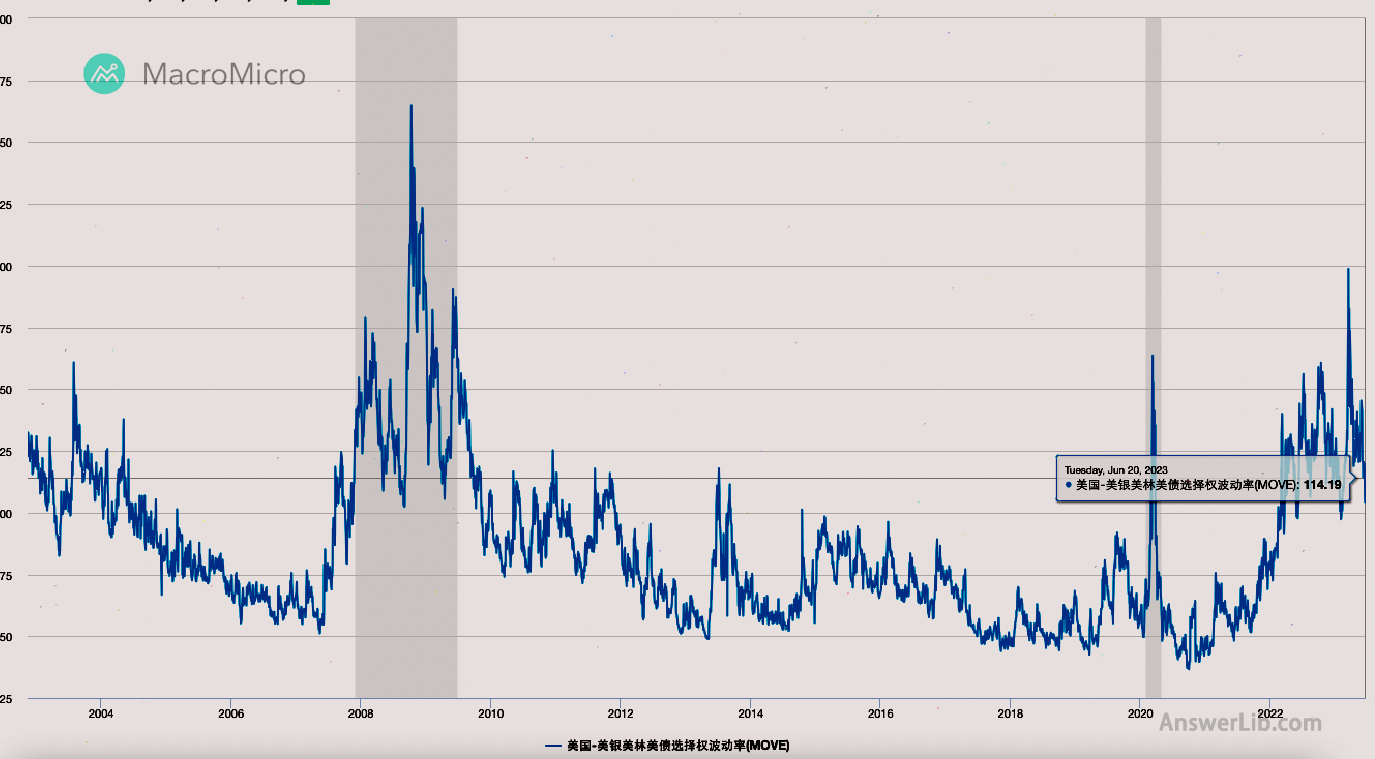

U.S.Treasury volatility index, abbreviation Move index, English full name m Errill Lynch Option Volatility Estimate Index, By Merrill Lynch Securities(( Merrill lynch) Developed, used to measure the expected volatility of the U.S.Treasury market.It is based on the option price of U.S.Treasury bonds, and more accurately, it is the implicit volatility of these options.

The value of the MOVE index reflects the market’s expectations for the volatility of US Treasury yields in the future.The higher the index, it shows that the market predicts that the rate of return on national bonds in the future will be greater, which often occurs when the market has a large uncertainty in the future economic situation.

For example, when the economic crisis, policy changes, or other major events occur, the market’s uncertainty to the future increases, and the MOVE index value may increase.On the contrary, when the value of the MOVE index is low, it means that the market-expected future Treasury bond yield is less volatility, which often means that the market expects the economic environment to be relatively stable.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- What are the investment value of the MOVE index?

- What is the difference between the MOVE index and the VIX index?

- Move index calculation method

- The limitations of the MOVE index

What are the investment value of the MOVE index?

The value of the MOVE index It reflects the market’s expectations of the future of US Treasury yields to volatility Essence

When the MOVE index value is high, it indicates that the market’s expected return on national bond may fluctuate in the future, which usually occurs when the market is large uncertain, such as the economic crisis, policy changes, or major events.Under influence.

Conversely, if the value of the MOVE index is low, it indicates that the market’s expected return on government bonds will be more stable in the future.

For investors, the high and low rate of volatility (that is, the MOVE index) of the US debt will affect their investment decisions.When volatility expectations are high, investors may reduce investment in risk assets and increase investment in security assets such as US Treasury bonds, which may push up the price of Treasury bonds and reduce national bond yields.When volatility is expected to be low, investors may increase investment in risk assets and reduce investment in US Treasury bonds, which may increase the price of Treasury bonds and increase the yield of national bonds.

What is the difference between the MOVE index and the VIX index?

Although the MOVE index and the VIX index of the stock market are indexes that measure market volatility, their attention is different financial markets.

The VIX index, also known as the “panic index”, is to indicate the risk or volatility of the stock market expected in the next 30 days by measuring the implicit volatility of the S & P 500 index options.

In contrast, the MOVE index focuses on the volatility of the fixed income market, especially the US Treasury market.

Both index provides investors with important tools to measure market expectations, help investors understand market sentiment and form corresponding investment strategies.But they each reflect the characteristics of the two different markets, so they need to consider separately when investing in investment decisions.

Move index calculation method

The calculation of the MOVE index involves multiple steps.

First of all, choose a series of US bond options that are different to date, such as 1 month, 3 months, 6 months, and 1 year.

U.S.debt options are the options of U.S.Treasury assets.Investors can buy or sell U.S.Treasury bonds at a agreed price at a specific price in the future to hedge risks or seek income.

Then, through the Black-Scholes model or other option pricing models, the implicit volatility of each option is calculated.

The implicit volatility is an expectation of the market change in the future of the market.It is calculated by the option pricing model (such as the Black-Scholes model).The higher the implicit volatility, the greater the risk and uncertainty of the market’s expectations.

Finally, the weighted average of these implied volatility (usually the weight of the expiration date distance), and the value of the MOVE index is obtained.

In the MOVE index, the role of implicit volatility is crucial.The calculation of the MOVE index is based on the implicit volatility of U.S.debt options.By measuring changes in implicit volatility, the MOVE index can reflect the market’s expectations of the future volatility of the US debt yield.

The limitations of the MOVE index

Because the MOVE index is based on the implicit volatility of U.S.debt options, and the transaction volume of these options may be relatively low, especially for certain options of certain periods of date, which may cause the MOVE index to be accurate in some cases.Reflects the real market volatility.

Secondly, the MOVE index only considers the options with a period of 1 month, which may not comprehensively reflect the market’s volatility expectations of all over-expired daily US debt.

Finally, the MOVE index is the same as the VIX index.It is a short-sighted indicator that ignores the process of market change from quantity to qualitative change.When using the MOVE indicator to guide investment, you must pay attention to its mutation.