Earnings per share, English is E armings P errand S Hare EPS It is to measure a listed company per share Profitability Financial indicators.The basic calculation method of earnings per share is to clean up the company’s net profit Subtract the preferred stock divisionnds and then eliminate it with the current total shares of circulating shares.Earns per share are often used to calculate another important index: P / E ratio Essence

In actual use, you can adjust the calculation formula per share based on the operating model of different companies.For example, a certain amount of profit part can be adjusted to get Adjust the income per share(Adjusted EPS), or a certain amount of adjustment of the number of circulating shares to obtain DiluTED EPS, in order to make a more reasonable assessment of the profitability of tradable stocks for listed companies.

However, it is relatively one-sided to analyze a listed company by using the income per share.Therefore, when analyzing the financial situation and operating capabilities of listed companies, it is still necessary to use other multiple types of financial analysis indicators to perform more comprehensive analysis.

Bleak American broker:Transparent securities| | Futu Securities| | Microex Securities| | Tiger securities| | First securities| | Robinhood in| | American Langshang Daquan

Directory of this article

- How to calculate the income per share?

- Three different benefits per share

- How to calculate Apple’s earnings per share?

- What is the income TTM?

- What is the investment guidance significance per share?

- What are the limitations of the income per share?

How to calculate the income per share?

exist Basic earnings per share(( BASIC EPS) In the calculation method, the company’s net income minus the dividend of the preferred shares, and then except the total number of current shares of the current circulation, that is::

Basic income per share = (net income-priority dividend) / current number of ordinary shares circulating

BASIC EPS = (Net Income -Preferred Dividnds) / End of Period Shares Outstanding

If a company sets a Preferred Stock, it is necessary to minus the preferred shares from net income when calculating the income per share.This is because the preferred shares holder have the contract effectiveness of obtaining dividends.The company’s net income must be assigned to all shares of ordinary shares after the company’s net income must be assigned to the shareholders of the preferred shareholders.

During the calculation process, it is often used Weighted average circulation stock(( Weighted average shares outstanding) Come as a denominator, that is,:

Basic income per share = (net income-priority dividend) / weighted average ordinary circulation stocks

BASIC EPS = (Net Income -Preferred Dividends) / Weight Average Shares Outstanding

The weighted average circulation stocks of listed companies are The weighing average of the number of circulation shares at the beginning of the period and the end of the period The significance of using this value is to avoid the impact of changes in the number of circulating shares on the income of each share.

For example, a company sold 10,000 shares at the beginning of the financial cycle, and 10,000 shares have been sold in the middle of the year.At the end of the year, there are 20,000 shares.The company has no preferred shares.At this time, calculate the income per share:

- If the number of circulating shares at the beginning of the year, the income per share is $ 200,000 / 10,000 = $ 20

- If the number of shares at the end of the year, the income per share is $ 200,000 / 20,000 = $ 10

It can be seen that the value of the front and rear is doubled, so at this time, you should choose the number of weighted average circulation stocks.

In this example, the number of shares at the beginning of the year was 10,000 shares, and the number of shares at the end of the year was 20,000.

(10,000+ 20,000) / 2 = 15,000 shares

At this time, calculating the earnings per share during the financial year is:

EPS = $ 200,000 / 15,000 ≈ $ 13.33

Three different benefits per share

There are often three types of income per share: basic basic EPS, adjustment per share (Adjusted EPS), and diluted earnings per share (Diluted EPS)

Basic earnings per share (BASIC EPS)

Basic income per share is the ratio of the net income displayed in the company’s financial report minus preferred dividends and then the ratio of ordinary average shares in circulation.This has been introduced above.

Diluted EPS after dilution

After dilution, earnings per share Based on the company’s currently issued ordinary shares, we also consider the company’s upcoming Potentially Outstanding Shares, Convertible Securities, and Employeee Stock Options.

From this calculating the income per share of all company shares into the inside, to obtain a more conservative earnings per share.Usually, the income per share after dilution is less than the basic earnings per share.

Calculated as follows:

Dilute earnings per share = (net income-priority dividend) / weighted average dilution stock

DILUTED EPS = (Net Income -Preferred Dividends) / Weighted Average Diluted Shares

Adjustment of earnings per share (Adjusted EPS)

After adjustment, earnings per share Is the company’s income part more finely adjusted, based on the net income to minus the preferred dividend, and then adjust according to the Non-Core Profits and Losses and the interests of minority shareholders.Part of the profit and loss subtract or increase from the basic formula to obtain the income per share generated by the company’s core business.

The difference and connection of three types of income per share

| BASIC EPS | Diluted EPS | Adjusted Eps | |

|---|---|---|---|

| Formula | Net profit-preferred dividend | Net profit-preferred dividend | On the basis of (net profit-preferred dividend), increase or minus all non-nuclear gains and losses and the interests of a few shareholders |

| Formula | In the current number of circulating shares or weighted average circulation shares | On the basis of the current number of shares or weighted shares in the current circulation stocks, potential circulation stocks and employee stock options are also added | In the current number of circulating shares or weighted average circulation shares |

Numerical | The surface income of the surface directly calculated through the data in the company’s financial statements | Considering the more comprehensive number of shareholders, you can get more conservative earnings per share | Calculate shareholders’ income from the company’s core business |

How to calculate Apple’s earnings per share?

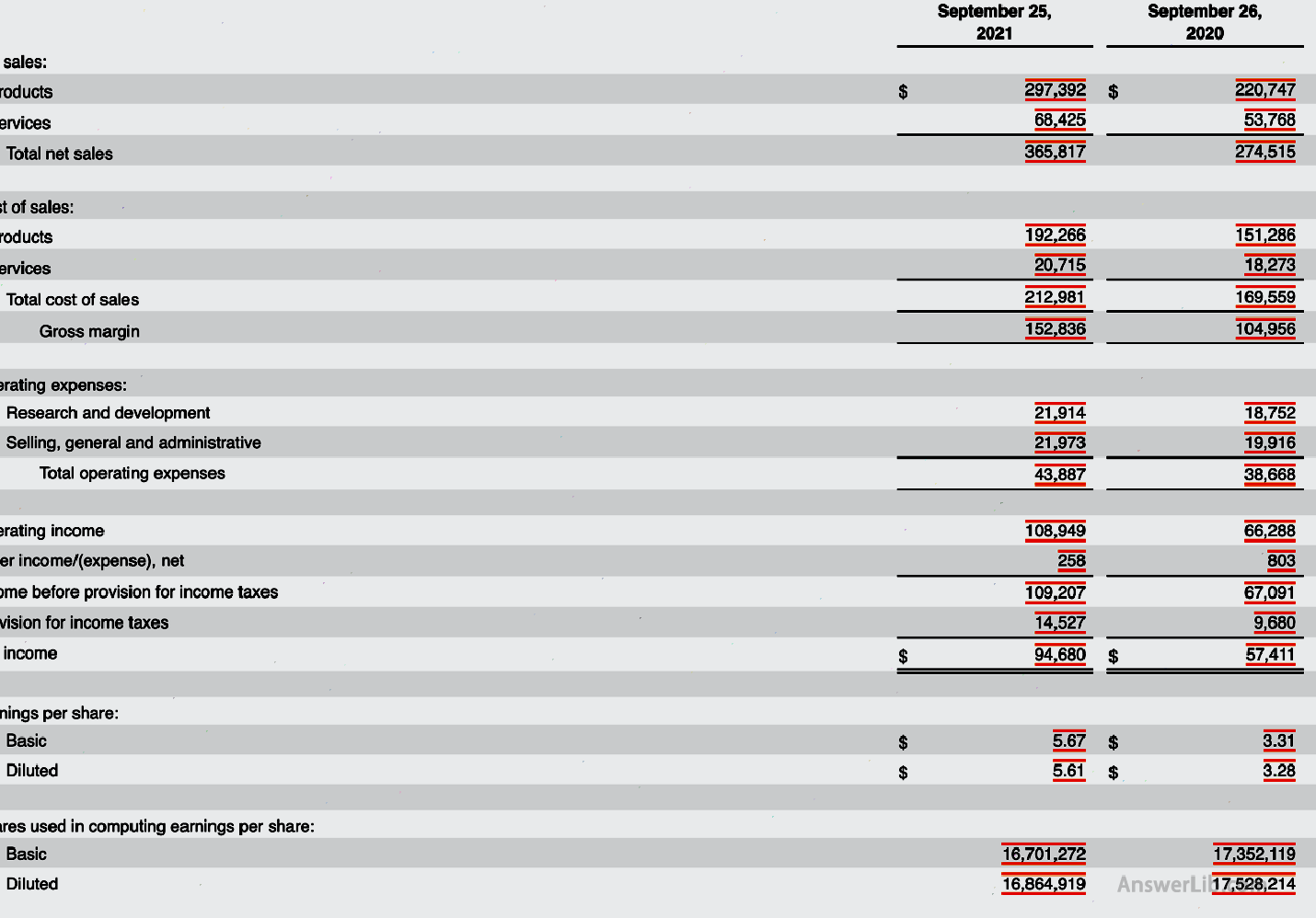

This chapter will be released by Apple in September 2021 10-K financial report Calculate the instance:

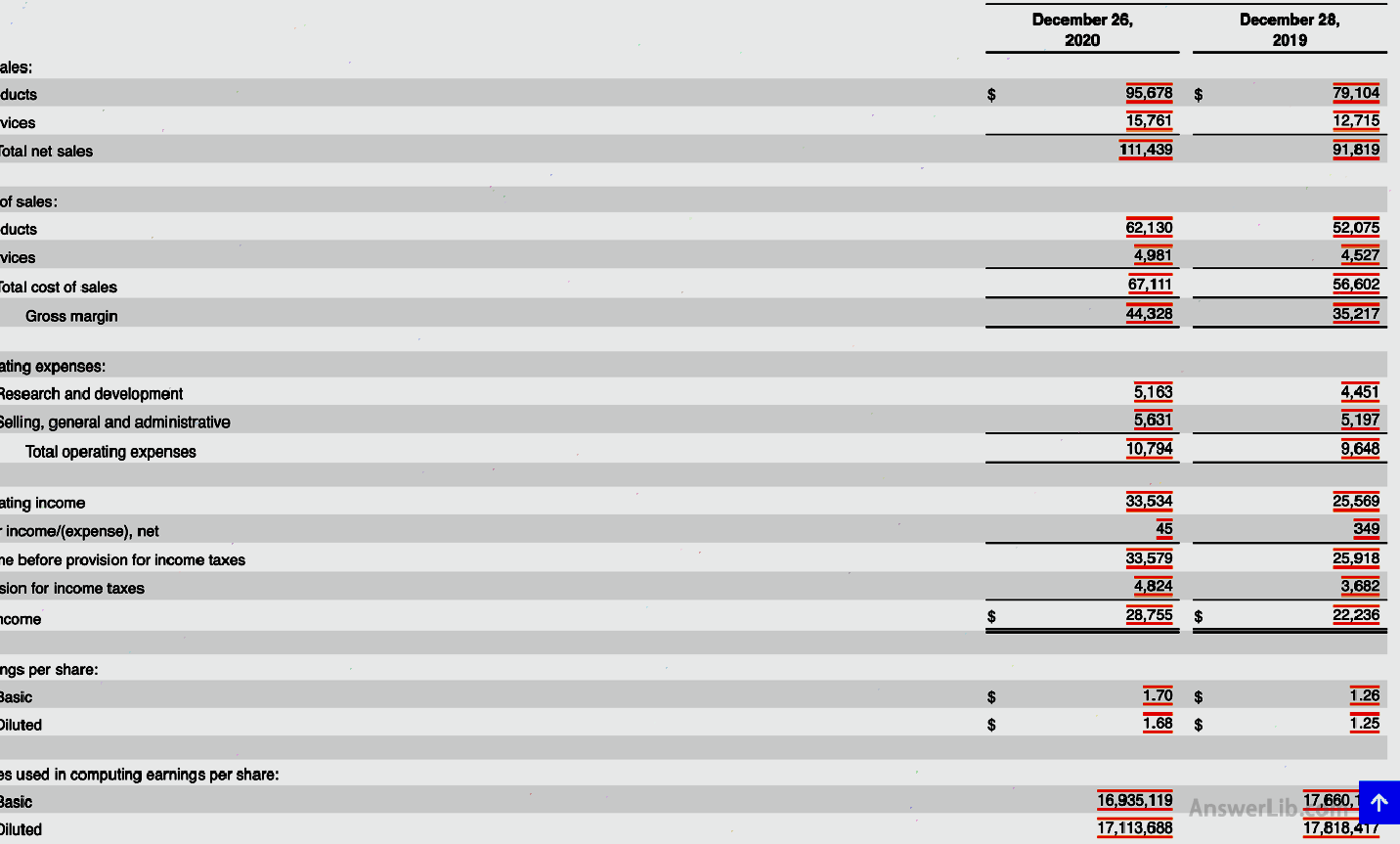

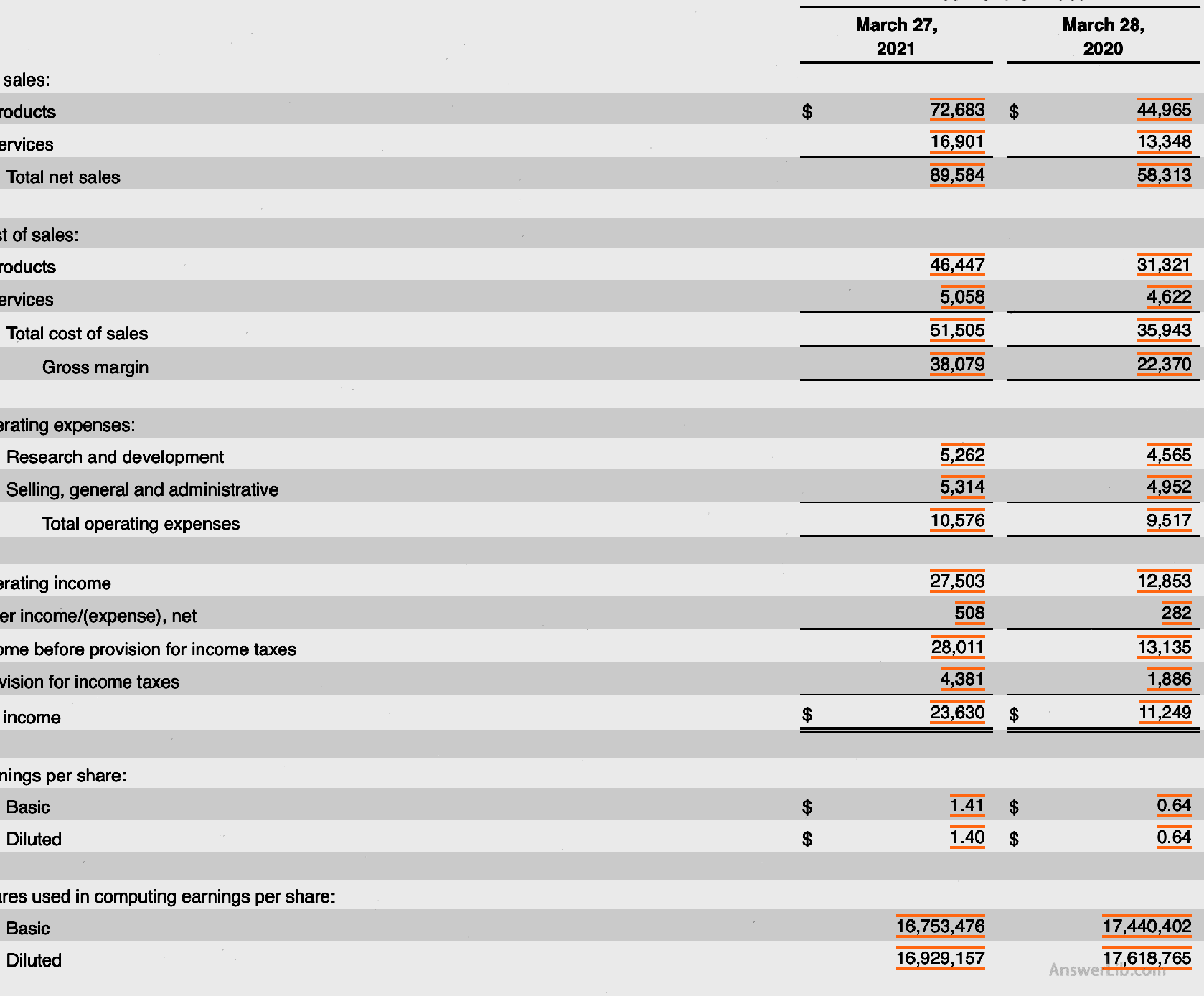

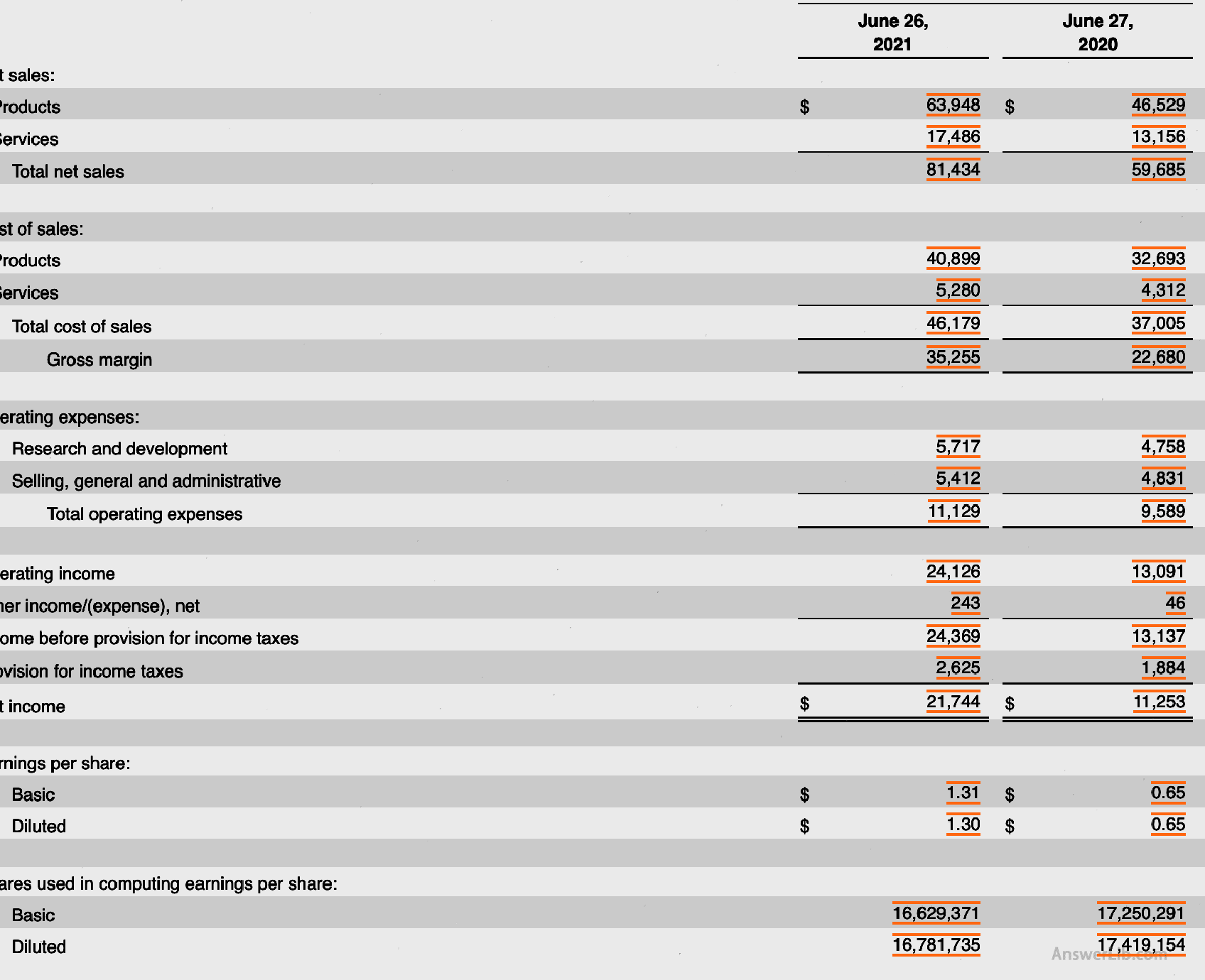

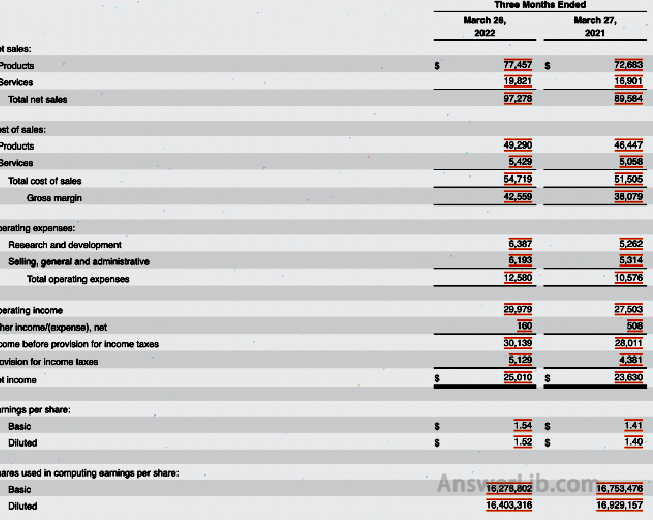

AAPL Financial Report The income statement per share is shown below (the income unit is million, and the number of shares is 1000):

The table directly gives the values of basic basic Eps and diluted earnings per share.

Below, let’s use the calculation formula.

From the income statement per share, you can see in the 2021 Finance Year:

- Apple’s net income: $ 94,680 m

- The average number of common circulation shares: 16,701,272 x 1000 shares, and there is no preferred shares

- Weighted average dilution circulation shares: 16,864,919 x 1000 shares

So the basic earnings per share are:

BASIC EPS = Net Income / Weighted-Average Basic Shares Outstanding

= $ 94,680 m / (16,701,272 x 1000)

= $ 5.67

Note that you can also get it directly from the balance sheet.

Similarly, the number of weighted average diluted shares is 16,864,919 x 1000 shares, and there is no preferred shares, so the diluted income is:

Diluted Eps = Net Income / Weight-Average Diluted Shares

= $ 94,680 m / (16,864,919 x 1000)

= $ 5.61

What is the income TTM?

Due to a company profit The number of circulating shares is constantly changing, so it is usually used Early income TTM Let’s analyze the company’s profitability trend.Among them, TTM is Trailing Twelve Months The abbreviation, indicating the past 12 months of earnings per share Essence

In the process of use, you can use the company’s annual release 10-K wealth Report 10-Q financial report Data in the annual annual earnings per share.

You can also use the 10-Q financial report released by the company.Using the net profit in the first four quarterly financial report data and the number of circulation shares in the first four quarters of the current quarter to calculate the earnings per share of the four quarters, and then add it to get the top 12 of the current quarter.The earnings per month, that is, EPS TTM.

From the above figure, the income per share in the fourth quarter of 2020 (December 26, 2020) is: $ 1.70

From the figure above, the income per share in the first quarter of 2021 (March 27, 2021) is: $ 1.41

From the above figure, the income per share in the second quarter of 2021 (June 26, 2021) is: $ 1.31

From the figure above, the income per share of 2021 (September 25, 2021) is: $ 5.67

From the above figure, the income per share in the fourth quarter of 2021 (December 25, 2021) is: $ 2.11

From the above figure, the income per share in the first quarter of 2022 (March 26, 2022) is: $ 1.54

Because the annual financial report is the sum of the first three quarters of the financial report and the value of the fourth quarter, so,

Annual income of the third quarter of 2021= Earlier of 2021, earnings per share in the second quarter of 2021 -Eap per share in the first quarter of 2021 -the 4th quarter of 2020

= $ 5.67 – $ 1.31 — $ 1.41 — $ 1.70

= $ 1.25

Therefore, in April 2022, the EPS TTM of Apple has been calculated in the past 12 months: as follows:

BasicEPS TTM= 2022 In the first quarter of earnings per share + 2021 Increase per share in the fourth quarter of 2021 + 2021 3 quarter earnings per share + 2021 In the second quarter of earnings per share

= $ 1.54 + $ 2.11 + $ 1.25 + $ 1.31

= $ 6.21

What is the investment guidance significance per share?

usually, The higher the income value per share, the better the profitability of the company The better after buying the company’s circulation stocks, the better.

However, in the specific analysis, in addition to the surface value of the income per share, it also depends on the recent company performance, the performance of its competitors, and the expected analysis given by analysts who track the stock.

What are the limitations of the income per share?

Analyzing the value of investment by analyzing the increase in income per share alone will obtain a more one-sided analysis result, because in actual profit distribution, there are many factors that will affect the profit distribution that shareholders can finally obtain.

- The scope of assessment of each share income is limited.When some special circumstances, such as selling land or warehouse fires, sudden asset changes will lead to increased or decreased income per share.The profitability of a company has increased or decreased.

- Because the company’s capital is not considered in the profit per share, if the company’s earnings per share are the same as the company B, but the assets invested by Company A are much more than Company B.It is obvious that although Company B’s income per share is as A.The company is the same, but it is much better in profit-making efficiency than Company A.

- In the income per share, there is no information about the stock price, so it is difficult to determine that the stock price of a company is overestimated or underestimated through the income of each share.At this time, you need to consider comprehensive consideration P / E ratio Important indicators.

- Listed companies can artificially change their denominator per share for the calculation of the income per share through the acting of stock issuance, splitting or repurchase, so as to control the benefits of each share, making it more conducive to investors.