Magic formula, English is The Magic Formula It is an investment strategy proposed by investor Joel GreenBlatt.

Joel GreenBlatt is used in this investment strategy ROC (capital return) and Earnings yield (yield) Let’s analyze and sort different listed companies, and then based on it “Buy at a cheap price” As well as “Buy a good company” Filter the investment objects, choose before the ranking 20-30 The company invests.

Through this set of magic formula investment strategies, Joel GreenBlatt obtained a 30%annual return rate from 1985 to 2005.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

What is the “magic formula”?

Joel GreenBlatt is a well-known economic scholar, investor, writer, hedge fund manager, financial professionals, and value investment experts in the United States.He graduated from the Wharton School of Business at the University of Pennsylvania, and later became a part-time professor at the University of Columbia Business School.

Joel GreenBlatt established the Gotham Asset Management company and helped investors to conduct various investment guidance as the fund manager.Its fund Gotham Capital obtained 40% of the amazing annualized return between 1985 to 1995.

In 2005, Joel GreenBlatt launched its work “The Little Book that Beat The Market” For the first time in the book, the “Magic Formula Investing” strategy concept was proposed.

Affiliate Link

Its main concept is: high ROC, high Earnings yield, and low market value companies are good investment targets.By choosing cheap stocks in the top 20 to 30 companies in the top 20 to 30 companies calculated by ROC calculation and Earnings yield.In the future long-term investment, it will get a return that is higher than the average market return.

The main advantage of the Magic Formula Investing strategy is its simple way of use.You only need to obtain a clear company ranking according to the rules according to the simple calculation and sorting.The influence, so, theoretically, all investors can use Magic Formula Investing strategy to screen for investment objects.

Two important indicators in the magic company

When using magic companies to rank listed companies, two important indicators are needed:

- Earning yield

- Return on Capital (ROC)

How to calculate the yield?

Inspection rate, English is Earning Yield.It is used to evaluate the return on investment in the company’s stock, that is, the profit ratio that the company’s stocks can obtain at the current price.

By the company’s Pre-tax profit(EBIT) Corporation value(Enterprise Value, EV) to calculate the yield, the calculation formula is as follows:

Earning yield = eBIT / EV

in,

EBIT is a profit before tax and can be found from the profit statement of the financial statements.

EV is corporate value, which is equivalent to the company’s market value plus the fair value of corporate debt, a small number of equity and priority stocks, and then minus the cash and cash equivalents.

The high yield means that investors have obtained more operating profit for each unit of investment, which is usually regarded as a sign of low stock valuation and high investment attractiveness.GreenBlatt’s magic formula is based on high profit yields (ie, low valuations) and high capital returns (that is, high efficiency) to choose stocks.

How to calculate ROC?

ROC The full name of English is Return on Capital That is, the “capital return rate” is an indicator that measures the transformation of capital into profit efficiency, which is different from the calculation method of the ROIC (Return on Investtal).

In general, The higher the ROC value, the higher the company’s ability to transform its capital into profits It shows that the more it is worth investing in the company.

ROC calculates profit and Targeted capital investment The ratio of the profit is pre-interest taxation profit, that is, Earnings Before Interest and Taxes, referred to as Ebitit Items

Tangible capital investment refers to capital investment actually used in production and operation, that is, the sum of net work capital and net fixed assets.

The calculation method of ROC is the company’s EBIT(EBIT) In addition to the company’s tangible capital investment, that is,:

Capital return rate = profit before interest tax / tangible capital invested capital

ROC = EBIT / TANGIBLE CAPITAL EMPLOYED

in,

The profit before interest tax refers to the profit that has not been deducted by tax and interest, that is, net income plus interest and taxes, that is,:

Profit of interest before interest tax = net income + interest + taxes

Ebit = net intertome + interest + taxes

Net income and taxes can be in the company Profits(Statements of Operations) found; interest can Cash flow sheet Found in Statement of Cash Flows.

The calculation method of tangible capital investment is as follows:

Tangible capital investment = net operation capital + tangible fixed assets

Tangible Capital Employed = Net Working Capital + Net Fixed Assets

in,

Toply fixed assets mainly refer to fixed assets that are actually used for production, plant and production equipment, etc.

The net operating capital refers to the difference between the company’s mobile assets and liabilities, namely:

Net operation capital = mobile assets-liabilities

Net working capital = Current Assets – Current Liabilities

These two values can be in the company Balance sheet Find (Balance Sheets).

how Calculate Apple’s ROC?

This chapter will be released by Apple in September 2021 10-K financial report Calculate the instance:

AAPL Financial Report The profit statement, the balance sheet and the cash flow statement are shown below:

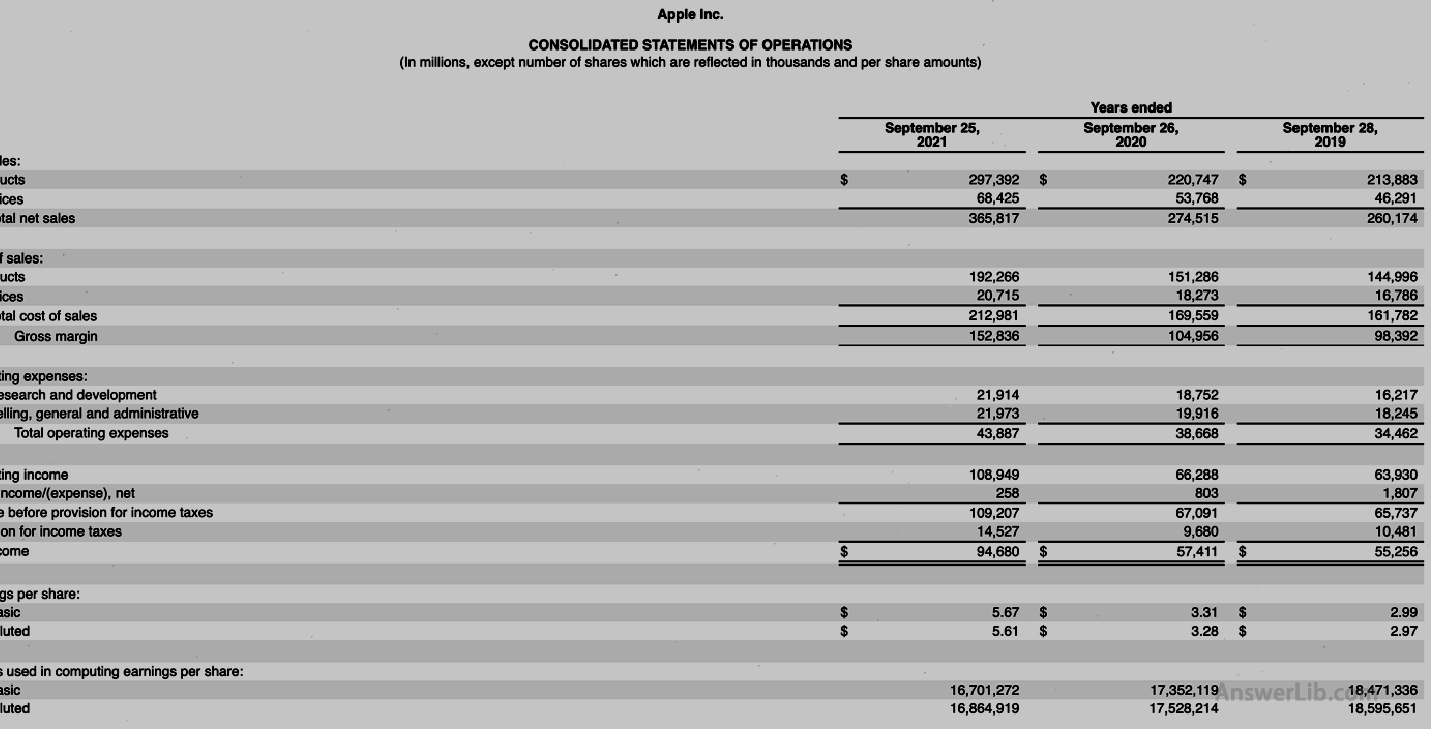

Profits (Statements of Operations) The

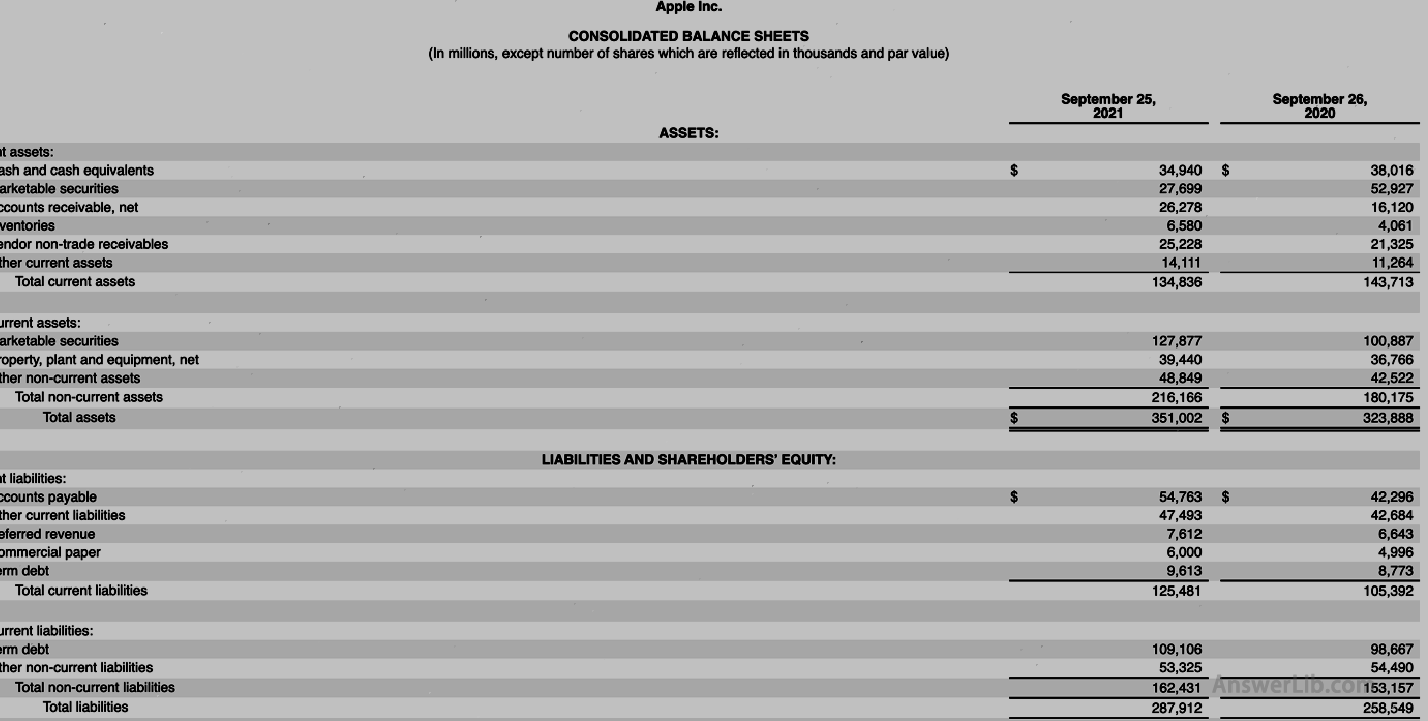

Balance sheet (Balance Sheets) The

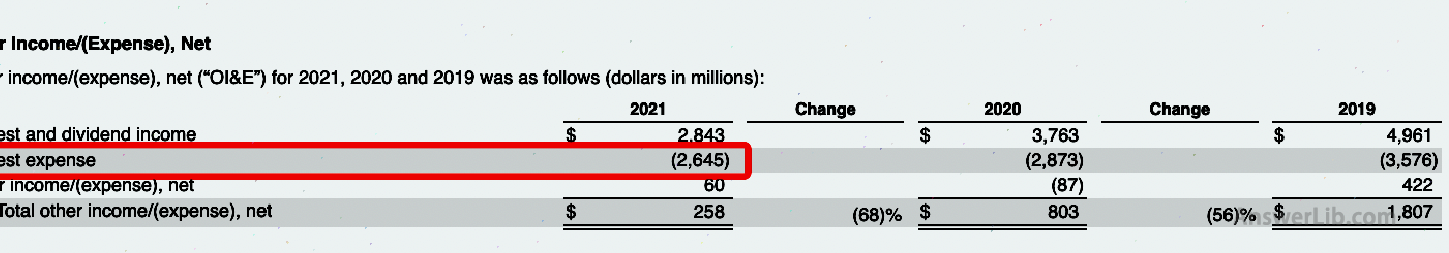

Other Income/ (Expense), Net

in:

Net income Net income | $ 94,680 m |

Interest Interest | $ 2,645 m |

Tax Provision for income taxes | $ 14,527 m |

Flow asset TOTAL CURRENT Assets | $ 134,836 m |

Current liabilities TOTAL CURRENT LIABILITIES | $ 125,481 m |

Fixed asset Total Non-Current Assets | $ 216,166 m |

Real Estate, plant, equipment,, plants, and equipment | $ 39,440 m |

so:

Profit of interest before interest tax = net income + interest + taxes

= $ 94,680 m + $ 2,645 m + $ 14,527 m

= $ 111,852 m

Net operation capital = flow assets-mobile liabilities;

= $ 134,836 m – $ 125,481 m

= $ 9,355 m

Capital = net operation capital + real estate, plant, equipment

= $ 9,355 m + $ 39,440 m

= $ 48,795 m

Therefore, ROC = before interest tax profit-capital = $ 111,852 m / $ 48,795 m = 229%

At the end

Joel GreenBlatt’s magic formula will sort the company according to ROC and Earning Yield, and then add two rankings to the top 20 to 30 companies in the order of high and low.

It should be noted that magic formulas are not applicable to financial companies and public institutions.

In addition, the assessment results in short-term investment are large.Usually in long-term investment in three to five years, better benefits can be obtained.

More value investment

- Julian Roberts – Julian Robertson: Father of Tiger Baby

- Explore the 24 first-level dealers of the Federal Reserve

- Important Finance and Investment News

- What is a corporate value multiple?Enterprise Multiple

- What is preferred stock?Preferred stock

- What is the operating leverage coefficient?Degree of Operating Leverage

- What is debt repayment payment rate?DEBT Service Coverage Ratio

- What is capital expenditure?Capital Expendital

- What is the capital asset pricing model?Capital Asset Pricing Model

- What is financial leverage coefficient? Degree of Financial Leverage