Asset turnover, English is Asset Turnover Ratio It is a financial indicator that measures a company that transforms its assets into turnover.The calculation method of asset turnover rate is to divide the company’s net operating sales with an average total assets.The calculation value of asset turnover means the sales income that the company can obtain from the assets per $ 1.

When the asset turnover rate is less than 1, it means that the company’s current total assets cannot be converted into sufficient returns.It is a more dangerous financial signal.When the asset turnover rate is greater than 1, it means that the company’s current total assets can create enough benefits, and and of.When measuring the sales capabilities of the two companies, the higher the asset turnover, the better its sales capacity.

However, because the total assets are used in the calculation of the asset turnover rate, it is impossible to judge the company’s specific business situation from the result value.For example, when the company sells a large amount of assets in the recent financial year, this will make the value of the asset turnover rate value valueStepping, but this result is not equal to the company’s sales capacity improvement.

Bleak American broker:Transparent securities| | Futu Securities| | Microex Securities| | Tiger securities| | First securities| | Robinhood in| | American Langshang Daquan

Directory of this article

- How to calculate the asset turnover rate?

- Calculate Apple’s asset turnover rate?

- What is the investment guidance significance of asset turnover?

- What are the limitations of asset turnover?

- Join investment discussion group

- More investment strategies

How to calculate the asset turnover rate?

The calculation method of asset turnover rate is to divide the company’s net sales with average total assets, that is,

Asset turnover rate = net sales / average total asset

Asset Turnover Ratio = N ET Sales / Average Total Assets

in:

Net Sales is the company’s total sales of the company’s total sales in the financial year to remove net sales after the sales discount discount and return refund.Net Sales can be found on the profit sheet of the company’s financial report.

Total assets refer to the company’s total mobility assets and non-current assets, including intangible assets.The average total asset is to remove the company’s early period in the period of the period in the financial year and the end of the period.

Average total asset = (initial assets + final assets) / 2

Total assets can be found in the balance sheet in the company’s financial report.

Calculate Apple’s asset turnover rate?

This chapter will be released by Apple in September 2021 10-K financial report Calculate the instance:

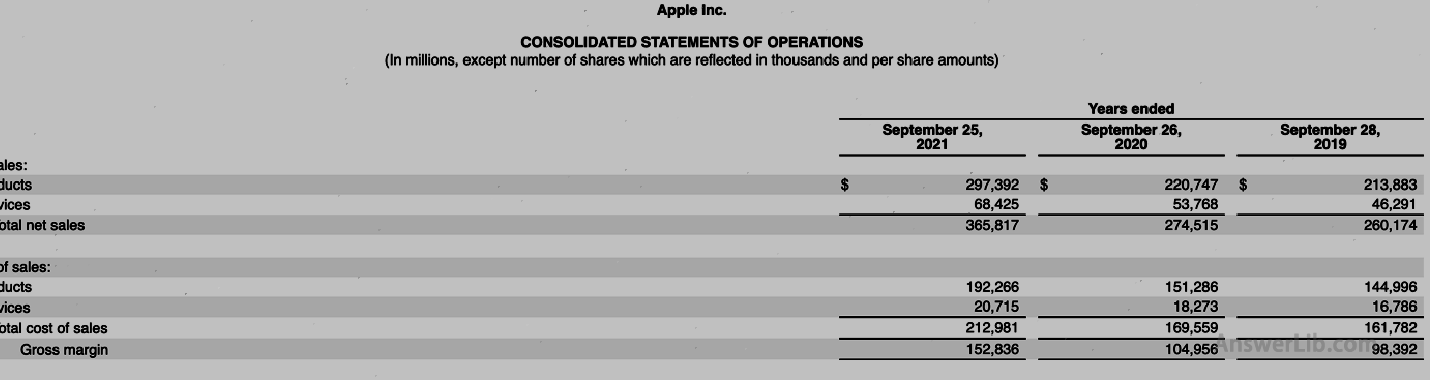

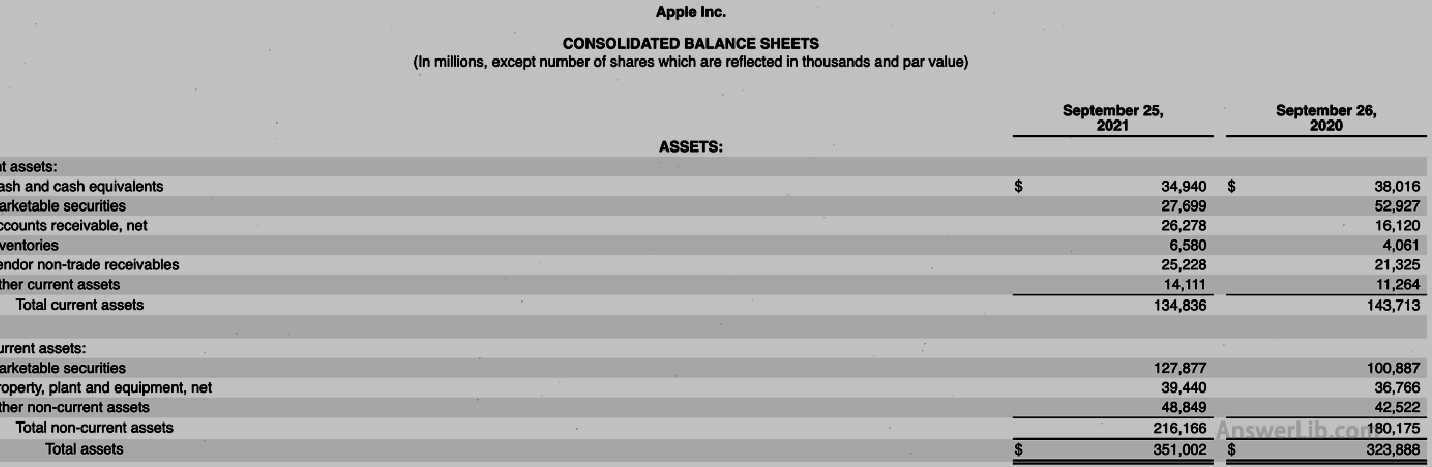

AAPL Financial Report The profit and loss sheet and the balance sheet are shown below:

Profit or loss statement:

Asset liabilities:

It can be seen from the financial statements that the net sales of Apple’s 2021 financial year Net Sales is $ 365,817 m, and the total assets of the previous year are the total assets of the previous financial year, $ 323,888 m, and the total assets at the end of the period are $ 351,002 m.

so:

Average total asset = (total assets at the beginning of the period + total assets of the period) / 2

= ($ 323,888 m + $ 351,002 m) / 2

= $ 337,445 m

Asset turnover rate = net sales / average total asset

Asset turnover ratio = net sales / average topal assets

= $ 365,817 m / $ 337,445 m

= 1.08

In other words, in the 2021 financial year, Apple uses its assets per $ 1 to earn $ 1.08 sales.

What is the investment guidance significance of asset turnover?

When the company’s asset turnover rate is less than 1, it means that the company’s sales per $ 1 can obtain less than $ 1, that is, the company cannot use its assets to generate sufficient income.This value is a relatively dangerous signal for a company, usually due to the company’s business model and planning problems.

However, if the company belongs to the industry, its average asset turnover rate is usually less than 0.5, then if the company’s asset turnover rate is between 0.5 and 0.9, it can also indicate that the company performs well.

When the company’s asset turnover rate is greater than 1, it means that the company’s sales of assets per $ 1 can generate sales greater than the asset value, which means that the company can create sufficient income for itself, which is a good performance of the company’s operation.

However, if the company belongs to industries such as retail industry, because this type of industry usually retains a lower level of total assets, the average asset turnover rate is higher, usually greater than 2.At this time, when a company in the industry, the company’s asset turnover rateWhen the value is 1.5, it shows that the company’s performance is not ideal, and managers need to examine their operating planning.

What are the limitations of asset turnover?

Because the asset turnover uses total assets, its value cannot reflect the company’s specific business performance during the financial year.

Under normal circumstances, the asset turnover rate is mainly affected by operating capacity, but if a company sells a large number of assets in the financial year, this will increase the value of the asset turnover rate, but in essenceof.

In addition, net sales are used in asset turnover ratios, not net income, so there will be a certain deviation when measuring the company’s real profits to earn the ability.

When using the asset turnover rate is relatively different, the capital-intensive companies often have more appropriate comparison.For the company types that outsourcing business outsourcing, because their asset holdings are low, the value of the asset turnover rate isIt is generally very high.At this time, the use of asset turnover to evaluate is meaningful.

Therefore, when analyzing the changes in the real business capacity of a company, more financial indicators need to be combined with more financial indicators to analyze the company’s operating capacity increase or decrease in detail.