Capital return rate The English name is Return on INVESTED CAPITAL, referred to as ROIC, which is used to measure the efficiency of the company’s transformation of capital into profits.Investors can often judge the company’s investment value by comparing the capital return rates of different companies in the same industry or different periods of the same company.

Understanding how to calculate the return on capital and the significance of its representatives will help better operate the company or invest in.

American broker:Futu Securities& nbsp; | & nbsp; Transparent securities& nbsp; | & nbsp; Microex Securities& nbsp; | & nbsp; Tiger securities& nbsp; | & nbsp; First securities& nbsp; | & nbsp; Robinhood in| Full investment strategy

Directory of this article

- What is the capital return?

- How to view/calculate the company’s capital return rate?

- How to use capital return to guide investment?

- What industries are suitable for capital returns?

- Is the capital return rate high or low?

- What is the difference between Roic and ROE, Roa, ROS?

- Capital returns in various industries in the United States

- More investment and financial management

What is the capital return?

The return on capital reflects the ratio of the company’s profit and the investment it obtained.The value means that the company has transformed the company’s ability to transform the external investment into profits.When calculating the return on capital, the company’s post-tax revenue (Nott) and the investment capital value (InvesteD Capital) need to be used.The calculation formula is as follows:

Capital return rate = before-tax income / total investment capital

Roic = nott / invested capital

Among them, NOPAT is the abbreviation of Net Operation Profit After Tax, expressing the company’s net operating income before tax after tax.Invested Capital contains the company’s debt and all shareholders invest in equity.

Capital returns are very important for company managers and investors: both:

- Company managers can use capital returns to evaluate the company’s operating capacity growth.

- Investors can use the capital return rate to analyze the company’s historical RIC value to analyze the company’s profitability, transform investment or loans into income, or estimate the return rate of their own investment based on the ROIC value; orAnalyze the ROIC value of different companies in the same industry to compare the operating capabilities of the target company in the same industry.

How to view/calculate the company’s capital return rate?

Capital return is not a conventional financial value.Therefore, it usually does not appear directly in the company’s financial statements, but it is necessary to calculate the company’s capital return on different data.The calculation formula of the root value is:

Roic = nott / invested capital

in:

| Nottat | Invested Capital |

|---|---|

Tax rate = tax expenditure/pre-tax income Tax rate = TAX Expense / Income Befroe Tax * 100% | Investment liabilities = short-term liabilities+long-term liabilities Interest Bearing Debt = Short Term BORROWING + Long Term Debt |

Revenue before tax = operating income*(1 -tax rate) Nott = Operating Income *(1 – Tax Rate) | Investment capital = investment liabilities+total shareholders stock Invested Capital = Interest Bearing Debt + Total Shareholders’equity |

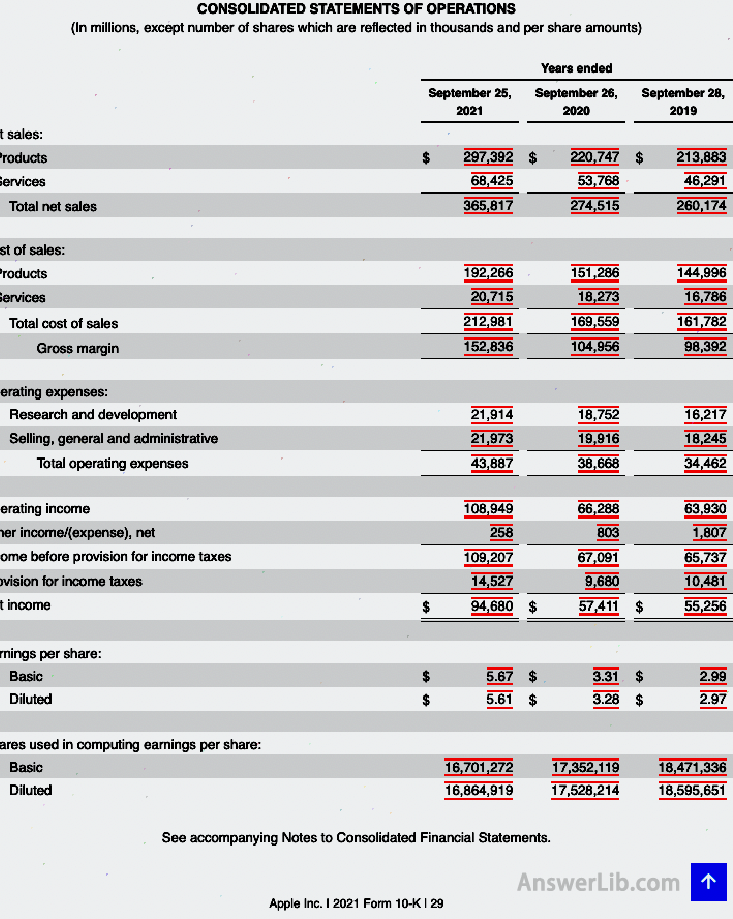

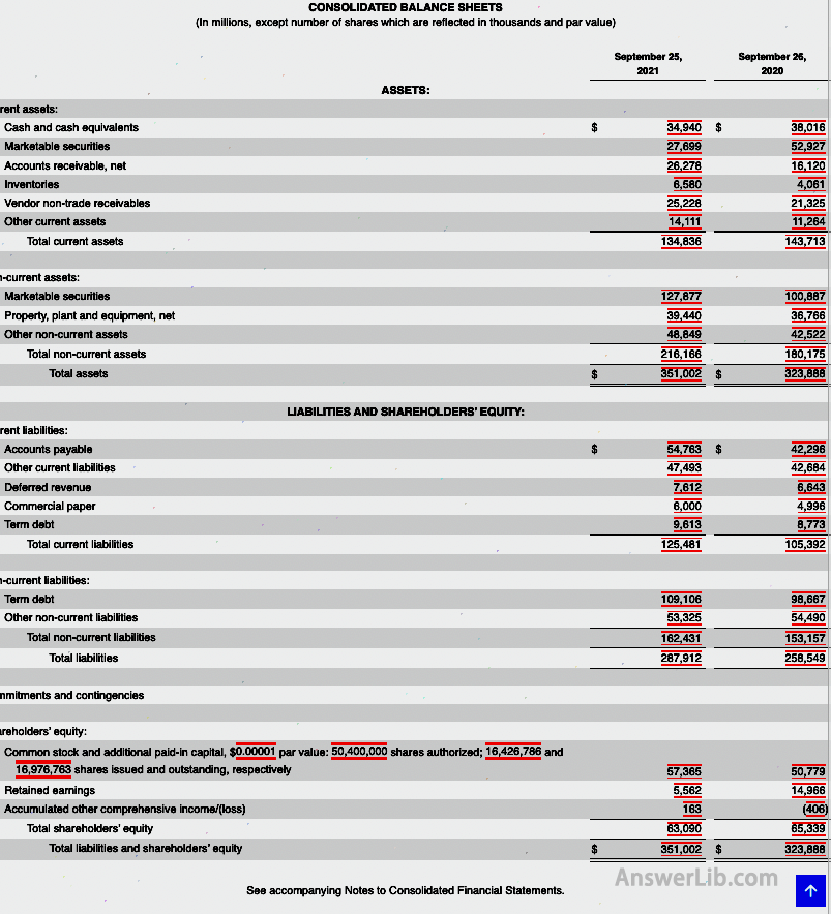

All data in the calculation formula can be found in the company’s publicly released profitable forms and Balance Sheet (BALANCE SHEET).Calculate its root value for example.The following two pictures are Apple’s 2021 profit statement and balance sheet.

Nottat | Invested Capital |

|---|---|

Obtain from the company’s profit statement | Obtained in the balance sheet |

Income Befroe Tax is $ 109,207M TAX Expense is $ 14,527M Operating Income is $ 108,949M | SHORT-TERM BORROWING is $ 9,613M Long-Term DEBT is $ 109,106m Total Shareholders` Equity is $ 63,090m |

Tax rate = TAX Expense / Income Befroe Tax * 100% = $ 14,527m / $ 109,207m * 100%= 13.3% | Interest Bearing Debt = Short Term Borrowing + Long Erm Debt = $ 9,613M + $ 109,106m = $ 118,719M |

Nottat = Operating Income *(1-TAX Rate) = $ 108,949m * (1 – 13.3%) = $ 94,458M | Invested Capital = Interest Bearing Debt + Total Shareholders` Equity = $ 118,719m + $ 63,090M = $ 181,809M |

Therefore, the RoIC value of Apple in 2021 is:

Roic = Nott / Investled Capital * 100%

= $ 94,458m / $ 181,809m *100%

= 51.95%

How to use capital return to guide investment?

When investors conduct investment analysis with capital returns value value, they can first analyze whether the company can earnestly improve its profitability based on the historical ROIC value of the same company in its development process.ROIC is ROIC.ROICThe value of a company with a stable rising model often represents its benign operating model.The higher probability and return rate of stable returns after investing after investing.

Secondly, the ROIC value will have large differences according to the operating background of different industries.According to the demand for capital and the rate of rewards in different industries, the stock god Buffett will divide the company into three categories to more accurately use the ROIC value more accuratelyAnalyze the company’s profitability and investment value, Buffett divides the company into three categories:

High-investment returns business with low capital requirements

Some low-capital demand companies, such as VISA, Facebook, etc., the required costs are low.After entering the benign operation track, they can get a considerable high return.Therefore, the ROIC value of such companies is usually very high.

For such companies, it is necessary to use a higher ROIC value as a comparative analysis starting point to determine its operating capacity positioning in the industry.

Enterprises that need capital growth; sufficient returns in this capital

Most companies’ operating models require certain capital investment to get excellent returns, such as retail giant Wal -Mart.The ROIC values of these companies are usually far lower than low capital demand companies in terms of value.At that time, it is necessary to compare it with a similar company to get more accurate investment value judgments.

Enterprises that need funds but low return rate

Buffett quoted Tesla of the airlines and automobile manufacturing industries in this type of company.The characteristics of these companies are densely capital-intensive.They need a large number of long-lasting investment to maintain operations, but the return may not last.ROIC values of such companies are often very low, and investors need to consider carefully.

What industries are suitable for capital returns?

Because the calculation value of Roic involves the earnings that the company can earn and the required external capital, capital comes from all debts and shareholders, so almost all companies can use ROIC to analyze their ability to use external capital to generate benefits.

�� � � � � 作为 industry capital as industries that operate the main capital of the company, such as manufacturing, service industry and other companies, are more suitable for using ROIC to analyze their capital returns.In the same industry, different companies will cause a large ROIC because of different operating capabilities, which will cause a large ROICThe difference can compare the investment value of different companies more clearly.

The manufacturing representative company includes: Exxon, Chevron, Ford, etc.

The representative company of the service industry includes: Cloud 9 Services, STREEFAIR, WONDERMENT, etc.

Other industries, such as the basic material industry, are vulnerable to external factors.The ROIC value has a large volatility, so ROIC can also be used as one of the main indicators of investment analysis.

Representative companies in the basic materials industry include: Rio Tinto, NUCOR, Air Products & Chemicals, etc.

In some industries, such as industry, public utilities, and telecommunications industries, the difference between the ROIC difference between different companies will not be much different.Therefore, in comparison, it is more suitable for analyzing the company’s own ROIC value to analyze the company’s own itselfOperation development.

Representative companies in the industrial industry include: Honeywwll, UPS, BOEING, etc.

Representative companies in the public business industry include: Pacific Gas & Electric, SOUTHERN CALIFORNIA EDISON, FLORIDA POWER & Light, etc.

Representative companies in the telecommunications industry include: AT & T, Verizon, T-Mobile US, etc.

Is the capital return rate high or low?

ROIC value is usually higher, the better.The higher the root value, it means that the company can transform the capital invested by the outside world into more benefits.At the same time, investors can get more returns, and the company is more capable of continuing to use capital to create more benefit returns.Essence

In the same industry, the higher the ROIC value company, the more you can get the attention of investors.

What is the difference between Roic and ROE, Roa, ROS?

ROIC, Roe, ROA and ROS are the ratio that investors often use when analyzing the investment value of a company.The main difference between them is::

| ROIC | ROE | ROA | ROS | |

|---|---|---|---|---|

Chinese name | Capital return rate | Asset return rate | Return on sale | |

Comparative content | The ratio of after-tax income to investment capital | The ratio of net income to total shareholders’ equity | The ratio of net income to total assets | The ratio of net income to total profit |

Calculation formula | Nott / Investled Capital | Net Income / Total Equity | Net Income / Total Assets | Net income / sales |

Numerical | The company transforms all foreign capital into profitability | The company transforms shareholders’ investment capital into profitability | The profit generated by the company’s assets | The company’s ability to gain benefits through sales |

Different from Roic | / / | The molecular part does not consider taxation The denominator part does not consider debt capital | The molecular part does not consider taxation The denominator considers total assets, not limited to external investment capital | The molecular part does not consider taxation The denominator section only considers sales, and has no capital with any capital |

More applicable scope | Companies that operate capital as the main operation of external capital Such as manufacturing, service industry, etc. | Companies that do not divide the company assets into operating assets and non-operating assets Such as commercial banks, insurance companies, etc. | Companies with fixed assets and tangible assets. Such as manufacturing, real estate industry, etc. | Small and medium-sized companies with relatively simple operating models |

Capital returns in various industries in the United States

The following is the ROIC data table of various industries and its sub-industries that as of January 2022:

| industry | Capital return rate |

|---|---|

advertise | 50.20% |

Aerospace/Defense | 14.76% |

air freight | -19.81% |

apparel | 20.35% |

Car and truck | 4.74% |

car parts | 14.77% |

Bank (Monetary Center) | -0.01% |

Bank (area) | -0.08% |

Drink (alcohol) | 15.28% |

Drink (soft) | 27.30% |

broadcast | 17.22% |

Brokerage and Investment Bank | 0.37% |

Architectural material | 30.44% |

Commercial and consumer services | 23.26% |

Cable TV | 12.77% |

Chemistry (foundation) | 27.31% |

Chemical (diversified) | 13.74% |

Major in Chemistry) | 15.02% |

Coal and related energy | -4.04% |

Computer service | 21.41% |

Computer/peripheral equipment | 44.93% |

Architecture | 12.88% |

Diversification | 21.45% |

Drug (biotechnology) | 7.30% |

Drug (pharmaceutical) | 19.66% |

educate | 7.10% |

Electronic equipment | 22.78% |

Electronic products (consumer and office) | 18.32% |

Electronics (general) | 17.59% |

Engineering/architecture | 15.99% |

entertainment | 10.06% |

Environment and waste services | 25.56% |

Agriculture/Agriculture | 13.48% |

Financial Services.(Non-bank and insurance) | 0.59% |

food processing | 19.54% |

Food wholesaler | 12.29% |

Furniture/home furnishings | 24.76% |

Green and renewable energy | 5.73% |

Health products | 18.64% |

Healthcare support service | 32.05% |

Healthcare information and technology | 23.06% |

construction | 22.92% |

Hospital/Healthcare Facilities | 23.17% |

Hotel/game | -4.69% |

household items | 39.78% |

Information service | 29.04% |

Insurance (general) | 12.97% |

Insurance (Life) | 6.49% |

Insurance (proposal/case) | 17.38% |

Investment and asset management | 9.72% |

mechanical | 27.22% |

Metal and mining | 36.12% |

Office equipment and services | 13.47% |

Petroleum/natural gas (comprehensive) | 5.12% |

Petroleum/natural gas (production and exploration) | -1.54% |

Petroleum/natural gas allocation | 6.81% |

Oilfield service/equipment. | 2.82% |

Packaging container | 15.40% |

Paper/forest product | 44.89% |

strength | 6.06% |

Precious metal | 14.75% |

Publishing and newspaper | 15.77% |

Real Estate Investment Trust Fund | 2.75% |

Real estate (development) | 1.29% |

Real estate (general/diversified) | 5.01% |

Real estate (operation and service) | -2.80% |

entertainment | 18.44% |

Reinsurance | 6.69% |

Restaurant/restaurant | 14.72% |

Retail (car) | 15.47% |

Retail (building supply) | 54.62% |

Retail (distributor) | 16.27% |

Retail (general) | 20.88% |

Retail (grocery and food) | 7.01% |

Retail (online) | 12.18% |

Retail (dedicated line) | 17.28% |

Rubber tires | 7.28% |

semiconductor | 21.70% |

Semiconductor equipment | 37.24% |

Shipbuilding and ocean | 15.01% |

shoe | 40.95% |

Software (entertainment) | 25.46% |

Software (Internet) | 1.65% |

Software (system and application) | 25.03% |

steel | 37.25% |

Telecom (wireless) | 5.18% |

telecommunications.equipment | 26.84% |

telecommunications.Serve | 15.33% |

tobacco | 64.45% |

transportation | 21.05% |

Transportation (railway) | 15.31% |

Truck transportation | 5.76% |

Practical program (general) | 5.91% |

Public cause (water) | 7.29% |

General market | 8.61% |

General market (excluding finance) | 10.58% |

It can be seen from the table that the return on investment between different industries is relatively different.

For example, large service industries such as the advertising industry, computer peripheral equipment service industry have less dependence on capital, so the ROIC value is higher among all industries.

For capital-intensive industries such as the aviation transportation industry and hotel industry, the ROIC value is very low, and even a negative value has occurred.

In the same large industry, depending on the sub-category, there will also be a larger ROIC value.For example, the retail industry’s building materials and retail food are the two sub-industries.The ROIC values are 54.62%and 7.01%, respectively.50%, which is related to different production and sales models in the two seed industries.