Capital expenditures, English is Capital Expendital, Abbreviation Capex It is a financial indicator of a company’s cash expenditure for long-term assets such as purchasing, maintaining or upgrading.

Long-term assets include factory buildings, land, equipment, desks, etc.Tangible assets, Also include patents, licenses, etc.Intangible asset These assets are usually continued to bring the company One year The above benefits.

In financial statements, there is no direct capital expenditure value, but will be distributed in many contents, including expenditure PP & E of property, plant, equipment, etc., and depreciation and amortization.

If the company purchased by the company to the company’s income time is within one year, it is included in expenditure, not capital assets.

When the company’s capital expenditure in the financial year can use the difference between the end and early period of the PP & E value during the financial year, coupled with the depreciation and amortization cost of the financial year.

Capital expenditure can be used to measure the growth of the company’s assets, and it can also be used for the calculation of multiple financial indicators to conduct a more comprehensive operation evaluation of the company.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- How to calculate capital expenditure?

- How to calculate Apple’s capital expenditure?

- What is the significance of investment in capital expenditure?

- What is the difference between capital expenditure and operating expenditure?

- Join investment discussion group

How to calculate capital expenditure?

The calculation method of capital expenditure is to use the end-of -term difference between the end of the financial year and the PP & E expenditure of the property, plant, and equipment PP & E, and the depreciation and amortization costs, that is,:

Capital expenditure = PP & E -PP & E + depreciation & amortization of the previous issue

Capex = Current Period PP & E -PRIOR PERIOD PP & E + Depreciation & AMORTIZATION

in:

- PP & E is the abbreviation of Property, Plant, and Equipment, which can be found in the profit and loss table in the company’s financial report;

- DEPRECIATION & AMORTIZATION can be found in the cash flow sheet in the company’s financial report.

How to calculate Apple’s capital expenditure?

10-k released by Apple in September 2021 Financial report Calculate the instance:

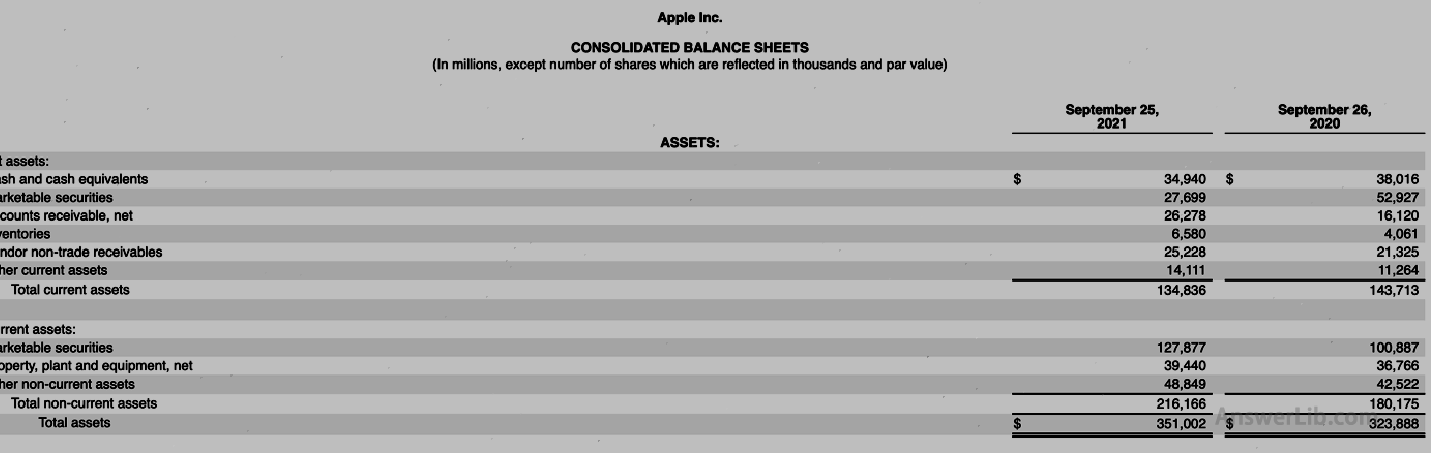

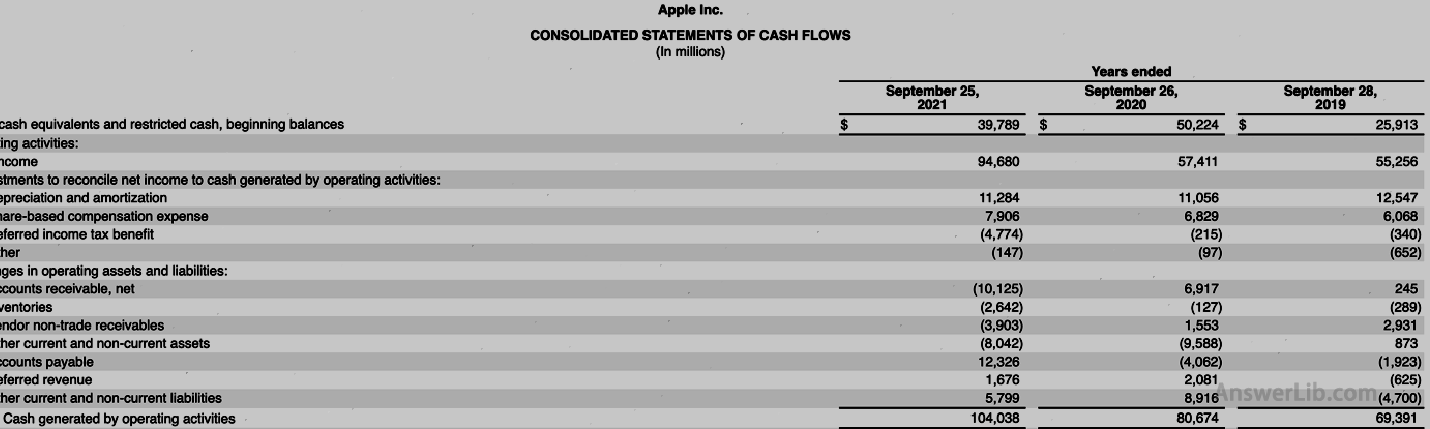

AAPL Financial Report The data tables such as the balance sheet and the cash flow sheet are shown below:

Asset liabilities:

Cash flow table:

It can be seen from the data table that in the 2021 financial year of Apple, the initial value of PP & E was $ 36,766 m, the end value was $ 39,440 m, and the depreciation and amortization fee was $ 11,284 m.

Therefore, the capital expenditure of Apple’s 2021 financial year is:

Capital expenditure = PP & E -PP & E + depreciation & amortization of the previous issue

Capex = Current Period PP & E -PRIOR PERIOD PP & E + Depreciation & AMORTIZATION

= $ 39,440 m – $ 36,766 m + $ 11,284 m

= $ 13,958 m

That is, the capital expenditure of Apple 2021 in the financial year is $ 13,958 m.

What is the significance of investment in capital expenditure?

By comparing historical capital expenditures, the company can make more reasonable planning for future capital investment.External investors can evaluate whether the company’s use of capital is reasonable, and judge its investment value.

Capital expenditure can be compared with the company’s depreciation and amortization fee to measure the company’s asset change:

- When capital expenditure> depreciation and amortization expenses, it means that the company’s assets are growing;

- When the capital expenditure is

Capital expenditure can be used for calculation Free cash flow Free Cash Flow (FCF), the calculation formula is:

Freedom cash flow = operation cash-capital expenditure

FCF = CASH FROM Operations – Capital Expenditures

It can be seen from the calculation formula that when the company increases funds for long-term assets, its free cash flow will decrease.Thereforeflow.

It is used to calculate the operation cash flow to the capital expenditure.

CFO / Capex = Cash Flow from Operations / Capex

The significance of this ratio is to measure whether the company’s operating income is sufficient to pay its capital expenditure.When the ratio is greater than 1, it means that the company’s operating income can pay all the amount of its capital expenditure.When the ratio is less than 1, it means that the company may need to operate in operation.Based on the income to pay the capital expenditure through borrowing, it usually indicates that the company’s cash flow has a certain problem.

It is used to calculate the free cash flow to equity, which means the amount of cash available for shareholders in the company’s assets.The calculation method is:

FCFE = EP− (CE−D) × (1−dr) − − × (1−dr)

in:

- EP = Earnings Per Share per share

- CE = Capex Capex

- D = depreciation depreciation

- DR = Asset-liability rate DEBT RATIO

- ΔC = net operation capital difference ΔNet Working Capital

What is the difference between capital expenditure and operating expenditure?

Operating expenditure, English is Operating Expense, refers to the cost that the company needs to pay for daily operations, such as employee salary, the electricity bill of the factory building, the rent of the office space, etc.These expenses will beTotal records.The main difference between its capital expenditure is:

| Capital expenditures Capex | Operating expenditure Operating expense | |

|---|---|---|

Indicator content | The capital expenditure for purchasing, maintenance or upgrading the long-term assets with a time limit of more than one year | Complete the short-term expenses required for the operation of the operation business |

Give an example | Buying property, land, equipment, desk and other tangible assets, networks, software and other intangible assets | Rental, salary, electricity bill, transportation fee, etc. |

Recording form | Tangible assets can be recorded as depreciation content, and intangible assets can be recorded as amortized content, including PP & E | In each financial year, all the amounts of this part must be recorded and recorded separately |

Characteristic | Low regularity | It has certain regularity and predictable |