Financial report, Also known as the financial report, which is a financial statement and financial analysis report that all US listed companies must regularly or irregularly submitted to the US Securities and Exchange Commission (SEC), and clearly disclose the operation of the company during the statistical period of the financial report.

As a shareholder of the company, investors have the right to understand these information, and as potential investors, they can analyze the company’s investment value through these public financial reports and changes.Therefore, understanding the financial report of a company can intuitively understand a company, andHow many financial reports are there?how to read?

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- What is the company’s financial report?

- How to find the financial report of listed companies?

- What are the 10-K financial report?

- How to read 10-K financial report?

- What is the difference between annual report and 10-K financial report?

- More company valuation

What is the company’s financial report?

Financial report, English is the Financial Report, referring to financial reports and financial analysis reports reported by listed companies every quarter or every year, as well as important changes in the company, and reported to the Securities and Exchange Commission (SEC).

According to the frequency of the report, the main:

- The 10-K financial report (10-k report) that must be submitted after the end of each year is often called 10-K table (form 10-k)

- The 10-Q financial report (10-Q Report) that must be submitted after the end of each quarter is also often called 10-Q (FORM 10-Q)

- The 8-K financial report (8-k report) that needs to be submitted in the company’s important financial changes, personnel changes, etc., often called 8-K table (form 8-k)

Among them, quarterly and annual refers to the quarterly and annual year of the company’s financial year, and it is not necessarily synchronized with the natural year.For example, Apple’s financial year is the end of September each year.

| 10-Q | 10-K | 8-K | |

|---|---|---|---|

The frequency of submitted report | After the first three quarters of the financial year | After the end of the financial year | After major financial, personnel and other companies changes |

Number of reports on the report | Three times a year, the first three quarters of the financial year | once a year | No fixed number of times, submit when needed |

Report deadline | Public shares <$ 75mm: within 45 days after the end of the quarter; $ 75mm ≤ Public shares <$ 700mm: within 40 days after the end of the quarter; Public shares are ≥ $ 700mm: within 40 days after the end of the quarter; | Public shares <$ 75mm: within 90 days after the end of the year; $ 75mm ≤ Public shares <$ 700mm: within 75 days after the end of the year; Public shares ≥ $ 700mm: within 60 days after the end of the year; | Most incidents need to be submitted 8 -K forms within four working days after the occurrence; The replacement of the auditor needs to be reported within two working days; The replacement of high-level leaders can be reported after the press conference; The 8 -K forms of the acquired enterprise can be submitted in the 71 calendar after the acquisition procedures are completed. |

main content | Part 1: The company’s related financial information during this quarter, including concise financial statements, management discussions, analysis of physical financial conditions, disclosure of market risks, and internal control. Part 2: All other related information, including legal lawsuits encountered by the company during the quarter, unregistered equity securities sales, the use of unregistered equity sales, and default of priority securities. | Including a whole year of the company’s financial situation, which includes the content of the company, involves the content covered by the 10 -Q financial report, including the company’s operational abstract, the financial prospects of management, financial statements, and any legal or administrative issues involved in the company, so, 10 – k replaced the 10 -Q in the fourth quarter. The financial statements used in the 10 -K financial report must be a audited report. | The company’s major financial and personnel changes, including but not limited to: bankruptcy, major debt, events involving major obligations such as loan defaults, such as loan defaults, etc.Change of changes, delisting from the Stock Exchange, the amendment of the rights of shareholders, the change of the registered accountant, the election, appointment and departure of the main managers, the amendments to the company’s articles of association, the change of the accounting cycle, the change of the employee welfare planDifferent financial changes, acquisitions or acquired by another company, corporate reorganization, modification or abandonment of moral norms, changes in the status of the shell company, the results of the shareholders’ meeting, some financial statements and other financial statements were acquired or acquired by another company.Special events, etc. |

Do you need audit | You can submit without auditing | You must be audited to submit | No audit requirements |

The consequences of not submitting in time | If it has exceeded the specified submission period, but in the following five days, a copy of a non-timely 10-Q financial report (Non-Timely / NT 10-Q) that is considered by the SEC will be considered that the financial report that has completed the time periodSubmitting obligation; If you cannot provide non-timely 10-Q financial reports, you may face the registration qualifications of the US Securities and Exchange Commission, the removal of the Stock Exchange and the legal consequences. | If it has exceeded the specified submission period, but in the following fifteen days, a copy of a non-timely 10-K financial report (NON-TIMELY / NT 10-K) that is considered by the SEC is considered to be considered that the time period has completed the time periodObligations for submission of financial reports; If you cannot provide non-timely 10 -K financial reports, you may face the registration qualification of the US Securities and Exchange Commission, the removal of the Stock Exchange and the legal consequences. | Delays 8 -K financial reports, some stock exchanges, such as the New York Stock Exchange or the Nasdaq Stock Exchange, asking the company to issue a press release to declare that it fails to submit 8 -K financial reports in time, which may cause investors’’sNegative emotions, believe that the company’s management is not good or intentionally hidden information; The delayed submission may cause the US Securities and Exchange Commission to file an administrative lawsuit on the company, and the most serious punishment may be eligible for the company. |

Role of financial report | Help investors understand the financial performance of the company in the quarter of the financial year, so as to analyze the company’s operating conditions and operating income capabilities. | Investors can understand the company’s most complete and accurate financial situation, operating capabilities, etc.in the financial year. | Help investors understand the company’s sudden changes more efficiently and fairly. Forcibly stipulated operating situation changes information disclosure can effectively avoid the occurrence of insider transactions |

How to find the financial report of listed companies?

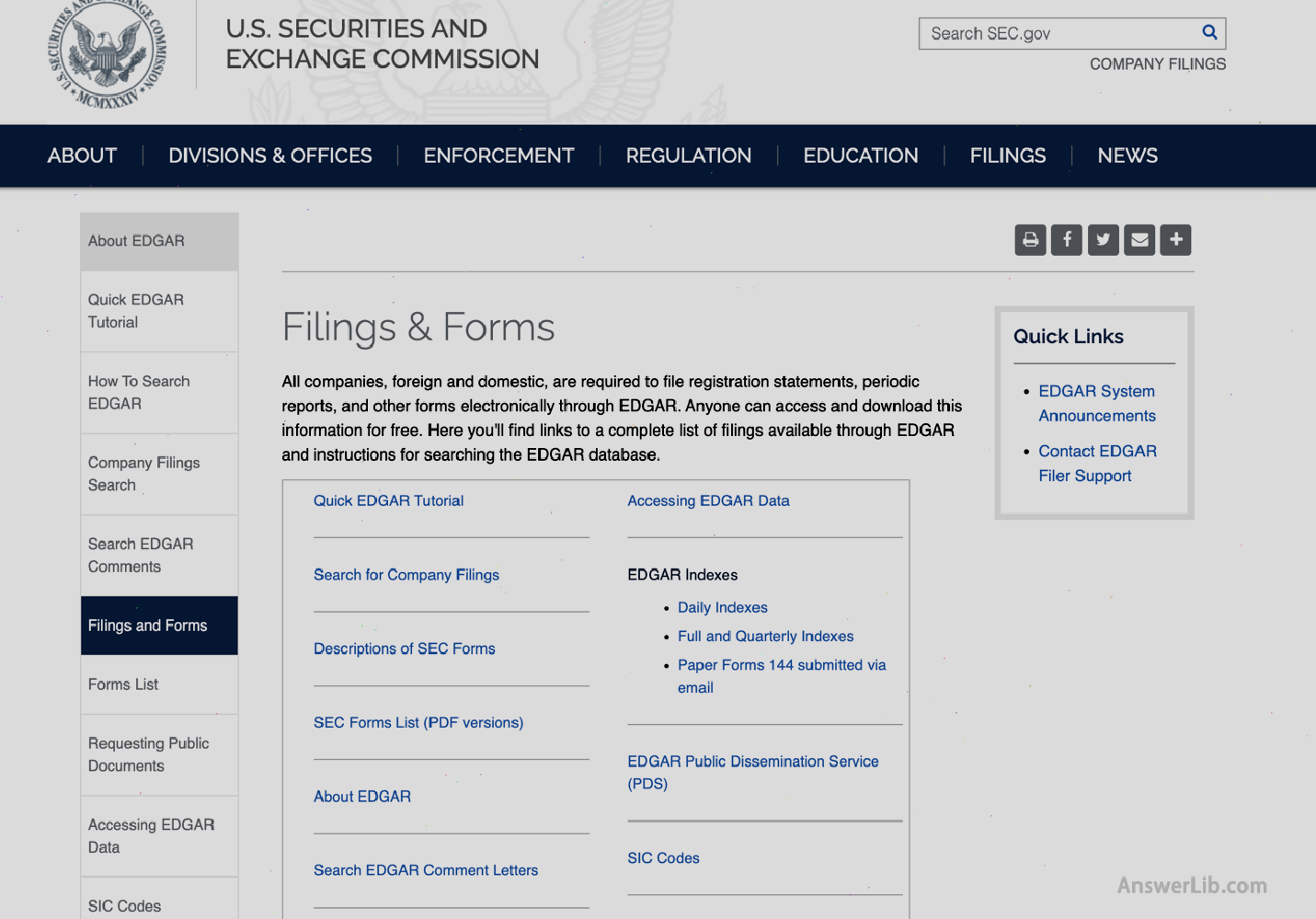

step one: When investors need to view the financial reports of different companies, they can search for “EDGAR” through Google and find “EDGAR -SEC.GOV” in the search results to enter the SEC official website.Or enter directly in the address bar http://www.sec.gov/edgar.shtml You can also directly enter the information form page.

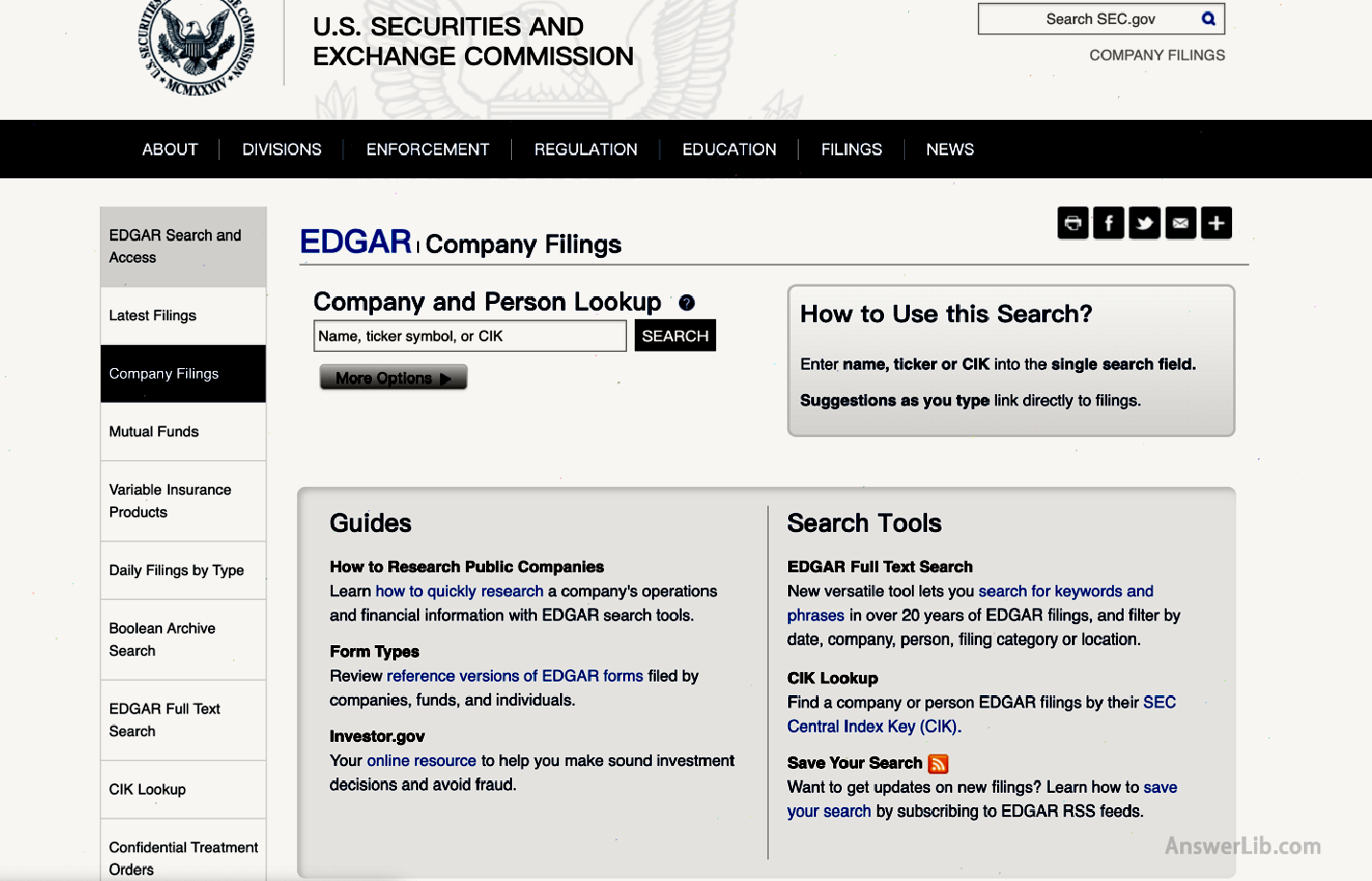

Step 2: Find the “Company Filings Search” menu on the left menu bar on the homepage of the US Securities and Exchange Commission.Click to enter to enter the company to search for the page.

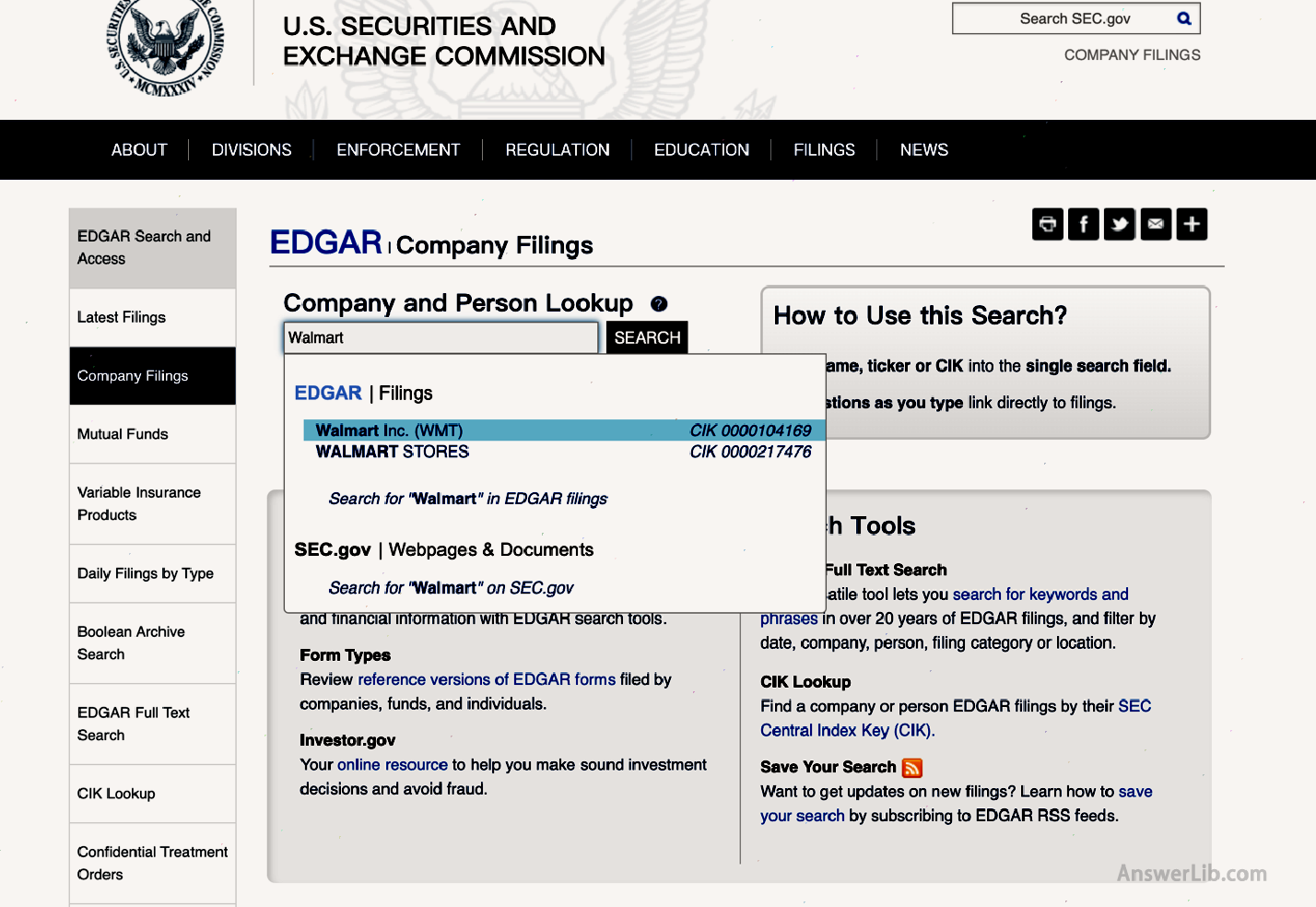

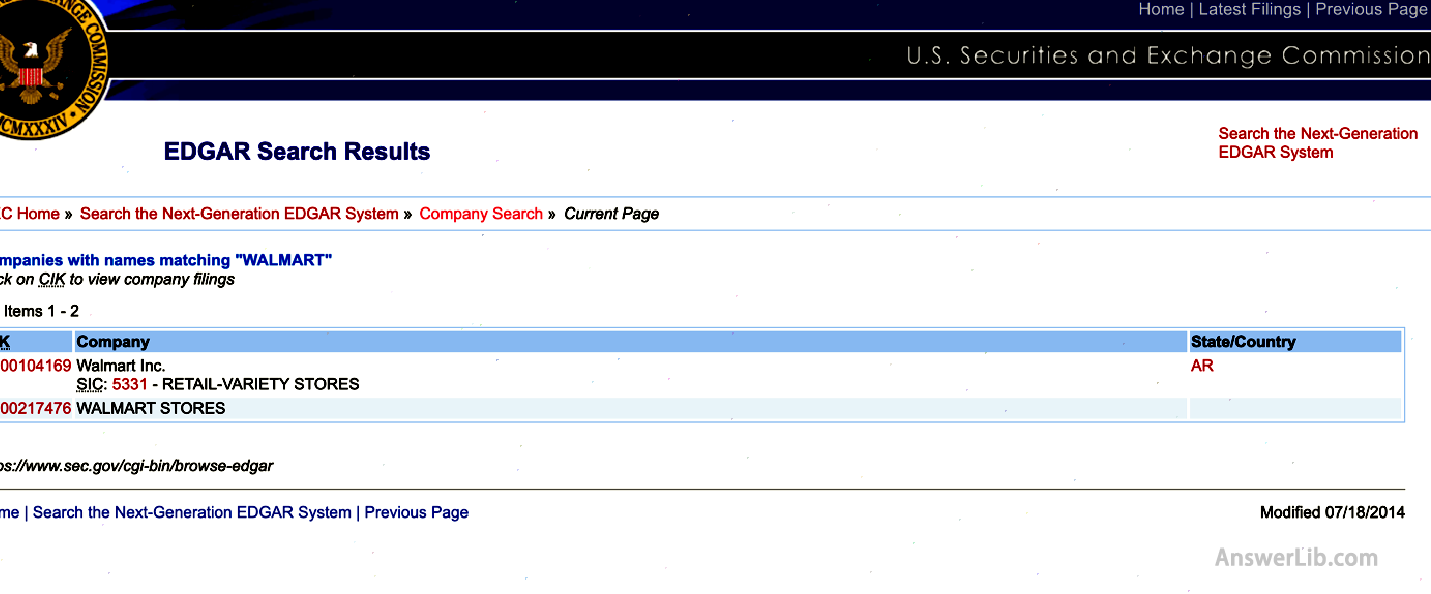

Step 3: In the search bar in the middle of the page, you can search for the target company by entering the company name or stock code.Here was an example of searching wlamart as an example:

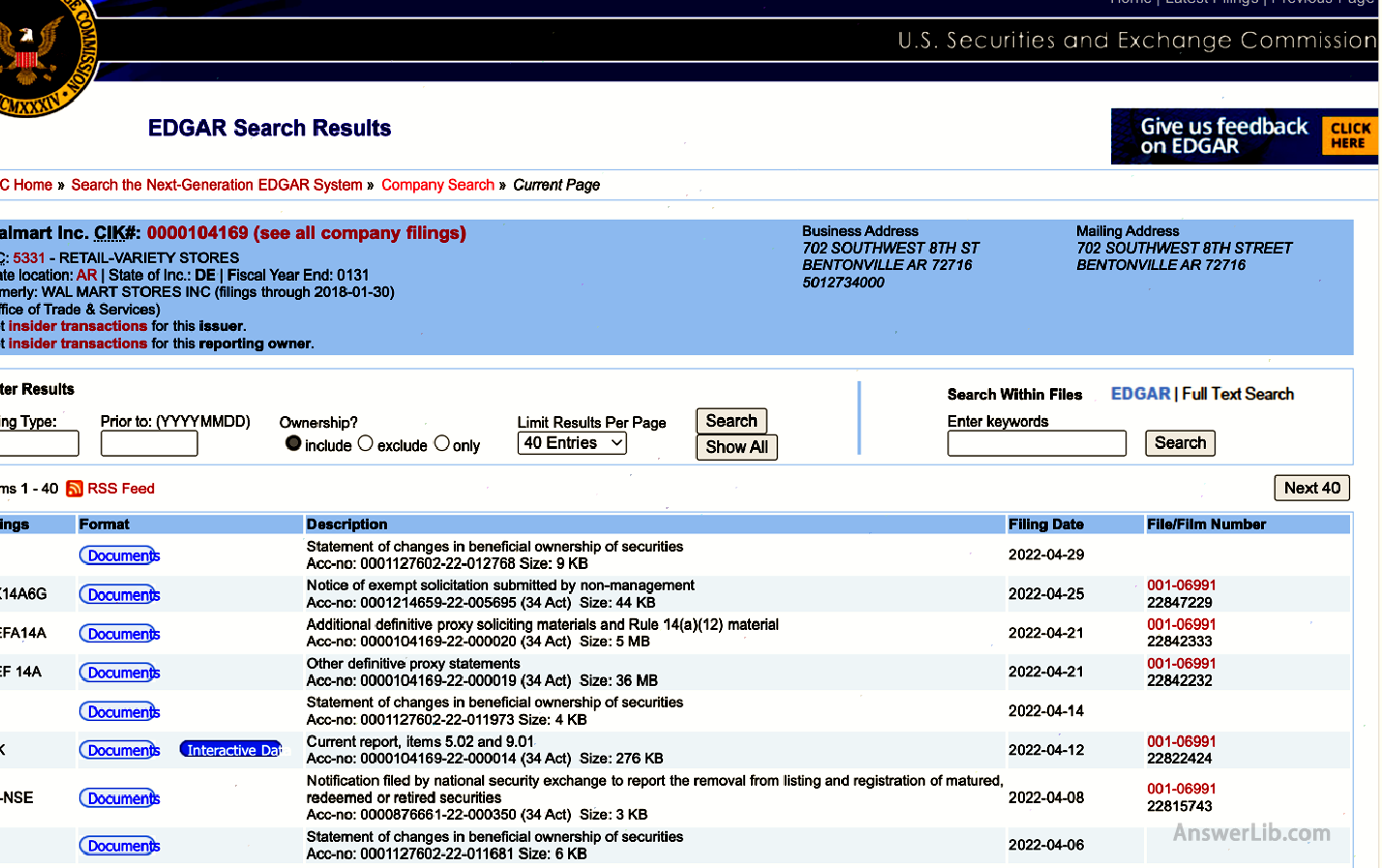

Step 4: Enter the link of the target company to enter its information form page:

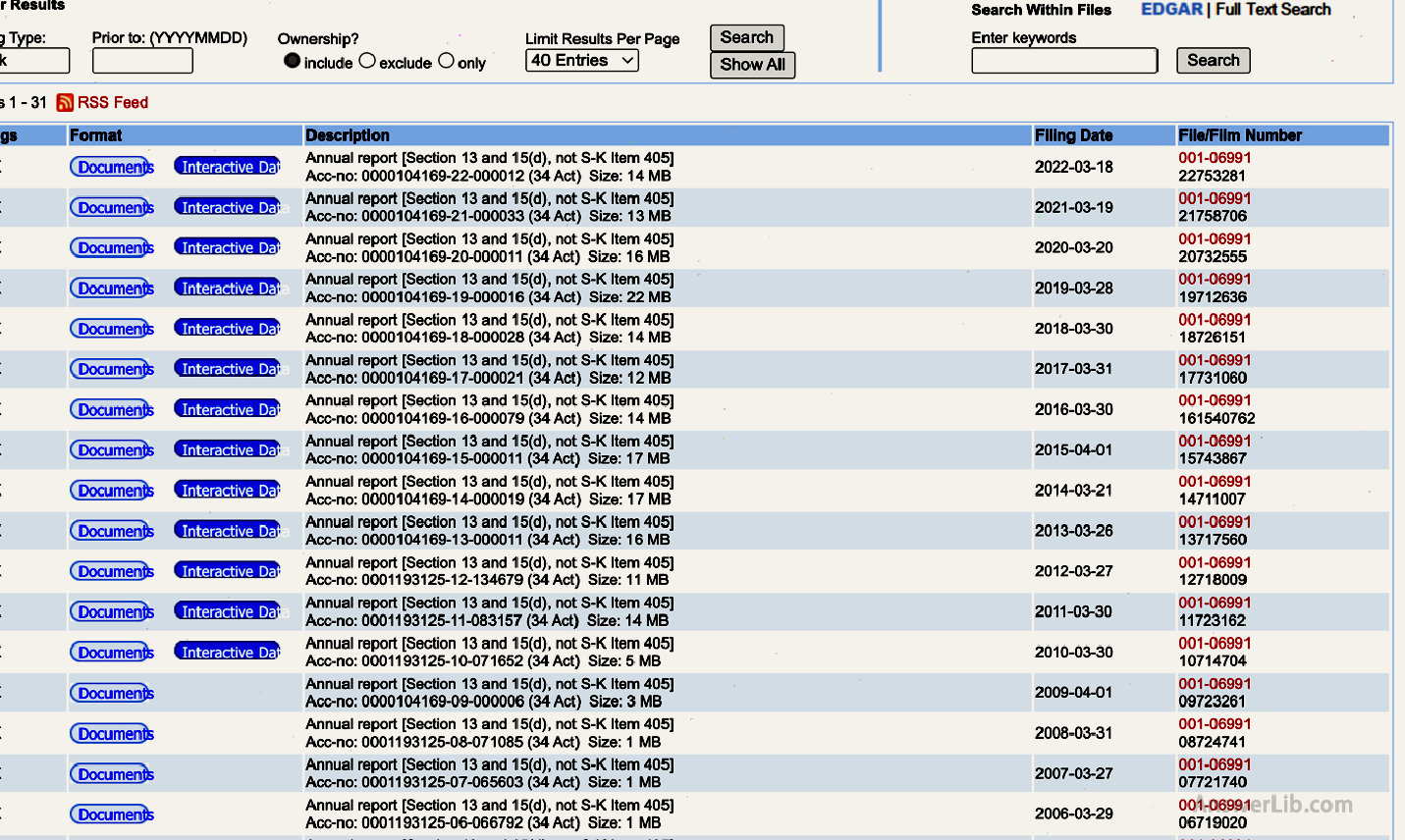

Step 5: In the information form page, it contains all the financial reports submitted by the company.When a specific financial report is required, you can enter 10 – k in the fast search bar aboveView the financial report submitted by the company at the designated year:

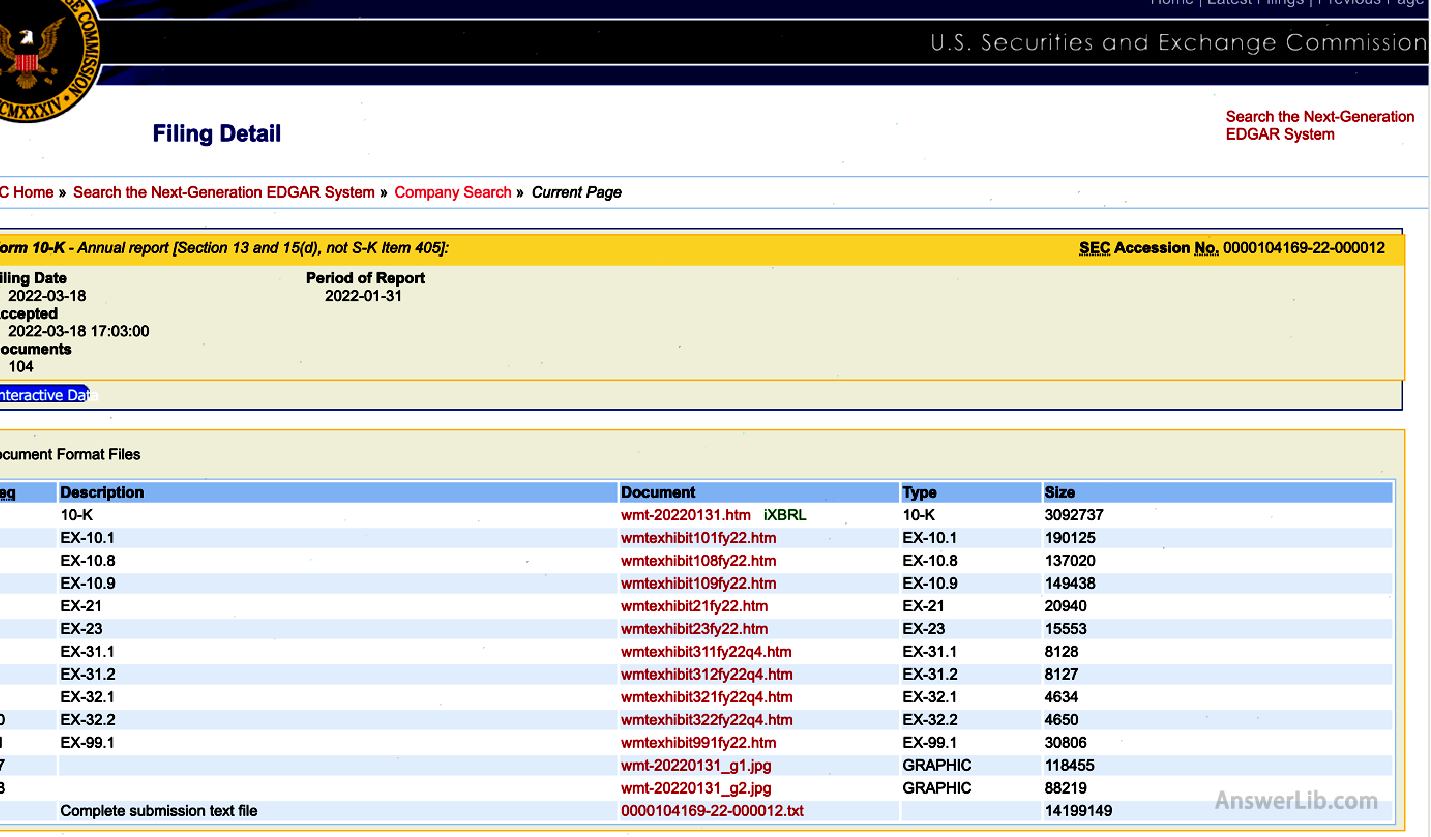

Step 6: Click the “10-K” connection of the required years to enter the link page of a variety of files.Click the “FORM 10-K” at the top to view the 10-k form of the year: Form:

What are the 10-K financial report?

10 -K as the company’s most important financial report, summarizes the changes in the company’s finances in the entire financial year, and all of them are audited numbers.They have high credibility and accuracy.In addition to business conditions, 10 – K, 10 – K, 10 – KThe form will also be recorded in the year of the financial year.The company’s analysis, discussion, and risk factors discussions this year are the most important financial report for investors.

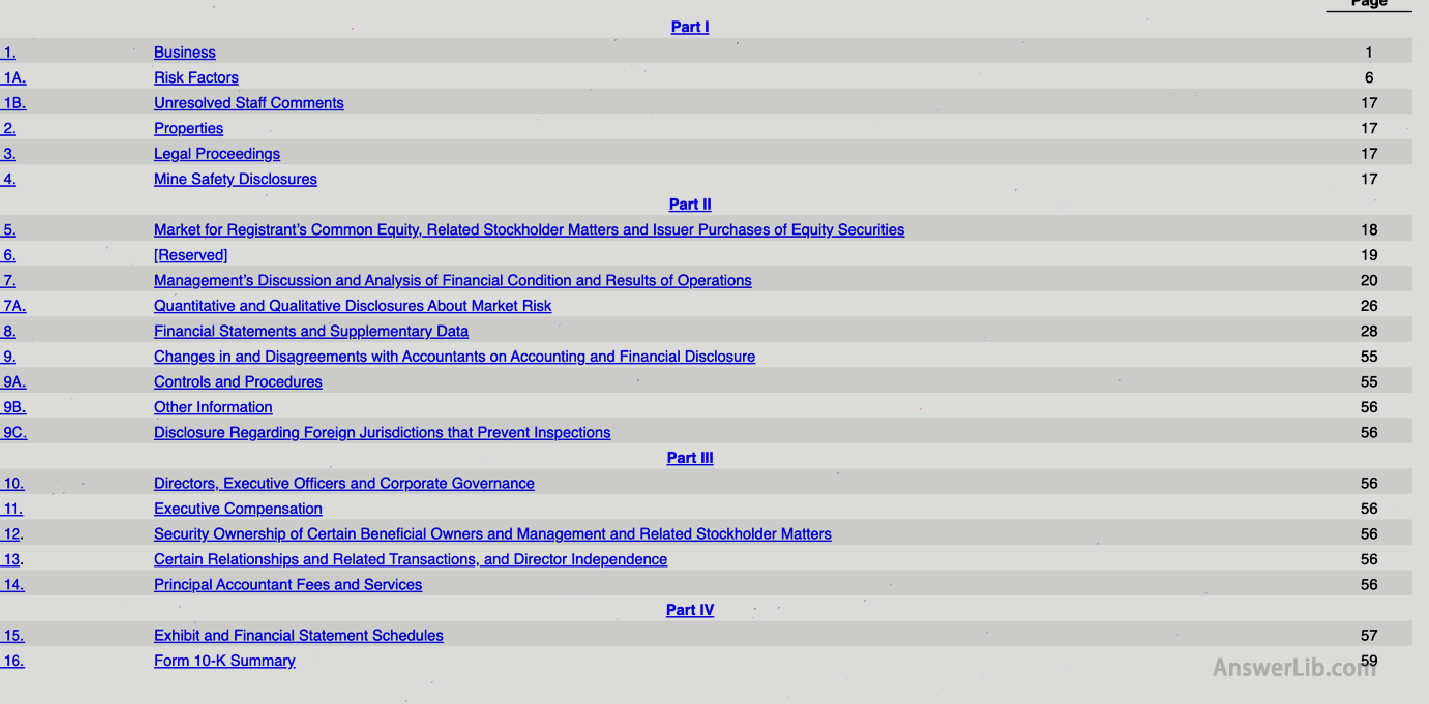

The 10 -K financial report mainly includes four parts, including 15 sub-projects.Take Apple’s latest 10 -K financial report as an example:

Part 1 (Part I)

It mainly summarizes the company’s operating overview, product and/service content in the previous financial year.At the same time, it also lists the risk factors related to the company’s business in the current and future operations.

At the end of the first part, Form 10 -K lists the company’s property held and the legal cases that are currently not yet over for the company’s property.

Part I content is as follows (take AAPL as an example):

Part II (Part II)

Part II is the most important part of Table 10 -K.

This part discloses all audited financial data that needs to be reported to the public, including the current number of shares issued, including multiple financial data reports including comprehensive business reports, profit and loss sheets, balance sheets, shareholders’ equity sheets, cash flow sheets, etc.Essence

At the same time, it will also disclose the management of the management of the company’s financial situation, the discussion and analysis of business results in the past financial year, and the quantitative and qualitative information of market risks.In addition, this part also includes the company’s supervision and supervision and supervision of supervision and supervision.Information disclosure.

Part III (Part III)

Part III mainly disclosed the relevant information of the company’s management and the board of directors, including its personal background information, work experience, salary status, the number of companies occupied by the company (if.)Qualifications, salary, etc., so that the company’s internal operators are more transparent.

Part 4 (Part IV)

The last part mainly includes the “Exhibition, Financial Statement Supplementary Form”, including the reference and links of important financial information contained in the document, the company’s articles of association, the copy of the important contract, and the statement of disclosure of the real and effective statement of the data in Table 10 -K.wait.In addition, like Apple, it can also increase the additional information that the company thinks needs to be disclosed to the public in this part, such as “10 -K Form Abstract”, so as to make financial data more complete and transparent.

How to read 10-K financial report?

10 – K’s financial report is usually very comprehensive.When making the company’s investment value judgment, you can focus on viewing Item 1, Item 7, and Item 8.

Let’s introduce the 10-K financial report by item by item:

Item 1: Business (business)

It mainly describes the company’s business, including its main products and services, currently owned subsidiaries and markets.At the same time, it may also include the recent incidents of the company, the competition facing the company, the laws information suitable for labor issues, and special operating costs or seasonal factors.

Investors can quickly understand the company’s background, and their products and services.For example, in the 10-K format of AAPL, some of the content of some Item 1 are as follows:

The Company Designs, Manufactures and Markets Smartphones, Personal Computers, Tablets, Wearables and Accessories, And Sells A Variety of Relates.The Company ’S FISCAL Year is the 52-or 53-Week Period that Ends on the Last Saturday of September.

source: SEC

Item 1A: RISK FACTORS (risk factor)

This part mainly includes the most important information suitable for the development of the company’s development or its securities transaction.Companies usually list different risk factors in the order of importance.In actual use, the content of the information is mainly aimed at the risk itself, not the company’s way or plan to deal with risks.The types of risks include risks from the entire economic environment, risks from the company’s internal operations, or potential risks of individual parts.

For example, in AAPL’s 10-K form, some of which the content of Item 1A is as follows:

“The Company ’s Business, Results of Operations and Financial Condition, As Well as the Price of the Company’ s Stock, have ben adverseed and cored in the fut URE be materly adversely aFFECTD by the Covid-19 pandemic.“

source: SEC

Item 1b: Unresolved Staff Comments

This part requires the company to explain certain comments on the previously submitted reports received from the SEC staff, mainly due to some comments that have not been resolved or answered after a long period of time.

Investors can check whether the company’s question or problem left by the US Securities and Exchange Commission has not been resolved.

In item 1, a company marked as “None” is usually a company with good operation.The financial reports they provide usually have no problems, or once they receive questioning from the US Securities Management Commission, they can quickly provide answers to ensureThe accuracy of financial reports.

Item 2: Properties (attribute)

This part mainly states the information related to the company, such as the basic situation of the company’s head office sitting on the ground, the main factories and mines owned by the company.

For example, in AAPL’s 10-K form, the content of Item 2 is as follows:

The Company’s Headquarters Are Located in Cupertino, California.AS of September & Nbsp; 25, 2021, The Company Owned or Leased Facilities and Land For Corporate Func Tions, R & D, Data Centers, Retail and Other Purposes at Locations Throughout The U.S.And in Various Places Outside theU.S.The Company Beelieves its Existing Facilities and Equipment, which are used by all reportable segments, are in good operationing content and are suritable for the confor.uct of its business.

source: SEC

Item 3: Legal Proceedings (Law Litigation)

This part discloses major or other litigation information that the company has not yet resolved, except for ordinary lawsuits.

For example, in the newly released AAPL10-K financial report in September 2021, item 3 lists a lawsuit against Apple:

EPIC Games, INC.(“EPIC”) Filed A Lawsuit in the U.S.Distribict Court for the Northern district of California (The “Northern California Distriburt”) Against T.He Company Alleging Violatives of Federal and State Antitrust Laws and California’s Unfair Competition Law Basedupon the company’s operation of ITS App Store.The Company Filed A COUNTERCLAIM for Breach of Contract.On sectionmber 10, 2021, The Northered California Distribired Count Ruled In Favor of the Company with Respect to Nine Out of the Ten Counts Included in Epic’s Claim, And in favor of the company with resin to the company’s class for break.Pany’s App Store Review Guidelines Violat California’s Unfair Competition Law and Issued An Injunction.FILED A Cross-APPEAL and is Seeking A Stay of the Injunction Pending Appeal.

source: SEC

Item 4: MINE SAFETY DISCLOSURE

If the company’s business involves mine, it is necessary to disclose whether the company strictly abides by the Mine Act related to the safety of the mine.

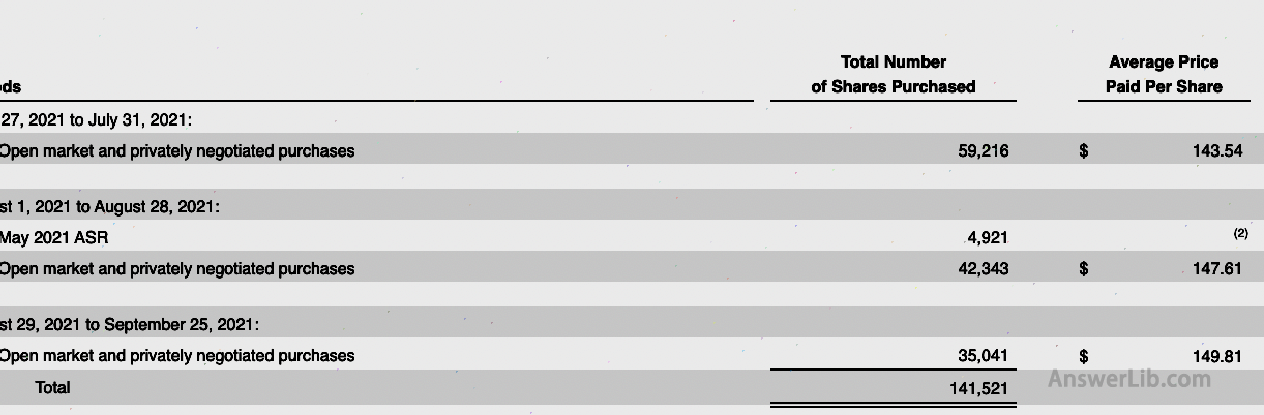

Item 5: “Registered ordinary, relevant shareholders’ information and share capital repurchase”

This part discloses the information of the company’s stock capital, including market information, the number of shareholders, dividends, company repurchase stocks, and market performance of the company’s stock.

For example, for AAPL, ITEM 5 shows the number of shareholders of Apple:

As of October & Nbsp; 15, 2021, there was 23,502 shareholders of record.

source: SEC

At the same time, Item 5 shows the specific situation of Apple’s repurchase stocks:

Item 6: reserved (reserved)

This part is reserved, generally not used for use

Item 7: Management ’s discussion and Analysis of Financial Condition and Results of Operations

ITEM 7, referred to as MD & A for short, mainly discloses the company’s view of the company’s annual operating results of the previous fiscal year.You can understand the development history and profitability of the company’s business through the company’s analysis and comments of the past.Obtain more complete risk qualitative quantitative analysis, thereby combining the company’s past and future risks, roughly made a preliminary judgment on the company’s investment value.

This part is often included:

- The company’s past fiscal year’s operation and financial performance, including the company’s capital liquidity and capital information, may have a significant impact on the company’s performance, which may have a significant impact or uncertainty.Measures taken to solve these risks;

- Compared with the previous fiscal year, the company’s performance has undergone major changes;

- Important accounting judgments, such as the estimation and assumptions of future financial conditions, these accounting judgments will have a significant impact on the numbers in the financial statements, such as assets, costs and net income.

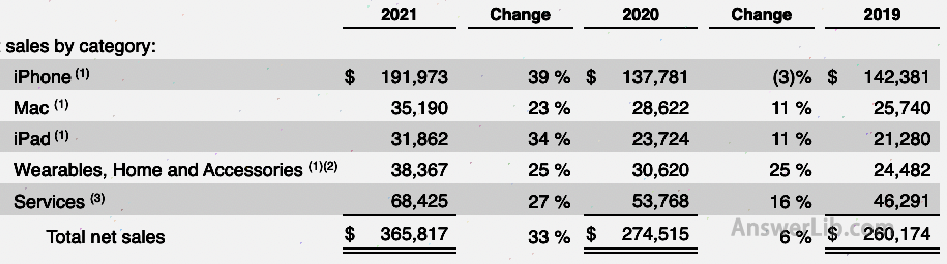

For example, for Apple’s 10-K financial report, some of its ITEM 7 are shown below:

Total Network 33% or $ 91.3 Billion During 2021 Compricd to 2020, Driven by Growth in All Products and Services Categories.Year-Over-Year Network Sales Durin G 2021 Also Grew in Each of the Company ’s Reportable Segments.

In April 2021, The Company Annound An Increase to ITS CURRENT SHARE Repurchase Program Authorization from $ 225 Billion to $ 315 & nbsp; Billion and Raise It s quarterly divided from $ 0.205 to $ 0.22 Per Share Beginning in May 2021.During 2021, The Company Repurchaset $ 85.5 Billion of itsCommon Stock and Paid DividEnds and DIVIDEND EQUILENTS of $ 14.5 Billion.

source: SEC

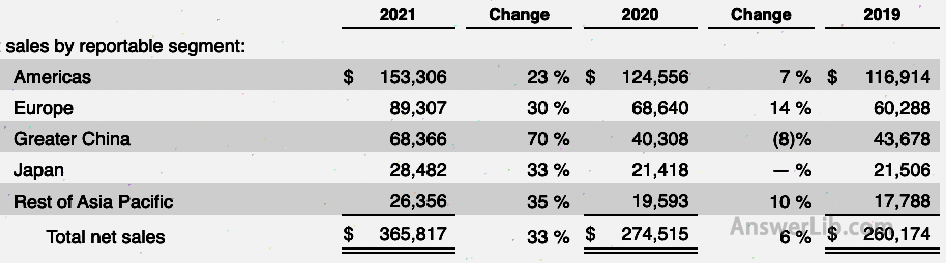

This part also lists the sales of Apple products and services in detail:

And the sales of Apple products in the world or country:

Item 7a: Quantitative and Qualitative Disclosure About Market Risk (quantitative and qualitative disclosure of market risks)

In this part, listed companies will disclose information on market risks they face, such as interest rate risk, foreign exchange risk, commodity price risk or stock price risk.

For example, in the Item 7A of 10-K financial reports in September 2021, Apple lists the risk of US interest changes and foreign exchange changes.

Item 8: Financial Statements and Supplementary Data (financial statements and supplementary data)

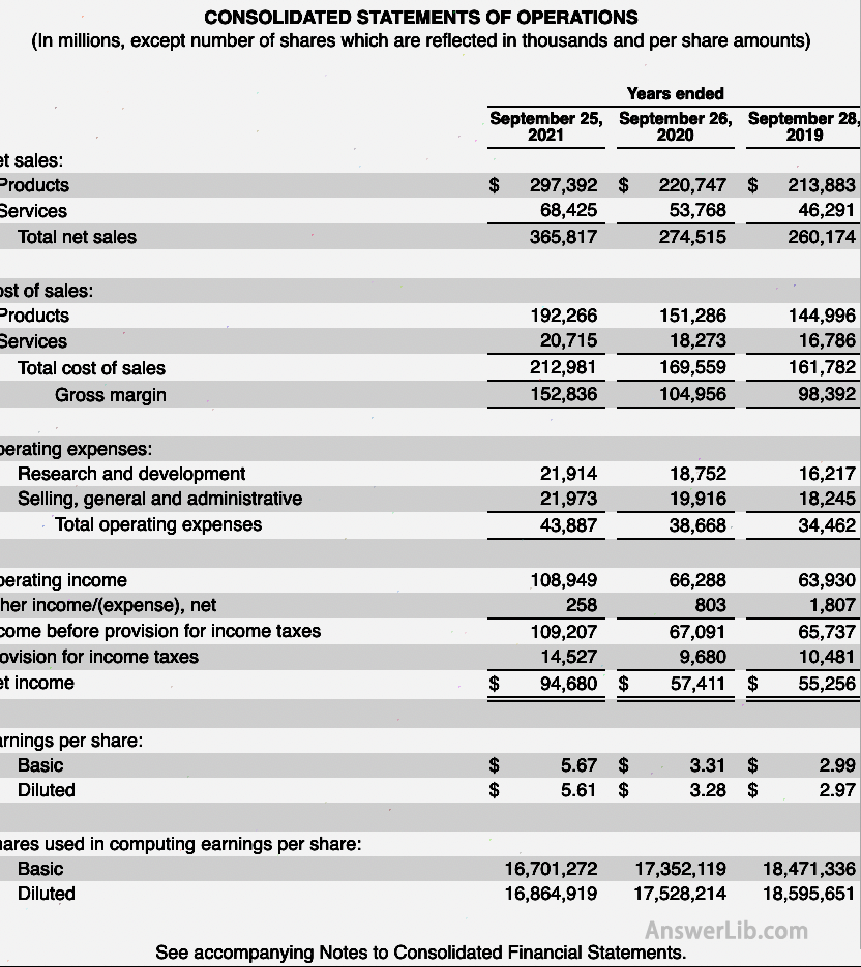

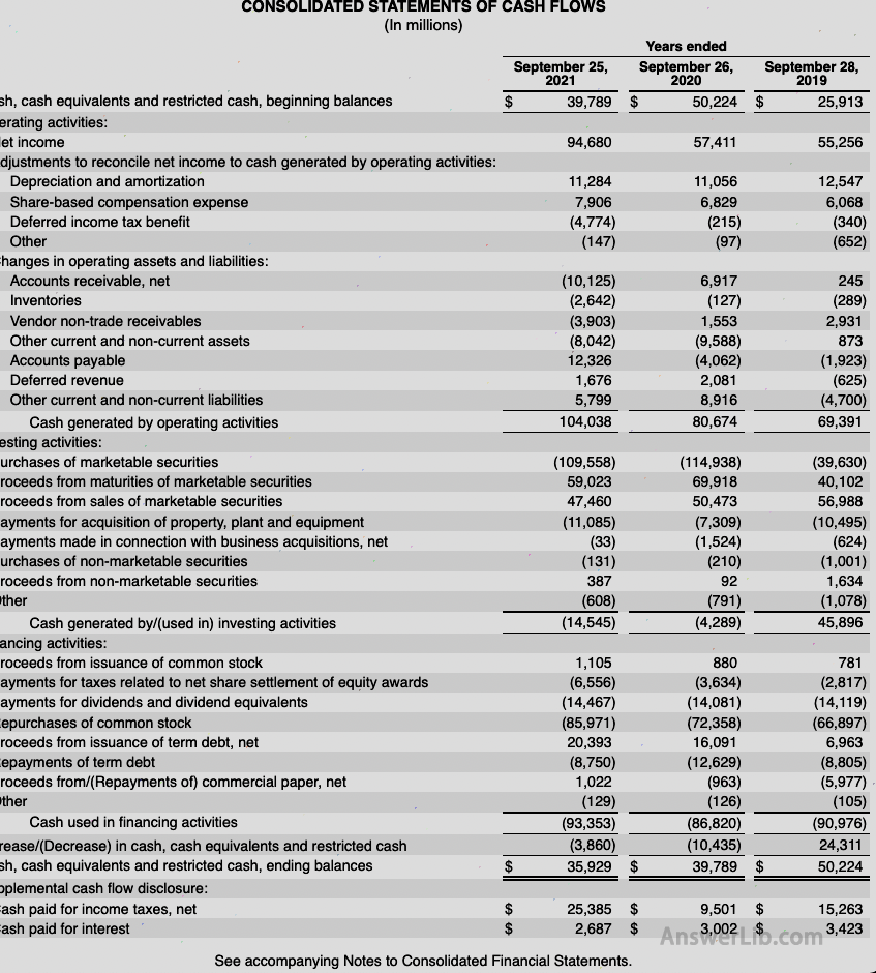

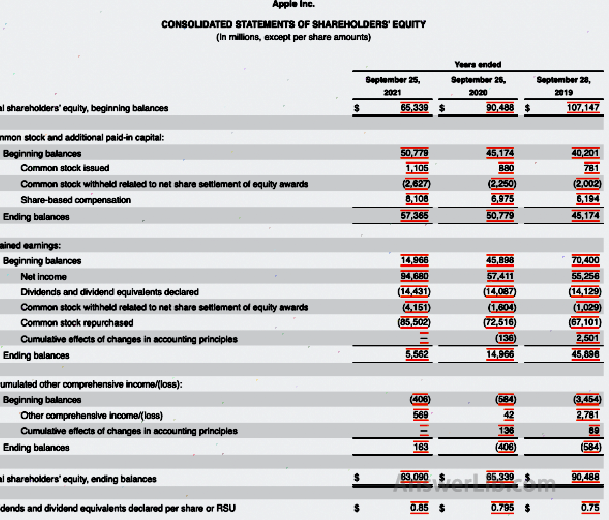

It can be said to be the most important part of this 10-K financial report.It provides multiple financial statements that have been audited, including the company’s Profits(Also known as the income table or operation table), Balance sheet As well as Cash flow sheet And shareholders’ equity table.In the report, compare the financial data of the past year or two years in the report, and use the data to calculate the company’s profit ratio, such as asset yields, equity yields, capital return rates, etc.The dimension evaluates the company’s investment value.

All financial statements provided in 10 – k must submit their financial statements based on a set of accounting standards, conventions, and rules called generally recognized accounting accounting principles (GAAP).

For most audit reports, auditors will indicate that the financial statement of the company is fairly reflected in the company’s financial status in accordance with the recognized accounting principles.However, if the auditors marked the “qualify opinion” or “Disclaimer of Opinion”, investors should check the reason carefully.

After checking these financial statements, investors should find a statement signed by the company CEO and CFO in the attachment to ensure the accuracy and integrity of the 10 -k form.

In addition to the above information, in some companies, investors may also find “non -GAAP financial indicators”, which means that these numbers do not meet the general recognition of accounting principles.While providing these data, the company must indicate that its general accounting principles and some have some accounting principles and there are some accounting principles.What is different, and investors need to weigh the weight of the company’s finances measured by non-recognized non-recognized accounting principles.

Below is the profit form of Table 10-K in September 2021.The profit statement shows the profit or loss of listed companies, including important information about companies such as gross profit, business profit, net profit, etc., and is an important source of data for analyzing the company’s profitability.

Below is the asset-liability statement of 10-K forms announced by Apple in September 2021.The balance sheet shows the assets (Assets), liabilities, and Sharesholder ’s Equities of listed companies at a certain time node.

Below is the cash flow table of 10-K forms released by Apple in September 2021.The cash flow table shows the specific situation of the cash inflow and expenditure of listed companies.

Below is the shareholders’ equity form of Table 10-K in September 2021.The shareholders ‘equity statement shows the changes of shareholders’ equity within the year.

Item 9: CHANGES in and Disagreements with Accountants on Accounting and Financial Disclosure

Item 9 mainly discloses the information of the company’s replacement of accountants and any differences between the company and the accountant.Because under normal circumstances, accountants audit and produce financial statements based on the most fair standards.Therefore, if there are too many contents of this part, it means that there are more differences between the company’s accountants, which usually means that the accuracy of the financial report is accurate.The decline is a unhappy signal.

Item 9A: Controls and Procedures (control and program)

Item 9A mainly discloses the company’s process of collecting and reporting financial report information.

Item 9B: Other Information (other information)

Item 9B is generally used to disclose, and in the fourth quarter of the fiscal year, it should be disclosed in the 8 -K but not disclosed.

Item 9C: Disclosure Regarding Foreign JurisDictions that Prevent Inspects

Item 9C is generally used to disclose the situation of foreign judicial jurisdiction hindering financial report review.For most companies, this one is not applicable.

Item 10: Directors, Executives and Corporate Governance (Director, Executive Officer and Company Management)

Item 10 disclosed the background and experience of the company’s directors and executive officers, the company’s moral norms, and some qualifications of directors and board committees.

Although 10-K requires disclosure of this information, most companies will provide relevant information in a separate file that is called a proxy statement to meet this requiredocument.If the information is provided by the proxy statement, the 10-K will include the company’s statement, that is, it is being quoted the information in the merged agency statement.

Item 11: Executive Compensation (executive salary)

ITEM 100 disclosed the company’s salary policy and plan in detail, as well as the salary amount paid to the company’s senior managers over the past year.

The company can also meet this requirement by providing relevant information in a separate file it is called proxy statement, and the company provides the document to its shareholders at the annual conference.

Item 12: Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

Item 12 discloses the shares held by the company’s directors, managers and some major shareholders and the share information covered by the equity compensation plan.

The company can also meet this requirement by providing relevant information in a separate file it is called proxy statement, and the company provides the document to its shareholders at the annual conference.

Item 13: Certain Relationships and Related Transactions, and Director Independence

Item 13 discloses the relationship between the company and its family members, managers and their family members, and will also provide information about whether each director of the company is independent.

The company can also meet this requirement by providing relevant information in a separate file it is called proxy statement, and the company provides the document to its shareholders at the annual conference.

Item 14: Principal Accountant Fees and Services (Chief Accountant fee and service)

ITEM 14 disclosed the various service fees paid by the company to accounting firms.

The company can also meet this requirement by providing relevant information in a separate file it is called proxy statement, and the company provides the document to its shareholders at the annual conference.

Item 15: exhibits, Financial statement schedules

ITEM 15 provides a list of attachment and attachment of a variety of financial statements, such as the attachment tables of some financial statements, the company’s articles of association, the copy of the material contract, the list of subsidiaries owned by the company, and the list of subsidiaries.

What is the difference between annual report and 10-K financial report?

Annual report, English is Annual Report.It is a promotional publication produced by the company, such as a booklet.The expression method provides more friendly reading compared to Tables such as more graphics and photos.

In the annual report, the company’s development history is usually briefly described, and a letter from the chairman may be attached, and then the company’s business data sheet will be provided in the previous financial year.Disclaimer to express the authenticity and reliability of the data table.The annual report does not have strict production time limit.It is usually completed in the annual shareholders’ meeting or before the board of directors.After the annual report is completed, it is directly handed over to directors, investors and customers.More functions to highlight and promote the company’s advantages.

| annual report Annual report | 10 – K financial report 10 – k report |

|---|---|

According to the company’s own arrangements, it provides corporate information including the company’s historical review, an overview of the operation of the previous financial year, and some important financial data tables. | Provide the corresponding details according to the content distribution of the standard 10 -k. |

Will use more and more visual description methods to use photos, graphics, etc. | Usually use only sentences, numbers and forms to express |

It is a publication that the company prepares for customers and investors with the company’s annual lesson as the main content | The information and data report provided for investors and analysts |

Annual report only provides on the company’s website | 10 – K financial report can be obtained on the SEC official website, and the financial portal website of some companies can also be obtained |

Each year, before the shareholders’ meeting or the board of directors, it is completed and distributed to shareholders or customers | According to the company’s different scale, it must be submitted to SEO within 60 to 90 days after the end of the fiscal year |

More company valuation

- Julian Roberts – Julian Robertson: Father of Tiger Baby

- Explore the 24 first-level dealers of the Federal Reserve

- Important Finance and Investment News

- What is a corporate value multiple?Enterprise Multiple

- What is preferred stock?Preferred stock

- What is the operating leverage coefficient?Degree of Operating Leverage

- What is debt repayment payment rate?DEBT Service Coverage Ratio

- What is capital expenditure?Capital Expendital

- What is the capital asset pricing model?Capital Asset Pricing Model

- What is financial leverage coefficient? Degree of Financial Leverage