Bollinger belt, English is Bollinger Bands, a technical analysis tool invented by John Bollinger in 1980.It is mainly used to analyze the market’s volatility and trend strength, and can be used as an indicator of superb purchase or oversold.

The Bollinger belt consists of three lines: the middle line is usually the moving average on the 20th, and the upper and lower bands are the standard deviation of the middle line.When the asset price is close to the top, it may indicate over buying, and it may be oversold.

On the basis of Bollinger, Bollinger Band Width appeared and Bollinge %B.

The Bollinger width is used to measure the width of the Bollinger belt, which is represented by a value, which reflects the volatility of the market.The percentage of Bollinger belt is used to measure the position of the asset price relative to the Bollinger belt, reflecting the state of overburning or oversold.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- How is the Blin belt calculated and drawn?

- How to use Bollinger, Bollinger bandwidth, and Bollinger belt percentage?

- What are the limitations of using the Blinger?

- More technical indicators

How is the Blin belt calculated and drawn?

There are three main lines on the Bollinger belt: Middle Band and the upper and lower boundary lines, called upper band and LOWER BAND.

The middle line is usually used for a whileN(For example, 20 days) the moving average, that is, find the closing price of the past 20 to find its average.

Calculated as follows:

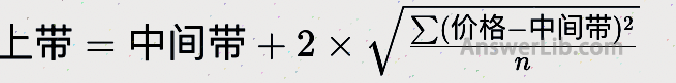

Then, calculateNThe standard deviation of the daily price, so the calculation of the upper comes is as follows:

The standard deviation of the price of the upper band = the middle band + 2 × n-day price

Write as the formula as follows:

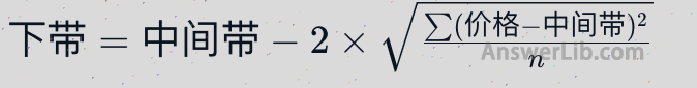

In the same way, the calculation formula brought as follows:

Therefore, through the value of the middle zone, the upper band, and the lower band (LOWER BAND), you can draw the Bollinger belt, which is usually placed with the price line, as shown in the figure below:

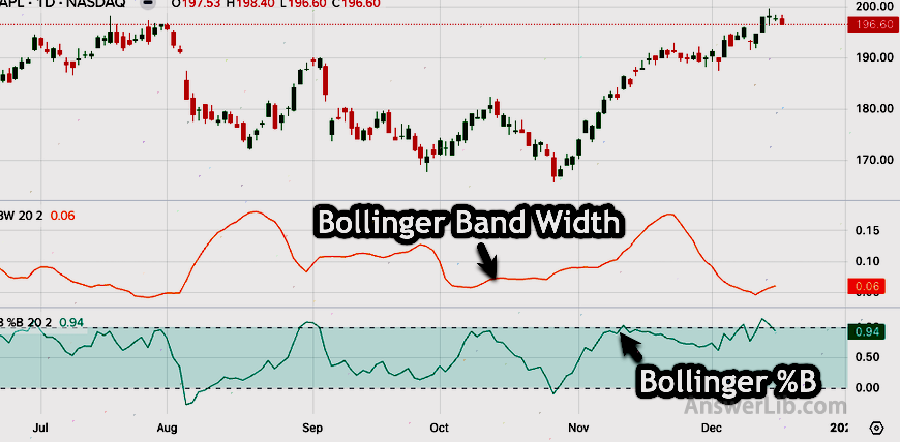

After that, we can calculate the Bollinger Band Width and Bollinger %B.These are two separate values, which are generally drawn on two independent pictures.

Bollinger Band Width indicates the relative width of the Bollinger belt, which reflects the changes in market volatility.

When the bandwidth increases, it indicates that the market volatility increases; when the bandwidth decreases, it indicates that the market volatility decreases.

The calculation formula of Bulin bandwidth is as follows:

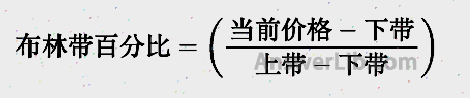

Bollinger %b is used to measure the position of the current price relative to the Bollinger belt.This indicator can be calculated by comparing the differences between the current price and the upper and lower bounds of the Bollinger belt, which can help identify the oversized or oversold status, as well as potential trading points.

The value range of %b is between 0 and 1, and more than 1 means over buy, lower than 0 means oversold.

The calculation formula is as follows:

Bollinger Band Width and Bollinger %(Bollinger %B) are generally displayed below the price line, such as:

How to use Bollinger, Bollinger bandwidth, and Bollinger belt percentage?

The Bollinger belt is a bandwidth, consisting of the two boundary lines and the middle line, which is generally drawn with the price line.

Several common methods of Bollinger belt are as follows:

1.Judgment trend

When the width of Bulin bandwidth expands, it means that the increase in market volatility may indicate the beginning of the trend;

When the bandwidth is narrowed, it means that the market volatility is reduced, which may be a signal of weakened trends or market integration.

2.Judgment Super buy or oversold

It can be considered that Blin belt with other super-buying and oversold indicators (such as RSI, CCI).

When the price is close or touched the Bollinger’s rail, and the RSI also shows superb purchase, then this price is often regarded as a market super purchase, which may indicate the price callback or decline.However, if the RSI does not show super buying, it may indicate that the price has more room for rising.

What are the limitations of using the Blinger?

The Bollinger belt cannot be used alone.The Bollinger can only provide information about the current price fluctuations, and cannot accurately predict the direction or amplitude of the future price.The Bollinger belt is usually used with other technical indicators or analysis tools to improve its effectiveness.

More technical indicators

- What is Bollinger Bands?How to use the Bollinger belt?

- What is the application cumulative/allocation line? A/D Line

- What is the commodity channel index CCI?How to use the CCI indicator?

- What is a random shock index Stochastic ollator?

- What is the average trend indicator ADX?How to use the ADX indicator?

- What is a balanced transaction volume index?How to use the OBV indicator?

- What is a mobile average?MOVING AVERAGE

- What is moving average convergence?MACD

- What is the capital flow index MFI?How to use the MFI index?

- What is a relatively strong indicator?Relate Stringth Index