Value of net flow assets, English is Net Current ASSET VALUE, Abbreviation NCAV It is a financial indicator of a listed company that generates high income capacity from mobile assets.

The value of net flow assets and net operating capital come from the Net-Net investment strategy proposed by Benjamin Graham.Graham believes that the income generated by the company’s mobile assets can display the true value of the company.Assets minus total liabilities.If the company sets up preferred shares, because preferred shares have certain contract constraints, when calculating the income of ordinary shareholders, it is also regarded as debt, that is, the mobile assets of net flow assets are the company’s mobile assets minus the total liabilities.

Net-Net investment strategy uses NCAV Per Share to valuation the company’s stock to find the cheapest high-quality company stock.However, in the calculation of the value of net flow assets, because only the mobile assets and total liabilities are used, and the data such as long-term assets are not considered, there is still certain limitations when used.

Bleak American broker:Transparent securities| | Futu Securities| | Microex Securities| | Tiger securities| | First securities| | Robinhood in| | American Langshang Daquan

Directory of this article

- Who is Benjamin Graham?

- How to calculate the value of net flow assets?

- How to calculate the value of Apple’s net flow assets?

- What is the significance of investment in the value of net flow assets?

- What are the limitations of the value of net flow assets?

- Join investment discussion group

- More investment strategies

B Who is Enjamin Graham?

Benjamin Graham was born in London, England in 1894.Later, the whole family moved to the United States and settled there.In the bank panic in 1907, Benjamin Graham’s family lost his family savings.LaterAnnual income.

But the collapse of the 1929 stock market made Benjamin Graham lose almost all assets.This time, the loss taught Benjamin Graham’s many valuable experience in financial investment, so he published it with David Dodd “Security Analysis” EssenceIn the subsequent financial investment, Benjamin Graham always adheres to the effective market principle.He believes that investors are often easy to invest irrational investment.Under the influence of various factors such as various facts and stock market fluctuations, they choose to buy an underestimated or not optimistic.Stocks will definitely provide a safe margin for investment.

In 1949, Benjamin Graham published his masterpiece “The Intelligent Investor” In the book, the personal investment view is clarified, including his believe that investors should not rely on the trading market emotions dominated by greed and fear, but should conduct their own unique analysis of stock value based on the company’s operation and financial status report.wait.The book is recognized by the investment community as the basic work of value investment.

Benjamin Graham not only shines in his own investment field, but also set up courses in many colleges.He has a professor’s investment concept and served as a professor class at Columbia Business School, University of California Los Angeles and Business School, and New York Finance College.Outstanding disciples, including the most famous Warran Buffet, Irving Kahn, and John Templeton.

How to calculate the value of net flow assets?

The calculation method of the value of net flow assets is to minus the total debt in the financial report in the listed company.If the company sets a preferred stock, it needs to subtract the preferred shares, that is,:

Right now:

Value of net flow assets = mobile assets-total debt-preferred shares

NCAV = Current Assets – Total Liabilities – Preferred Stock

in:

- For mobile assets, the value of net flow assets directly uses the total flow assets in the financial report when calculating, and there is no need to adjust the flow assets like net operating capital.

- Total debt is the same as net operation capital, and the total debt in the financial report can be used.

- Priority shares can also find the corresponding value in the company’s financial report.

When calculating the value of net flow per share, the value of net flow assets can be removed by diluted total shares after dilution, that is:

The value of net liquidity per share is = net flow asset value / diluted circulation stocks

NCAV Per Share = NCAV / Diluted Shares Outstanding

All related data calculated in the value of net flow assets can be found in Balance Sheets, the balance sheet in the company’s financial report, and the number of shares of diluted circulation can be found in the company’s comprehensive operating statement.

How to calculate the value of Apple’s net flow assets?

This chapter will be released by Apple in September 2021 10-K financial report Calculate the instance:

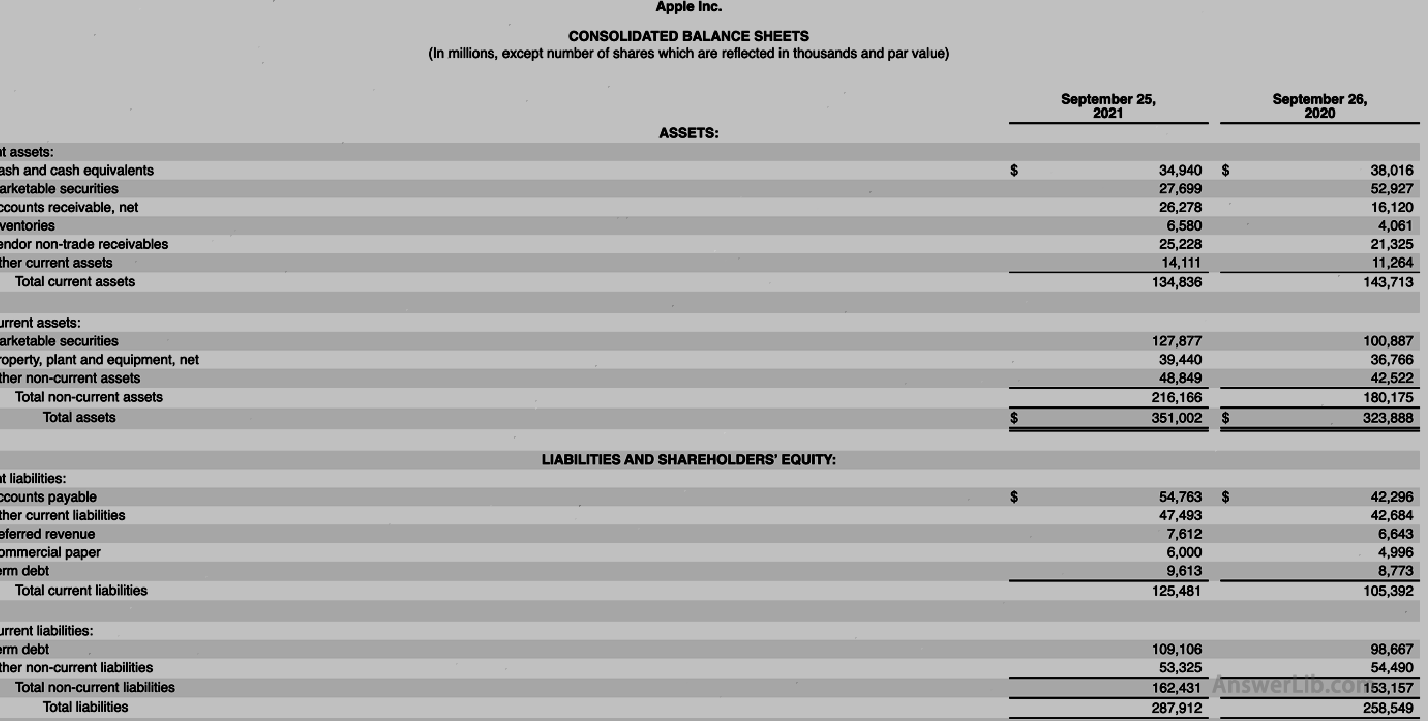

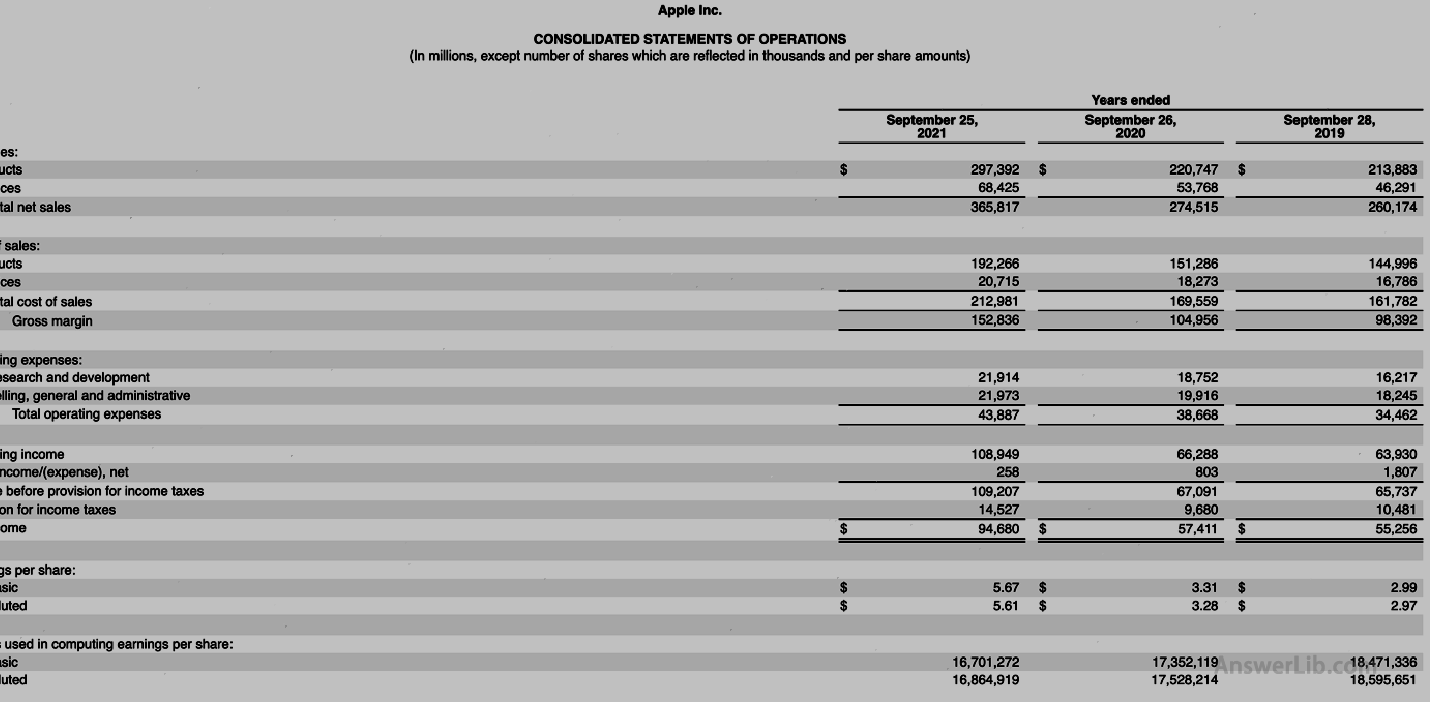

AAPL Financial Report The balance sheet and comprehensive business reports are shown below:

It can be seen from the financial statements that Apple’s 2021 Financial Year:

Flow asset | $ 134,836 m |

total liability | $ 287,912 m |

Preferred shares | none |

Dilute circulation stocks | 16,864,919 |

The calculation method of using the value of net flow assets is:

Value of net flow assets = mobile assets-total debt-preferred shares

= $ 134,836 m – $ 287,912 m

= – $ 153,076 m

It can be seen that Apple’s 2021 Financial Year of the Financial Year net The value of flow assets is negative.Let’s calculate the value of net flow assets per share:

Value of net liquid assets per share = net flow asset value / diluted circulation shares

= – $ 153,076 m / (16,864,919 x 1000) shares

= – $ 9.08

What is the significance of investment in the value of net flow assets?

In the Net-Net investment strategy proposed by Benjamin Graham, the greatest significance of the value of net flow assets is to determine whether a company’s stock price is cheap and worth buying.

Benjamin Graham believes that judging whether the price of a stock is worth buying can compare the value of the stock price and the net flow assets per share.When the stock price is less than equal to 2/3 of the value of the net flow assets per share, it is considered that this is cheap.Stocks, such as the value of a company’s net flow assets per share at $ 10, according to Benjamin Graham’s Net-Net investment strategy, when the price is equal to or less than $ 6.66, it is an ideal purchase price.

Benjamin Graham also stated that when investing in investment strategies based on net-net, investors do not guarantee that 100%of high returns can be obtained, and decentralized shares are still needed to diversify investment risks.He suggested that investors should hold at least 30 onlystock.

As the two major indicators in Net-Net investment strategies, most investors prefer to use the value of net mobile assets per share to choose stocks, instead of net operating capital per share, because the value of net mobile assets per share is more suitable for reality.And the calculation method is simpler, but for specific stocks, the price is lower than the net operating capital per share is a better choice.

What are the limitations of the value of net flow assets?

The value of net flow assets and net operating capital are financial indicators suitable for assessing the company’s short-term mobile capital situation.The use of mobile assets and long-term debt has not considered the impact of long-term assets in the development of the enterprise.The real value of a company.

The value of net flow assets is more suitable for evaluating the value of the assets held when the company needs to be liquidated.However, when the company is already in the stage of being liquidated, it means that the company’s operating ability has problems.ThereforeFor investors who have invested in long-term investment, the value of net flow assets does not have too important evaluation.