After reading this article, you will understand in detail:

Directory of this article

- 1.Common problems in buying a house in the United States

- 2.The key vocabulary of buying a house in the United States

- 3.The process of buying a house in the United States

- 4.Monthly monthly mortgage calculation method

- 5.Analysis of the total cost of housing monthly housing

1.Common problems in buying a house in the United States

We first from a few common problems such as the title, but we did not explain in-depth.Read the full article, you understand.

Question 1: What factors do I need to consider when buying a house?

Depending on the needs of each person, the factors that need to be considered are not the same.Here we list a few:

1) School district: Good school district, the price will be better;

2) Community: Around the good school district, the general community is also good.It is also necessary to consider the new, old, safe and non -HOA costs of the community;

3) Transportation: You have to consider whether you are convenient for work, especially the peak period for getting get off work, how long it takes to get off work;

4) House itself: You must check the house itself, such as how light transmission, how the materials are, whether energy saving, how the house is orientation, etc.Especially whether the foundation is solid, whether there is a termite problem, etc.

Of course, there are many issues that need to be considered, such as price, loan interest rates, and so on.This article explains in detail the above issues.

Question 2: Do I need to ask the house agent?

Be sure to ask.You can benefit from at least the following three aspects:

1) The house agent may give a return point, so your final purchase price will be cheaper;

2) When you are looking at the house, the experience of the house agent will help you discover the potential problems of the house;

3) When you sign a house sale contract, the house agent can take good care of you to ensure that the procedures are reasonable and legal;

Question 3: Which websites provide housing information?

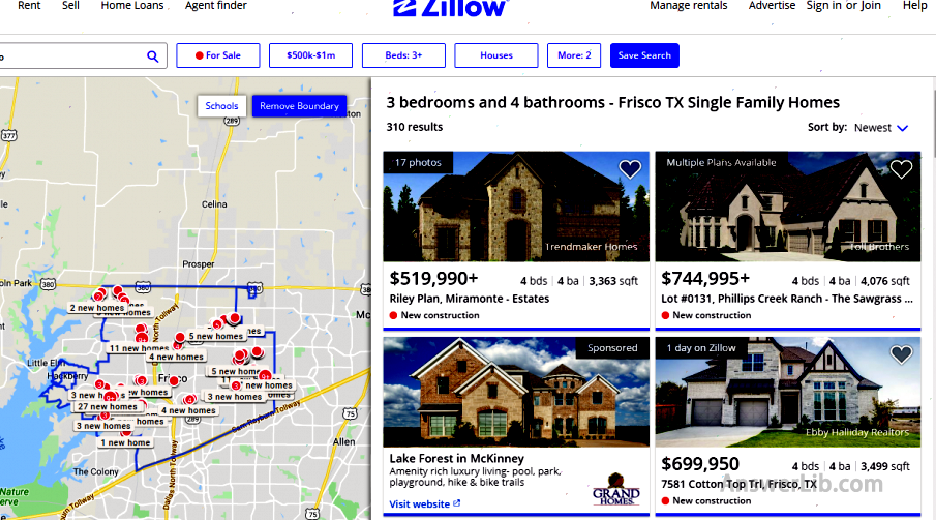

You can use two websites to find house information: Zillow and Redfin Essence

Question 4: How to find the current housing loan interest rate?

You can find the current interest rate of the current housing loan from most bank websites, such as: Wells Fargo and Bank of America Website.Your real estate agent will also provide you with more information channels.

Question 5: Buy old houses or buy new houses?

According to your preferences and the situation of your state, the conclusions will be different.Many states, such as New York and Illinois, have not been built in many new houses, so buying old houses is the only choice; for Texas, North Carolina and other states, the construction of new houses has never stopped, so you can choose a new house, or the old old, or the old old.The main difference is as follows:

- The maintenance cost of new houses is low, and there will not be too much maintenance costs within 10 years.At the same time, the structure, layout, and design of the house follow the trend.At the same time, it is relatively cheap in terms of energy saving.It may be higher.At the same time, the land of new houses is generally small, especially the backyard is significantly reduced significantly than the old house;

- The land of the old house is very large.In Texas, you can often see a acre of land.The price is relatively easy to talk about.But because the house is old, there will be a lot of maintenance costs, and the cost of water and electricity will be large.

Question 6: Is it a 15 -year loan or a 30 -year loan?

- If you choose a 15 -year loan, the interest rate is low (currently 2.875%), but because you choose to complete the repayment earlier, your monthly repayment fee is higher;

- If you choose a 30 -year loan, the interest rate is relatively high (currently 3.625%), but because you choose long-term repayment, your monthly repayment fee is low.

my suggestion is Choose a 30 -year loan The reason is as follows:

- The less repayment per month, the better the financial burden on your family’s monthly;

- As mentioned later 28/36 Principles The monthly repayment fee determines the price interval you can buy.If you choose a 30 -year loan, it means you can buy higher-grade houses;

- If you buy a house for rent, you can choose a 30 -year loan to allow you to pay less per month, so that the fee paid by the tenant will have more surplus to ensure that sufficient cash flow per month can be guaranteed to ensure that the monthly current cash flow is sufficient.EssenceIf you choose a 15 -year loan, then the rent you charge each month may be lower than the amount you repay, then you have to put money to raise this house yourself, it should not be a good choice.

Recommended reading:Sweeping robot recommendation, IROBOT, EUFY, Stone Robot Full Analysis

2.The key vocabulary of buying a house in the United States

- ReaLTOR: Real estate agent, with professional licenses, provides professional help for buyers or sellers to ensure reasonable and legal transfer procedures.In the process of buying and selling houses, there may be two real estate agents, one serves buyers and the other serves the seller.It may also be a broker serving both parties at the same time.As a buyer, we hire a real estate agent to help us find housing, contact the house, provide relevant resources, give professional suggestions, assist in signing the transfer procedures, and so on.

- Commission: House buying and selling commissions, that is, the US buying agency fees.The real estate agent who bought a house provides professional help for the buyer.The real estate agent will receive 3%of the house prices as a commission.The seller’s real estate agent serves the seller and also charges 3%of the service fee.This money generally does not need to be paid separately, but when the house is sold, it is completed, and Seller Pay this money to the real estate agent of both parties.Of course, this money also came from house prices.For example, if a house sells $ 500,000, the seller needs to pay $ 15,000 (3%) to the seller’s real estate agent and pay $ 15,000 (3%) to the buyer’s real estate agent at the same time.

- Cash back: Due to the fierce market competition, many real estate agents will provide buyers with a certain amount of return.For example, real estate agents will return a part of 3%commission to buyers.This proportion is often about 1%of house prices.Continue the above example.Your real estate agent has received a service commission of $ 15,000.After the transaction of the house, he will return the $ 5,000 to you.How much will you return?Related paper files.

- Mortgage: In the United States to buy a house loan, if you start to pay the house fee, then you need to find a loan company to borrow money to buy a house, of course, you need to pay interest.In recent years, the interest on mortgages has been very good, often below 4%.Most people do not pay the house fee at one time.The reason is very simple.Because the current housing loan interest is low, you can use the cash on your hand to engage in other investments.As long as the income is higher than the interest rate of this house, it is beneficial to you.

- Earnest Money: When you signed a house purchase contract with the seller, the fee you need to pay is generally about 1%of house prices.

- Down payment: The down payment for a house in the United States is generally 20%of the house price.For a house of $ 500,000, your down payment is about 100,000 US dollars.

- Closing Cost: Express costs, this is a fee that you need to pay immediately when signing a house contract.The cost may include loan fees & nbsp; (Origination CHARGES), survey fees & nbsp; (Survey Fee), property insurance & nbsp; (Title Insurance), house valuation & nbsal fee, & nbsp; register Tolls & nbsp; (Recording Fee)etc.

- HOA: Homeowner Association, English is H ome O Wner A Ssociation is an organization composed of all residential residents.It is often responsible for managing by specialized management companies, but residents of community are Board Members.It is mainly responsible for related affairs in the community, such as weeding and greening, pond renovation, etc.in public areas in the community.You need to pay a certain fee to HOA every month, called HOA Fee.

- 15 Years Amortization: 30 years of installment payment, which is the time for your loan, is generally 15 or 30 years.Select 15 years of installment payment, the interest rate will be low, but the repayment will be high per month; the 30 -year installment payment will be higher, the loan interest rate is slightly higher, but the monthly repayment is relatively low.

- Interest Rates: The current loan interest rate, the current loan interest rate is about 3.8%(30 years of payment).

- Home Inspect: House inspection, you need to spend money to invite people before the house is finally transferred, including the roof, foundation, air conditioning, walls, and so on.If you have any problems with the house, you can also choose to exit and do not buy it or let the seller take over.

Below, let’s look at the specific process of buying a house in the United States:

Recommended reading:Air purifier, at home for a long time, indoor air cannot be ignored

3.The process of buying a house in the United States

- Process 1: Determine the budget of buying a house and the price of the house

- Process 2: Contact real estate agent

- Process 3: Poster the Pre-APPROVAL letter

- Process 4: Choose a house, watch a house

- Process 5: Talk about price and bid

- Process 6: Sign a housing contract

- Process 7: House inspection

- Process 8: Finally determine the loan company, lock the loan interest rate

- Process 9: Buy house insurance

- Process 10: Signing transfer documents and paying transfer fees

Process 1: OK to buy a house budget and the price of the house

Buying a house is not a small movement.It requires a lot of funds.Especially when signing a housing contract, you need to pay the down payment and transfer fee of the house first.At the same time, you also need to pay housing loans, HOA costs, and real estate taxes every month.Therefore, please reasonably determine the price range of the planned house based on your deposit and monthly income.

you can use it 28/36 Principles Calculate the price range you can buy.The principle of 28 refers to the total cost of the house that cannot exceed 28%of the income.You can use the whole year or monthly calculation.The 36 principle refers to the family’s total cost cannot exceed 36%of the income, including total housing costs, student loans, credit card costs, and so on.

| Total income before tax | Family monthly income | The monthly cost of the house (28 Rule) |

|---|---|---|

| $ 50,000 | $ 4,167 | $ 1,167 |

| $ 100,000 | $ 8,333 | $ 2,333 |

| $ 150,000 | $ 12,500 | $ 3,500 |

| $ 200,000 | $ 16,667 | $ 4,667 |

| $ 250,000 | $ 20833 | $ 5833 |

| $ 300,000 | $ 25000 | $ 7000 |

- House loans have a lot to do with the loan interest rate when buying a house.The time is different and the loan period is different.The monthly mortgages are different.At the end of the article, we will give you an excel table.You can accurately calculate your house loan;

- HOA costs are related to the community of buying a house;

- Real estate tax is related to the city and school district where the house buying;

- House insurance It is related to cities and regions buying a house.

After determining the budget of buying a house, you need to decide where to buy a house.You need to consider factors such as school districts, communities, far away from the company, new houses/old houses.Of course, you are not static for these buying factors.You can make real-time adjustments in the subsequent steps.

Process 2: Contact real estate agent

Real estate agent will be the most important partner in the process of buying a house and the agent of your house.They are mainly responsible:

- Provide housing information;

- Take you to see the house and give professional guidance to the house itself;

- Act you communicate with the seller’s information, for example, ask questions about houses;

- The agent you bid for the seller and coordinate the price;

- Assist you to complete all transfer documents;

- Provide you with multiple information resources, for example, where to buy house insurance.

In fact, you can ask for help from your real estate agent.Before determining the real estate agent, you need to pay attention to the following points:

- Understand the qualifications and experience of real estate agent;

- It is best to find a real estate agent recommended by friends or reliable people;

- Confirm whether the real estate agent provides a return point and what is the proportion of the return point.

Real estate agent is one of the most important factor in the entire process of buying a house.The attitude, experience and professional ethics of the real estate agent directly determine the effect of your buying a house.Please stay away from those real estate agents who do not reply and call.

Process 3: Press Pre-APPROVAL letter and negotiate multiple loan institutions

Pre-APPROVAL Letter is to prove your credit limit and loan ability, You can find the bank where your deposit is located to handle it However, in the end you don’t need to loan from this bank.You can tell the bank’s customer representative: “I am planning to build a house.Could you please leave a pre-Approval Letter for Me?”

This file needs to be used when you bid for the seller, so if you do not get the Pre-Approval Letter issued by the bank for the time being, it will not affect the third step below you start, selecting and watching the house.

At the same time, please contact multiple loan institutions to ask the loan interest rate you can provide, for example, you can check online Bank of America or Wells Fargo Loan interest rate.

Tips: House loan interest rates can be bargain within a certain range, so please contact a few more loan companies to see who can provide the best loan interest rate.Must be more than three Essence

In order to attract you to loans, many loan companies will give certain preferential conditions.For example, many loan companies will pay all or part of your transfer costs.At that time, when I bought a house, my loan company paid a transfer fee of $ 3000.

Process 4: Selecting and watching a house

If you buy a house for the first time or invest in real estate in the United States, you must watch more and compare it.If you look at the house too much, you can become an expert yourself.House information mainly comes from the following four sources:

- Housing 1: House Listing website, such as Zillow and Redfin EssenceThese websites have a good classification search function, so that you can find your favorite house more quickly.

For example, we use several key attributes to search for listings with Zillow and Redfin.The key attributes are: new houses, 500,000 ~ 1 million, the location is in Texas FRISCO, with 4 or more bedrooms, 3 or more or moreHouse of parking spaces.The results of Zillow and Redfin are as follows:

For any house you searched at Zillow and Redfin, you can view the details of the house, including house pictures, listing time, and school district credits.Here we take a house on Zillow as an example.You can see the school district where the house belongs:

The basic principle is that the better the school district, the more expensive the price.Many Chinese and Indian friends use school districts as the first element of buying a house.Therefore, before looking at the house, try to understand all the information of the house as much as possible so that you can find the most suitable house.

- Housing 2: Your real estate agent will send you a lot of new houses.A large number of new houses come out every week, and your agent will send you these house information to you.

- Housing 3: Through your friends or colleagues, you can ask whether there are empty houses in their communities or nearby communities.If they can live with friends or colleagues in a community, it is really a good choice, and they have a response to each other.

- Housing 4: Around the city and schools you are interested, drive.You will see a lot of “Open House”, or you will find a lot of very beautiful communities.You can drive in and turn around to see if there are houses that are selling.The house I currently buy is found through this 4th method.

Process 5: Talk about prices and bids

When you see Xinyi’s house, you will naturally talk about the price.Before talking about the price, please prepare the Pre-Approval letter in the second step.When you bid, you need to give this letter to the seller together.At the same time, you need to know more about the current market price of this house.This information may include:

- Most important and available information: Query the sales price of other houses in the same community in the last time, you can find your real estate agent to check these professional information;

- Most important and available information: If your real estate agent is very experienced, he can provide you with the most correct price judgment.Ask your agent, “Is this price appropriate?”

- Important, but not easy information: See if you can find other homeowners in the community and talk to them about the purchase price at the time.For example, you can see if there are friends, colleagues, or acquaintances in the community.Of course, people are likely to be unwilling to share this information, but try, try, try, tryIt’s always right;

- Not important, but easy to get information: For old houses, you can check the house evaluation price of this house on the Internet in recent years.The homeowner is delivered to the real estate tax every year at this price.Generally, this price will be higher than his actual price.

With the above information, when you talk about the price, you will naturally have a bamboo.However, whether the price can be talked about, it depends entirely on the market conditions, the time of buying a house, and whether the seller is eager to shoot.

- If you are buying an old house, you can tell the real estate agent who expects your expected price to help you negotiate with the seller.You only need to wait for the real estate agent to reply.

- If you buy a new house, you need to talk to the price directly with Builder: you can talk to the real estate agent to sell the office office to talk to the sales staff.

Two models of buying a new house:

If you choose to buy a new house, then you need to discuss the price directly with Builder.Builder will generally provide you with two types of purchases:

- Buy existing house: English is Inventory Home.This kind of house is a house that has been built according to its drawings and materials, or is about to be built.You can buy it directly and transfer it immediately.The price of such a house is relatively good, and there will be better discounts.The advantages are: price discounts, transfers immediately; the disadvantage is: room type, structure, and selection of materials may not necessarily fit your mind.

- Customized new house: You need to choose a open space first, and then select a favorite room type from the room type provided by Builder.Finally, you must choose the materials of all rooms, the style of the electric fan, the number of ovens, the color of the kitchen cabinet, and so on.You can customize your house almost completely and personalized.The advantage is that the house is carefully selected and customized; the disadvantage is: the price is relatively fixed, the customized process is laborious and laborious.At the same time, you need to wait for 8-10 months before you can stay in the household.

Recommended reading:Elliptical machine recommendation-must-have for fitness at home

Process 6: Sign a house trading contract

If the buyers and sellers are agreed on the price, then the housing transaction contract is required to make a time.The housing transaction contract is a formal document with legal effects.It is a formatted contract and is very complete.It is fully considered the interests of both buyers and sellers.The contract contains a lot of information, such as the price of houses, how to pay for buyers, when the house is finally transferred, and so on.

When signing a housing transaction contract, you need to pay two charges:

- Earnest Monty: The house purchase deposit is generally about 1%of house prices, which is equivalent to buying a house.This money will become part of your payment when the last step passes.Note that this money can be refunded within a certain period of time after signing a house transaction contract, depending on the specific time in the contract.

- Option Fee: This is a unique fee for buying a house in Texas, ranging from about $ 100 to 300, in order to protect the rights and interests of the buyer, so that the buyer can cancel the purchase contract unconditionally within a certain period of time (5 ~ 10 days) after signing the contract (5 ~ 10 days), and and the house purchase contract, and and and.Retain the repurchase deposit.Buyers usually complete the next process in 5 to 10 days-do house inspection.

Process 7: House inspection

House inspection is a necessary procedure for house trading contracts and before the house transfer procedures.Generally, it is completed within 5 ~ 10 guaranteed by Option Fee.You need to hire a third-party housing inspection agency to check the quality of the house.The cost is about hundreds of dollars, which is related to the size of the house.You can consult your real estate agent and let them recommend reliable house inspectors to you.

- If a big problem is found during the house inspection process, naturally you cannot buy it.You can withdraw from the previously signed house contract, get the repurchase deposit, and continue to choose a house and see the house.However, Option Fee cannot be taken back;

- If there is a small problem in the house inspection, you can negotiate with the seller, let the seller repair, or let the seller make a concession at the price.

Process 8: Finally determine the loan company and lock the loan interest rate

Before completing the house transfer, you need to finally confirm your loan company and lock the loan interest rate.In fact, this step can be carried out at the same time as the fifth step and the sixth step.

In the second step process, you have contacted several loan companies and discussed the interest rate of the house they can provide.In this step, you need to finally determine the interest rate of the loan and the preferential conditions you can provide with each company.

Tips: You can start locking the interest rate of housing loan 30 days, 60 days, or longer before the final transfer.For specific time, you need to consult a loan company.Sometimes, you need to pay a certain amount to lock your loan interest rate earlier.

Because the interest rate of buying a house is floating every day, you must complete all the loan application process before the house is transferred and lock your loan interest rate.

Please note that the application for loans takes a certain time, usually 2 to 3 weeks, and the fastest one week can be completed.

Process 9: Determine house insurance

House insurance It is essential.If you do n’t buy house insurance, how can a loan company loan you to buy a house?If there is any problem with the house and the buyer does not afford money, the loan company must not want to.

Therefore, before signing the housing contract, you need to contact different housing insurance companies, such as Geico, State Farm, etc., ask for the price list, compare the price, and finally determine where to buy, and before signing the house contract, and before signing the house contract, and before signing the house contract, it is before signing the housing contract.Communicate information to a loan company.

Your real estate agent will also recommend you a very good housing insurance salesman.Our house insurance is a Chinese company recommended by real estate agent, saving a lot of silver.

Reading in-depth:American housing insurance purchase process | Chinese and English control+action guide

Process 10: Sign a house transfer document and pay the transfer fee

The last step of buying a house is to sign a house transfer document and pay the transfer fee (Closing Cost).In the sixth step of the process, you have determined the specific time to sign the transfer formalities with the seller.

One to 2 days before signing the transfer procedures, you will receive a list of transfer fees (referred to, HUD-1) & nbsp;, this list clearly indicates that you needPayment fee.The transfer fee may include the following items:

A.Loan Costs: Loan Costs:

- Loan handling fee: Origining CHARGES, this is the relevant cost of the loan company to prepare for the loan;

- House valuation fee: APPRAISAL FEE, this is the cost of asking people to ask people to estimate the house;

- Credit report fee: Credit Report, this is the fee for the loan company to query your credit limit;

- Flood area certification fee: Flow Certification, this is the cost of the loan company inquiring whether the house is in the flood area;

- Measurement fee: Survey, this is the cost of determining the boundary of the house.

B.Title Charges Besides

- Property right-related expenses: English is Title Services and LENDER ’s Title Insurance.The relevant service costs paid to the property rights company, as well as the property insurance purchased for the loan company to avoid the previous property rights;

- Your property rights insurance premium: English is Owner ’s Title Insurance.The property rights insurance purchased for you can avoid the previous property rights.

C.Government record fees: The cost of the government will be very different from different states.

D.Prepaid fee (Pre-Paids)

- HOA Prepaid: You need to pay the cost of the homeowner (HOA) for the more than the month of this year;

- Housing Real Estate Tax Prepaid: You need to pay the real estate tax of the more than the month of this year, including City Tax, School Tax and County Tax.

- House insurance: Homeowner ’s Insurance, usually purchased one year a year.

- Prepaid interest: PRE-PRE-PAID Interest, interest from house transfer to the first loan repayment.

- Prepaid hosting fee: ESCROW Fee, if you ask the bank to pay for your housing tax and HOA costs monthly, you need to pay a certain custody fee.If you decide to pay housing taxes and HOA fees at the beginning of each year, then you do not need to pay the hosting fee.

For these costs, you need to pay for the Title Company by bank check or bank transfer.After signing, after paying the money, the property rights delivery procedures are completed.

Congratulations to you, after completing the above ten processes, your house is officially transferred.After getting the key, you can stay in and start a new journey.

4.Monthly monthly mortgage calculation method

After buying a house, you need to repay the mortgage every month.How much mortgage do I have to pay each month?

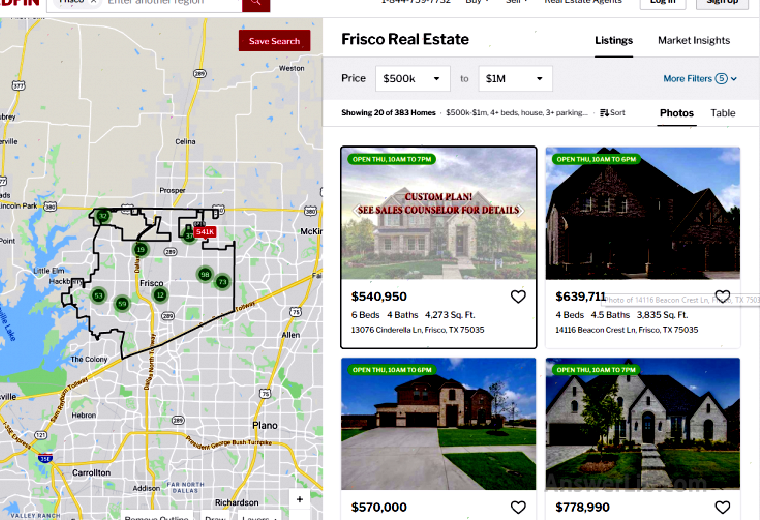

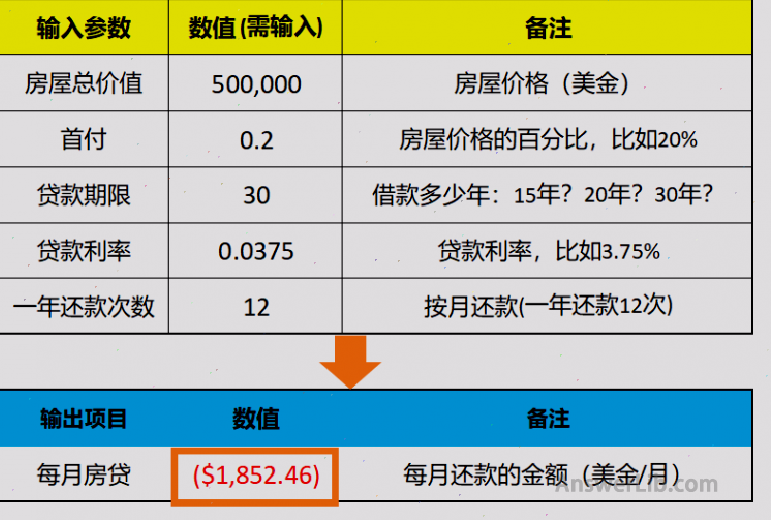

Taking a house worth 500,000 in Texas as an example, the down payment house price is 20%, the remaining 30 -year loan is used, and the loan interest rate is 3.75%.The use of monthly repayment, that is, 12 times a year.

Through and enter the above values, we can quickly calculate the monthly mortgage:: $ 1852.46/month

Tips: You can download the EXCEL form we made for you for your monthly mortgage.Based on your situation, calculate the mortgage you need to pay every month.[Download the mortgage calculation form]

In the mortgage computing form, enter the price, down payment ratio, loan period, loan period, loan interest rate and number of one-year payment.In this way, you can estimate the monthly mortgage.

You can also calculate your mortgage online:

[MortgageCalCulator][Su_icon icon = “ICON: Arrow-Circle-DOWN” background = “#FFF” color = “#f74851 ″ size =” 36 ″ shape_size = “8 ″ text_size =” 30 ″ “0px 0p” 0px 0pp x 0px 0px “target =”Self”] [/su_icon]

Recommended reading:electric toothbrush+ Dental floss, Thoroughly eliminate dental plaque, manage your own teeth during the epidemic

5.Analysis of the total cost of housing monthly housing

Please note that in addition to the monthly mortgage, there are real estate tax, HOA expenses, house insurance, weeding expenses, insect expenses, etc.in addition to the monthly mortgage.The monthly maintenance fee of 100 to 200 US dollars is paid.

Let ’s take an example: 2.5%of the real estate tax valuation, HOA costs are $ 1200 per year, house insurance is $ 1200 per year, and hasty cutting fees and insect-removing fees have a total of $ 720 a year.

Based on some of the above parameters, let’s estimate the cost required for the monthly house supply (monthly calculated):

- House loan interest: $ 1,852

- Real estate tax: $ 1,042 (= 500,000 x 2.5%/12)

- HOA cost: $ 100 (= 1,200/12)

- House insurance: $ 100 (= 1,200/12)

- Cutted+remove insects: $ 60

Therefore, raising a house of about 500,000 in Texas, the monthly cost is about $ 3,154/month Essence

According to the 28/36 principle we mentioned in the first step, in order to pay the cost of $ 3153 a month, the annual income required for this family is $ 135,000, which may be a relatively safe investment.

More American life articles

- US tax return 2020: use Turbo Tax to report taxes by themselves

- US shopping rebate: Easily get 15%shopping cashback

- Amazon Shopping in the United States 13 tricks: Teach you how to get free

- American green card schedule: the fastest monthly update of green card scheduling information

- US discount network summary: how to find the strongest discount products

Finally, if you like our article, please leave a message at the “publishing” at the end of the article.

statement:This article is the author's own experience summary, articledo not includeIf you have any questions, if you have any questions, please consult a professional real estate agent.At the same time, in the process of buying a house, due to the different time and place, the situation you encounter will be very different.Please judge reasonably according to the situation at the time.