Federal Reserve Open market operation, English is Open Market Operations, Referred to as OMO, refers to Fed Buy or sell government securities in the open market.

The open market operation is one of the important economic regulation tools of the Federal Reserve.The Fed’s Federal Open Market Commitee (FOMC) through the Federal Reserve for public market operations, thereby increasing or tightening the currency circulation in the banking system, therebyHelp the Federal Reserve better Federal fund interest rate Regulate control to complete the task of price control and employment.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- The history of public market operation?

- How is the Fed’s open market operation?

- What are the types of public market operations?

- What is the significance of open market operation?

- How to query the Fed’s open market operation transaction data?

- More macroeconomic concepts

The history of public market operation?

The Fed’s open market operation begins with the beginning 1936,, Fed FOMC selects New York Fed to set up a system open market account ( System Open Market Account, Referred to as SOMA) as a trading account, all transactions were carried out at the New York Fed ’s Open Market Trading Desk (THE Desk).

The desk performs all operations based on FOMC’s authorization and instructions, and selects a SOMA manager to report the transaction status and the overall financial market situation to FOMC.

There are two types of open market operations: permanent operation and temporary operation.Among them, the permanent operation is to adjust the market’s currency supply by buying and selling securities such as US Treasury bonds; temporary operations include the currently popular repurchase protocol (Repurchase Agreements) and Reverse repurchase agreement(Reverse Repurchase Agreements), etc., and the reserve regulation is made through short-term operation.

How is the Fed’s open market operation?

The Fed’s open market operation process is generally similar to ordinary open market operations.Among them, the open market means that the Fed does not purchase securities directly from the US Treasury Department.Instead, by securities dealers in the open market, according to the price trend, via electronics through electronics through electronics.The auction system is traded.

First of all, the Fed chose to open an account in the Fed in New York: System Open Market Account (SOMA).

Then, at the New York Fed’s Open Market Trading Desk (The Desk), a SOMA agent designated by the Federal Reserve was based on FOMC’s authorization and instructions on the New York Fed’s Open Market Trading Desk (The Desk).trade.

The operation instructions are usually specified according to the Federal Reserve’s federal fund interest rate regulation:

When the Fed wants to increase the interest rate of federal funds, it will send instructions for selling government securities to recover the market currency circulation by selling securities to retrieve currency tightening, thereby slowing the degree of inflation and stabilizing economic growth.

When the Federal Reserve hopes that the interest rate of federal funds will decline, it will issue instructions to buy government securities.By buying government securities, to increase market currency circulation and make currency expansion, thereby stimulate consumption and accelerate economic growth.

What are the types of public market operations?

There are two main types of public market operations:

- Permanent open market operation: Permanent Open Market Operations

- Temporary open market operation: Tempory Open Market Operations

1.Permanent public market operation

The permanent public market operation refers to the regulation of market currency circulation by buying and selling government securities in the open market.Increase the money supply and tighten the amount of currency supply by selling securities.

2.Temporary open market operation

The temporary open market operation is the Federal Reserve’s repurchase agreement and Reverse repurchase agreement(Reverse Repurchase Agreements) and other tools adjust the available preparation deposit in the banking system when they come.

The repurchase agreement is the Federal Reserve “buy” securities first, and then “sell” the securities, thereby increasing the amount of reserve, and the inverse repurchase is the Federal Reserve “sold” securities first, and then “buy back” securities.Absorb the amount of excessive deposits between banks.

What is the significance of open market operation?

The main responsibility of the Federal Reserve is to stabilize prices, promote employment rates, and stabilize long-term interest rates.In the process, federal funds interest rates are the most important influencing factor.It is the most important of them.

Through two different open market operations, the Fed can assist in regulating the federal fund interest rates from two aspects: currency circulation and reserve circulation.

1) The Federal Reserve regulates currency circulation through permanent public market operations

- By buying securities, increase the amount of currency supply to the market and carry out the currency expansion policy.The federal fund interest rate will decline.From this to reduce the development cost of the enterprise, stimulate consumers’ desires and capabilities of consumption, improve the level of prices and market vitality.The employment rate will rise.

- By selling securities, absorb currency from the market and carry out currency tightening policies.The economic development is restored to a relatively stable normal.

2) The Federal Reserve regulates the reserve through the temporary open market operation

- Implement the repurchase agreement.By “buy” the securities, provide cash to the bank, and then “sell back” the securities to the bank to increase the reserves and liquidity of the inter-bank reserve.Fund interest rate.

- Implement the inverse repurchase agreement, first “sell” securities to the bank, absorb cash, and then “buy back” securities to the bank to absorb the excess reserve reserves of the bank and control the liquidity.interest rate.

How to query the Fed’s open market operation transaction data?

able to pass New York Federal Reserve Query and download the Fed’s open market transaction records.

First enter the official website of the Fed in New York: https://www.newyorkfed.org/

Find the “Historial Transaction Data” in the drop-down menu “Markets & Policy Implementation” drop-down menu.

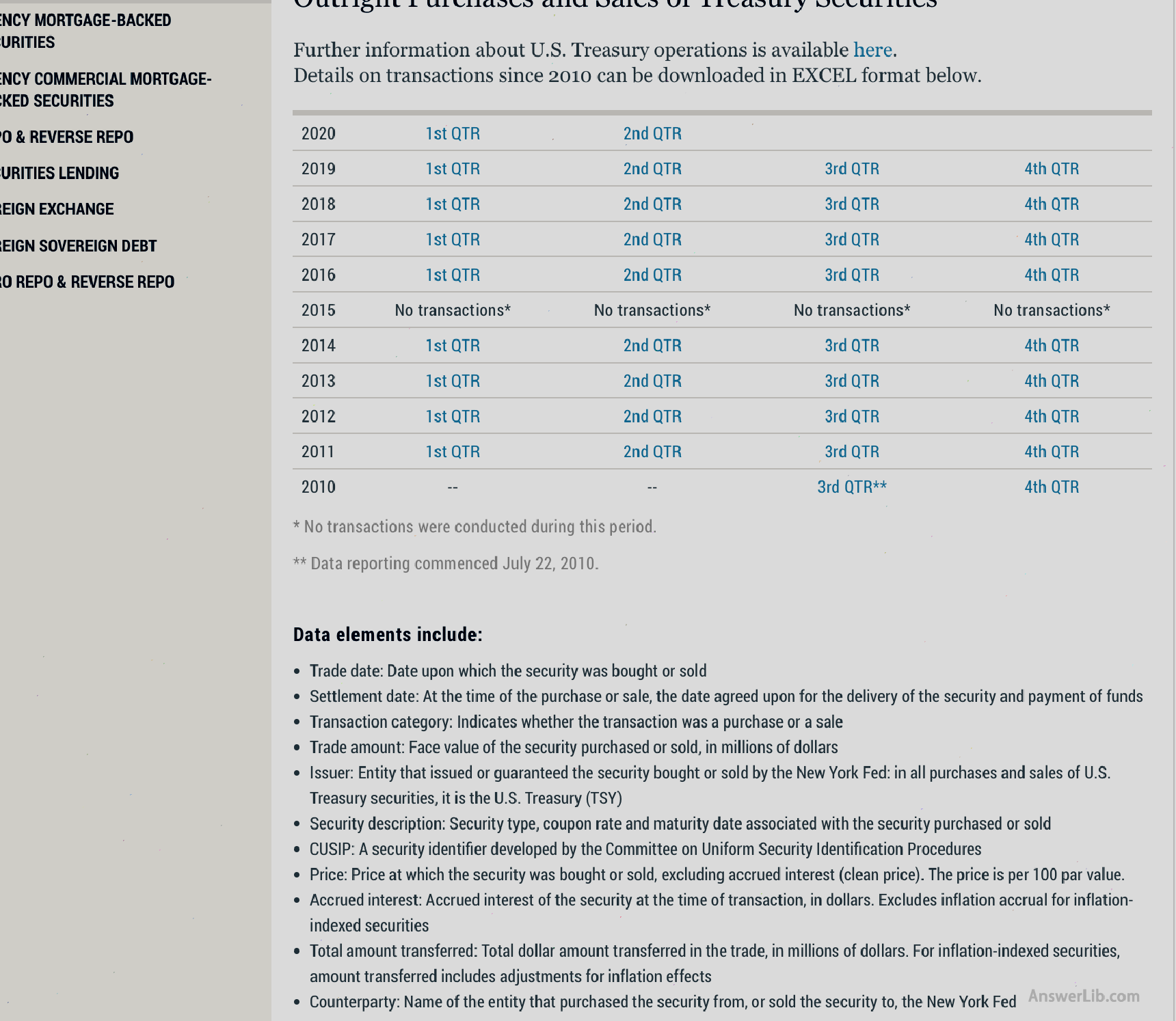

Click to enter to see the historical open market transaction data list:

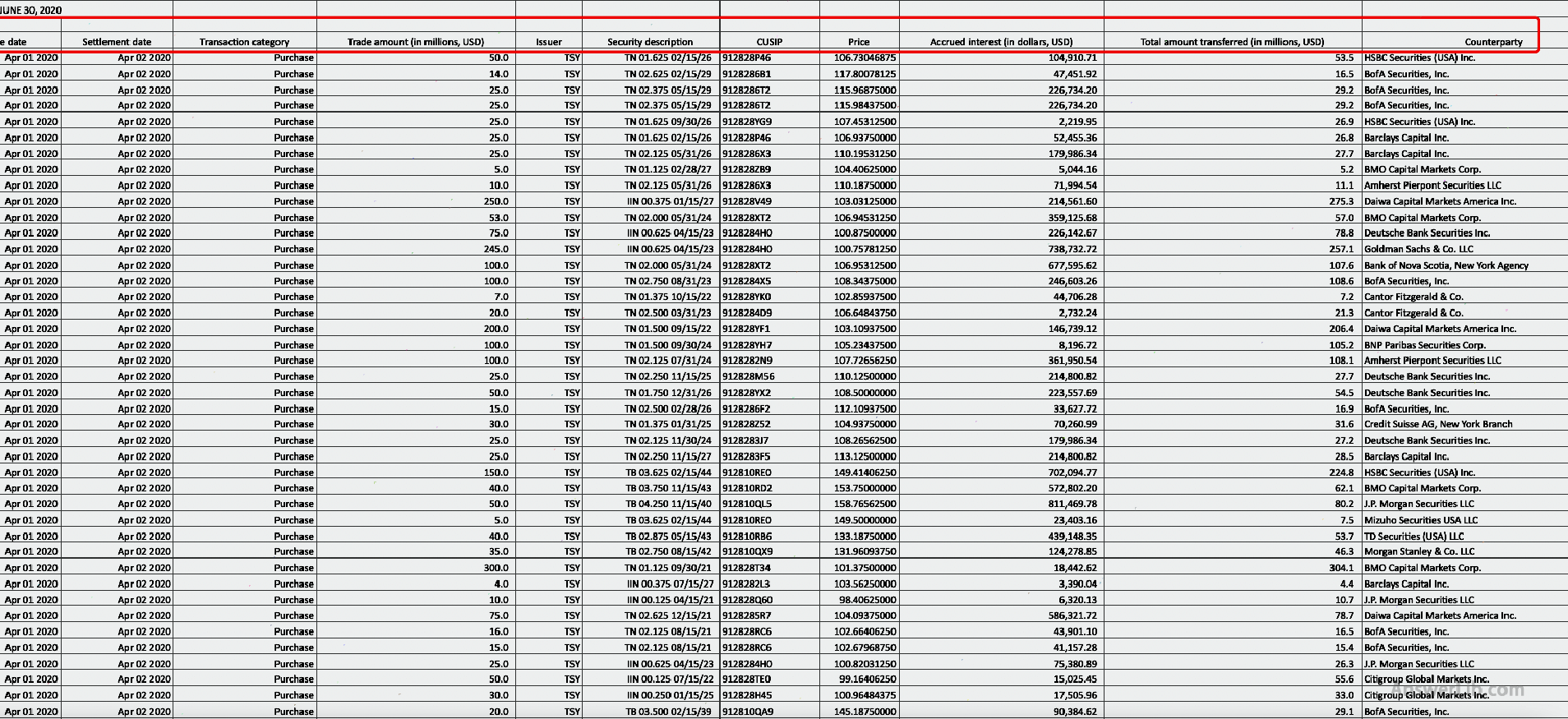

After entering the data page, click the corresponding quarter to download and view the transaction data form on the season.The following are some screenshots of the public market operation transaction data table in the second quarter of 2020:

From left to right in the data table:

- Trade date: The date of transaction, the date of buying and selling securities.

- Settlement date: The settlement date, that is, the date agreed on the date of delivery and payment of funds when purchasing or selling.

- Transaction Category: Trading category, indicating whether the transaction is purchased by Purchase or selling Sale.

- Trade Amount (in Millions, USD): The amount of trade, that is, the face value of purchasing or selling securities, is calculated by millions of dollars.

- Isuer: The issuer, that is, the entity that issues or guarantee the New York Fed of Sales Securities.Among all the trading of US Treasury bonds, it is U.S.Treasury (TSY) of the US Department of Finance.

- Security Description: Securities description, that is, the securities type, ticket interest rate and expiration date of securities related to purchased or sold.

- Cusip: The transaction code is the security identifier developed by the uniform security identification procedure committee The Commottee On Uniform Security Procedures.

- Price: The price, that is, the price of buying or selling securities, does not include interest (net price).The price is every 100 faces.

- Accrumd Interest (in Dollars, USD): Interests should be calculated, that is, the interest of securities should be calculated in the US dollar.It should not include inflation that does not include inflation index securities.

- Total Amount Transferred (in Millions, USD): The total amount of transfer, that is, the total amount of transaction transfer, the unit is one million US dollars.For inflation index securities, the amount of transfer includes adjustment of inflation effects.

- Counterparty: Trading opponents, the name of purchasing securities from the Fed in New York or selling securities to New York Fed entities.

More macroeconomic concepts

- What is the national financial status index?

- What is the Buffett index?Buffet indicator

- What is the U.S.Treasury volatility index?Move index

- What US dollar index?US dollar index

- What is a bank deposit reserve?Bank reserves

- What is an open market operation?Open Market Operations

- What is the reserve balance interest rate?Interest on Reserve Balances

- What is personal consumption expenditure index?PCE Price Index

- What is overnight reverse repurchase?On Reverse Repurchase

- What is unemployment rate?UNEMPLOYMENT RATE