Debt repayment payment rate, Also known as ” Debt coverage rate“, English is DEBT Service Coverage Ratio, Abbreviation DSCR It is the financial indicator that measures the company’s income to repay all debt capabilities.When calculating DSCR, different computing formulas will be used according to different industries.For example, the real estate industry needs to use operating income to measure with total debt.For companies in general industries Ebitda Calculate with total debt (Debt).

The significance of the debt repayment rate is to measure the proportion of the company’s income to debt: When the debt repayment rate is greater than 1, it means that the company’s income is sufficientIt shows that the company’s income is not enough to deal with total debt.

However, when evaluating the company’s operating ability, the debt repayment rate is not the only reference value.In order to obtain more accurate and more comprehensive evaluation results, more financial values are required for comprehensive assessment.

Bleak American broker:Transparent securities| | Futu Securities| | Microex Securities| | Tiger securities| | First securities| | Robinhood in| | American Langshang Daquan

Directory of this article

- How to calculate the debt repayment payment rate?

- How to calculate Apple’s debt repayment payment rate?

- What is the significance of investment in debt reserve rate?

- What are the limitations of debt repayment rates?

- Join investment discussion group

- More investment strategies

How to calculate the debt repayment payment rate?

When the use of debt repayment rate evaluations and other industries such as real estate, use operating income and total debt to calculate, that is:

Debt repayment coverage = operating income / total debt

DSCR = Operating Income / Total Debt

Among them, operating income refers to the profit income obtained by the company through operation, excluding tax and interest payment, because the payment level of these two fees is preferred to repay debts, that is, the company’s income needs to pay taxes and interest first.Then began to repay the debt, so during the calculation process, this part of the amount was not included in the income value.Business income can be found in the profit and loss statement of the company’s financial report; total debt refers to the company’s short-term debt and long-term debt, which can be found in the balance sheet.

When the use of debt repayment rates evaluate most enterprises, you can use the EBITDA (EBITDA) and the total debt (DEBT) to calculate it, that is,: that is,:

Debt coverage rate = interest tax discount pre-amortization of income / total debt

DSCR = EBITDA / TOTAL Debt

in:

EBITDA refers to Net profit All profit values, including interest expenditure, tax expenditure, and depreciation and amortization.The calculation method is to add the company’s net income with tax expenses, interest costs, and depreciation and amortization costs, that is,:

EBITDA = net income + tax + interest cost + depreciation and amortization

EBitda = network + taxes + interest expense + depreciation & amortization

Among them, net income and taxes can be found in the gains and losses in the financial report.Interest expenditures can be found in other expenditure tables.Depreciation and amortization can be found in the cash flow sheet.

How to calculate Apple’s debt repayment payment rate?

10-k released by Apple in September 2021 Financial report Calculate the instance:

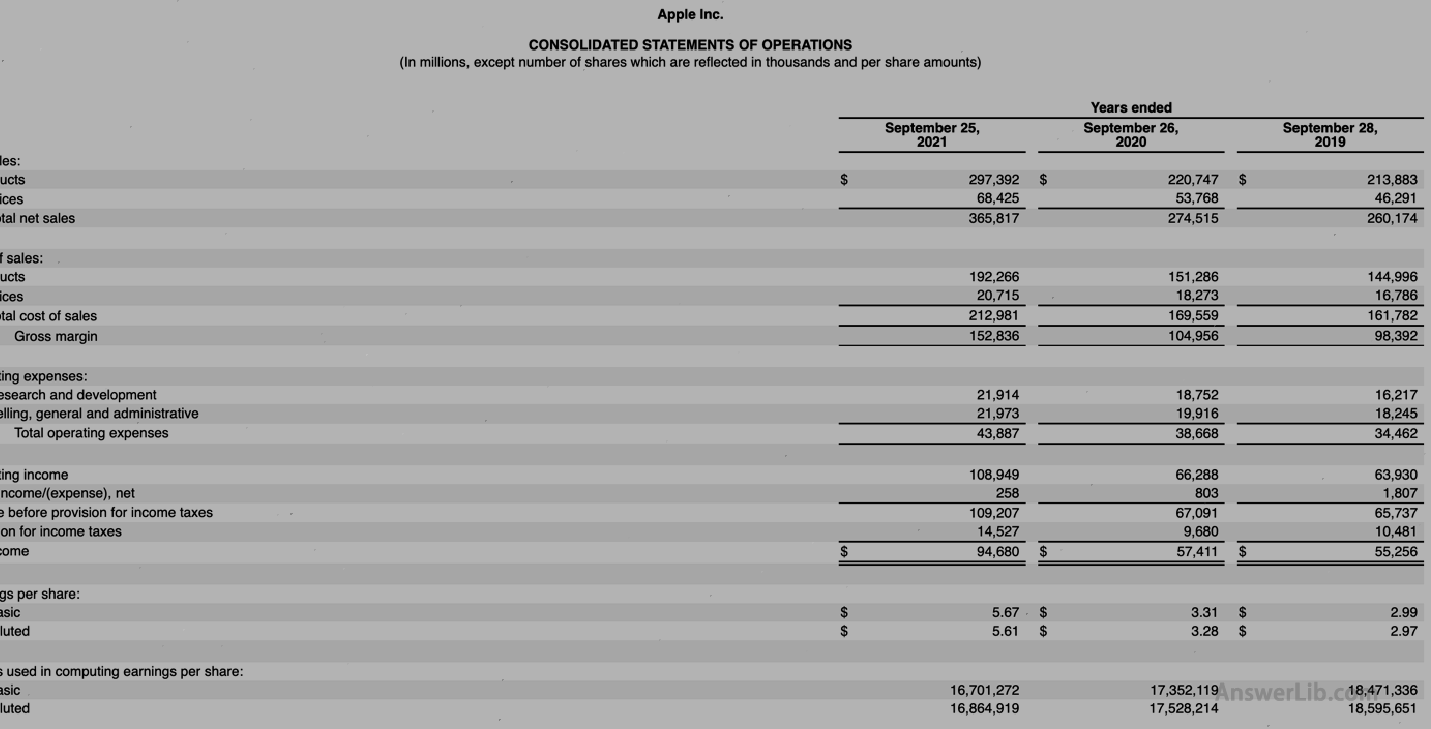

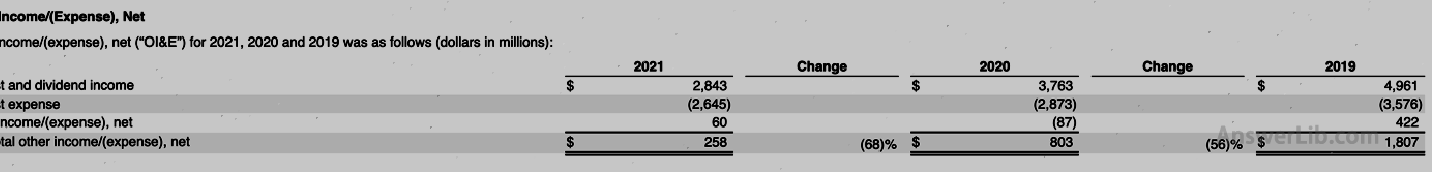

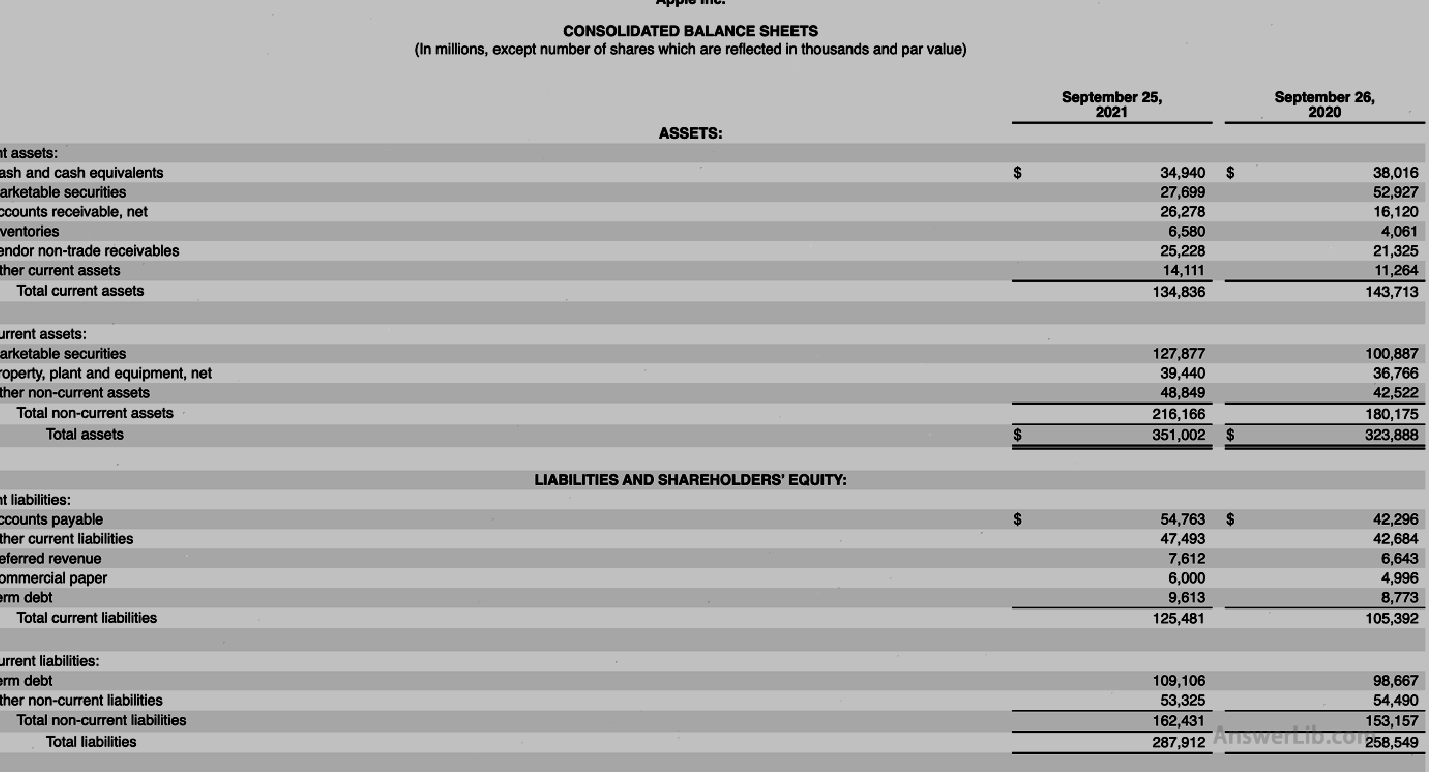

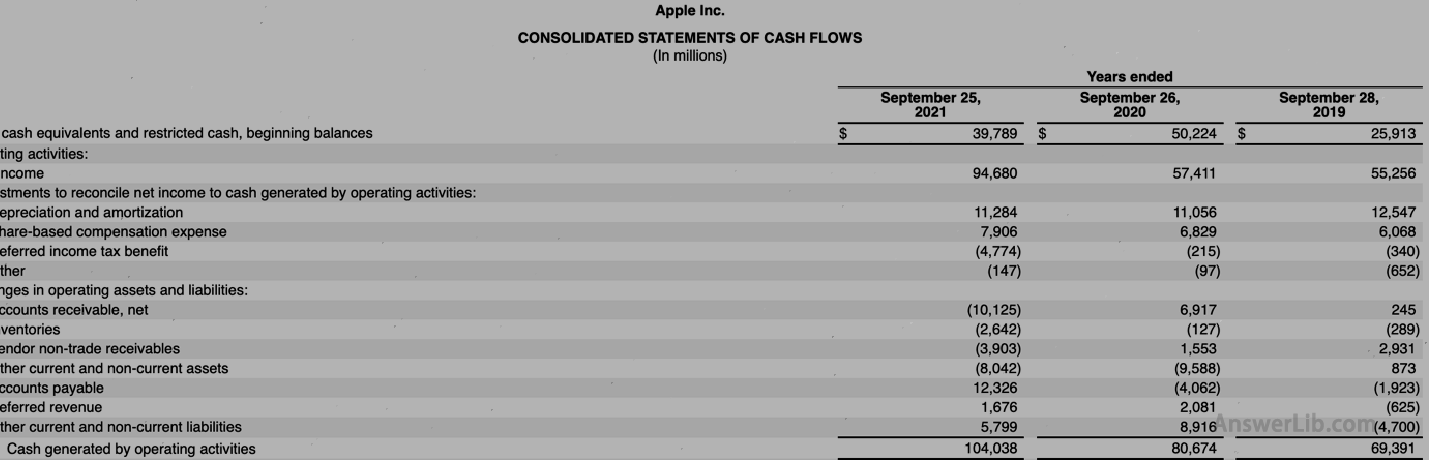

AAPL Financial Report middle Profits, Other expenditure tables, Balance sheet As well as Cash flow sheet The data table is shown below:

Profit table:

Other expenditures:

Asset liabilities:

Cash flow table:

You can see from the data table:

Net income | $ 94,680 m |

Taxes | $ 14,527 m |

Interest Expense | $ 2,645 m |

Depreciation & amortizati | $ 11,284 m |

Total Debt | $ 287,912 m |

Because Apple does not belong to the real estate industry, the formula is used to calculate its DSCR value.

EBitda = network + taxes + interest expense + depreciation & amortization

= $ 94,680 m + $ 14,527 m + $ 2,645 m + $ 11,284 m

= $ 123,136 m

DSCR = EBITDA / TOTAL Debt

= $ 123,136 m / $ 287,912 m

= 0.43

Therefore, Apple’s debt repayment rate during the 2021 financial year is 0.43, that is, its current income is not enough to repay its total debt.

What is the significance of investment in debt reserve rate?

The debt repayment rate is calculated because of the use of profits and total debt, so its ratio directly shows the proportional relationship between the company’s current profit and its liabilities.

- When the debt repayment rate is less than 1, it means that the company’s current profit is not enough to repay its total debt.For example, when the DSCR value is equal to 0.8, it means that the company’s operating income can only pay 80%of its total debt.Usually this is not a good goodThe phenomenon.However, considering the different distribution modes of debt capital ratio in different industries, the value of less than 1 does not necessarily mean that the company is in a bad operating stage.

- When the debt repayment rate is greater than 1, it indicates that the company’s current profit is enough to pay its total debt, and there is a surplus volume to expand the scale, which is in a good stage of operation.In addition, when the DSCR value is greater than 2, it is generally considered a good operation.

For the same company, it can compare its historical DSCR value to observe whether the company’s profit is continuously growing compared to debt volume.A company with a DSCR value maintains a benign development momentum indicates that it is in a good operating model.

When comparing the debt repayment rate to compare different companies, it cannot be judged from the simple DSCR value.For example, when an industry, its average DSCR value is 0.8, then a company with a DSCR value of 0.9 and their debt paymentsThe ability is better than the DSCR value of 0.8, although both are less than 1.

What are the limitations of debt repayment rates?

In the calculation of debt repayment rates, the debt is not subdivided and the company’s debt characteristics cannot be reflected.Therefore, for companies in different industries, DSCR cannot be used for cross-industry assessment, otherwise there may be serious serious ones.Evaluation bias, for example, for industries such as Utility, their DSCR values are usually low; and for industries such as generator manufacturers, due to price fluctuations, they have a greater affected and risk value.Therefore, its average DSCR value is higher.