Market value, English is Market Capitalization, Abbreviation Market Cap It is an important financial indicator for measuring the operation scale of a company.The market value of listed companies is to calculate the total number of circulating shares of the company at the current stock price.That is to say, the market value of a listed company will continue to change with the change of the stock price or the number of circulating shares.

The initial market value of listed companies was determined when the initial public offering (IPO) was determined for the first time.Before the first public offering, the company hired a professional investment banker to valuation of the company’s value, and then based on this value based on this valueTo determine the number of stocks and stocks sold to the public.For example, the company’s valuation is 1 billion US dollars.When fundraising for the first time, it can offer a 10 million shares of stock price of $ 100, and it can also sell 50 million shares of $ 20.

Evaluating a company’s market value is usually of great significance for investors.The financial community will also divide companies of different scale according to the company’s market value.Divide listed companies into large-cap stocks ( L ARGE-CAP, MID-CAP, Small-CAP, and Micro-CAP.Different levelsInvestment will be based on its own investment style and based on the stock category divided by the company’s market value.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- How to calculate the market value?

- How to calculate the market value of Apple?

- What is the significance of investment in market value?

- What are the limitations of market value?

- 100 companies with the highest market value

- More macroeconomics

How to calculate the market value?

The market value of listed companies is the total number of shares of the company’s circulation shares and the stock price of the stock price, namely:

Market value = Circulation stocks X stock price

Market Cap = Shares Outstanding X Share Price

in:

- The number of circulating shares is the current number of circulating shares that can be traded.The number of circulating shares can be found on the company’s 10-Q or 10-K financial reports, or it can also be found on major financial and securities websites.

- The company’s stock price will continue to fluctuate during the transaction period.You can choose a real-time stock price or choose the final stock price before the market to calculate.

During the company’s business process, the number of circulating shares issued by the company and the fluctuations of the stock price will affect the company’s market value, but when the company conducts shares or splits, it will not affect the company’s market value.

Because when the company has a share division or split, the stock price will be adjusted accordingly due to the increase in the number of shares.For exampleIn the company’s market value calculation formula, the number of circulating shares doubles, and the stock price is halved, that is,:

New company market value = 2 x (the number of company original circulation shares) X ½ (company original stock price) = company original shares of the company

It can be seen that splitting or dividing stocks will not affect the company’s market value.

how Calculate the market value of Apple?

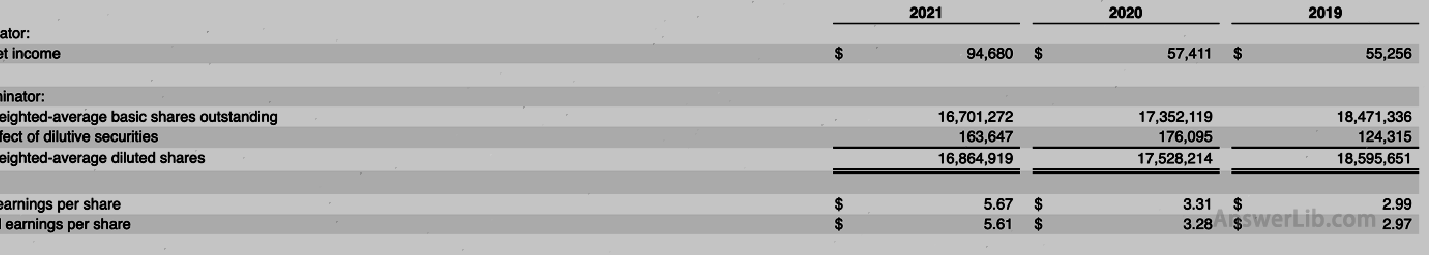

This chapter will be released by Apple in September 2021 10-K financial report Calculate the instance:

AAPL Financial Report The number of circulation shares in China is as follows:

It can be seen from the data table:

Apple’s current circulation shares are (16,701,272 x 1000) shares;

AAPL’s latest stock price is: $ 147.11;

Therefore, the current market value of Apple is:

Market value = Circulation Stocks XP price

Market Cap = Shares Outstanding X Share Price

= 16,701,272 x $ 147.11

= $ 2.46 trillions

What is the significance of investment in market value?

The significance of market value is to measure the company’s current market value, because it is difficult for investors to judge the company’s investment value based on the stock price.

The two companies with the same stock price may have obvious value differences.For example, the stock price of the company A and the company B both is $ 40, the number of company A currently circulates 1,000,000 shares, and the number of company B current shares is 2,000,000 shares.The market value of the company A is $ 40,000,000, and the market value of company B is $ 80,000,000.Therefore, the market value of company B is twice that of the company A.Therefore, the product of the stock price and the number of circulating shares can be used to evaluate the investment value of a company.

According to the company’s market value, listed companies are divided into several main levels: large-cap stocks, medium-cap stocks, small-cap stocks and microcrolered stocks.

| Large-cap stock Large-cap | Medium-cap shares MID-CAP | Small-cap stock Small-CAP | Micro-stock Micro-CAP | |

|---|---|---|---|---|

Market value | More than $ 10 billion | 2 billion to $ 10 billion | 300 million to $ 2 billion | 50 million to 300 million US dollars |

Company characteristics | Production provides high-quality products or services; Excellent records of continuous payment of dividends for a long time; Have a relatively stable growth rate; It is a more mature company in the same industry; | It is a relatively mature company in the industry; The company is experiencing or expected to enter the period of rapid growth; | It is a young emerging company in the industry; The company’s development is easily affected by the commercial or economic environment; During the development process, it was easily affected by the competition of other emerging companies; | Emerging companies in the industry; At the beginning of the development, the dependence on the market environment is high, so it is more likely to be affected by the market and economic environment; |

Investment characteristics | Investment income is more stable; The growth rate will be relatively small; | Investment risks and income are slightly higher, but less than small-cap stocks; | The investment risk is higher than the mid-cap shares; Because there is a high growth space, it may also generate high returns; | Generally, the stock price of these companies is very high, so investors may face higher investment risks and investment income; |

On behalf of the company | Apple Inc.(AAPL), Amazon.com Inc.(AMZN), EXXON MOBIL CORP.(XOM) | Eagle Materials Inc., AVIS Budget Group, Inc.(Car), Antero Resources Corporation & Nbsp; (AR) | HOVNANIAN ENTERPRISES Inc.(HOV), Agios Pharmaceuticals Inc.(Agio), Shenandoah Telecommunications Co.(shen) | Astronova (Alot), EUROSEAS (ESEA), Fat Brands (FAT) |

What are the limitations of market value?

According to the calculation method of the market value, it can be seen that market sentiment and investor concept will directly affect the company’s stock price, which will affect the market value.of.

The market value cannot reflect the company’s debt capacity, profit and loss ability, etc.Therefore, if you want to evaluate the operation level of a company, you need to combine more data to analyze the company’s fundamentals to make more reasonable and comprehensive assessment.

Although it measures the cost of purchasing all shares of the company, the market value is not determined by the company’s acquisition cost in mergers and acquisitions transactions.The better way to calculate the price of direct acquisition of corporate prices is corporate value.

100 companies with the highest market value

The following data is the data of May 2022:

| Listed company | Stock code | Market value | Belonging country |

|---|---|---|---|

Saudi aramco | 2222.SR | $ 2,521 B | Saudi |

Apple | AAPL | $ 2,381 B | USA |

Microsoft | MSFT | $ 1,953 b | USA |

Alphabet (Google) | Goog | $ 1,531 B | USA |

Amazon | Amzn | $ 1,150 b | USA |

TESLA | TSLA | $ 797 B | USA |

Berkshire Hathaway | Brk-a | $ 684 B | USA |

Meta (Facebook) | FB | $ 568 B | USA |

TSMC | TSM | $ 472 b | Taiwan, China |

Johnson & Johnson | Jnj | $ 465 B | USA |

Unitedhealth | UNH | $ 455 B | USA |

TENCENT | Tcehy | $ 441 B | China |

Nvidia | NVDA | $ 441 B | USA |

Visa | V | $ 429 B | USA |

Walmart | WMT | $ 408 B | USA |

Exxon mobil | Xom | $ 375 B | USA |

ProCTER & Gamble | PG | $ 368 b | USA |

Samsung | 005930.KS | $ 350 B | South Korea |

Jpmorgan chase | Jpm | $ 350 B | USA |

Nestlé | Nesn.sw | $ 336 b | Switzerland |

Chevron | CVX | $ 330 B | USA |

MasterCard | Ma | $ 326 b | USA |

Kweichow Moutai | 600519.SS | $ 325 B | China |

HOME DEPOT | HD | $ 306 b | USA |

LVMH | Mc.paa | $ 303 b | France |

Coca-cola | KO | $ 285 B | USA |

Bank of America | Bac | $ 283 b | USA |

Pfizer | PFE | $ 282 b | USA |

Roche | ROG.SW | $ 278 B | Switzerland |

Eli lilly | Lly | $ 277 B | USA |

Abbvie | ABBV | $ 271 B | USA |

Novo nordisk | NVO | $ 240 B | Denmark |

Pepsico | PEP | $ 240 B | USA |

Broadcom | AVGO | $ 240 B | USA |

ICBC | 1398.HK | $ 239 B | China |

Alibaba | Baba | $ 236 b | China |

Merck | MRK | $ 229 B | USA |

Bhp group | BHP | $ 226 b | Australia |

Toyota | TM | $ 222 b | Japan |

ASML | ASML | $ 221 B | Netherlands |

Costco | Cost | $ 220 b | USA |

Shell | Shel | $ 212 B | U.K. |

Thermo Fisher Scientific | TMO | $ 212 B | USA |

Reliance Industries | Reliance.ns | $ 211 B | India |

Cisco | CSCO | $ 206 b | USA |

Verizon | VZ | $ 202 B | USA |

Astrazeneca | AZN | $ 196 b | U.K. |

WALT DISNEY | Dis | $ 195 B | USA |

Abbott Laboratories | ABT | $ 192 b | USA |

Adobe | Adbe | $ 192 b | USA |

Novartis | NVS | $ 190 B | Switzerland |

Oracle | Orcl | $ 190 B | USA |

Comcast | CMCSA | $ 186 b | USA |

L’s oréal | Or.pa | $ 183 b | France |

Accenture | ACN | $ 182 b | Ireland |

Mcdonald | MCD | $ 181 B | USA |

Danaher | DHR | $ 181 B | USA |

Infel | Intc | $ 178 B | USA |

Nike | NKE | $ 178 B | USA |

China Construction Bank | 601939.SS | $ 176 b | China |

Salesforce | CRM | $ 166 b | USA |

Philip morris | PM | $ 162 b | USA |

Wells Fargo | WFC | $ 162 b | USA |

Bristol-myers squibb | BMY | $ 161 B | USA |

TATA CONSULTANCY Services | TCS.NS | $ 159 B | India |

T-Mobile US | TMUS | $ 158 B | USA |

Texas Instruments | TXN | $ 157 B | USA |

United Parcel Service | ups | $ 156 b | USA |

Linde | Lin | $ 155 B | U.K. |

AMD | AMD | $ 155 B | USA |

AgricultUral Bank of China | 601288.ss | $ 154 B | China |

Qualcomm | QCOM | $ 151 B | USA |

Union Pacific Corporation | UNP | $ 145 B | USA |

Propusus | Prx.as | $ 142 b | Netherlands |

At & t | T | $ 142 b | USA |

Morgan Stanley | MS | $ 141 B | USA |

Catl | 300750.SZ | $ 140 B | China |

Chinese Mobile | 0941.HK | $ 140 B | China |

CM Bank | 3968.HK | $ 139 B | China |

Royal Bank of Canada | Ry | $ 139 B | Canada |

Totalenergies | TTE | $ 138 B | France |

Medtronic | MDT | $ 138 B | Ireland |

Nextra Energy | Nee | $ 137 B | USA |

Raytheon Technologies | RTX | $ 137 B | USA |

Conocophillips | COP | $ 133 b | USA |

Petro China | PTR | $ 133 b | China |

Honeywell | Hon | $ 132 b | USA |

Bank of China | 601988.ss | $ 131 B | China |

Amgen | Amgn | $ 130 B | USA |

Sanofi | Sny | $ 130 B | France |

Toronto Dominion Bank | TD | $ 129 B | Canada |

Meituan | 3690.HK | $ 129 B | China |

Lowe ’s companies | LOW | $ 128 B | USA |

CVS Health | CVS | $ 128 B | USA |

Charles SCHWAB | SCHW | $ 124 B | USA |

HSBC | HSBC | $ 124 B | U.K. |

Commonwealth bank | Cba.ax | $ 122 b | Australia |

IBM | IBM | $ 120 B | USA |

American Express | AXP | $ 120 B | USA |

Unilever | Ul | $ 118 B | U.K. |

More macroeconomics

- What is the national financial status index?

- What is the Buffett index?Buffet indicator

- What is the U.S.Treasury volatility index?Move index

- What US dollar index?US dollar index

- What is a bank deposit reserve?Bank reserves

- What is an open market operation?Open Market Operations

- What is the reserve balance interest rate?Interest on Reserve Balances

- What is personal consumption expenditure index?PCE Price Index

- What is overnight reverse repurchase?On Reverse Repurchase

- What is unemployment rate?UNEMPLOYMENT RATE