The Buffett indicator, English is the Buffett Indicator.It is a financial indicator that measures the total stock value of a country’s public transactions in the country’s total domestic product.

The calculation method is to remove the total market value of a country with its GDP value and the calculation ratio.

Investment master Warren Buffett believes that this indicator “may be the best single indicator for measuring any specific time valuation level” and promoted the indicatorEssence

The direct role of using the Buffett indicator is to evaluate whether the stock market is overvalued:

- When the Buffett index ratio is between 50%and 75%, it is believed that the stock market is underestimated;

- When the ratio is between 75%and 90%, it is believed that the value of the stock market is in a fair state;

- When the ratio is 90%to 115%, it is considered to be appropriately overvalued, and when more than 115%, it is considered overestimated.

In addition, compared with its historical values, the country can evaluate the country’s economic development trend in a certain period.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- How to calculate the Buffett index?

- What is the significance of the Buffett indicator?

- How to use the Buffett index to evaluate the current US stock market?

How to calculate the Buffett index?

The calculation method of the Buffett indicator is to remove the total market value of the stock market with the total domestic product GDP during the corresponding period, and the result is transformed into a percentage, that is,:

The proportion of market value accounts for GDP = stock market value / GDP × 100%

Market Capitalization to GDP = SMC / GDP × 100%

in,

- SMC: The entire stock market value Stock Market Capitalization

- GDP: GDP

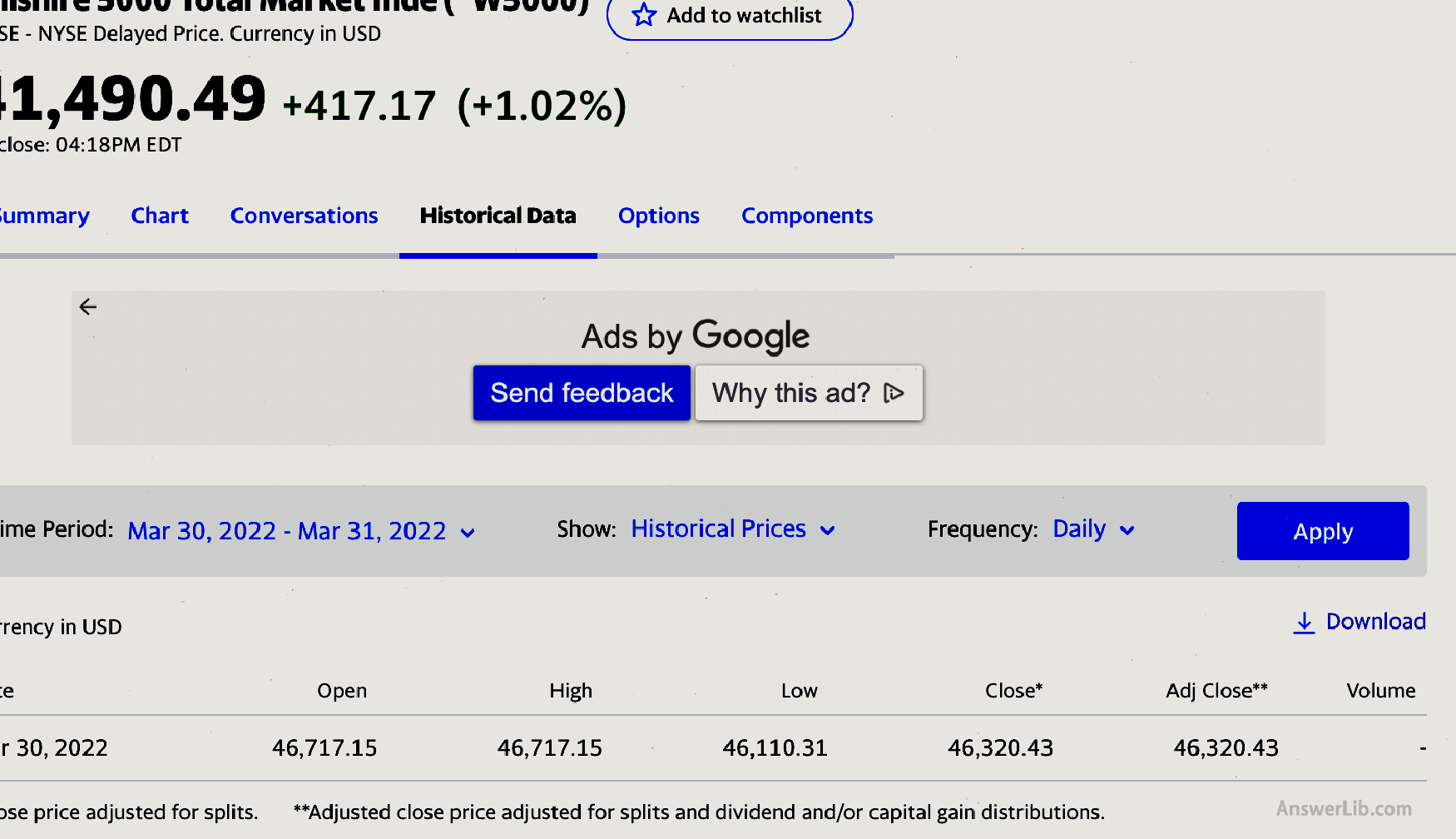

In response to the US market, analysts usually use the total value of all public trading stocks in the United States because the Wilshire 5000 Total Market Index (The Wilshire 5000 Total Market Index) is an index that represents all stocks in the US market.

GDP of GDP GDP US Government Economic Analysis Administration Calculate and publish each quarter.

For investment analysts, the market value of the stock has a certain future trend predictability, and the GDP value is a measure of previous economic activities.The combination of the two is an analysis of current economic activities.

What is the significance of the Buffett indicator?

The significance of the Buffett index in terms of value is to evaluate the total value of the listed company compared with the GDP, and the proportion of the proportion.When the Buffett index ratio is between 50%and 75%, it is believed that the stock market value is underestimated.At between 75%and 90%, the value of the stock market is considered fair.When the ratio is 90%to 115%, it is considered to be appropriately valued.When more than 115%, it is considered overestimated.

On the other hand, because the United States is a major financial country and stock investment is the most important financial investment product, the use of the total market value of the stock market with the GDP value can be compared, which can be more integrated to evaluate the economic environment.

For example, from 1972 to 1975, in 1972, the Buffett index rose to the highest point at the time of 85%, and then gradually started to fall, which corresponds to the first oil impact and the stock market collapse at the time.

From 1999 to 2002, in 1999, the Buffett index rose to 143%, and then began to decline until 2002, which echoed the economic recession caused by the Internet bubble at the time.

From 2007 to 2008, the Buffett index recovered from the previous decline to 103%in 2007, but with the outbreak of the global financial crisis in 2008, it began to fall again.

In 2009, the United States began to quantitatively loose policies.Since then, the Buffett index has continued to soar, and its significance of the evaluation of the economy has also begun to have deviations.In 2013, it exceeded 100%of the proportion and further increased during the COVID-19 period.The Buffett index has reached 186%, and in the first quarter of 2022, the value was close to 192%.

Since the beginning of the quantitative easing policy, the continuous soaring value of Buffett’s value first shows that the total value of all listed companies in the United States has exceeded the total economic output.On the other hand, it can also show that investors are generally expected to be in the future, and economic growth will still be still.Very strong.

However, with the beginning of the quantitative easing policy, the Buffett index continued to soar, and investors began to question whether the financial index still had its reasonable evaluation value.

First of all, as more and more private companies start to make public offering, in the economic environment of the United States, the proportion of listed companies and private companies has increased significantly, which will lead to the continuous rise in the Buffett index, but from the overall economy to the United States, the overall economy of the United StatesIn terms of influence, there is no great difference in public fundraising or privatization of the company.

Secondly, with the continuous diversification of the financial investment portfolio, investors can invest in more types of objects, such as bonds, real estate or physical goods.Disglement is occurred.

In the end, the Buffett index did not consider the economic activities of international pieces.The stock market may reflect this, but GDP does not have it.For example, Amazon’s sales in China will not calculate the GDP in the United States, but it will be reflected in the United StatesIn Amazon’s stock price, this type of operation model will directly raise the value of the Buffett index, and as international trade continues to expand, this situation will continue to intensify.

How to use the Buffett index to evaluate the current US stock market?

According to the Wilshir 5000 overall market index provided by Yahoo Financial website, the value of the first quarter of 2022 was $ 46.7 Trillion.

The first quarter of the United States in the first quarter of 2022 was $ 24.38 TRILLION 【BEA】

Therefore, the current Buffett indicator in the United States is:

The proportion of market value accounts for GDP = stock market value / GDP × 100%

Market Capitalization to GDP = SMC / GDP × 100%

= $ 46.7T / $ 24.38T × 100%

= 191.55%

The calculation results show that the current value of the entire stock market in the United States is 191.55%of GDP, which is overvalued.

However, considering the various economic policies after the United States experienced COVID-19 and the continuous expansion of international trade, it remains to be questionable whether the indication of this value is accurate.