Commodity channel index, English is Commodity Channel index, Abbreviation CCI It is a technical analysis indicator.By measuring the changes in the average statistics of the price, it is judged whether the market is in the stage of buying or selling.

Generally speaking, CCI is generally higher than +100, which usually means over buying, and lower than -100 to represent oversold.

The product channel index was proposed by Donald Lambert in 1980.He created this indicator mainly to identify the cycle of cyclical commodity prices, but later found that CCI also applied to technical analysis of stocks and other types of markets.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- How to calculate the product channel index?

- How to use the commodity channel index CCI?

- What are the limitations of using the commodity channel index?

- More technical indicators

How to calculate the product channel index?

1.Calculate typical price (Typtical Price)

Typical price shows the average level of stock or commodity prices in a certain time period (such as one day).

By combining the highest price, minimum price and closing price, the typical price captured the middle value of price fluctuations during this period, which reflects market emotions and trading activities more comprehensively than a separate closing price.

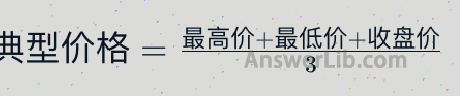

We use TP to express typical prices, adding the highest price, lowest price, and closing price of the day, and then divide the average value.so,

After obtaining the typical price on the day, you need to calculate the average value of N (such as 20 days) for a period of time, marked as TPNEssence

2.Calculate average deviation

From the calculation of the first step, we got two data:

- Typical price TP of the day

- The average mobile average TP of the typical price of the dayN

Therefore, the calculation of the deviation of the same day is as follows:

Bad = | TP – TPN|

Among them, | | take absolute value.

Then, let’s calculate the average deviation (marked as DIV), that is, for a period of timeNMovement average of deviation.

3.Calculate the product channel index CCI

CCI = (TP -TPN) / (0.015 x div)

Among them, 0.015 is a commonly used zoom factor to adjust the sensitivity of the CCI indicator.

How to use the commodity channel index CCI?

1.Identify the oversold status

The CCI value is higher than that of +100, which may indicate that the market enters the overtime state, and lower than -100 may indicate the oversold status.

2.Trend change signal

The CCI value returns from the over-purchase or oversold area to the normal range may be a signal of trend transformation.

3.Disposter

The departure of CCI occurs when the indicator is inconsistent with the stock price trend, and departure is an important signal that the market may reverse.

For example, if the stock price is innovative and the CCI fails to reach a new high accordingly, this is called the disconnection, which may indicate the decline in the stock price.

On the contrary, if the stock price is innovative but the CCI is not innovative, this is called the bottoming, which may indicate the rise in the stock price.

What are the limitations of using the commodity channel index?

Like many other technical indicators, CCI, as a historical data-based indicator, may lag behind the actual changes in the market.

CCI also frequently mislead signals.It cannot be used by CCI separately to analyze the price trend.It needs to be used with other technical indicators and needs to consider the fundamental aspect of investment targets.

More technical indicators

- What is Bollinger Bands?How to use the Bollinger belt?

- What is the application cumulative/allocation line? A/D Line

- What is the commodity channel index CCI?How to use the CCI indicator?

- What is a random shock index Stochastic ollator?

- What is the average trend indicator ADX?How to use the ADX indicator?

- What is a balanced transaction volume index?How to use the OBV indicator?

- What is a mobile average?MOVING AVERAGE

- What is moving average convergence?MACD

- What is the capital flow index MFI?How to use the MFI index?

- What is a relatively strong indicator?Relate Stringth Index