Interest coverage ratio, English is the Interest Coverage Ratio, referred to as ICR, is one of the most important financial indicators of the company.Through the ratio of the company’s income and the interest required to pay the repaid debt, the company’s ability to pay debt interest is measured.It has certain reference significance outside.So, how to calculate the interest guarantee multiple?How to use it?

Bleak American broker:Transparent securities| | Futu Securities| | Microex Securities| | Tiger securities| | First securities| | Robinhood in| | American Langshang Daquan

Directory of this article

- What is the interest guarantee multiple?

- How to view the company’s interest guarantee multiple?

- Interest guarantee multiples are suitable for analysis of which industries?

- How to use interest guarantee multiple to guide investment?

- Is the interest guarantee multiples good or low?

- Interest guarantee multiples of various industries in the United States

- More investment and financial management

What is the interest guarantee multiple?

The interest guarantee multiples are mainly used to measure the ability of a company to pay debt interest.Its English is the Interest Coverage Ratio (ICR) or Times Interest Earnet (TIE).

The ratio of interest guarantee multiple is the ratio of the pre-tax profit (EBIT) to the interest expenditure (Interest Expense) for a period of time.The calculation formula is as follows:

Interest guarantee multiple = pre-interest taxation profit / interest expenditure

Interest COVERAGE RATIO = EBIT / Intert Expense

Among them, the English profit before interest tax is EARNININGS BeFore Interest and Taxes (EBIT, and interest expenditure is the sum of interest on all borrowings including bonds, loans, credit quotas, etc.

EBit = net intert + interest expense + tax expense

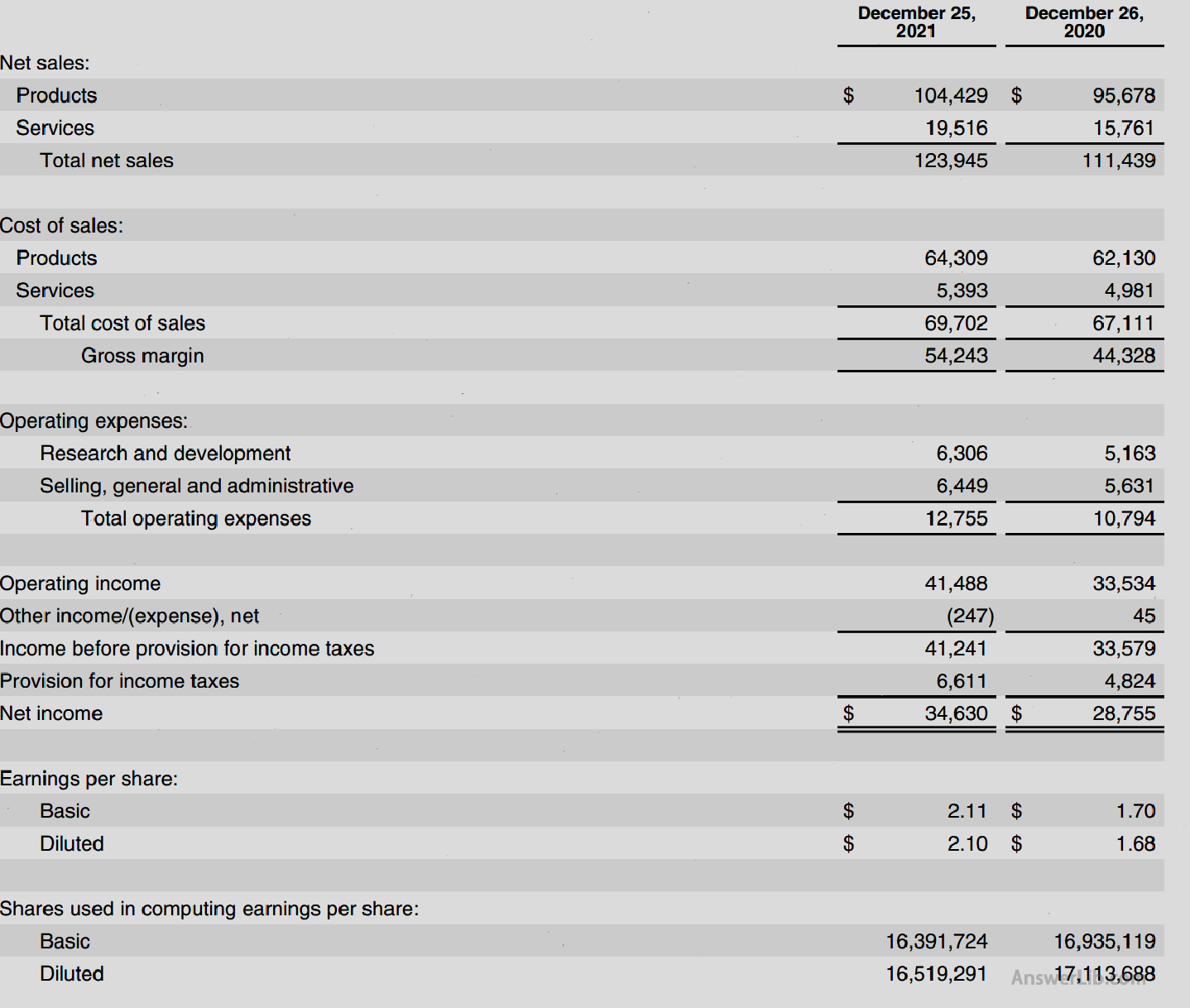

In some cases, you can also use Operating Income instead of EBIT.The two are close to the final ICR calculation value.The following data released by Apple Inc.The latest 10-K format data as an example:

It can be seen from the table that in the quarterly financial statements as of December 25, 2021, Apple Inc’s Net Income is $ 34,630m, TAX Expense is $ 6,611m, the Internet Expense is $ 694m, and Operaating Income is $ 41,488M

Use EBIT calculation as:

ICR = (Net Income+TAX Expense+Interest Expense) / Interest Expense

= ($ 34,630m+$ 6,611m+$ 694m) / $ 694m = 60.425

Calculate with Operating Income as:

Ice = Operating Income / Interest Expense

= $ 41,488m / $ 694m = 59.780

For the company, the interest guarantee double value can indicate one of the indicators of the company’s financial status.You can quickly understand the company’s current financial situation.The interest guarantee double value of the change means that the company’s operations have problems, or changes have occurred.The interest guarantee double values are used as one of the company’s operating status reference value, which can provide a certain guiding role for the company to maintain or change the operating strategy.Generally speaking, the trend of maintaining a relatively stable and rising ICR value is a symbol of a benign operation of a company, and the decline trend or too low value means that the company’s profitability has problems.

For outsiders, interest guarantee double values and interest guarantee double value fluctuations in different time periods can help investors and loan lenders make judgments on the profitability and debt repayment capacity of the enterprise to finally make the most most the most.Safety investment decision.Investors are usually more willing to invest in companies with higher ICR values in the same industry, because this usually means that the company’s profitability is determined, and it has sufficient capabilities to pay interest to repay debts.

The interest guarantee double value has a certain limitations when used.

首先在数值上,通常采用EBIT作为分子,但EBIT不考虑税费,部分公司需要交纳高额的税款,由此会导致利息保障倍数值无法准确体现公司财务情况,针对这种情况,部分Personally use the pre-profit interest (EBIAT) as the molecule in the calculation.

According to factors such as different scale and different operating models, there are several variants of the calculation method of interest guarantee multiple:

| Other variants of interest guarantee multiple | Computing characteristics | Computing meaning |

|---|---|---|

ICR = EBITDA / Intert Expense | The profits of taxes, interest, interest, depreciation, and amortization are not deducted as molecules, but the denominator remains unchanged. | Increased interest guarantee double value is the highest among several ways |

ICR = EBIT / Intert Expense | The use of unsatisfactory interest and taxes, but removal of the profits of depreciation and amortization as the molecule, the denominator remains unchanged. | The most traditional and most commonly used calculation value |

ICR = Ebiat / Intert Expense | The profit of the income after deducting taxes and fees is used as the molecule, the denominator remains unchanged | Adjust the situation of income tax need to be paid in business profits |

ICR = (EBITDA – Capex) / Interest Expense | Do not deduct taxes, interest, depreciation, amortization, but the profit after deducting capital expenditure.Among them, Capex is the abbreviation of Capital Expenditures., Buildings, equipment or technology assets. | Get the most conservative interest guarantee double value |

Secondly, the interest guarantee multiples may be large in different industries, or different companies in the same industry, and even with different departments of the company.Therefore, it is difficult to compare the value guarantee multiple values.Or do the same part of the vertical comparison to observe its development trend.

However, under normal circumstances, in a normal operating environment, there are certain comparability among different companies in the same industry.For exampleBusiness ability.

How to view the company’s interest guarantee multiple?

You can calculate the financial data in Table 10-K in the listed company.From the first section we know, the formula of the interest guarantee multiple is as follows:

Interest COVERAGE RATIO = EBIT / Intert Expense

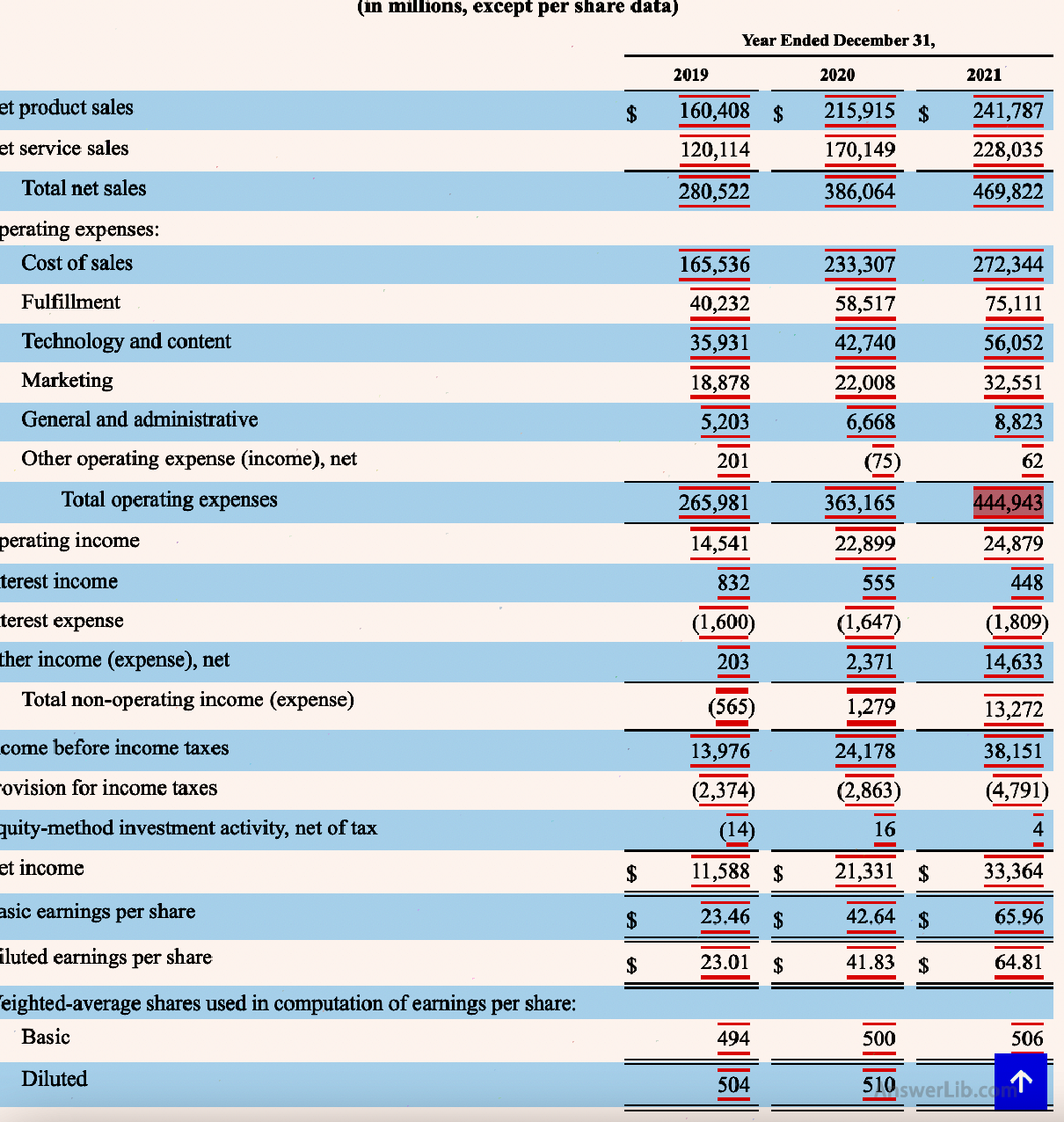

Information such as EBIT and Intert Expense can be calculated in the company’s profit statement or balance sheet.Taking Amazon’s latest 10-K table as an example, we will step up to calculate Amazon’s interest guarantee multiple.

It can be seen from the table that in the annual financial statements as of December 31, 2021, Amazon’s Net Income is $ 33,364m, TAX Expense is $ 4,791m, the Internet Expense is $ 1,809m, and Operaating Income is $ 24,879M

Use ebitit as molecular calculation

ICR = (Net Income+TAX Expense+Interest Expense) / Interest Expense

= ($ 33,364m+$ 4,791m+$ 1,809m) / $ 1,809m = 22.091

Use Operating Income as a molecular calculation

ICR = Operating Income / Interest Expense

= $ 24,879m / $ 1,809m = 13.752

When used in detail, some accountants will also use other related financial data to calculate

Calculated with Ebiat, even if the income before deducting the interest after deducting taxes is calculated:

ICR = (Net Income+ Interest Expense) / Interest Expense

= ($ 33,364m+$ 1,809m) / $ 1,809m = 19.443

Interest guarantee multiples are suitable for analysis of the industry?

The interest guarantee multiples can be applied to almost all industries, including banking, insurance, financial industry, manufacturing, service industry, and public institutional companies, but it should be noted that the interest and disadvantages of interest guarantees among different industries have comparison.Large differences.

For example, the infrastructure industry is often obtained after the project is completed because of its income and profits, and high loans will be made before the project starts, and interest has been paid since the first year.The guarantee double value is often very low, but this does not mean that the company does not have the ability to repay interest.Asset-intensive industries such as the banking industry also have similar situations.

In the start-up stage, a company is often very low.At this time, it is impossible to make accurate judgments on it through interest guarantee double values.Data to comprehensively analyze.

The other is public institutional companies such as Duke Energy, PG & E Corp, etc.They have relatively stable production and income, and they are supported by government regulations.Pay interest.

And fast-moving products such as COCACOLA, KRAFT FOODS, etc., because there are stable and high sources of income, there are not many loans required, so the interest guarantee double value is often very high.

How to use interest guarantee multiple to guide investment?

For ordinary stocks, shareholders can judge the investment value of the stock based on the volatility and trend of the company’s interest guarantee.

- If the interest guarantee double value is stable, it shows that the company is in the stage of stable and benign development, and usually has good investment value.

- If the original rising or stable interest guarantee double values have declined, indicating that the company may face liquidity problems and the ability to repay debt interest is declining.It is necessary to carefully consider the amount of investment in it.

However, for small-cap stocks, because the company represented by small-cap stocks often relies heavily on the support of funds, and the income is relatively stable as large-cap stocks.Therefore, its interest guarantee double value is low, but this does not necessarily meanThe company is about to go bankrupt and may be in a stage of rapid development, so it is necessary to combine more other information to comprehensively analyze the investment value of the stock.

Is the interest guarantee multiples good or low?

For different periods of the same industry, or the same company, the higher the value of interest guarantee, the better the company’s income capacity, the better the interest ability that has not paid the debt, and the more worthy of trust and investment.

Similarly, the lower the value of interest guarantee, the higher the debt of the company and the higher the possibility of bankruptcy.However, for those companies that have a very high value guarantee value compared to other companies in the industry, such as the interest guarantee double value of the overall industry, and a company in the industry’s interest guarantee double value of 20, it may also indicate that this house is also explainedThe company did not make full use of their income, and missed some opportunities to increase the company’s income through leverage transactions.

Because the value guarantee double value may have a large difference in different industries, different companies, and even different departments of the company.For example, the interest guarantee double value of the fast-moving industry may be tens or even one hundred, and the infrastructure industry may only be only in the infrastructure industry.For the number of digits.

Interest guarantee multiples of various industries in the United States

The following table is the average value of interest guarantee multiplication of interest guarantee in the United States from 1970 to 2017:

| industry | Average interest guarantee double value |

|---|---|

All industry total value* | 3.71 |

communication | 3.35 |

electricity | 2.49 |

Former oil manufacturing | 4.71 |

Oil mining | 3.89 |

retail | 4.25 |

Serve | 3.73 |

transportation | 2.72 |

Large cargo | 3.27 |

*All industries refer to all non-financial enterprise sectors

It can be seen from the table that except for the financial enterprise sector, the average ICR value of the remaining departments is 3.7, that is, the average profit of the pre-interest tax of these departments is 4 times the expenditure required for their interest.

Among all departments, the lowest ICR value is the power department with a ICR value of 2.49, which is the weak ability to pay for debt and interest.The highest is the pre-oil manufacturing, the ICR value is 4.71, and the interest payment is relatively stable.

At the same time, it can be seen from the difference that the ICR values between different industries are relatively significant.