Net operating capital, English is Net Working Capital, referred to as NWC for short, and often referred to as working capital (Working Capital), showing that the company can directly use the capital situation of daily operations.financial indicator.

The calculation method of net operating capital is to subtract the company’s mobile assets off the liabilities.In general, the higher the capital value of the operation, the smaller the current financial pressure of the company, the more stable the operation of the operation, and has good growth potential and investment value.The indicators often used with net operating capital are called “Rap ratio” It refers to the ratio of liquid assets to liabilities.

If the net operating capital is negative, it shows that the current liabilities are greater than the flow assets, which further shows that the company’s current assets cannot cope with debt repayment, in a difficult stage, and even the possibility of bankruptcy.

However, some types of enterprises with high inventory turnover rates, when net operating capital is negative, does not mean that companies are facing a financial crisis.Therefore, only using net operating capital to evaluate the development status of a company still has certain limitations, and there is still a certain limitations of limitation.It is necessary to analyze more comprehensive analysis with more financial indicators.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- How to calculate net operating capital?

- How to calculate Apple’s net operating capital?

- What is the significance of investment in net operating capital?

- What are the limitations of net operating capital?

- Join investment discussion group

- More investment strategies

How to calculate net operating capital?

The calculation method of net operating capital is to be listed companies financial report The flow assets and liabilities in China are reduced, that is,:

Net operating capital = total flow assets-total liabilities

Net working capital = Current Assets – Current Liabilities

Moral assets and total liabilities in the formula can be from Balance sheet In the middle of it.

Moral assets generally refer to assets that can be converted to cash within one year, including:

- Cash, including funds and checks that have not been deposited in the bank account;

- Valuable securities, such as the U.S.Treasury Coupon and Currency Market Fund, etc.;

- The company intends to sell short-term investment within one year;

- Accounts receivable, that is, all the reserves except the accounts that cannot be paid;

- The receiving bills, short-term loans provided to customers or suppliers within one year;

- Other receivables, such as income tax refund, employee cash cushion and insurance claims;

- Inventory inventory, including raw materials, products and finished products, etc.;

- Prepaid fees, such as insurance premiums, etc.;

- Prepaid for future purchase;

Moral liabilities mainly refer to all liabilities expired within one year, including:

- accounts payable;

- Paper payables expired within one year;

- Salary;

- Taxes;

- Shopping loan interest;

- Any loan principal that must be paid within one year;

Other fees should be paid;

Delay income, such as prepaid payments for unpack goods or services, etc.;

How to calculate Apple’s net operating capital?

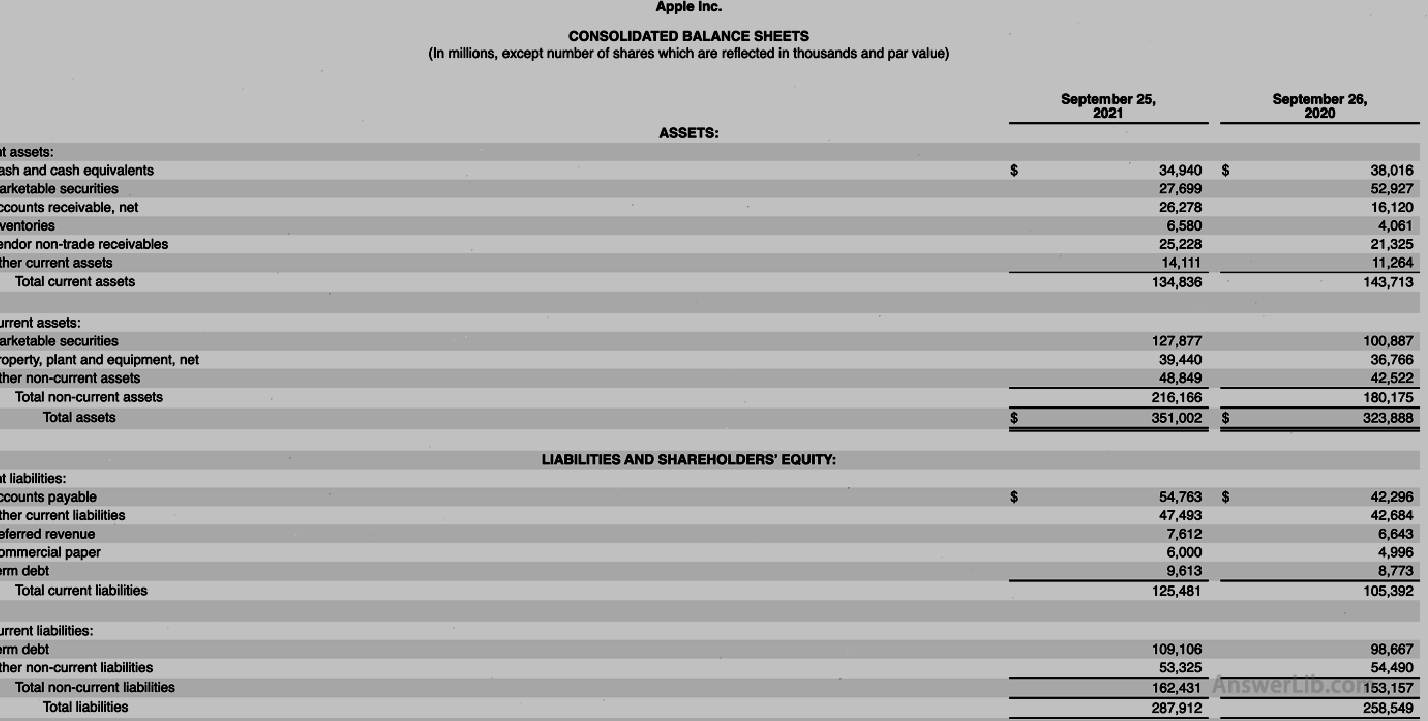

This chapter will be released by Apple in September 2021 10-K financial report Calculate the instance:

AAPL Financial Report The balance sheet in the middle is shown below:

Calculate the calculation formula of three types of net operating capital:

Basic formula.

Net operating capital = mobile assets-liabilities

NWC = Current ASSET -Current Liabilities

= $ 134,836 m – $ 125,481 m

= $ 9,355 m

What is the significance of investment in net operating capital?

Net operating capital can be used to judge the current capital circulation of a company and the ability to repay the short-term debt.

- When the value of net operating capital is positive, it indicates that the current mobile assets held by the company are sufficient to cope with all current liabilities, and the higher the value of net operating capital, the company has better growth potential.Therefore, the company has higher ones.Investment value;

- When the value of net operating capital is negative, it indicates that the company’s current mobile assets cannot perform the repayment obligations of short-term debt, and it is likely that defaults will occur, which will affect the company’s growth rate, and may even have the worst situation such as bankruptcy.

However, the value of net operating capital is not as high as possible.Excessive net operating capital values may indicate that the company’s inventory is too much, or it does not effectively use mobile assets for corporate development.

Similarly, the value of negative net operating capital does not always mean that a company is in a bad financial situation.For example, companies such as Wal -Mart and McDonald’s in stock turnover rate can receive customers’ payment in the short term to rapidly increase cash to cash quicklyIn general, the company does not need to reserve too much operating funds.For this kind of enterprise, the capital value of negative net operations does not indicate the decline in the company’s operating capacity.On the contrary, enterprises may be in a benign operation.

What are the limitations of net operating capital?

Because net operating capital calculates the company’s mobile assets, when using companies with different capital allocation types, there will be a deviation assessment result.For example, when using net operating capital to evaluate the company with fast inventory turnover rate, even if the negative value of net operating capital has a negative value, it does not necessarily mean that there is a problem with the company’s operations, because they can quickly get payment from customers to improve the flow of enterprises from customers to improve the company’s flow.Assets.

However, if the use of net operating capital to evaluate capital-intensive enterprises such as heavy machinery manufacturers, if the net operating capital has negative value, it means that the enterprise has serious operating problems, because such enterprises are focusing on the long cycle trading model, It is impossible to raise cash quickly from inventory, and the fixed assets they have usually cannot be liquidated, so sufficient mobile assets need to be dealt with to cope with mobile debt.Once the net operating capital is reduced, it means that the company’s pressure on short-term debt has begun to increase.MoreNeedless to say, when the net operating capital is negative, the company will not be able to fulfill the repayment obligation of its short-term debt.