Dividend payment rate English is the financial indicator of DIVIDEND PAYOUT RATIO, which measures the net income ratio paid by listed companies to shareholders.The dividend payment rate can be calculated using the annual total dividend of the year in the year of the financial year.It can also be calculated by using dividends per share and earnings per share during the financial year.

The value of dividend payment rate represents the dividend returns that shareholders can get from the company’s income.For investors, the higher the dividend yield, the better.However, in the actual situation, the high dividend payment rate means that the company is facing high financial risks.Once the company has a fluctuation of operating capacity, it may face high operating costs.

In specific calculations, different analysts will use different values.For example, some analysts use dividends at the end of the year, while some analysts will choose to use dilution dividends.It is necessary to make more accurate judgments on the company’s investment value in combination with more financial data.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- How to calculate the dividend payment rate?

- How to calculate Apple’s dividend payment rate?

- What are the investment guidance significance of dividend payment rates?

- What are the limitations of dividend payment rates?

- What is the difference between dividend payment rate and dividend rate?

- More company value analysis

How to calculate the dividend payment rate?

The calculation method of the dividend payment rate is to remove the annual total dividend with the total annual net income of the year, that is,:

A dividend payment rate = total dividend / net income

Dividend Payout Ratio = DIVIDENDS / Net Income

Or use the dividend and the income per share to calculate, that is,:

Dividend payment rate = dividend per share / earnings per share

Dividend Payout Ratio = DIVIDENDS PER ShaRE / EPS

in:

Net Income and earnings per share (EPS) can be found from the profit and loss statement of the company’s financial report.Dividends and dividends per share can be found in the shareholders’ equity statement in the company’s financial report.

How to calculate Apple’s dividend payment rate?

This chapter will be released by 10-k released by Apple in September 2021 Financial report Calculate the instance:

AAPL Financial Report middle Loser, The shareholders’ equity table is shown below:

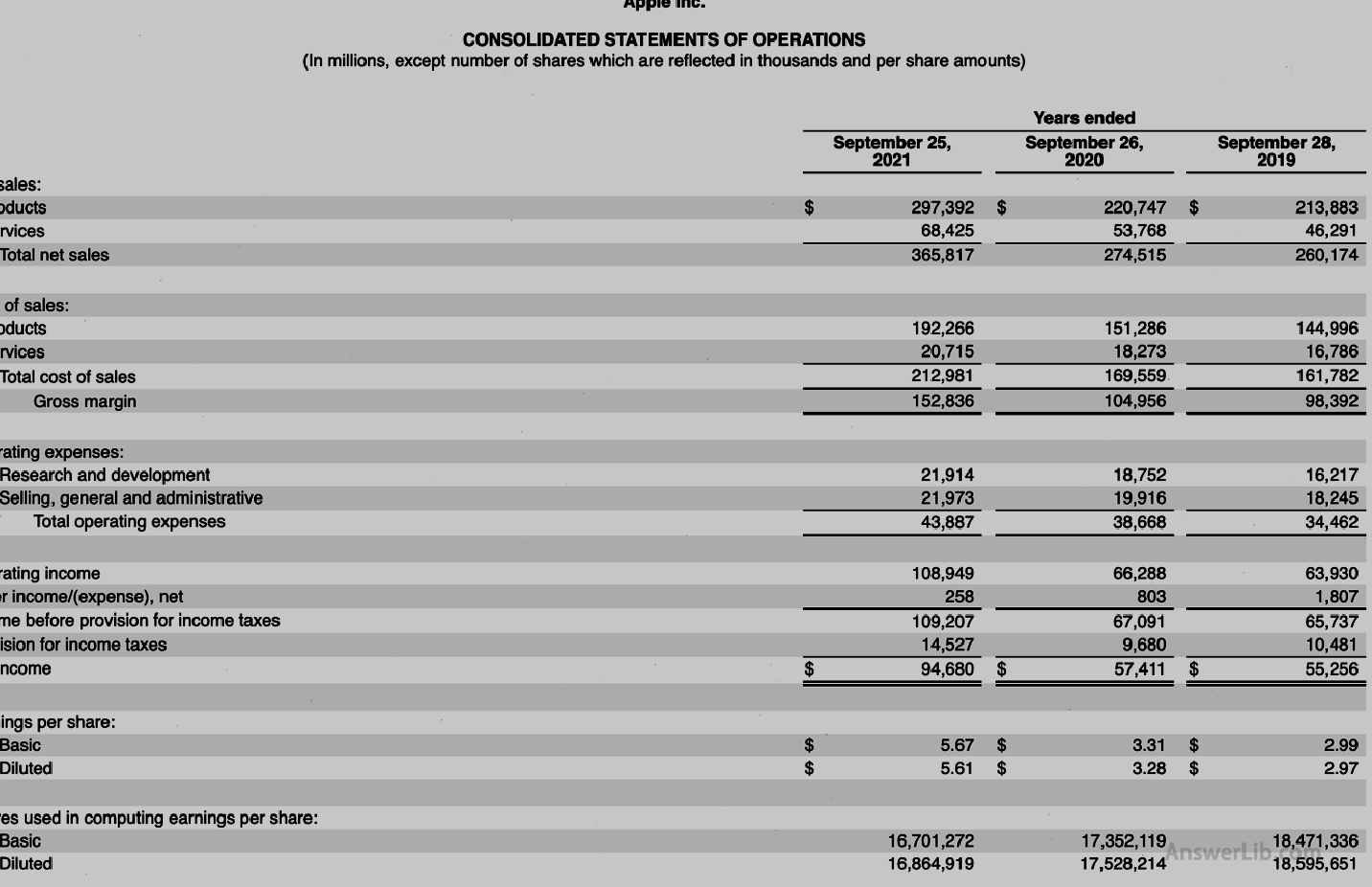

Profit or loss statement:

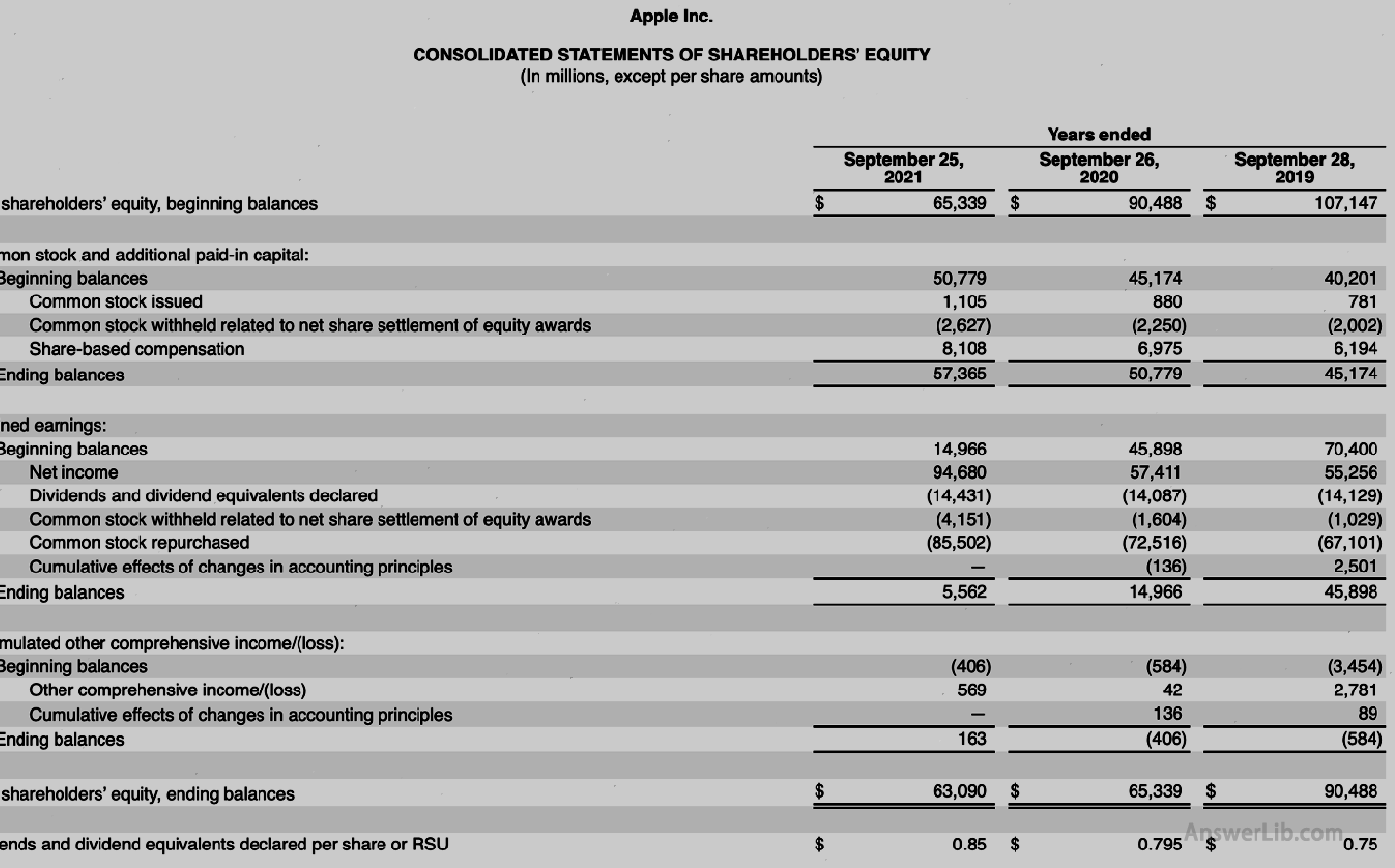

Shareholders’ equity form:

As can be seen from the data table, Apple’s 2021 Financial Year:

Dividends | $ 14,431 m |

Net income | $ 94,680 m |

Dividends Per Share | $ 0.85 |

BASIC EPS | $ 5.67 |

Diluted Eps | $ 5.61 |

so:

A dividend payment rate = total dividend / net income

Dividend Payout Ratio = DIVIDENDS / Net Income

= $ 14,431 m / $ 94,680 m

= 15.24%

Dividend payment rate = dividend per share / earnings per share

DivIDEND PAYOUT RATIO = DIVIDENDS PER ShaRE / BASIC EPS

= $ 0.85 / $ 5.67

= 14.99%

Dividend payment rate = dividend / circulation per share earnings per share

DIVIDEND PAYOUT RATIO = DIVIDENDS PER ShaRE / DILUTED EPS

= $ 0.85 / $ 5.61

= 15.15%

It can be seen from the calculation results that the dividend payment rate in the 2021 financial year of Apple Company is about 15%.The dividend payment rate using diluted income calculations is closer to the dividend payment rate obtained from the total dividend and net income calculation.

What are the investment guidance significance of dividend payment rates?

The biggest effect of dividend payment rate is to measure the dividend income that investors can obtain after investing in a company:

- The higher dividend payment rate means that investors can get more income distribution from the company’s profit;

- The lower dividend payment rate means that investors’ income in dividends will be relatively limited during the investment process.

Another role of dividend payment rate is to evaluate the company’s development stage:

- When the company is in the development stage, its dividend payment rate is usually low, because companies at this stage need to use a large number of operating income for re-investing and expanding the size of the company.Investors in such companies usually have more income in stock prices and have limited benefits in dividends.

- In the mature stage, or the company with limited space, its dividend payment rate is usually relatively high, because such companies do not have much room for business income to invest in reinvestment.Investors in such companies usually value value-added at the stock price.There will be less benefits and more benefits in dividends.

- However, a very high dividend payment rate is not a good thing for the company and investors.The high dividend payment rate means that the company has high operating costs.Once the company’s operating ability fluctuates, it is very very good.It may be reduced by reducing dividends.However, reducing dividends will bring negative investment emotions to investors, which can easily cause stock prices to decline.In the end, investors may reduce their income in dividends, and the revenue of stock prices also decreases.

What are the limitations of dividend payment rates?

The dividend payment rate is not recognized as the best value, because different industries, dividend distribution ratio will be largely different, such as the public institutional industry and consumer necessities industry.The dividend payment ratio, such as the technology industry, is needed for continuous innovation and growth, so its dividend payment rate is low.

As a result, when using dividend payment rates to measure different companies, we need to pay attention to evaluating companies in the same industry.

In addition, when calculating the dividend payment rate, different analysts will choose different values, such as the income per share, and some analysts will use the income of each share at the end of the period.Some analysts will use dilution per share to calculate.ThereforeWhen it is more in line with the evaluation results required by your own investment, you need to combine more other financial indicators to analyze more comprehensive and accurate investment value analysis of the company.

What is the difference between dividend payment rate and dividend rate?

A dividend rate, English is DIVIDEND YIELD, and has also become a dividend yield.

Dividend rate The calculation method is to divide the company’s annual dividend of the year by share price, that is,:

A dividend rate = annual dividend / stock price per share price

Dividend yield = Annual divisionnds per share / Price Per Share

| Dividend payment rate | Dividend rate | |

|---|---|---|

Calculation | A dividend per share / earnings per share | Performs per share / per share price |

Numerical indicator | The dividend income obtained by shareholders from the company’s income; | The ability of shareholders to gain from the company’s stock price; |

Numerical comparison | The higher the value, the higher the return of shareholders from the company’s income; However, the payment rate is too high indicating that the company uses most of its income for dividend payment, not the company’s expansion; | The higher the value, it means that investors can get more dividend returns from the company’s stock price; The higher the company’s stock price, the lower the shareholder’s dividend yield; the |

use | Measure the company’s development progress through dividend payment rates, as well as returns that investment can get | Judging the value of investment through dividend rates, and the position of the stock price of investment |

More company value analysis

- Julian Roberts – Julian Robertson: Father of Tiger Baby

- Explore the 24 first-level dealers of the Federal Reserve

- Important Finance and Investment News

- What is a corporate value multiple?Enterprise Multiple

- What is preferred stock?Preferred stock

- What is the operating leverage coefficient?Degree of Operating Leverage

- What is debt repayment payment rate?DEBT Service Coverage Ratio

- What is capital expenditure?Capital Expendital

- What is the capital asset pricing model?Capital Asset Pricing Model

- What is financial leverage coefficient? Degree of Financial Leverage