699 m |

Accounts Receivable | $ 26,278 m |

Current inventory (Inventory) | $ 6,580 m |

Suppliers non-trade receivables | $ 25,228 m |

Other current assets | $ 14,111 m |

Short-Term DEBT | $ 9,613 m |

Accounts Payable | $ 54,763 m |

Liability and other debts | $ 47,493 m |

So Apple 2021 Financial Year:

Liquid asset = cash and cash equivalent + securities + account receivable + current inventory inventory + prepaid fee

Current Assets = Cash and Cash Equivalents + Marketable Securities + Accounts ReceIvable + Inventory + Prepaid Expenses;

= $ 34,940 m + $ 27,699 m + $ 26,278 m + $ 6,580 m + $ 25,228 m + $ 14,111m

= $ 134,836 m

Liabilities = short-term debt + account payable + liabilities and other debt

Current Liabilities = Short-Term DEBT + Accounts Payable + Accrumd Liabilities and Other DEBTS

= $ 9,613 m + $ 54,763 m + $ 47,493 m

= $ 111,869 m

Liquid ratio = mobile assets/liabilities

Current Ratio = Current Assets / Current Liabilities

= $ 134,836 m / $ 111,869 m

= 1.21

It shows that the proportion of Apple’s 2021 financial year is 1.21.

What is the investment guidance significance?

By calculating the liquidity ratio, it can help analyze whether a company is a good investment target.By analyzing the company’s abundant mobility assets in the current period of time, the mobile ratio of the company can be analyzed.During this period of time, it can continue to increase its ability to repay short-term debt.

When analyzing a single data, it is usually used as several important comparison indicators with 1, 1.5, and 3.

Flow ratio <1 | The company’s mobile assets are not enough to pay the current liabilities, which is a more dangerous situation, and may even have hidden dangers of bankruptcy; |

1≤ flow ratio is less than 1.5 | It shows that the company’s current mobile assets can fully pay their mobile liabilities, but after paying all the liabilities, the assets used for the company’s expansion operation are very limited; |

1.5 ≤ flow ratio <3 | It is a relatively good mobile ratio, which usually indicates that the company has sufficient liquid assets to repay its liabilities.At the same time, it does not accumulate too much liquid assets. |

3 less than the flow ratio | It is usually considered to be an excessive liquidity ratio.Although the high mobile ratio means that the company has strong financial capabilities to cope with all mobile liabilities, at the same time accumulates too much flow assets without using it for the company’s expansion.Expansion also means that it may limit or slow down the company’s growth rate, and investors’ investment is not effectively used to operate and generates efficient investment returns. |

What are the limitations of the mobile ratio?

If the financial ability of a company is only analyzed by the flow ratio, the results will often occur due to some factors.The influencing factors include:

Inventory inventory

Because in the calculation of the flow ratio, the inventory inventory is calculated in the inside, so for companies such as large supermarkets, the flow ratio value will show very obvious periodic fluctuations.Before various holidays, supermarkets will often increase inventory volumeTo cope with consumer demand, this is that the value of the flow rate will increase with the increase of inventory.After the holidays, the inventory inventory will be reduced by a large amount, and the value of the flow ratio will be greatly reduced.It is good or bad to measure the operations of such companies.

Debt repayment method

Some companies use credit lines to repay the debt.Under such a model, the company’s cash stock is often very low.When calculated by the calculation formula of the flow ratio, the result will be very low, but in essence, the company may beIt has enough debt repayment capacity, so it is impossible to accurately analyze the ability to repay the liabilities of such companies through the mobile ratio.

Cross-bank analysis

Like most financial analysis data, it is difficult to analyze the operating status of cross-industry companies, because the running assets of different industries will be very different.When the mobile ratio is compared, it is impossible to accurately treat different industries.The company’s financial ability analysis and comparison.