Moving average, English is MOVING AVERAGE, Abbreviation Ma It is one of the most basic and widely used technical indicators.By calculating the average price within a certain period of time, the trend of identification and tracking asset prices.

The moving average is not only used to determine the overall trend of the market (up, down, or sideways), but also often uses to identify potential support and resistance levels.

The moving average of different time frames is suitable for different types of trading strategies.The short-term mobile average is more suitable for short-term transactions, while long-term mobile average is more suitable for long-term investment analysis.In addition, multiple mobile average of different cycles is often regarded as a signal of buying or selling.

However, it should be noted that because the mobile average is lagging and misleading signals that occur, you need to combine it with other technical indicators and fundamental data to get relatively correct information.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- What is a mobile average?

- What are the types of mobile average?

- What are the commonly used cycles on the moving average?

- How to apply a mobile average?

- How to combine the moving average with other tools?

- What are the limitations of using the moving average?

- More investment basic knowledge

What is a mobile average?

The moving average is based on the set time span (such as the day, week, month, month, etc.), and the price data during this period of time is average, and then this calculation process is continuously performed over time.

For example, a 10 -day moving average increased the price of the past 10 days after 10 days, so as to get the current average price.When the current trading day arrives, add new price data, remove the oldest price data at the same time, and calculate the average value again to form a “mobile” effect.

The importance of the moving average is that it provides a simple and effective way to identify the trend, direction and strength of asset prices.

Through smooth daily price fluctuations, you can see the long-term trend of prices, so as to seize the main trend in complicated market information.

- Trend recognition: The moving average can clearly show whether the market is on the upward trend, a downward trend or a horizontal state.

- Transaction signal: Multiple mobile average cross (such as short-term moving average through long-term moving average) is often used as signals for buying or selling.

- Support and resistance: In some cases, the moving average can also be used as a potential support or resistance level of price.

What are the types of mobile average?

The three most common types of mobile average: simple mobile average (SMA), index moving average (EMA), and weighted mobile average (WMA).

These three mobile average have their own characteristics and are suitable for different trading strategies and market conditions.

- Because of its simple and stable, SMA is suitable for long-term trend analysis;

- EMA is suitable for capturing short-term price changes because of its sensitive response;

- WMA provides a choice between SMA and EMA, allowing users to more flexibly define the importance of price data.

Simple moving average (SMA)

Simple moving average is the most basic mobile average, which is obtained by calculating the arithmetic average of the price in a certain period of time.

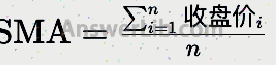

Select a specific time cycle (such as 10 days, 20 days, 50 days, etc.) to add all closing prices in this cycle, and then divide the number of days.The formula is:

in,NIs the number of days the selected cycle

Index moving average (EMA)

The index moving average gives more weight data for the nearest price.Therefore, it is more sensitive to price changes and can reflect the latest changes in the market faster.

First calculate the simple moving average (SMA) as the starting point of the initial EMA.

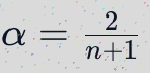

Calculate the smooth coefficient (weight factor) α, the formula is:

in,NIs the cycle of EMA

Then, calculate EMA according to the following formula:

Weighted moving average (WMA)

The weighted moving average is similar to EMA, and it also gives a higher weight to the recent price data.The difference is that WMA clearly specifies the weight of each price point.

First determine the weight, usually the weight increases over time (the most recent price weight is the largest)

For example, in the 10th WMA, the price weight of the last day was 10, and the previous day was 9.According to this type, the weight of the first day was 1.

Then, Calculate the weighted average That is, the daily closing price is multiplied by its corresponding weight, and the total weight is divided by the total weight.The formula is:

in,NThe number of days for the selected cycle, weightIBe the firstIThe weight of heaven.

What are the commonly used cycles on the moving average?

5 -day moving average

The 5 -day moving average is used to capture very short-term price trends and market momentum.Suitable for short-term traders and inter-day traders to pay attention to the instant response of the market.

10 -day moving average

The 10 -day moving average provides information about short-term market trends.Suitable for short-term traders to evaluate recent market performance and opportunity for admission.

20 -day moving average

The 20 -day moving average (or 21 -day moving average, a trading month) is usually regarded as the standard for judging the short-term trend.Commonly used for swinging transactions and trend tracking.

50 -day average

The 50 -day moving average is regarded as an indicator of the mid-term trend.It is widely used to evaluate the mid-term market performance and is useful for long-term investors and mid-term traders.

100th/200th moving average

These long-term moving average are important indicators to evaluate long-term market trends.Among them, one of the most important long-term trend indicators of the 200 -day moving average is widely used to evaluate the overall health status and long-term trends of the market, and has attracted great attention from long-term investors and market analysts.

How to apply a mobile average?

The mobile average is the most commonly used technical indicator in financial market analysis, and several key aspects in practical applications.

1.Identify the market trend

- Trend judgment: The moving average can help traders determine whether the market is on the upward trend, a downward trend or a horizontal trend.When the price continues to above a certain moving average, it usually indicates that the market is on the rise; on the contrary, if the price continues to the moving average, it indicates that the market may be in a downward trend.

- Trend change: When the price breaks through below the moving average to the top, or falls below from the top to the bottom, this may indicate the change of trend.

2.Determine the level of support and resistance

- As support and resistance: Moving average is often regarded as a potential support or resistance level.In the upward trend, the moving average can be used as a supporting bit of price callback; in the downward trend, it may become the resistance level of a rebound.

- Multi-cycle analysis: Using different cycles of moving average (such as short-term, medium, and long-term) can help more accurate support and resistance areas.

3.Trading decision-making strategy

- Move average cross: The cross-term movement average and long-term mobile average cross-line are often used as transaction signals.Long-term long-term long-term lines may be buying signals, otherwise it may be selling signals.

- Price and mobile average relationship: When the price is obviously deviated from the moving average, some traders will look for trading opportunities to return to the average, especially after the price is far from the moving average.

- Trend follow strategy: In a clear trend market, traders can use the moving average as a guidance for the market and holding the position.For example, keep the position in the upward trend until the price falls below a certain moving average.

How to combine the moving average with other tools?

In the financial market analysis, a single indicator often cannot fully reveal the complexity of the market.Therefore, combining the mobile average with other technical analysis tools can provide more comprehensive and in-depth market analysis.

1.Combined with MACD

- MACD and MA: MACD (mobile average convergence scattered) itself is an indicator based on the mobile average.Combining MACD and MA can provide a comprehensive view of price trends and momentum.

- Trend confirmation: When the MA shows a clear rise or decrease trend, MACD can be used to confirm the strength and sustainability of this trend.For example, when the price is above MA for a long time and MACD displays the rising volume, this is usually regarded as a strong upward trend.

2.Combined with relatively strong indicators

- Recognize, buy and sell: Relative and weak index (RSI) is a popular tool for measuring whether the assets are excessively bought or sold.When RSI and MA indicate the same direction, this may be a stronger signal.

- Price reversal signal: For example, if MA shows a decline, and RSI is close to the oversold area and starts to rise, which may indicate that the price reversal is about to occur.

3.Combined with Bollinger

- Volatility analysis: Bollinger belt is a mobile average adjusted according to the standard deviation, which can provide information about market volatility.When the price touches the upper or lower band of the Bollinger belt, combined with MA can help determine whether this is the beginning of temporary fluctuations or trends.

- Trend intensity: For example, if the price continues to rise above the rising MA, and is close to or breaks the upper limit of the Bollinger belt, which may indicate a strong upward trend.

4.Combined with trading index

Transaction volume is the key factor in confirming the strength of the trend.If MA indicates that prices rise and accompanied by increasing trading volume, this is usually regarded as an effective confirmation of the upward trend.

What are the limitations of using the moving average?

Although the mobile average is a tool widely used in financial market analysis, it also has some limitations.

Therefore, the mobile average cannot independently provide all the necessary market information.It is best used to use other technical analysis tools and indicators, such as MACD, RSI, support/resistance levels, to obtain more comprehensive market analysis.

Lag

Because the moving average is calculated based on past price data, it is born with a lag.This means that the market change in the mobile average is always slightly delayed.

Misleading signal

The mobile average performed the best in the market with obvious trends.However, in the sidewalk or the lack of a clear trend, the moving average may not be effective.

Therefore, in the small vertical market, the mobile average may generate multiple misleading trading signals, resulting in frequent entering and leaving the market and increasing trading costs.

More investment basic knowledge

- Julian Roberts – Julian Robertson: Father of Tiger Baby

- Explore the 24 first-level dealers of the Federal Reserve

- Important Finance and Investment News

- What is Bollinger Bands?How to use the Bollinger belt?

- What is the application cumulative/allocation line? A/D Line

- What is the commodity channel index CCI?How to use the CCI indicator?

- What is a random shock index Stochastic ollator?

- What is the average trend indicator ADX?How to use the ADX indicator?

- What is a balanced transaction volume index?How to use the OBV indicator?

- What is a mobile average?MOVING AVERAGE