Average cost method, English is Dollar Cost Averaging, referred to as DCA, which is often called “fixed investment”, which is a specified investment strategy.Among them, regularly refer to a specific cycle, such as once every two weeks, once a month, and so on.Quantitatives refer to specific amounts, such as $ 50, $ 100, $ 1,000 each time.

For example, take the average cost method of divided into 10 periods, each time the average cost method of $ 1,000 as an example.The average is divided into 10 paids, which is about $ 10,000 at one time, and only pays $ 1,000 each time.If you hold a 401 (K) account, etc., you have adopted such an investment strategy by default.

The investment advantage of the average cost method is to maximize the investment risk, especially when the stock price fluctuates significantly, it is difficult for investors to confirm an excellent buying point.It will be averaged to reduce losses.At the same time, the psychological burden caused by stock price fluctuations to investors will also be greatly reduced.But while reducing the degree of losses, the average cost method will also reduce the degree of returns, which is one of the biggest disadvantages of the average cost method.

Bleak American broker:Transparent securities| | Futu Securities| | Microex Securities| | Tiger securities| | First securities| | Robinhood in| | American Langshang Daquan

Directory of this article

- How to calculate the yield and average price of the average cost method?

- Average cost method income calculation example

- How to better use the average cost method investment strategy?

- What are the advantages and disadvantages of the average cost method?

- Join investment discussion group

- More investment strategies

How to calculate the yield and average price of the average cost method?

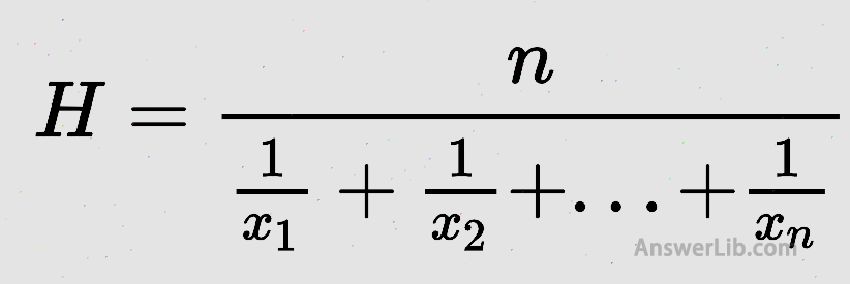

When calculating the yield of the average cost method, the first number of selected periods need to be selected.For example, the 12 -stage period is the calculation cycle, and then find the stock price at the time of each purchase, so as to calculate the balance of the 12 stock prices, as shown below:

in:

- N: The number of purchases

- X1As well asX2, …XN: Each time you buy the stock price

After calculating the equal number of stock prices in 12 times, divide the stock price of the last period to divide the blending average of the 12 -phase stock price, and then reduce the yield of the average cost method, that is, the average cost method, that is:

R(= (H–H)//H=H/ /H– 1

Investment yield = (stock final price-reconciliation of fixed-investment stock price)/conformal value of fixed investment stock price

in:

- H: The stock price of the final phase

- H: Adopt a blending average of the stock price after the fixed investment

Average cost method income calculation example

The following takes SP500ETF (stock sales: SPY) for the last 12 months of fixed investment as an example.The monthly investment amount is $ 1,000.If the 1st is the weekend or holiday, the first working day will be made to compare the one-time investment at one time.The benefits of strategies and average cost method investment strategies are poor.

| Fixed investment date | Transaction price ($) | Input amount ($) |

|---|---|---|

01/06/02021 | 419.67 | 1000 |

01/07/02021 | 430.43 | 1000 |

02/08/02021 | 437.59 | 1000 |

01/09/02021 | 451.80 | 1000 |

01/10/02021 | 434.24 | 1000 |

01/11/02021 | 460.04 | 1000 |

01/12/02021 | 450.50 | 1000 |

03/01/02022 | 477.71 | 1000 |

01/02/02022 | 452.96 | 1000 |

01/03/02022 | 429.98 | 1000 |

01/04/02022 | 452.92 | 1000 |

02/05/02022 | 414.48 | 1000 |

Calculate the yield of one-time investment strategy:

On June 1, 2021, investors invested a total investment of $ 12,000 at a price of $ 419.67/share at one time.By May 2, 2022, all the stocks were sold for $ 414.48/share, so:

Number of purchases: $ 12000 / $ 419.67 = 28.6

Increase per share: $ 414.48 – $ 419.67 = – $ 5.19

Total income:-$ 5.19 x 28.6 =- $ 148.43

The yield is:-$ 148.43 / $ 12,000 =- 1.24%

Calculate the yield of the average cost method:

| Transaction price / $ | 1 / transaction price |

|---|---|

419.67 | 0.00238282 |

430.43 | 0.00232326 |

437.59 | 0.00228524 |

451.80 | 0.00221337 |

434.24 | 0.00230287 |

460.04 | 0.00217372 |

450.50 | 0.00221976 |

477.71 | 0.00209332 |

452.96 | 0.0022077 |

429.98 | 0.00232569 |

452.92 | 0.0022079 |

414.48 | 0.00241266 |

Value | 0.027148317 |

Then, the average value of the stock price of the last 12 fixed-rate stocks is:

H = 12 / 0.027148317 = $ 442.02

rate of return:R= ($ 414.48 – $ 442.02) / – $ 442.02 = – 6.23%

From the above example, it can be seen that because SPY was in the list of December, the stock price was the first trend, so the use of fixed investment methods caused a decline in yields.At the same time, for the trend of unilateral rising, fixed investment will also reduce a certain yield.

However, for the trend of preemptive and then, or the decline in unilaterally, the rate of return on fixed investment is higher than the return on one investment.

How to better use the average cost method investment strategy?

The average cost method can be carried out automatically or manually.

1.Choose automatic fixed investment

Investors only need to set the frequency of paying principal, such as once a week, once every two weeks, once or once a month, and then set the amount of each investment, such as $ 50, $ 100, or $ 1,000.

When choosing automatically, investors can avoid the trouble of continuous attention to the trend of stock prices, and avoid the impact of market volatility on investment mentality, resulting in wrong investment decisions.

However, when choosing automatically, it is often possible to miss the opportunity to get higher returns in the rise of stock prices.

Suitable for the crowd:

- Investors with lack of investment experience;

- Investors who want long-term investment;

2.Choose manual fixed investment

Investors can stop investment at any time when needed, and stop more investment losses that may occur in time, or increase the investment amount when they think that the market will rise to obtain higher returns.

However, when manually, investors need to have certain investment experience and judgment of the market.At the same time, when selling or adding amounts in advance, additional costs may be faced.

Suitable for the crowd:

- Experienced investors;

- Hope to maximize the income investor;

3.Determine the investment frequency

The factors that affect the investment income of the average cost method are the determination of the investment frequency.The higher the frequency, the greater the income is affected by market fluctuations.On the contrary, the lower the frequency, the smaller the influence of market fluctuations.Investors can follow their own investment experience orDetermine the frequency of investment according to the investment opinions provided by the agent.

What are the advantages and disadvantages of the average cost method?

The average cost method is the same as all investment strategies.At the same time, there are investment advantages and investment disadvantages.

Advantage

- Metro the impact of market fluctuations on income.The average cost method will average investment costs, so that the impact of market fluctuations on returns is also spread, thereby reducing the impact on total investment when the price falls.

- Reduce the negative emotions of investment.Short-term investors are easily affected by market fluctuations.They always hope to buy stocks at the lowest point and throw them out at high points, but the market trend changes rapidly.When the trend that is opposite to investors predicts, short-term investors are vulnerable to sufferingThe impact of the trend of the stock price produces a negative category, making wrong investment decisions due to greed and disappointment.When the average cost method is used, because the impact of price fluctuation on investment costs is average, it can minimize the impact of fluctuations on investment emotions.

- Establish good investment habits.When setting a regular automatic payment investment payment, investors will not miss any investment operations, and at the same time, they can avoid using investment funds for other things, so as to cultivate and adhere to their own investment habits.

Disadvantage

- Press the higher investment income.The biggest advantage of the average cost method is to reduce investment losses by the averageization of investment losses.However, at the same time, the investment income will be average, thereby reducing the highest investment income that can be obtained.Generally speaking, the average cost method is obtained by the average cost method to obtainInvestment income is lower than a single investment with the same amount.

- Can’t completely avoid losses.Although the average cost method can reduce losses to a certain extent, it cannot completely avoid losses.Therefore, if investors want to retain the principal in the bear market through the average cost method and even obtain income, they will eventually face a lot of losses.

Join investment discussion group

Publish the latest market information on a regular basis and share your investment experience: