The expensive medical expenses of the United States are famous.Even if they buy American medical insurance, medical expenses are often dazzling.Then if you do n’t buy the right US medical insurance, if you get sick, the cost is really scary.

Therefore, in the United States, even if medical insurance costs are expensive, you and I have to buy.Moreover, when buying American medical insurance, there are many tips.Today, we will come with you August 18.

Directory of this article

- Common term for American medical insurance

- What are the types of American medical insurance?

- What is the difference between HSA and FSA?

- What is Obama Medical Insurance?

- Steps to buy medical insurance

- More in the United States seeking medicine

Common term for American medical insurance

- Premium (insurance premium): The amount you paid for medical insurance every month is generally paid on a monthly basis; the cost of at least hundreds of dollars per month.If the entire family purchase insurance premiums together, it may cost thousands of dollars a month.Therefore, US medical insurance premiums are very expensive.

- Deductible (self-funded): Before medical insurance starts to pay medical expenses, you need to pay for medical services yourself.For example, the Deductible you purchased is $ 800.Then, the first $ 800 medical expenses you need to pay your own, and the excess part will be paid by the insurance company, or the insurance company will pay with you proportionally.

- Co-Insurance (Common Insurance): If you are using Co-Insurance, after you pay the depuctible, the remaining medical expenses will be paid by you and the insurance company at the proportion of Co-Insurance.For example, if your Co-Insurance ratio is 20%, then you need to bear 20%of the remaining medical expenses, and the remaining 80%will be borne by medical insurance companies.Therefore, the smaller the proportion you need, the higher the monthly insurance cost.

- CO-PAY (pay for your own, or outpatient fee): For a certain category of medical services, you need to pay a fixed medical expenses.For example, for some medical insurance, if you go to a family doctor, you only need to pay a fixed $ 30 at a time.In addition, no cost is needed.Then this $ 30 is called “CO-PAY”.

- In-network (in the network): If your doctor is a doctor in which medical insurance companies are insured (or cooperation), you can get the rate of certain agrees (that is, discounts).Therefore, when you choose a doctor, if the doctor belongs to in-network, you will save a lot of medical expenses.At the same time, some medical insurance only allows you to use in-network doctors.

- Out-of-network (outside the network): It is exactly the contrary to the above In-NetWork.If your doctor does not sign a contract with your medical insurance company, the proportion of medical insurance companies will be very low.Some medical insurance companies will not allow you to use OUT-OF-Doctor of Network.

- OUT-OF-POCKET MAXIMUM: In the year of insurance, the highest medical expenses you need to bear, the lower the quota, the better.For example, your maximum self-payment amount is $ 10,000, so after you pay $ 10,000, the insurance company pays 100 % of the medical expenses after paying, but it will not exceed the MAXIMUM benefit below.

- Maximum benefit (maximum insurance amount): Refers to the highest premium that medical insurance companies can bear within a period of time.

- COVERAGE (insurance reimbursement amount): Medical expenses that comply with medical insurance reimbursement.

- Pre-Existing Conditions (existing disease): If you have some health problems before you buy medical insurance, some medical insurance companies may refuse medical expenses for reimbursement of related diseases.

- WAITING PERIOD (waiting period): Some insurance companies require that the insurer will start to reimburse medical expenses after a period of time when purchasing insurance.This time is called “waiting period”.

- Prescriptions/RX (prescription medicine): Need a doctor’s prescription drug.

- PCP (Primary Care Provider): Family doctor, responsible for all the diseases of the ophthalmology and dentistry.You generally receive a annual medical examination at your family doctor.For some diseases, if family doctors cannot handle it, they will refer to other specialists.

- Specialist: Experts and doctors specializing in certain diseases, such as endocrine doctors, surgery income doctors, etc.Some medical insurance requires you to see a professional doctor through a family doctor to see a professional doctor; other medical insurance does not have such a requirement.

What are the types of American medical insurance?

There are several types of American medical insurance, and the most widely widespread American medical insurance is PPO and HMO.

- PPO: Preferred Provider Organization

- HMO: Health Maintenance Organization

- POS: Point-OF-Service

- EPO: Exclusive Provider Organization

PPO | HMO | POS | EPO | |

|---|---|---|---|---|

| Self-payment amount and premium | high | Low | middle | Low |

| Do family doctors need specification | no | yes | yes | Not always |

| See if experts need Referral | no | yes | Depends on the situation | no |

| Whether to allow Out-OF-Network | Yes, but spend high | No, except for emergency situations | yes | No, except for emergency situations |

1.PPO (Preferred Provider Organization)

The full name of PPO is Preferred PRovider Organization, and its biggest features are as follows:

- If you choose a doctor in IN-Network, the medical expenses you need to bear are less;

- You can also contact any expert doctor yourself, no family doctor Referral;

- You can see the doctors of Out-OF-Network, and PPO will also bear part of the medical expenses;

- However, the medical insurance premium you need to pay every month is higher;

Below is the advantages and disadvantages of PPO:

A.Advantages

- PPO does not require you to choose a family doctor;

- PPO can not only reduce the cost of self-payment, but also have flexibility;

- You can see any experts if you don’t need Referral;

- Not only support in-network, but also Out-OF-Network;

B.Disadvantages

- PPO’s monthly medical insurance cost is higher;

- PPO often has deductible;

- PPO supports out-of-network, but the proportion of reimbursement medical expenses is low;

2.HMO (Health Maintenance Organization)

HMO’s full name Health Maintenance Organization is also a medical insurance plan.It is a medical insurance that only provides In-Network medical services.Its main characteristics are shown below:

- Compared with PPO, HMO has stricter In-Network.The cooperative doctors agreed to charge lower medical expenses;

- HMO only affords the medical expenses of Dr.In-Network, and does not afford any medical expenses of Out-OF-Network, unless it is an emergency;

- HMO requires that the insured must designate a family doctor and look at a specialist, and the family doctor Referral is needed;

- HMO’s monthly medical insurance cost is lower than PPO;

A.Advantages

- Compared with other insurance plans, HMO’s monthly insurance costs are lower;

- HMO generally does not require the insurer to bear the cost of Deductible, or the cost of Deductible is very low;

B.Disadvantages

- HMO’s medical treatment process is cumbersome.In order to reduce costs and insurance premiums, HMO will ask you to choose a family doctor to be responsible for coordinating all your health care needs.If you want to see an expert, you must refer it through a family doctor;

- HMO does not support any Out-OF-Network, unless it is an emergency;

3.POS (POINT-OF-Service)

The full name of POS is Point-OF-Service, which is a fixed-point service plan that combines medical insurance for HMO and PPO.PPO establishes its own medical care network, asking the insurer to designate a family doctor, and from it to an expert in IN-Network, thereby reducing medical expenses.

POS is relatively small in the medical market.The main characteristics are as follows:

- Compared with HMO, POS also allows you to see the doctors of Out-OF-Network, but you need to get the referral of a family doctor.In this way, POS will pay more medical expenses;

- Compared with PPO, POS provides cheaper costs, but its in-network is smaller than PPO.POS’s CO-PAY ($ 10 ~ $ 25 each time) is lower than the CO-PAY of PPO.At the same time, you generally do not need to pay the Deductible cost for in-network.

- The monthly insurance premiums of POS insurance are between PPO and HMO.

A.Advantages

It is more loose to see if the experts have the requirements for family doctors.

If you seek medical treatment at In-Network, the insurance company will bear most of the costs, and your personal payment is relatively low.

You can also go to the Out-OF-Network clinic, and the insurance company will also reimburse some expenses.POS gives members more self-seeking choices.

B.Disadvantages

- The number of doctors in in-network is limited

- POS still requires you to designate family doctors, and require family doctors’ Referral

4.EPO (Exclusive Provider Organization)

The full name of EPO is Exclusion Provider Organization.If you use EPO’s In-Network, you will pay less and do not need a family doctor Referral.In addition, the range of EPO’s In-Network is larger than HMO.

EPO does not bear any medical services for Out-OF-Network, except for emergency situations.

A.Advantages

- EPO’s monthly insurance costs are lower.The EPO plan is more suitable for those who do not need a lot of medical care and do not want to spend too much.

B.Disadvantages

- Only suppliers within the EPO network.You must only use the doctor or clinic of in-network.

What is the difference between HSA and FSA?

HSA and FSA are two commonly used pre-Tax medical expense payment accounts commonly used in the United States.Generally, the pre-tax salary is recharged to the account, and then the funds in the account will pay for medical expenses.

You may ask, why do you do this like this?Can you pay it directly with money?

The main reason is to save taxes.The income tax in the United States is very high.Through the HSA and FSA accounts, the cost of medical treatment in the income can be stored in the HSA or FSA account in advance.The income tax is paid.

However, HSA is completely different from FSA.The biggest difference is that the HSA account belongs to individuals, while FSA belongs to your employer.If you change jobs, HSA will still follow you, and the FSA account will be canceled.

Is it choosing a HAS account or a FSA account?In fact, in many cases, this is determined by your employer and your way of working.

1.What is HSA?

The full name of HSA is the Health Saving Account, which is a savings account that allows you to deposit pre-tax income and use it to pay for medical expenses.Pay medical expenses with duty-free funds in HSA, but HSA generally cannot be used to pay premium.

HSA account account opening has relatively harsh requirements, and you need to have HDHP medical insurance.The biggest feature of the HDHP medical plan is: Deductible, but the monthly medical insurance premiums (Premium) are very low, so it is very suitable for young people and people who do not need to see doctors often.At the same time, any preventive care is paid by HDHP 100%.

HDHP medical insurance can be HMO, PPO, POS, or EPO account, but Deductible and Out-OF-Pocket are very high.

Company employees and self-employed personnel can open a HAS account.Note that those who have a HAS account are individuals, not employers.If the company employees leave the company, employees can take their accounts away.

Employees, employers, or both can enter the HAS account.These funds are available when deposited in the employee account.Employees can also change the amount of HAS at any time throughout the year, but there is the highest limit each year.It’s $ 7200.

If the funds in HAS are not used up at the end of each year, they can be automatically transferred to the next year.

The funds in the HAS account can be used to pay for medical expenses, but also to invest in stocks or common funds, and the income of investment is also tax-free.

2.What is FSA?

The full name of the FSA is Flexible Spending Account, which is also an account that is deposited and used to pay for medical expenses.

FSA must open an account for you by the employer, and the company’s employees or individuals cannot open an account by themselves.

The FSA must be used in that year.Only $ 500 can be transferred to the next year, and where the remaining funds will be transferred to the employer.

If the company’s employees leave within one year, the employer will confiscate the remaining FSA funds.Employees who resign in the year, if the funds used in the account exceed the amount paid, must be repaid.

3.What are the differences between HSA and FSA?

The difference between HSA and FSA is:

- Qualification of account opening: For HAS, you can only open an account when you have the HDHP medical plan.You can open an account by the employer, and you can open an account yourself.FSA must be provided by the employer.

- Annual Contribution Limits: Annual Contribution: For HAS, individuals can enter $ 3,600 each year, and family can enter $ 7200 (Year 2021); for FSA, individuals or families can be paid to $ 2750 (year 2021).

- Supply change: For HSA, you can change your deposit in your account at any time.For FSA, you can only set at the enrol every year, unless your family situation changes, such as new babies.

- The amount that was not used up that year: The HSA account is not available to the next year.For the FSA account, you will lose the balance, unless your employer allows delay, the upper limit is $ 500.

- job transfer: When you change jobs, as long as you still have HDHP medical insurance, the HSA account can follow you to a new company.But FSA will be lost because of the mobilization of your work.If you are qualified to use the COBRA plan and continue to use the FSA account.

- Account funds: In addition to paying medical expenses, funds in HAS can also be used for investment, and any investment income is tax-free; funds in the FSA account can only be used to pay medical expenses.

What is Obama Medical Insurance?

Obama Medical Insurance’s English is Obamacare -The Affordable Care Act, referred to as ACA.

Obama Medical Reform, also known as the “Acts for Affairs Medical Act”, was signed by the United States General Obama in 2010 as a law.

The bill is a major reform of the US government’s US medical system, reducing the burden on the expensive medical expenses of ordinary families.Obama’s medical reform basically retains the basic system of Medicare, Medicaid, and employers to buy insurance for employees.At the same time, it has made significant reforms on personal medical insurance.Obama medical insurance requires that insurance companies cannot collectDifferent costs.

At the same time, Obama Medical Insurance requires that medical insurance policies must have the most basic insurance benefits, including: prevention of health care, emergency care, outpatient care, hospitalization, pregnancy and neonatal care, mental health and drug use, rehabilitation services, pediatric care, etc.

ACA initially asked everyone to have medical insurance and provide assistance for those who could not afford medical insurance.However, in December 2017, the Trump administration passed a tax bill to abolish individuals for compulsory medical insurance.

Obama’s medical reform includes medical subsidies to help low-income personal payment of their plan costs.These medical subsidies are also called tax credits.

Obama’s medical reform also pays the insurance company to maintain a low amount of compensation.According to the medical plan you choose, the specific coverage you get in the Obama medical reform plan will be different.

Under Obama’s medical reform, if you have Pre-Existing Conditions, insurance companies cannot refuse your insurance or charge you more.Pre-Existing Conditions refers to a disease that has been diagnosed before your purchase insurance.

Steps to buy medical insurance

1.Choose your health insurance

Most people’s medical insurance is obtained from employers.If your employer can provide medical insurance, you don’t need to buy it yourself.

Medical insurance provided by employers is generally relatively low monthly insurance premiums.And most employers pay a part of the insurance premium for employees.

If your company does not provide medical insurance, you can buy in the public market in your state, it is best to find the lowest insurance premium in the federal market.

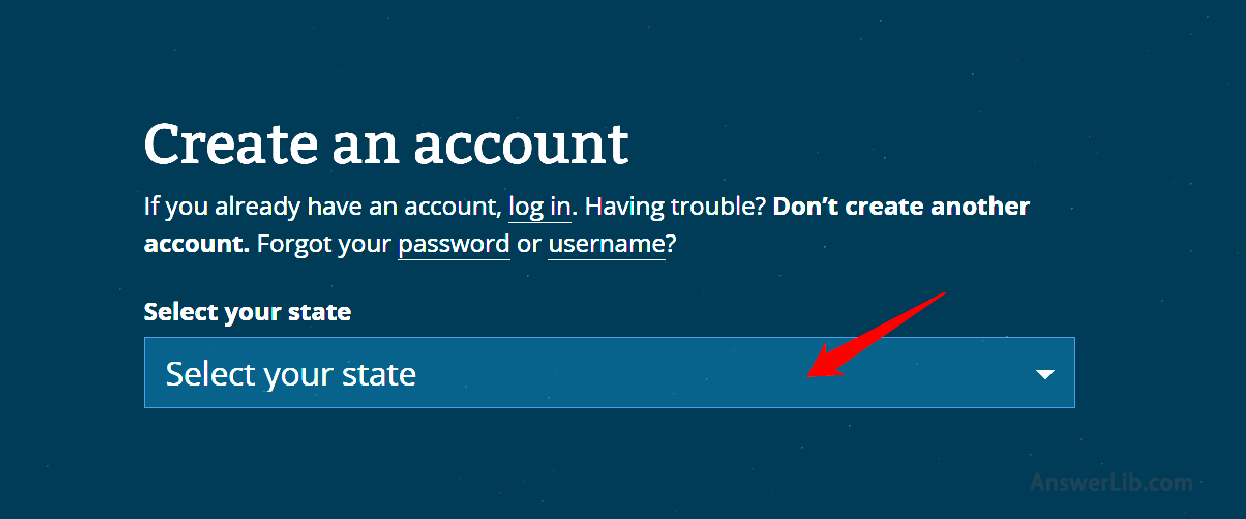

First log in Healthcare.gov Website, click the button [take the first step to apply].Then, find your state.

After that, please follow the prompts to complete the application for medical insurance.

You can also check whether you sit in the state whether there are websites to buy medical insurance.Taking Texas as an example, you can be in Texas Health Plan Compare Check the monthly expenses of different medical insurance and medical insurance content.

2.The type of comparative medical insurance plan

Choose the best one to you and your family from HMO, PPO, EPO, or POS, and consider whether you need a HAS account or FSA account.

In more different plans, carefully consider your family’s medical needs, and check the treatment projects you have received in the past and the medical expenses you spent, so as to choose a medical insurance plan that is most suitable for you or your family.

If you choose the HMO or POS program, you need to know that these two medical plans need to be referred, and you must obtain a family doctor Referral before arranging surgery or visiting experts.Due to some restrictions, HMO is often the cheapest health plan.If you don’t mind choosing experts for you, POS and HMO programs may be better.

If you are more willing to choose an expert clinic, you may prefer PPO or EPO.As long as you find the specialist you trust in in-network, you can make an appointment directly without Referral.

3.More actual medical costs

Determine whether you want more medical insurance and higher premiums, or lower premiums and higher payment fees.

For any plan, please calculate how much medical expenses your family needs to pay each year according to your or family’s medical needs.This cost includes annual insurance premiums and all medical expenses.You can consider choice, the cheapest medical plan for the overall payment.

If you have the following situations, for example, you often go to see a family doctor or a specialist, take expensive drugs regularly, plan a child, and be diagnosed with chronic diseases, then choose a monthly high insurance premium, but low medical expenses, but maywill be better

If you are still very young and your health is very good, you rarely go to a doctor, then you can choose monthly insurance premiums, but high medical expenses, which may save money.