Corporation value, English is Enterprise value, Abbreviation EV It shows the company’s acquisition price.Enterprise value is different from the company’s market value (Market Cap).When calculating the company’s corporate value, the company needs the company’s current current Market value(Market Cap), the company set Preferred shares Value Shares, the company’s current total debt, and some minority shareholders’ equity, and then minus the company’s current cash and cash equivalent values (Cash and Equivalents).Therefore, corporate valueIt contains market value and has adjusted value adjustments based on the company’s other financial changes in actual operation.

The value of the enterprise is more used.When the company will be acquired, the acquirer will calculate the value of the company to measure the amount of income that may obtain after the acquisition, or compare it with different companies in the same industry to evaluate the value of the income value during the acquisition to evaluate the value of income valueHeight.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- How to calculate corporate value?

- How to calculate Apple’s corporate value?

- What are the investment guidance significance of corporate value?

- What are the limitations of corporate value?

- What are the differences between corporate value and market value?

- More company valuation

How to calculate corporate value?

The calculation method of corporate value is to add the company’s current market value, the company’s priority stock value, the company’s current total liabilities, and the equity of some of the minority shareholders, and then minus the company’s current cash and cash equivalent values, namely::

Corporate value = market value + preferred shares + total debt + minority shareholders’ equity-cash and cash equivalent

EV = Market Cap + Preferred Shares + Total Debt + Minority Interest -Cash and Cash Equivalents

in:

The market value is equal to the company’s current total number of shares of the company and the current stock price, that is,:

Market value = Diluted Circulation Stock X Current Stock Price

Market Value = Diluted Shares Outstanding X Stock Price

In addition to the current market circulation stocks, diluted stocks also include potential circulation stocks, Convertible Securities, EMPLOYEE Stock Options, In-the-Money Opti ons)And warrants, etc.to reflect the company’s more complete market value.

Priority shares are a mixed securities with both equity and debt characteristics.When the company acquisitions, preferred shares are usually considered debt, because the company needs to issue fixed dividends based on the rights and interests of the preferred shareholders.

Total debt is the sum of the company’s short-term debt (Short-Term Debt) and long-term debt (Short-Term DEBT). most Found in the balance sheet in the new 10-K financial report.

A few shareholders’ equity usually appears among companies that set up subsidiaries.The parent company holds more than 50%of the subsidiaries and less than 100%.In normal operations, the subsidiary does not belong to the parent companySome equity, when purchasing a parent company, the subsidiaries usually merge to buy, so this part of the special equity should also be considered.

The reason why cash and cash equivalent need to be removed from the value of the enterprise, because when the enterprise is purchased, the cash and cash equivalents in the enterprise will be owned by the buyer.The buyer can immediately use this part of the asset to repay the debt or invest in this part.It can also be found in the balance sheet of the company’s latest 10-K financial report.

How to calculate Apple’s corporate value?

This chapter will be released by Apple in September 2021 10-K financial report Calculate the instance:

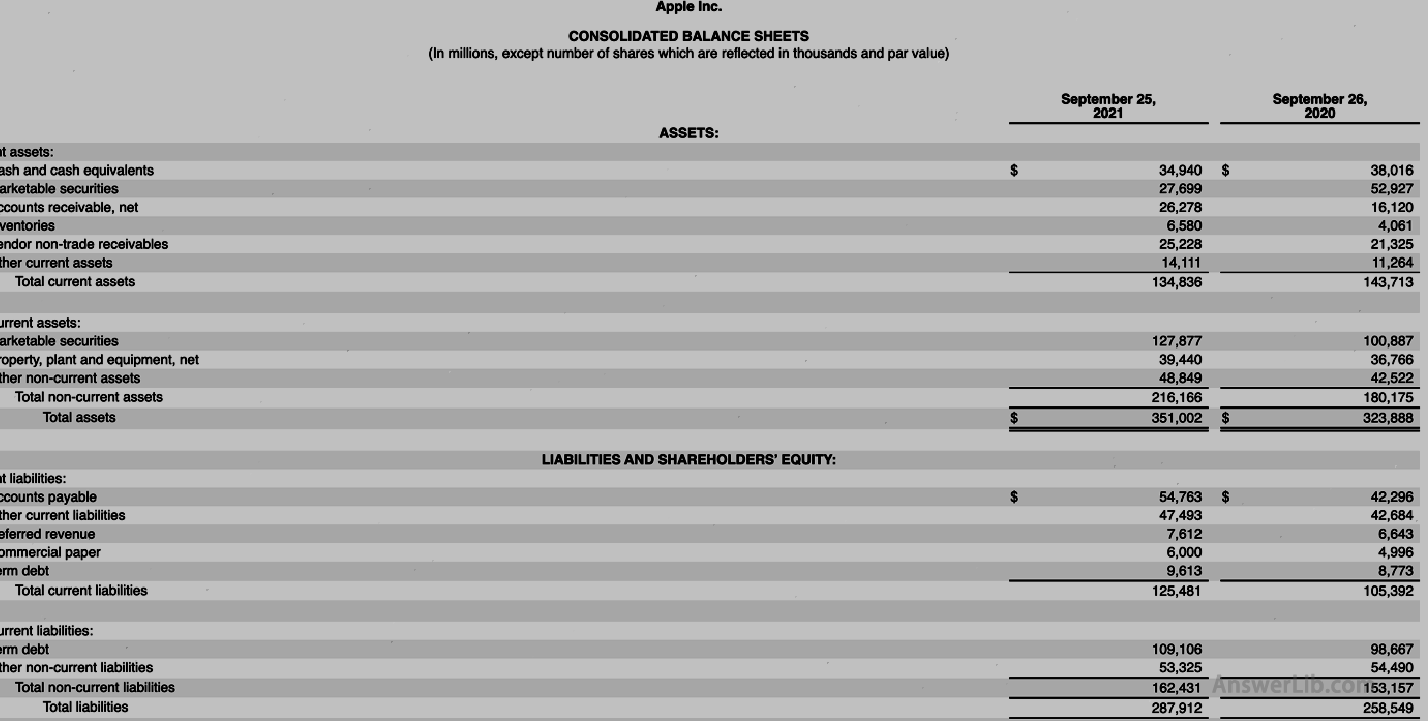

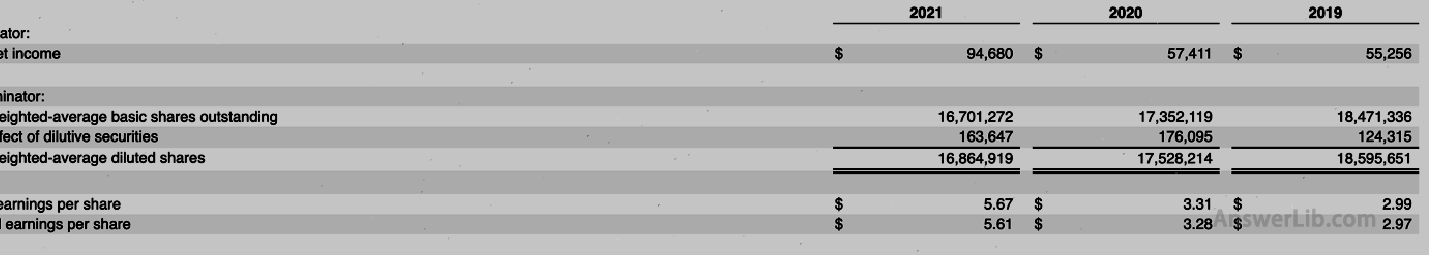

AAPL Financial Report The number of balance sheets and circulation shares in China are as shown below:

It can be seen from the data table:

- Apple’s current dilution circulation shares: (16,864,919 x 1000) shares of the stock

- The latest stock price: $ 147.11

- Apple does not set up preferred shares and subsidiaries, so there is no need to consider the value of preferred shares and a minority shareholder value in the calculation

- Short-term debt: $ 9,613 m

- Long-term debt: $ 109,106 m

- Cash and cash equivalent value: $ 34,940 m

So the current corporate value of Apple is:

Corporate value = market value + total debt-cash and cash equivalent

= 16,864,919,000 x $ 147.11 + ($ 9,613 m + $ 109,106 m) – $ 34,940 m

= $ 2,481,251 m

Therefore, Apple’s current enterprise is worth $ 2,455,780 m.

What are the investment guidance significance of corporate value?

When using the value of the enterprise alone, you can intuitively view the company’s current value and compare it with other peer companies.When analyzing and using, corporate value is often used in combination with financial indicators such as EBITDA and sales before the interest tax depreciation and amortization.

Corporation value / / Extraction of interest tax depreciation and amortization benefits (EV/ EBITDA)

This ratio is also the Enterprise Multiple of Enterprise.

Earnings BeFore Interest, TAXES, DEPRECIATION, and AMORTIZATION), are the company’s continuous operating income, interest, taxation, depreciation and amortization cost

Equipment of interest tax depreciation and amortization = continuous operating recurring income + interest + taxation + depreciation + amortization

EBitda = recurring earnings from Continuing Operations + Interest + TAXES + Depreciation + Amortization

The use of EV/ EBITDA values can initially evaluate whether a company’s value is overestimated or underestimated.The lower corporate ratio indicates that the value of the enterprise is undervalued, and the higher ratio indicates that the value of the enterprise is overvalued.

Enterprise value / pre-tax income (EV / EBIT)

The ratio of this ratio considers the depreciation and amortization part relative to the corporate ratio when calculating.The profit before interest taxation is deducting taxes and profit before interest, that is, net income plus interest and taxes, that is,:

Profit of interest before interest tax = net income + interest + taxes

Ebit = net intertome + interest + taxes

This ratio can also be used to measure the company’s stock price compared to companies in the same industry, which is overestimated or underestimated.The lower ratio indicates that the stock price may be underestimated, and the higher value indicates that the stock price may be overvalued.At the same time, this ratio is useful for capital-intensive enterprises that have a large proportion of depreciation and amortization in corporate economic costs.

EV/Sales

This ratio is to compare the value of the company with the company’s sales, and it can also be used to determine that the value of the company is overestimated or underestimated.

The lower the value of the EV/Sales, indicating that the company’s value is underestimated, and the more attractive it is usually.

What are the limitations of corporate value?

Because the value of the company contains the company’s current total debt, for some capital-intensive industry companies, such as oil and natural gas companies, they usually have a lot of debt to help the company continue to develop, such as increasing equipment to increase equipment, such as increasing equipment, such as increasing equipment., Expand the plant, etc., when compared with industry companies with less debt, it will cause deviations in the evaluation results.Therefore, when using the company’s value to evaluate the company’s investment value, it is also applicable to evaluating different companies in the same industry.Essence

What are the differences between corporate value and market value?

| Corporation value Enterprise value | Market value Market Cap | |

|---|---|---|

Content | Market value + preferred shares + total debt market value + minority shareholders’ equity-cash and equivalent | Total stocks of market circulation x current stock price |

Use meaning | Evaluate the overall comprehensive value level of a listed company itself | Evaluate the value level determined by a company |

Mutual relationship | Companies with excellent corporate value, their market value usually performs well | Companies with high market value, after considering data such as debt and priority stocks, their corporate value is not necessarily very attractive |

Suitable | Consider investors in the acquisition of companies | Only investors who invest in investing in shares |

More company valuation

- Julian Roberts – Julian Robertson: Father of Tiger Baby

- Explore the 24 first-level dealers of the Federal Reserve

- Important Finance and Investment News

- What is a corporate value multiple?Enterprise Multiple

- What is preferred stock?Preferred stock

- What is the operating leverage coefficient?Degree of Operating Leverage

- What is debt repayment payment rate?DEBT Service Coverage Ratio

- What is capital expenditure?Capital Expendital

- What is the capital asset pricing model?Capital Asset Pricing Model

- What is financial leverage coefficient? Degree of Financial Leverage