What is the IPO?The company’s issuance of shares and raising funds from the public to expand its own enterprise scale is the development journey of most good companies.

Before listing, most companies are private share systems.If you want to enter the open market, you need to pass the IPO in the traditional process, that is, enter the open market through the first public offering of stocks and start fundraising of shares.What does IPO mean for ordinary traders and what do you need to pay attention to?

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- What is the IPO?

- How does IPO work?What is the process?

- Why does the company want an IPO?

- How to purchase an IPO?

- The difference between IPO and direct listing?

- What is Pre-IPO?

- Is pre-ipo worth investing?

- What is the difference between IPO and Pre-IPO?

- common problem

- More investment strategies

What is the IPO?

IPO, the full name is the Initial Public Offering, Chinese translation is: the first public fundraising.

A private company, that is, a company that has not been listed on the Stock Exchange, can sell securities or shares to public investors for the first time to raise funds in this way to promote its own growth and repay debts.

After entering the public trading occasions through IPOs, the company converts from a private joint-stock system to a public joint-stock system.The company’s stocks can be freely traded in the open market (secondary market).

In other words, IPO is a way of conversion by the company’s transition from a private joint-stock system to a public joint-stock system.

Related Reading The US securities firms ranking and comparison [2021] Recommended by the 12th National Congress of American securities firms

How does IPO work?What is the process?

A company chooses listing, that is, re-planned the company’s original private shares, and separated from some shares to the open market for fund-raising and transactions to increase the company’s value.

There are two main ways to enter the public financing market: direct listing or through the IPO, and IPO is the most important form.

There are several steps when the company decides to go public through the IPO:

- The company proposes the intention of listing to several underwriters.After the operating situation of the underwriter research the company, it proposes valuations and suggestions to discuss the best securities types, issuance prices and the number of shares issued, and the expected time framework for market issuance.It also includes the services and related quotations that you will provide throughout the process.At present, the major IPO underwriters in the United States are: JP Morgan Chase, Goldman Sachs, Credit Suisse, etc.

- Based on the data provided by the underwriter, the company finally chose a underwriter to officially agree to the IPO process through the underwriting agreement;

- Establish an IPO team.The main members are composed of underwriters, lawyers, registered accountants, and experts from the Securities and Exchange Commission.The content of the team’s work mainly has a large and thorough and strict due diligence to evaluate the company’s relatively maturity of the overall market.In-depth understanding of the sustainability of the business model of the candidate company and its competitiveness and disadvantages, in-depth research on the development opportunities of the industry where the candidate is located, and comprehensively evaluating the potential risks of the company’s development.

- Prepare IPO application documents, and apply for the US Securities and Exchange Comibility (US Securities and Exchange Comics SEC) Register an IPO and decide which exchanges are listed.

The most important thing in the application document is the S-1 registration statement, which consists of two parts: the filing information of the prospectus and the private holding shares.The content includes the company’s current status, advantages, as well as difficulties and effective response strategies that may face, and also need to propose detailed information about how the company plans to allocate shares from investors, and how the company intends to use funds raised after listing.

The prospectus will continue to be modified during the application period to meet the requirements of the committee and be fully recognized.This instructions are also important documents that investors must read when they are considering investment after listing.

- Prepare marketing materials.This material is made for pre-marketing issued by new shares.The underwriters and company executives discuss the issuance of marketing stocks to estimate market demand and determine the final issue price.The underwriters can modify financial analysis throughout the marketing process, including changing the appropriate IPO price or issuance date.The company takes the necessary steps to meet the requirements of specific public stock issuance.At the same time, it must also comply with the requirements of the stock exchange and the requirements of the SEC for listed companies.

- The company set up a board of directors.The company determines the process of financial and accounting information that can be audited every quarterly report.

- The company issued its shares on the date of the first public offering.The capital issued by shareholders for the first time is charged in cash and recorded as the shareholders’ equity on the balance sheet.

On the day of the IPO, the capital’s capital will be transferred to the company’s bank account, which is also the only income from the company from the IPO.Subsequently, the company began to sell stocks in the secondary market, and large investors could also issue stocks in their hands after the lock-up period.

All transactions in the stock market after IPO are between investors, and the value of the company will change with the rise and fall of the stock price.

Why does the company want an IPO?

Before the company, the company was regarded as a private company.As a private company, the source of investment is mainly the founders, family, friends, angel investment, or venture capital, etc., with limited amounts.

When the company grows to a certain stage, these limited investment will restrict the company’s continued growth.At the same time, the company itself has also met the strict requirements of SEC supervision and the ability to bear the responsibility for the interests of public shareholders.Public company.

IPO is an important part of the growth process for the company, which will bring a lot of funds raised to the company and gain greater development capacity.After entering the open market, the transparency and credibility of the company’s operations can also be an important factor for their raising more borrowing funds to obtain more favorable terms.

At the same time, because the original shareholders of the private company sold their own shares to the public, the IPO can be regarded as the withdrawal strategy of the company’s founder and early investors (such as angel investment and venture capital), realizing that all their private investment is all of them.Profit acquisition.

Private companies will involve primary and secondary markets in their IPOs.

The first-level market is a private company provided some of the expected stocks to the underwriter.The underwriter will be sold to their customers at the issue price of the IPO before the stock trading on the public exchange.There are often significant differences between buyers, the IPO’s issuance price and the transaction price after its listing, which brings a considerable benefit return to buyers in the first-level market.

After the IPO, the private company will issue the remaining issuance shares to the secondary market.Buyers in the first-level market can also sell the stocks in the second market to the secondary market, but there is usually a lock-up period to avoid buyers in the first-level market.The stock price fell.At this time, most investors, including ordinary buyers, can purchase stocks through their agent placing an order.

Under normal circumstances, the stock price will fluctuate violently after the new shares enter the market, so the purchase price in the secondary market is often higher than the issuance price of the first-level market.For example, the issuing price of a company’s issuance is $ 10, then buyers of the first-level market can buy at a issue price of $ 10 per share.Once entering the secondary market, the price may rise immediately.Buyers in the secondary market need to pay more.The amount, that is, the opening price to buy stocks.

Of course, ordinary buyers can also obtain qualifications for the issue price of a new shares through ETF or common fund.

How to purchase an IPO?

Generally investors are difficult to enter the first-level market and purchase issued shares issued at the issue price.Usually, they are purchased through agent through the secondary market, such as Weimiu and Tiger Securities.

1.Wei Niu-webull

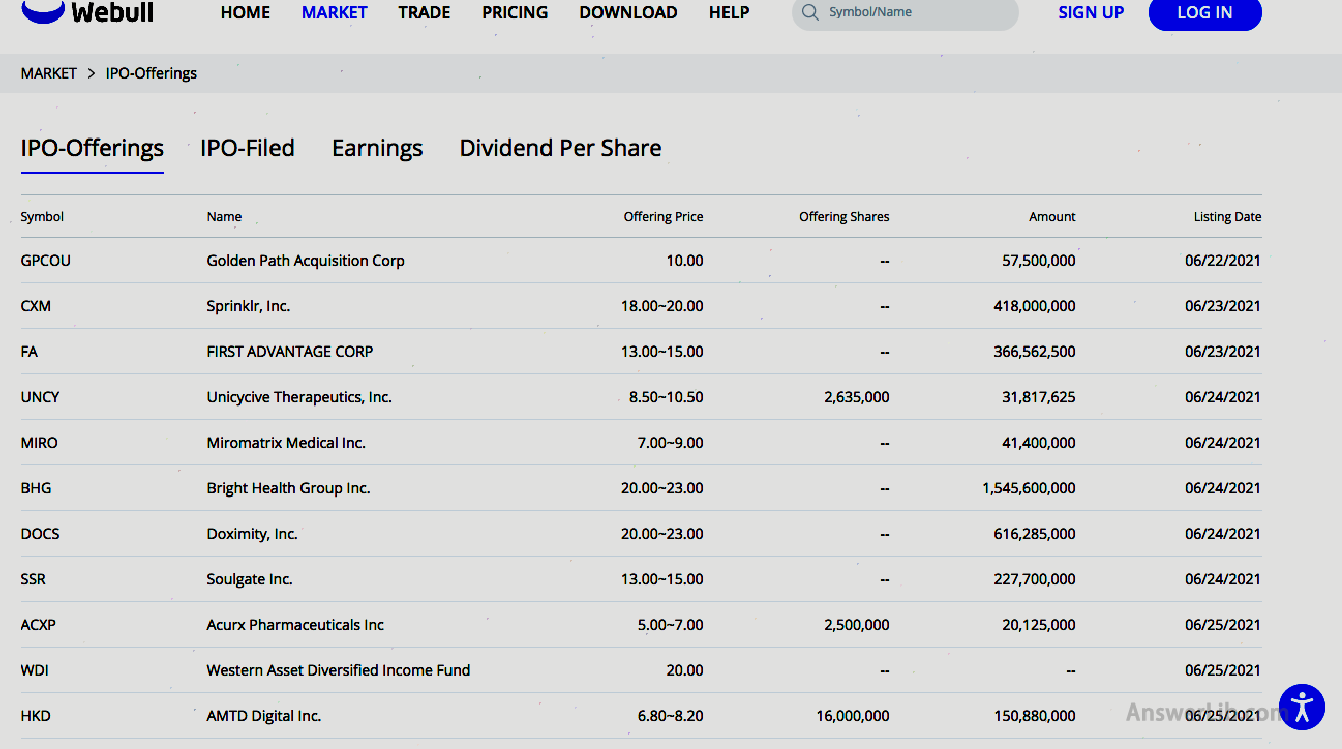

When searching for an IPO on the homepage of Weiu Niu, it will jump to the IPO market page and provide four forms, including companies to be issued to IPOs, companies that publish IPO files, companies’ income information, and the company’s dividend information per share.

To be released, the company’s code, company name, issuance estimated price price, sale shares, quantity, date and other information are provided.

The IPO file form is the company’s code, the company name and rough issuance number and the date of disclosure of the file.

The income information form shows the current income situation on the market, the company’s code and name, the date of issuance, the estimated earnings and the final price per share.After entering different companies, you will see the specific information of the market and the analysis of the company.

The expression of dividend information per share is to release dividend information per share, including the company’s code and name.At present, dividends, yields, and dividends of dividends.

The Sabbath refers to the next trading day after the registration of the equity.On this day or later, the shareholders who purchase the company’s shares will no longer enjoy the company’s dividend allocation.

Reading in-depth:How about Weiu Niu, Weimiu Securities Account Opening Reward and Step

2.Tradeup (Tiger)

Tradeup is a mobile trading app provided by the broker’s service by Marsco Investment Corporation to provide free streaming market data in real time.Using innovative technology, customers can seamlessly trade various securities, including IPOs.

The user interface layout is clear, and even the first traders can quickly find the target module, get the required data and conduct transaction operations.

At the same time, it also provides a large number of professional analysis reports and real-time data analysis charts, filter, fan-shaped charts and other data to meet the needs of senior investors’ in-depth market analysis needs.

Reading in-depth:How about Tiger Securities, Tiger Securities Entry Gold Reward, Account Opening Step

The difference between IPO and direct listing?

Private companies enter the Stock Exchange and convert them into public companies.They can go through the IPO or bypass the underwriters and go public directly.The difference between the two is:

A.Stock types of sale

IPO is released on the new stock after the reorganization of the original company, and the directly listed companies sell existing stocks held by company employees and investors.

B.The issuance price is high

The issuance price of the stock on IPO will increase due to the existence of underwriters.In contrast, the stocks of direct listed companies are relatively cheaper.

C.The purpose of sale of stocks

The purpose of the IPO to sell new shares is to raise additional funds, and directly listed companies issue shares to increase shareholders’ liquidity.

D.Stock trading liquidity

In the IPO, the shareholders of the first-level market may have a lock-up period and shall not sell the stocks in their hands, and all shareholders of the company directly listed can trade the stock at any time.

E.Applicable company type

IPO is more suitable for companies that need to raise new funds to expand scale; and directly listing is more suitable for companies with abundant funds but lack of exposure popularity.

What is Pre-IPO?

PRE-IPO is an investment institution’s investment before the listing of listing and meeting the listing conditions.

This type of company usually reserves a small amount of stocks available for purchases, and is sold to some investors in private, such as hedge funds, private equity companies, investment banks, etc.

These stocks can be put into market transactions after the IPO, and they will get high returns.

But at the same time, there will be certain risks, such as the company cannot smoothly IPO and listing transactions.

Is pre-ipo worth investing?

For companies preparing to be listed, Pre-IPO is a way to raise funds and avoid the risk of successful IPOs to a certain extent.The funds paid by investors ensure that the company has sufficient funds before the IPO.Reverse the possibility of the company’s successful listing.

For investors, PRE-IPO has both risks and rewards.

A.investment risk

The risk lies in that if the company’s invested company fails to pass the SEC review and cannot be listed as scheduled, the return rate of this investment will be limited to the company’s internal small return.And if the company invested is successfully listed, investors will often be limited by “lock-up” and cannot immediately sell the stocks held to make a profit.

B.return on investment

In terms of return, once the PRE-IPO investment is successful, the return that can be obtained is often considerable.Because PRE-IPO investment is usually carried out, the target company has strong strength, and it will be immediately sought after after listing.The stock price will often rise rapidly.Pre-IPO is worth investing.For example, Alibaba’s stock, the price on the first day of the transaction has exceeded the issue price of 36.3%.

Therefore, for experienced investors, mastering enough company information, understanding the company’s strength, and the possibility of making PRE-IPO often profitable than the possibility of failure.

What is the difference between IPO and Pre-IPO?

- Object: Pre-IPO is invested in private companies, and IPOs are companies that have been eligible for or listed.

- price: The purchase price of Pre-IPO will be lower than the purchase price of the IPO, and the potential for rising returns is higher than the IPO.

- Assure: PRE-IPO objects do not need to provide a prospectus.The company’s operations and financial information are not fully transparent, and they are not regulated by SEC.The IPO must issue a prospectus recognized by the SEC to describe the company’s situation in detail and accurately, while being regulated by the SEC.

common problem

Question 1: What does IPO mean?The full name of the IPO is the Initial Public Offering, Chinese translation: the first public offering.IPO is a way of conversion from the company’s transition from a private joint-stock system to a public joint-stock system.

See More

Generally, it is difficult for investors to enter the first-level market and purchase and issue shares issued at the issue price.Usually, it is purchased through agent through the secondary market, such as Weimiu and Tiger Securities.

See More

Private companies enter the Stock Exchange and convert them into public companies.They can go through the IPO or bypass the underwriters and go public directly.The two have different types of stocks, and the purpose of the sale of stocks is also different.

See More

IPO is an important part of the growth process for the company, which will bring a lot of funds raised to the company and gain greater development capacity.After entering the open market, the transparency and credibility of the company’s operations can also be an important factor for their raising more borrowing funds to obtain more favorable terms.

See More