American consumer confidence index There are two types, which are consumer confidence index provided by the US Economic Counseling Bureau Consumer Confidentx, referred to as CCI, and the consumer confidence index compiled by the University of Michigan, Michigan ’s Consumer Sentiment Index (MCSI.

The index is large, indicating that consumers’ consumption is strong; the index is small, indicating that consumption willingness is sluggish.According to historical experience, the American consumer confidence index is often associated with the economic trend and is an important indicator of economic conditions.

American personal consumption accounts for nearly 70%of the US GDP.Therefore, consumers’ consumption power directly affects the US economic index, and its consumption confidence can directly reflect or predict the trend of the economy.

When the consumer confidence index is high, it means that the economy is in the ideal positive development stage, or it is about to move towards a good development.On the contrary, when the consumer confidence index is reduced, it shows that economic development has stagnated or even retrogs, or a decline is about to occur.

The two consumer confidence indexs can usually be used, but there are still some subtle differences in specific production and results indicators.For example, CCI has a certain lag in actual use.For example, the increase in the current index may represent economic growth in the past few months, while MCSI is more forward-looking, that is, the increase in the index means that consumers will be in the future in the future in the futureIt will increase consumption and the economy will grow.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- What is Consumer Confidence Index?

- What is Michigan ’s Consumer Sentiment Index?

- How to check the consumer confidence index CCI?

- How to check the consumer confidence index MCSI?

- What are the differences between CCI and MCSI?

- More macroeconomics

What is Consumer Confidence Index?

Consumer Confident of consumer confidence index, referred to as CCI, is a financial index managed and released by the US Consulting Bureau The Conference Board, which measures the optimism or pessimistic of consumers’ financial conditions through this index.

The higher the index, the more optimistic consumers are in their financial conditions, the more confidence in consumption.On the contrary, the lower the index, which shows that consumers are more pessimistic about their financial conditions, lower consumption confidence, and more will make more.Savings to replace consumption.

CCI was calculated for the first time in 1985 and used the 100 at the time as the benchmark value.During the statistical process, the U.S.Advisory Administration will investigate a certain number of US families every month.There are mainly 5 problems, including:

For the status quo:

- The interviewee’s evaluation of the current business status

- The interviewee’s evaluation of the current employment status

Expectation for the futureThe

- The respondents’ expectations for business conditions after six months

- The expectations of the interviewees for employment conditions six months later

- The interviewee’s expectations for total family income after six months

After obtaining the survey data, according to the proportion of different types of problems in the survey, it adjusts it.The current status view index accounts for 40%of the results, the expected index of the future status is 60%, and then the result value is obtained, and 1985 and 1985The benchmark value of the year is compared with 100.If the value is higher than 100, it means that consumers have more confidence in consumption than 1985.If the value is lower than 100, it means that consumer consumption confidence is not as good as 1985.The statistical results will be released at 10 am on the last Tuesday of the Eastern Time of the United States.

Personal consumption accounts for nearly 70%of the US GDP.Increased or decrease in consumer consumption will directly affect changes in GDP values, and then react or affect the overall US economic situation.When the CCI value increases, it means that consumers are optimistic about consumption.As consumer increases, it will stimulate the economy and speed up economic development.When the CCI value is reduced, it means that consumers are pessimistic about consumption and reduce consumer expenditure.It will lead to a decrease in GDP value and the possibility of decline in the overall US economy.

In addition, manufacturers, banks, and governments monitor the rate of change of CCI.When the change rate is higher than 5%, it means that the direction of economic development has already changed or is about to change.

Some economists believe that the numerical indicator of the CCI is lagging because consumers need to respond to economic events and changes for a certain time.The increase in the current CCI value may be caused by economic stimulus policies a few months ago.

What is Michigan ’s Consumer Sentiment Index?

Michigan ’s Consuume Sentiment Index, referred to as MCSI, is the consumer confidence index provided by the University of Michigan’s University of Michigan.

MSCI shows the consumer willingness of American consumers, and also shows consumers’ confidence in their personal or family economic conditions, as well as their confidence in the entire economic situation.When the index is large, it means that consumers’ willingness to consume is strong; the index is small, indicating that consumption willingness is sluggish.

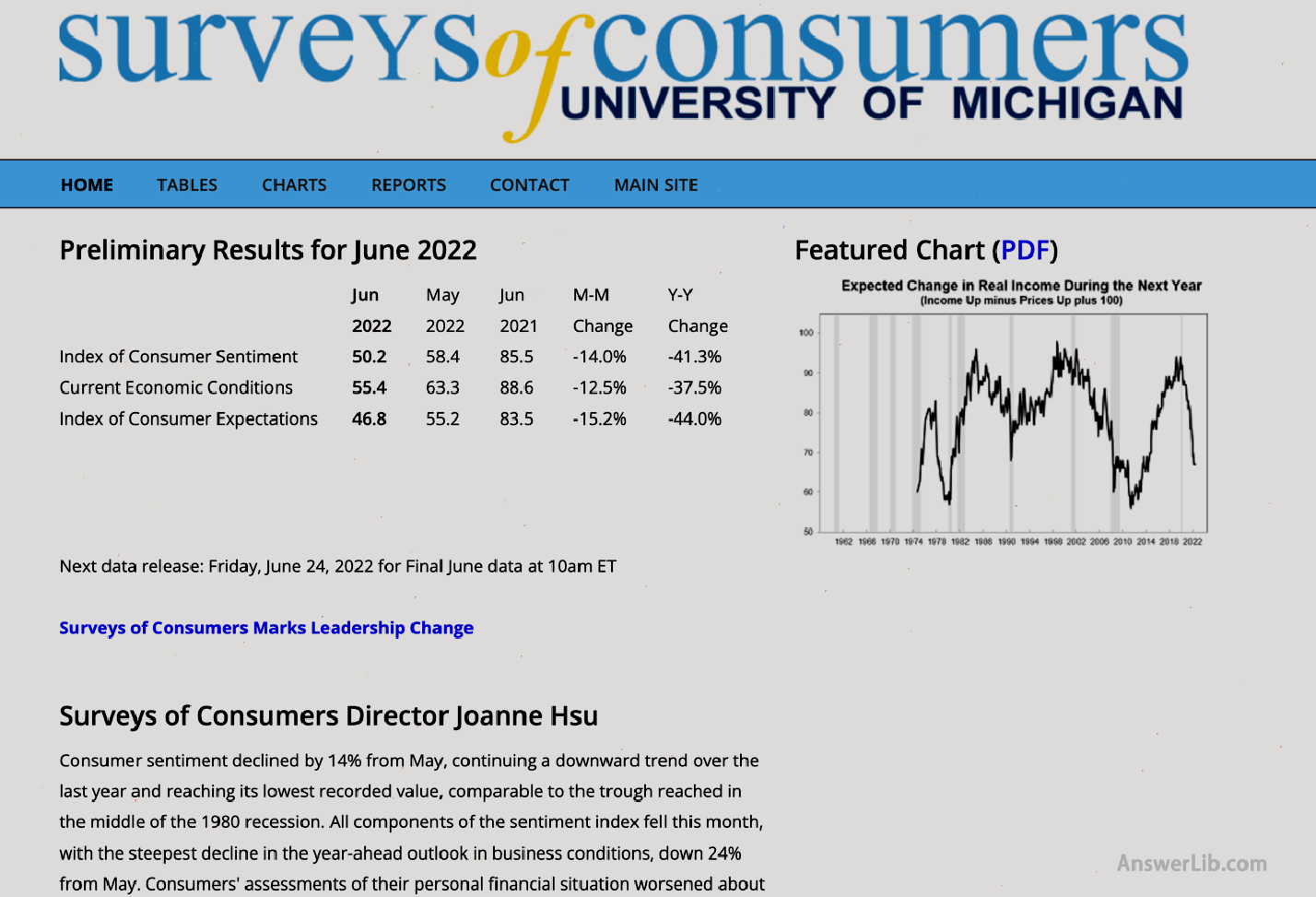

This index was founded by Professor George Katona at the University of Social Research Institute of Michigan in the 1940s.The index is statistics once a month and at the University of Michigan Consumer research website Published.

MCSI uses 5 questions like CCI to study consumer consumption confidence.During the investigation, it focuses on their views on future consumption.For example, whether it will buy cars or real estate in the future, or may be raised or laid off in the future.

Therefore, MCSI’s significance for the assessment of the US economic development has more forward-looking nature compared to CCI, and it can estimate the consumer’s future consumption situation from the changes in MCSI.

When the MCSI value increases, it means that consumers are optimistic about the future and may make more consumption in the future.On the contrary, if the MCSI value is reduced, it means that consumers may choose to save money in the future instead of more consumption in the future instead of more consumption in the future.Essence

However, excessive MCSI values will be considered an index value that is unfavorable to economic development, because when people are too enthusiastic about consumption, buying a large amount of goods and services will lead to a significant increase in prices, which will cause significant inflation.At this time, the central bank usually uses the form of raising interest rates to increase borrowing costs to appropriately suppress inflation rate

60 years of MSCI index tracking

In the figure below, the red line indicatesThe trend of the consumer confidence index; The blue area is historical【Economic Depression】Essence

[amcharts id = “chart-us-consumer-sentiment”]]

Data source:University of Michigan

It can be seen from the figure above: the economic depression period is often accompanied by, the downward consumer confidence index.

Taking the 2008 subprime mortgage crisis as an example, the crisis began in December 2007 and continued until July 2009.

However, from the perspective of the consumer confidence index, from June 2007, ICS continued to decline.From [88] in July 2007, it fell to June 2008 [59], and then experienced another shock.The lowest point of that time [57.7] has continued to rise since March 2009.Then, the economic crisis was finally over.

Therefore, keeping up with the US consumer information index is of great significance to household investment, consumption, and financial management.

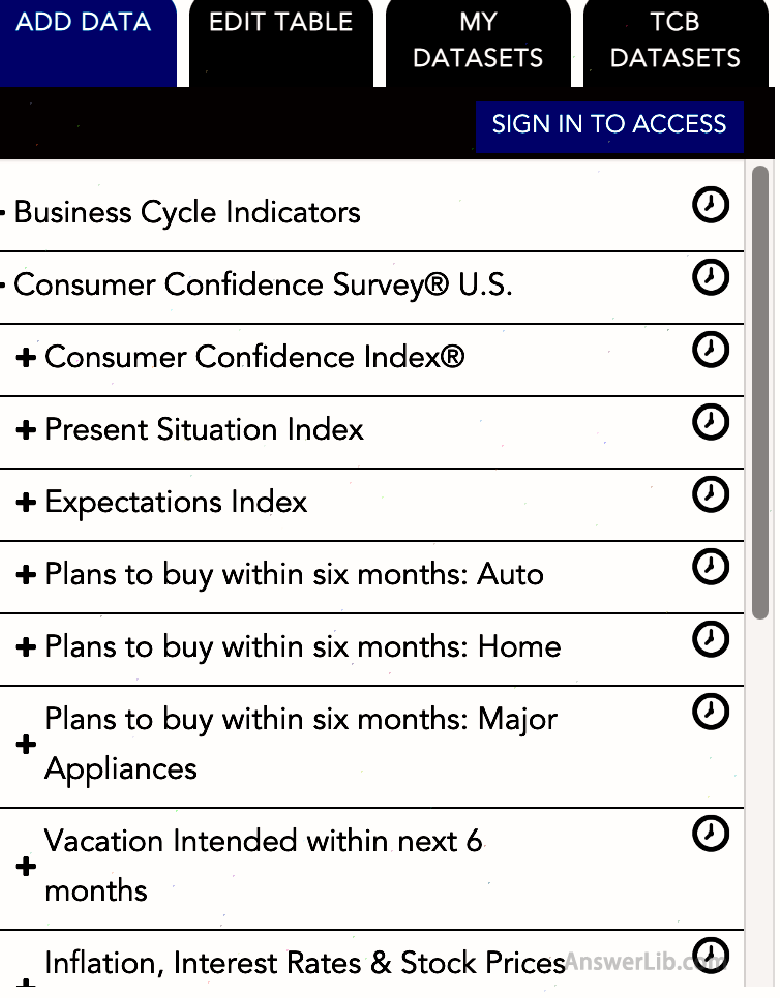

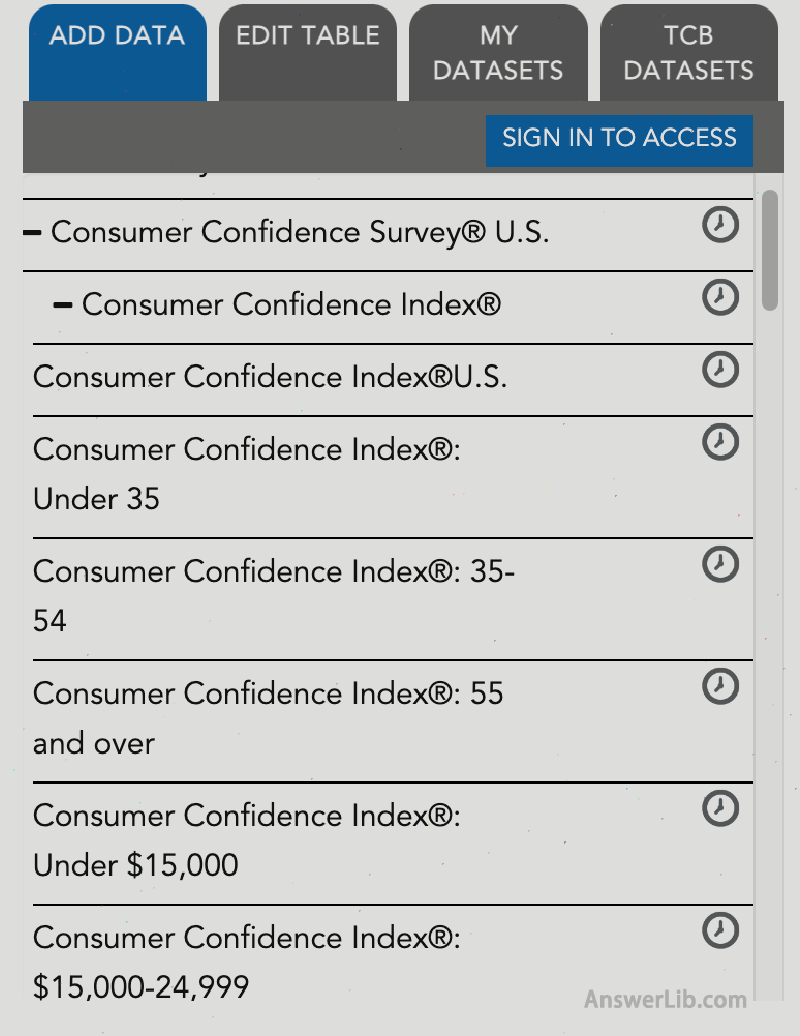

How to check the consumer confidence index CCI?

The index is released at 10 am on the last Tuesday of the Eastern Time of the United States.Consumers and investors can Official website Found in the data sector on the top.

step one: Enter the official website of the US Consultation Bureau and enter the Economic Indicators sector.

Step 2: Find consumer confidence to investigate the Consumer Confidence Survey sector.

Step 3: In this sector, the consumer confidence index Consumer Confidence Index can be found.

Step 4: In this sector, users can see more detailed analysis indexes, including the index value of classification based on age, income, and region.

Step 5: Users can also pass this Link Come to view the analysis of the US Consulting Agency on the consumption confidence index

How to check the consumer confidence index MCSI?

Users can enter the University of Michigan, USA Consumer survey website Come to see the consumer confidence index it released monthly:

What are the differences between CCI and MCSI?

As the two main consumer confidence indexes in the United States, CC I and MCSI have their own similarities and use in production and use.

| Consumer Confident index | Michigan ’s Consuuume Sentiment Index | |

|---|---|---|

Release frequency | Once a month | Once a month |

investigate subject | 5 questionsInvolved in consumers’ views on the present and future | 5 questionsMore viewing to X consumers’ views on the future |

Content involving the field | Personal finance; consumption status; employment situation; | Personal finance; consumption status; employment situation; |

Content focus | Employment and labor market | Personal or family financial status |

Index indication meaning | It has a certain lag, the index result may be caused by economic changes in the early stage | It has a certain forward-looking, users can use the index to estimate the economic development trend |

More macroeconomics

- What is the national financial status index?

- What is the Buffett index?Buffet indicator

- What is the U.S.Treasury volatility index?Move index

- What US dollar index?US dollar index

- What is a bank deposit reserve?Bank reserves

- What is an open market operation?Open Market Operations

- What is the reserve balance interest rate?Interest on Reserve Balances

- What is personal consumption expenditure index?PCE Price Index

- What is overnight reverse repurchase?On Reverse Repurchase

- What is unemployment rate?UNEMPLOYMENT RATE

- What is non-agricultural employment data?NON FARM PAYROLLS

- What is the house price index?House Price Index

- What is currency supply?Money Supply M0, M1, M2

- What is the federal fund interest rate? Federal Funds Rate

- What is the Federal Reserve?Federal Reserve

- What is the inflation rate?Inflation rate

- What is the American consumer confidence index?Consumer Confidence Index

- What is the US debt yield curve?Yield curve