Fund traffic index, English is English Money Flow Index, Abbreviation MFI It is a technical indicator for measuring the inflowing and outflow of funds within a specific cycle and market.

The calculation of the capital flow index also considers the stock at the same time price and Trading volume Then evaluate the trend of the stock through specific calculation values, including judging the stock price in the state of overbight or oversold, and whether the price turning point has occurred.

The correct use of MFI can help investors identify the potential trend reversal point, thereby providing valuable insights for your trading decisions.

The value of the capital flow index is introduced in 0~ 100 between.Generally speaking, the stock price rises, the MFI value will rise, the stock price will fall, and the MFI value will fall.When MFI is greater than equal to 80, it is generally believed that stocks have been over-bought, and when MFI is less than equal to 20, it is considered that the stock is in a state of oversold.If the stock price has risen and the MFI value starts to decline, it means that the loser emotion in the market has gradually dominated, and the possibility of the price turning point is very high.

Another technical indicator in MFI and the market ” Relative intensity indicator“RSI is similar, but RSI only considers the stock price, and MFI also considers the fluctuation of the stock price and transaction volume.When evaluating the stock price, the two have different judgment indicators.

For MFI, the evaluation standard value is usually 20 and 80, while the RSI evaluation standard value is 30 and 70.

If you use the TradeUP card, you can easily find the capital flow index (MFI) of any listed company to help you analyze the trend of the stock.It is an important indicator in the analysis of stock investment technology.At present, open accounts and deposits in the TradeUP certificate can get free US stocks and check the details.

P️ & nbsp; Note: This article uses Apple stock AAPL as a demonstration.The stock is only used as a demonstration content, not to guide you to buy the stock.Remember: the stock market is risky and investment needs to be cautious.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- What is the guiding significance of the capital flow index?

- The combination of capital flow index and other technical indicators

- How to find capital flow indicators in the TradeUP card?

- How to calculate the capital flow index?

- Calculating example: Apple’s stock’s capital flow index

- What is the difference and connection between the capital flow index (MFI) and the price strength index (RSI)?

- What are the limitations of using fund traffic indicators?

- Summarize

- Disclaimer

What is the guiding significance of the capital flow index?

The main role of the Money Flow Index is: to evaluate the stock price trend of the stock, the judgment price is in a super-buying or oversold status, and whether the stock price is about to appear a turning point.

1.Determine the stock over or oversold

For most stock prices, 20 and 80 can be used as a standard value for judging oversold or overshide.

- when MFI Value up 80 When the above, the stock will be considered in a super-buying state.That is, the current price has exceeded the price suitable for buying.It is not recommended to continue buying, but suitable for selling.

- when MFI Value down 20 In the following, the stock will be considered oversold.That is, the current price has exceeded the price suitable for selling.It is not recommended to sell it, and it is suitable for holding or buying.

However, it should be noted that 80 and 20 are not absolute guidance values.

- If the MFI value of the stock lasts for a period of time, 90 can be used as the standard line for super-buying, that is, if the MFI value of the stock exceeds 90, it is judged to enter the super-buying state.

- Similarly, if the stock price has a strong decline, the MFI value is maintained below 20 for a period of time, and 10 can be used as the standard line for oversold, that is, the MFI value of the stock is less than 10, and it is considered to enter the oversold state.

2.Stock price judgment of the trend of stock price

Generally speaking, the value trend of MFI is echoing the trend of the stock price.If the trend appears, it is generally considered to be a signal of price turning.

When the stock price continued to fall and MFI began to rise, the flow of funds began to increase, buyers began to gradually enter the market, and the price was about to occur from bottom to top.

When the stock price continues to rise and MFI begins to fall, it means that the number of sellers in the stock will begin to increase, and the stock price will have a turning point from high to low.It is a signal for capital investment for short-to -low investors.

3.Identify the potential top and bottom reversal signal

MFI can also help investors identify the potential top and bottom reversal signals.

When the stock price is innovative, and MFI fails to reach a new high, this may be a top signal, indicating that the market’s buying power is weakened, and the stock price may be recovered.

Similarly, when the stock price is innovative, and MFI fails to reach a new low, this may be a departure signal at the bottom, indicating that the market selling power weakens, and the stock price may rebound.

It should be noted that MFI is not an absolute trading signal, but as an auxiliary tool to help investors understand market sentiment and capital flow.When using MFI, you also need to consider other technical indicators and fundamental factors to obtain more comprehensive market analysis.

The combination of capital flow index and other technical indicators

Combining MFI and other technical indicators can help investors get more comprehensive and accurate market analysis.Through the comprehensive analysis of multiple indicators, the shortcomings of a single indicator can be made up, thereby improving the accuracy and transaction success rate.

For example, MFI mainly focuses on the inflow and outflow of funds, and Moving average(MOVING AVERAGE) reflects the price trend, Relatively strong index(RSI) measures price momentum.Combining these indicators, investors can better understand the market trends, momentum and market participants.

Here are examples of combining MFI with other technical indicators.These indicators can be found from the TradeUP certificate 劵 APP:

- Use MFI to identify super-purchase and oversold status: When MFI is higher than 80, the market may be in a super-buying state; when MFI is lower than 20, the market may be in a state of oversold.

- Use a mobile average to confirm the trend: Investors can observe the relationship between stock prices and short-term (such as 20 days) and long-term (such as 50 days or 200 days).When the price is above the short-term and long-term moving average, it indicates that the market is on the upward trend; on the contrary, when the price is under the short-term and long-term mobile average, it indicates that the market is declining.

- Use a relatively strong and weak index to evaluate momentum: When RSI is higher than 70, it may indicate that the market is overheating and faces the risk of callback; when RSI is lower than 30, it may indicate that the market is too cold and there is a chance to rebound.

Combining these indicators, investors can develop a more comprehensive trading strategy.For example, when MFI is in a super-buying state, the stock price is above the short-term and long-term moving average, and the RSI is higher than 70, investors may think that the market is facing a callback risk, and may consider reducing positions or watching.

Similarly, when the MFI is oversold, the stock price is under the short-term and long-term moving average, and when the RSI is lower than 30, investors may think that the market has a chance to rebound, and may consider increasing positions or find appropriate buying opportunities.

How to find capital flow indicators in the TradeUP card?

Taking Apple (TICKER: AAPL) as an example, let’s introduce how to find its capital flow index MFI in the TradeUP card app.

Note that you need to open the TradeUP certificate first to find the capital flow statement of the stock.

step one: Open the TradeUP card r app, search for stock AAPL, and enter the AAPL stock page, as shown below:

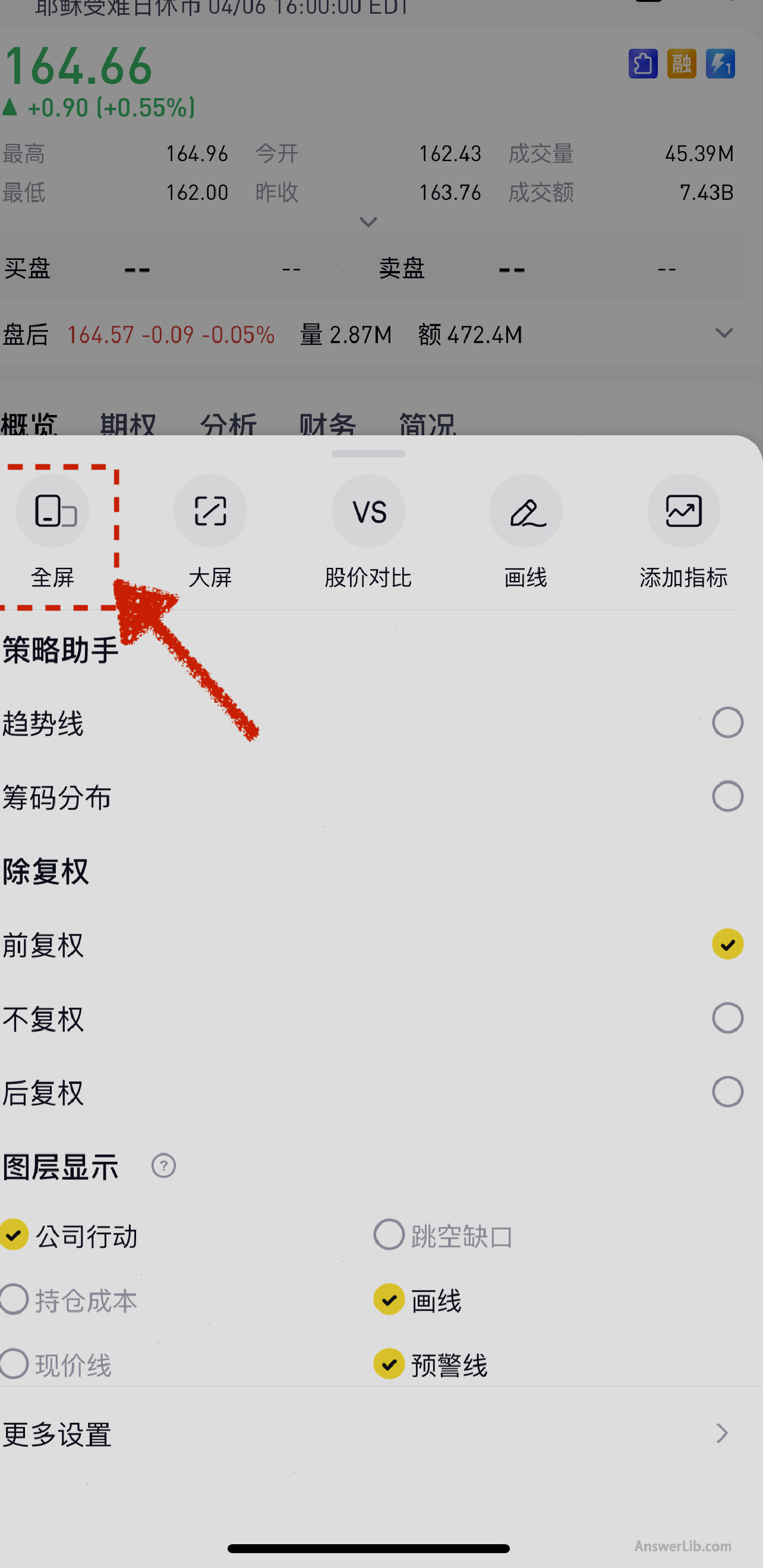

Step 2: In [Overview], find the real-time price chart of the stock, click on the upper right corner to find the [full screen] option, as shown below:

Step 3: In the right indicator option in the K-line diagram of AAPL, find MFI.This is the capital flow index.After clicking, you will find the corresponding MFI indicator line under the K-line diagram.It can be seen from the figure that MFI reached 88.08 in the market CLOSE on the day of the market on April 6, 2023.

Step 4: Exit in full screen display, return to the stock homepage, the MFI indicator will always be displayed.

How to calculate the capital flow index?

The capital flow index needs to refer to the specific cycle share price and Transaction volume For calculations, in general, the specific cycle is 14 This day, then calculate based on the following four steps:

Step 1: Calculate typical price (TP)

Typical price, English is Typical Price, referred to as TP, is the lowest price, highest price and closing price of a trading day, that is::

Typical price = (minimum price + maximum price + closing price) / 3

Typical Price = (Low + High + Close) / 3

Step 2: Calculate funds flow (Money Flow)

The calculation method of capital flow is to multiply the typical price with the turnover of the day, that is,:

Fund flow = trading volume X typical price

Money Flow = VoluMe X Typical Price

Then, calculate a certain cycle (such as 14 days) based on the size of the typical price Orthopedic flow and Negative funds The

- Positive capital flow ( Positive Money Flow): It refers to the sum of all capital flows with typical prices higher than the typical price of the previous trading day within a period of cycle.

- Negative capital flow ( Negative Money Flow): It refers to the sum of all capital flows with typical prices of typical prices in the previous trading day during the cycle.

If the typical price is the same as the previous trading day, it is not included in the calculation, but the calculation cycle remains unchanged.

Step 3: Calculate the rate of funds (Money Flow Ratio)

Fund flow ratio, English is Money Flow Ratio, and its calculation method isNDaily cumulative capital flow andNDaily cumulative negative capital flows have been removed, that is:

Fund flow ratio = =NCumulative capital flow /NDaily cumulative negative capital flow

Money Flow Ratio = Positive Money Flow / Negative Money Flow

Step 4: Calculate the capital flow index ( MFI)

Calculate the funds ratio in the following formulas to calculate MFI:

Fund traffic index = 100 – [100 / (1 + fund ratio)]

Money Flow Index (MFI) = 100 – [100 / (1 + Money Ratio)]

The value of Money Flow Index is 0 to 100.Generally, when the MFI is higher than 80, the market is considered to be over-buying, which means that the stock price may face the risk of callback.On the contrary, when the MFI is less than 20, the market is considered an oversold, which means that the stock price may have a chance to rebound.

It should be noted that MFI is not an absolute trading signal, but as an auxiliary tool to help analyze market sentiment and capital flow.

However, you’d better not be able to use the MFI index alone.You should also combine with other technical indicators and fundamental factors to obtain more comprehensive market analysis.

Finally, let’s summarize several important indicators used in calculating funds flow index:

- cyclen:Generally use 14 days;

- Super buying point: when MFI is greater than 80

- Superbo: When MFI is less than 20

Calculating example: Apple’s stock’s capital flow index

The following is from Apple Investor website The data sheets of the first 14 trading days from July 6, as well as calculation values obtained by using typical price calculation formulas and capital flow calculation formulas:

date | The lowest price/$ | The highest price/$ | Closing price/$ | Transaction volume/m | Typical price/$ | Fund flow/$/m |

|---|---|---|---|---|---|---|

7.6 | 141.08 | 144.12 | 142.92 | 73.6 | 142.71 | 10503.21 |

7.5 | 136.93 | 141.61 | 141.56 | 71.0 | 140.03 | 9942.37 |

7.1 | 135.66 | 139.04 | 138.93 | 71.1 | 137.88 | 9803.03 |

6.30 | 133.77 | 138.37 | 136.72 | 98.6 | 136.29 | 13437.87 |

6.29 | 136.67 | 140.67 | 139.23 | 66.0 | 138.86 | 9164.54 |

6.28 | 137.32 | 143.42 | 137.44 | 66.8 | 139.39 | 9311.47 |

6.27 | 140.97 | 143.49 | 141.66 | 70.0 | 142.04 | 9942.80 |

6.24 | 139.77 | 141.91 | 141.66 | 89.1 | 141.11 | 12573.20 |

6.23 | 135.63 | 138.59 | 138.27 | 72.2 | 137.50 | 9927.26 |

6.22 | 133.91 | 137.76 | 135.35 | 73.1 | 135.67 | 9917.72 |

6.21 | 133.32 | 137.06 | 135.87 | 80.7 | 135.42 | 10928.3 |

6.17 | 129.81 | 133.08 | 131.56 | 134.5 | 131.48 | 17684.51 |

6.16 | 129.04 | 132.39 | 130.06 | 108.1 | 130.50 | 14106.69 |

6.15 | 132.16 | 137.34 | 135.43 | 91.1 | 134.98 | 12296.37 |

6.14 | 131.48 | 133.89 | 132.76 | 83.9 | 132.71 | 11134.37 |

In the typical price list, the typical price of the previous trading day will be marked asgreen, Below the typical price of the previous trading dayredFrom this calculation, in this cycle, the positive capital flow is $ 113518.59m, and the negative capital flow is $ 46020.57m.

Calculation funds ratio:

Fund ratio = Positive capital flow / negative capital flow

Money Ratio = POSIVE MONEY Flow / Negative Money Flow

= $ 113518.59m / $ 46020.57m

= 2.47

Calculate funds flow index:

Fund traffic index = 100 – [100 / (1 + fund ratio)]

Money Flow Index (MFI) = 100 – [100 / (1 + Money Ratio)]

= 100 – [100 / (1 + 2.47)]

= 71.15

Therefore, Apple’s MFI value in the 14th cycle on July 6 was 71.15.

What is the difference and connection between the capital flow index (MFI) and the price strength index (RSI)?

Both MFI and RSI are financial indicators that measure the price trend of the stock, both of which measure the stocks in a super-buying or oversold state through the upper limit and lower limit value.

The calculation method of MFI is: fund flow index = 100- [100 / (1 + fund ratio)]

The calculation method of RSI is: RSI = 100 – [100 / (1 + (1 + (average of the stock price increase / average of the stock price decline)]]

The main difference between the two is the consideration of transaction volume.

- In the calculation of MFI, use typical prices to trading volume to calculate the ratio of funds;

- RSI only uses the rise and fall of the stock price to calculate.

In terms of evaluation:

- MFI generally uses 20 and 80 as the evaluation standard for superbasing and super-selling.When MFI is higher than 80, it means that the stock price enters the super-buying state, which is lower than 20, which means that the stock price enters the oversold state.

- RSI generally uses 30 and 70 as the evaluation criteria for oversold.When the RSI exceeds 70, it means that the stock price enters the super-buying state, and the RSI is lower than 30, indicating that the stock price has entered the oversold stage.

Both measurement standard values can be adjusted according to the actual stock price trend.For example, when the stock price trend is strong, the standard value can be adjusted as the evaluation standard value of the super-buying.As an oversold evaluation standard value.

| index | MFI | RSI |

|---|---|---|

Consider content | The price and trading volume of the stock | Stock price |

Indicator | Make measures whether the stock is in a super purchase or oversold state through the value | Make measures whether the stock is in a super purchase or oversold state through the value |

Super buy evaluation | Mfi ≥ 80, indicating that the stock enters the superb purchase state | RSI ≥ 70, indicating that the stock enters the overshile status |

Oversold evaluation value | MFI ≤20, indicating that the stock enters the oversold status | RSI ≤ 30, indicates that the stock enters the oversold status |

What are the limitations of using fund traffic indicators?

Analyze MFI that may be misleading (such as in a market environment in extreme fluctuations)

MFI is a useful technical indicator, but it may be misleading in some cases.Here are some situations that may cause misleading:

- Extreme fluctuation market environment: In the case of violent market fluctuations, MFI may change rapidly and the response is too sensitive.This may lead to misjudgling in the market state, such as volatility that normal price fluctuations are considered to be super-buying or oversold signals.

- The departure signal is not necessarily accurate: although MFI can be used to identify the departure signal at the top and bottom, these signals are not always accurate.Sometimes, the departure signal may be temporary, not the reversal of the trend.

- Affected by external factors: MFI mainly focuses on the inflow and outflow of funds, and may be affected by external factors (such as emergencies, policy changes, or community transactions, etc.).In these cases, MFI may not accurately reflect the real situation of the market.

Emphasize the auxiliary of technical analysis, and cannot completely depend on a single indicator

Although MFI is a valuable technical indicator, investors should not fully rely on single indicators to formulate trading strategies.Technical analysis should be regarded as auxiliary tools to help investors understand market trends and emotions.

When using MFI, investors should also consider other technical indicators (such as the mobile average, relative weak index, etc.) and fundamental factors to obtain a more comprehensive market analysis.In addition, market conditions may fluctuate with the changes in the relationship between news, policies, and supply and demand.Therefore, when using MFI, investors should keep paying attention to market developments and adjust their strategies at any time.

Summarize

The Money Flow Index is an important technical indicator.It combines price and transaction information to help investors understand the inflow and outflow of funds.MFI can help investors identify super-purchase and oversold status, confirm the trend of stock price, and discover the potential top and bottom reversal signals.This information is of great significance in stock trading and can assist investors to develop more effective trading strategies.

However, investors should pay attention to their limitations when using MFI, and should not rely entirely on single indicators.In order to make more wise investment decisions, investors should use MFI with other technical indicators (such as mobile average, relatively weak index, etc.) and consider fundamental information to obtain more comprehensive market analysis.At the same time, investors should maintain market dynamics and adjust their strategies at any time to adapt to the changing market environment.

Disclaimer

Tradeup: TradeUP is a trading platform, not a broker or dealer.Its brokerage service is provided by Tradeup Securities, Inc..

Tradeup securities inc.: Tradeup Securities, Inc.is a brokerage company registered at the US Securities and Exchange Commission (CRD: 18483; SEC: 8-36754), a member of FINRA/SIPC, and a member of the DTC/NSCC.Supervision of the Financial Industry Supervision Bureau.For more information, see FINRA Brokercheck and SIPC insurance coverage.

Non-investment advice: The information contained in this material is for reference only.It is not designed to provide professional, investment or any other types of suggestions or recommendations, nor is it designed to create a trustee relationship.Tradeup does not make any explicit or implied statements or guarantees for the accuracy, reliability, integrity, applicability or adequateness of any information containing any information in this material.Some information may be provided by a third party source.Although it is considered reliable, its accuracy or integrity cannot be guaranteed without the independent verification of Tradeup.You should not make investment decisions based on this material, because this is a information that may change without notice.

Risk: Securities and derivatives transactions involve losses, including principal losses.You should weigh potential interests and risks.past

The performance cannot guarantee future results.

Non-valuation: This material is not the official valuation of any securities or derivatives mentioned here.Any pricing information provided is for reference only, and does not reflect the level of tradeup to prepare for the transaction; it is not designed to show the actual results that any transaction may achieve.

Electronic transaction: Electronic transactions bring unique risks to investors.Due to market conditions, system performance and other factors, system response

It may be different from visiting time.Market fluctuations, transaction volume and system availability may delay account access and transaction execution.