Cash flow indicates the capital income or output of a company or enterprise, and free cash flow (FCF) is a cash flow that the enterprise can dominate, that isThe difference.

Free cash flow is the actual funds that enterprises can use.These funds can be used to pay shareholders, re-invest, or use it for enterprise expansion and growth.Free cash flow can reflect the company’s operating situation, and can also be used to make a certain value judgment on companies that issue equity.As investors, how to understand and use free cash flow?And the price-related price and free cash flow value?

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- What is free cash flow?

- What is the guiding significance of free cash flow?

- What is the market rate?

- The advantages and disadvantages of P/FCF

- How to use P/FCF to estimate the listed company?

- P/FCF ratio is high or low?

- How to check the company’s P/FCF value?

- common problem

- More investment strategies

What is free cash flow?

Free cash flow, English is Free Cash Flow, referred to as FCF.

Free cash flow refers to the company’s remaining cash that can be used freely after paying all costs required for business operations, such as equipment costs, venue costs, labor wages, taxes and inventory, etc.For companies that issue bonds or shares, freedom cash flow is cash flow that can be used to repay creditors or pay dividends and interest to investors.

Different types of companies in the industry will have different accounting computing methods in the types of income, as well as the expenditure part.For free cash flow, its income is a general value, as is expenditure.

Therefore, in order to calculate the company’s free cash flow, it can be in the company’s Cash flow sheet(Cash Flow Statement), Profits(Income Statement), or Balance sheet Find the information that can be used to calculate on the (Balance Sheet).

The easiest way to calculate free cash flow is:

Free Cash Stream = Operating Cash Flow – Capital Expenditure

For example, Company A, its operating cash flow reported in the 2019 annual cash flow sheet is $ 774,000, and the expenditure section is to purchase two new machines, which costs $ 295,000.Then the free cash flow of Company A in 2019 can be:

$ 774,000 – $ 295,000 = $ 479,000

There are several other methods to calculate free cash flow.Although the calculation methods are different, they are essentially the same:

- Free Cash Stream = Sales Revenue- (Operating Cost + Tax) -The required operating capital investment

- Free cash flow = net business profit after tax-net capital investment

Free cash flow is an important indicator of the company’s financial health.

Through free cash flow, you can learn how much cash left after paying the cost of maintaining the business.

Investors can use the free cash flow of listed companies, the possibility of obtaining dividends and the stability of dividend acquisition.Therefore, free cash flow is an important indicator of the company’s operating conditions.

What is the guiding significance of free cash flow?

A.For the company itself

Free cash flow is an important indicator of the company’s available asset value.The company can make decisions on key businesses by calculating free cash flow, such as whether to continue to expand scale or re-invest.

The free cash flow with a positive value indicates that the company’s overall business is operating well, and companies with sufficient free cash flow can provide more option directions for the company’s development.

Companies with rising free cash flow usually perform well and may consider expansion.

B.For investors

Investors looking for the rapid growth of free cash flow is a normal investment strategy, because the growth of free cash flow indicates that the future income may also surge, and it also shows to investors that the company has enough repayment debt and payment.Dividend ability.

As a result, when a company’s free cash flow is rising and the stock price is low, the attractiveness of investors will be greater, and the possibility of their income and appreciation of stock value will be greater.

In contrast, the narrowing of free cash flow means that the company may not be able to maintain profit growth.The lack of profit growth may force the company to increase debt levels and will greatly affect investors’ attractiveness.

However, low free cash flow does not always indicate that the company’s operations have problems.Because when the company is pursuing rapid expansion, it is often accompanied by a decline in free cash flow.Especially when new product development, acquisition, and investment occurred, these business activities will temporarily reduce free cash flow.

Free cash flow indicators are more suitable for non-financial companies with clear capital expenditures, such as manufacturing or service companies.

What is the market rate?

The market rate English is P/FCF, which is also called “price to free cash flow ratio”, which refers to the stock price and free cash flow ratio.The calculation formula is as follows:

P / fcf = stock price / free cash flow per shanre

Stand-up rate = stock price / free cash flow per share

In the absence of special explanations, the values provided on the market are TTM P/FCF, which is the Trailing Twelve Month P/FCF, which is calculated even if the free cash flow value value of free cash flow has been used in the past twelve months.

Suppose Company B has 10,000,000 shares, and the transaction price per share is $ 3.The company received a free cash flow of $ 15,000,000 last year.Then the ratio of the price and free cash flow of Company B last year was:

Price to free cash flow ratio = $ 3 / ($ 15,000,000 / 10,000,000) = 2

P/FCF value is usually used to compare the company’s stock value.

Generally speaking, stocks below 5 of P/FCF are considered “underestimated”, which means that the stock may be traded at a low price and may rise in the future to correctly reflect the company’s free cash flow.

The advantages and disadvantages of P/FCF

P/FCF is similar to the price-earnings ratio in calculation, which can be used to evaluate the company’s stock price.

The price-earnings ratio calculates the ratio of the stock price to the profit per share (EPS), and P/FCF calculates the ratio of stock price to free cash flow per share.

The biggest difference between free cash flow and profit value is:

- The profit value will convert some of the profits that have not yet converted into cash.For example, in the company’s account, the values in the profit statement include the profit that has determined the transaction, but has not actually received the payment;

- Cash flow is a real cash income, so it can better reflect the company’s current actual revenue ability.At the same time, because the company’s actual development requires real cash rather than digital profits, free cash flow can show the company’s future development trend.

Therefore, when judging the company’s value, the P/FCF value can better reflect the current company’s operating conditions and operation development capabilities.

But on the other hand, the company’s free cash flow is not completely truly reflected in the company’s available cash.For example, to retain more cash by extending the time of payment bills, delaying purchase of inventory, etc., or shortening the time required to recover the arrears to accelerate income cash, so as to adjust the free cash flow value, it may also cause the P/FCF value to value.deviation.

How to use P/FCF to estimate the listed company?

The P/FCF value is more suitable for evaluating industries with actual capital expenditures, such as manufacturing and service industries, which are not suitable for the financial industry that rely on money, such as banks, such as banks.

For industries with actual capital expenditures, free cash flow means whether the company can continue to run because all operations require funds, the company is operating well, free cash flow is charged, and the P/FCF value will be reduced.

When the company needs to be expanded in a mature stage, cash is still the most important demand, and there is enough free cash flow to continue to expand.

In contrast, the financial industry and banking industry, these industries mainly depend on the operation of money to make profits, and the high circulation of funds is the main source of profit.If they hold a lot of free cash flow, they show poor capital circulation.Therefore, it is not appropriate to use the P/FCF value in the financial industry.

P/FCF ratio is high or low?

For a company (except for the financial industry and the banking industry), the lower P/FCF value usually indicates that a company is underestimated, and its stock is relatively cheap compared to its free cash flow.

Instead, higher P/FCF value may indicate that the company’s stock is overestimated relative to its free cash flow.

Therefore, investors often prefer companies with lower or decreased P/FCF values, indicating that their total free cash flow is higher or increased, and the stock price is relatively low.

Investors will also avoid companies with higher P/FCF values, because this shows that the company’s stock price is relatively high compared with its free cash flow.

In summary, the lower the P/FCF value, the lower the company’s stock is considered to be the object worth investing.

How to check the company’s P/FCF value?

Macrotrends It provides a very convenient P/FCF value query:

step one: Enter the target stock name or code in the search box of the Macrotrends homepage.In the drop-down menu, select “Apple (AAPL) -Rensue”

Step 2: Enter the data analysis page of the stock, you can see Price-FCF Ratio under the Price Ratio tab.

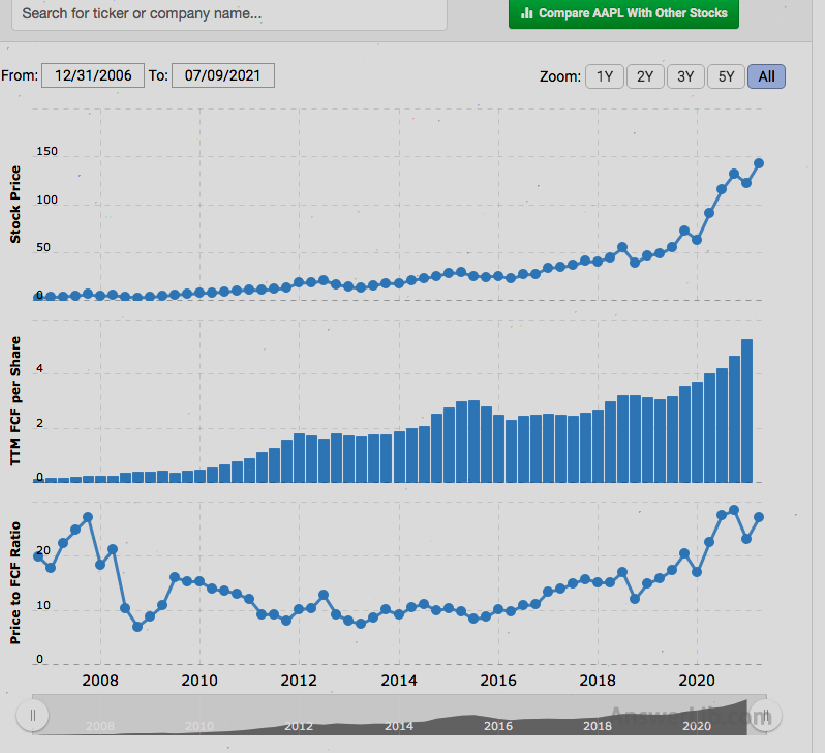

Step three: Pull down the page to see the data of each group of data in the data statistics, including the trend chart of the stock price, the TTM FCF trend chart, and the TTM P/FCF ratio trend chart.

common problem

Question 1: What is free cash flow?Free cash flow, English is Free Cash Flow, referred to as FCF.

Free cash flow refers to the company’s remaining cash that can be used freely after paying all costs required for business operations, such as equipment costs, venue costs, labor wages, taxes and inventory, etc.For companies that issue bonds or shares, freedom cash flow is cash flow that can be used to repay creditors or pay dividends and interest to investors.

See More

Free cash flow is an important indicator of the company’s available asset value.The company can make decisions on key businesses by calculating free cash flow, such as whether to continue to expand scale or re-invest.The free cash flow with a positive value indicates that the company’s overall business is operating well, and companies with sufficient free cash flow can provide more option directions for the company’s development.

See More

The market rate English is P/FCF, also known as the “ratio of price to free cash flow”, which refers to the ratio of stock price to free cash flow.

P / FCF = Stock price / US stock free cash flow

See More

For a company (except for the financial industry and the banking industry), the lower P/FCF value usually indicates that a company is underestimated, and its stock is relatively cheap compared to its free cash flow.Instead, higher P/FCF value may indicate that the company’s stock is overestimated relative to its free cash flow.

See More