The National Financial Condex (NFCI), published by the Chicago Federal Reserve Bank, is a comprehensive indicator aimed at measuring and reflecting the overall situation of the US financial market.

This index integrates more than 100 different financial indicators, including the credit market conditions, the volatility of the debt market, bank liquidity status, and market pressure.Through these data, NFCI can provide a comprehensive perspective, showing the stability and potential risk level of the financial market.

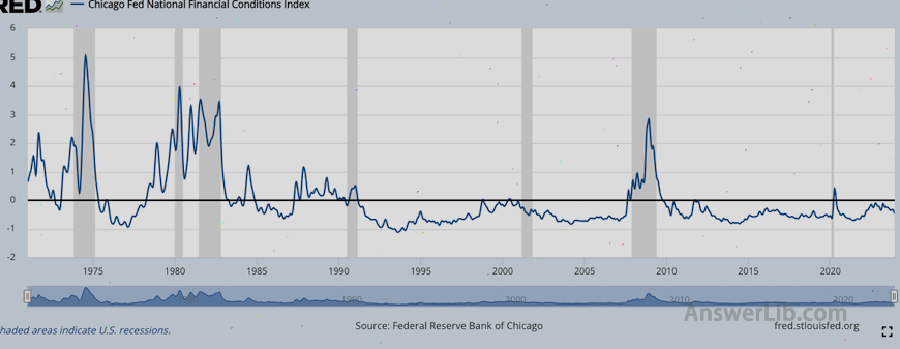

In general, rising national financial status indexs may indicate that the market liquidity is reduced, credit conditions are tightening or market risk increases, which may be signs of financial market pressure.

Instead, the declined national financial status index usually represents the relaxation of the financial environment, the credit is more convenient, and the market risk is low.

Therefore, the national financial status index is a key indicator of monitoring and predicting the economic cycle, financial market fluctuations, and potential financial crisis.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- How to use the national financial index?

- How is the national financial status index developed?

- How is the national financial status index calculated?

- More macroeconomics

How to use the national financial index?

The rise/decrease of the national financial status index and their positive values are very important, but the information they provide are different: they provide different information:

The rise and decline of NFCI

The rise or decline of the national financial status index reflects the trend of changes in financial market conditions.

Rising may indicate that the financial market conditions are tightening.For example, credit conditions have become stricter, market liquidity decreases, or financial risks have risen.

The decline may indicate that the market conditions are relaxing, such as the credit conditions have become more loose, market liquidity increases, or financial risks decline.This change trend is very important for monitoring the economic cycle and predicting future market developments.

NFCI’s positive and negative value

The positive and negative value of the index provides information about market conditions relative to historical average.

It is precisely that the market conditions are more tense than the historical average, and negative values indicate that the market conditions are more relaxed than the historical average.This helps to understand whether the current market environment is in a normal range or deviates from normal levels.

How is the national financial status index developed?

The National Financial Status Index was developed by the Chicago Federal Reserve Bank.

Chicago Federal Reserve (Chicago Federal Reserve) US Central Banking System(Federal Reserve System) is part of the important role.

This bank is not only a key executor of the US monetary policy, but also supervises and regulate the banking industry, provides financial services, and conduct economic research.Its actions and decisions have a profound impact on the United States and the global economy.

The development of the National Financial Status Index originated from a more comprehensive and in-depth understanding of the needs of the financial market.After the global financial crisis from 2007-2008, the importance of the financial market analysis and early warning system became more significant.During this period, the extreme volatility and instability of the financial market exposed the limitations of the existing financial monitoring tools, and gave birth to the demand for more effective tools.

In order to better monitor the overall situation of the financial market and predict potential risks, the Chicago Federal Reserve Bank began to develop a more comprehensive indicator system, that is, the national financial status index.The design of this index aims to capture the subtle changes in the financial market.It not only pays attention to the current state of the market, but also analyzes market trends through historical data comparison.The development and application of the National Financial Status Index have enhanced their understanding of the dynamics of the financial market and helping policy makers and investors make better decisions.

At present, the national financial status index has become one of the key tools for assessing the health of the US financial market.

How is the national financial status index calculated?

The calculation of the National Financial Status Index involves multiple indicators in multiple financial and economic fields.These indicators can be roughly divided into the following categories:

- Credit market conditions: Including the terms and conditions of bank loans, the spread of the credit market and the breach of contract.

- Liquidity index: The source and usage of banks involving banks include but not limited to inter-bank loan interest rates and bank deposit growth rates.

- Market risk: Including the fluctuation of the stock market volatility, the spread of the bond market, and the fluctuation of other asset prices.

- Leverage: Pay attention to the debt level of enterprises and families, and the overall leverage of the financial market.

The data of the National Financial Status Index is widely sources, including data from the federal reserve banking system, and public financial market data.

For example, the information from the US Treasury market, the loan data of major banks, the price and transaction volume data of the stock market and the bond market are an important part of the national financial status index calculation.The acquisition and processing of these data follow strict standards and procedures to ensure accuracy and timeliness.

The national financial status index calculation methodology is based on advanced statistical models.First of all, all original data is standardized to eliminate potential deviation and inconsistency between different data sources.

These standardized data are then integrated into a unified index, and a value that reflects the overall financial status is calculated through specific algorithms and models.This process involves complex mathematics and statistical technologies, including the analysis of the main component to ensure that the index can accurately reflect the comprehensive status of the financial market.

The calculation of the National Financial Status Index is not just simply adding a variety of data.It provides a market health indicator that is integrated and analyzed by comprehensively considering data changes and relationships in different fields.This calculation method enables NFCI to effectively capture key market developments and trends in a complex and changeable financial environment.

More macroeconomics

- What is the national financial status index?

- What is the Buffett index?Buffet indicator

- What is the U.S.Treasury volatility index?Move index

- What US dollar index?US dollar index

- What is a bank deposit reserve?Bank reserves

- What is an open market operation?Open Market Operations

- What is the reserve balance interest rate?Interest on Reserve Balances

- What is personal consumption expenditure index?PCE Price Index

- What is overnight reverse repurchase?On Reverse Repurchase

- What is unemployment rate?UNEMPLOYMENT RATE