How to invest in Hong Kong stocks in the United States?We introduced four tips for you to easily trade Hong Kong stocks.

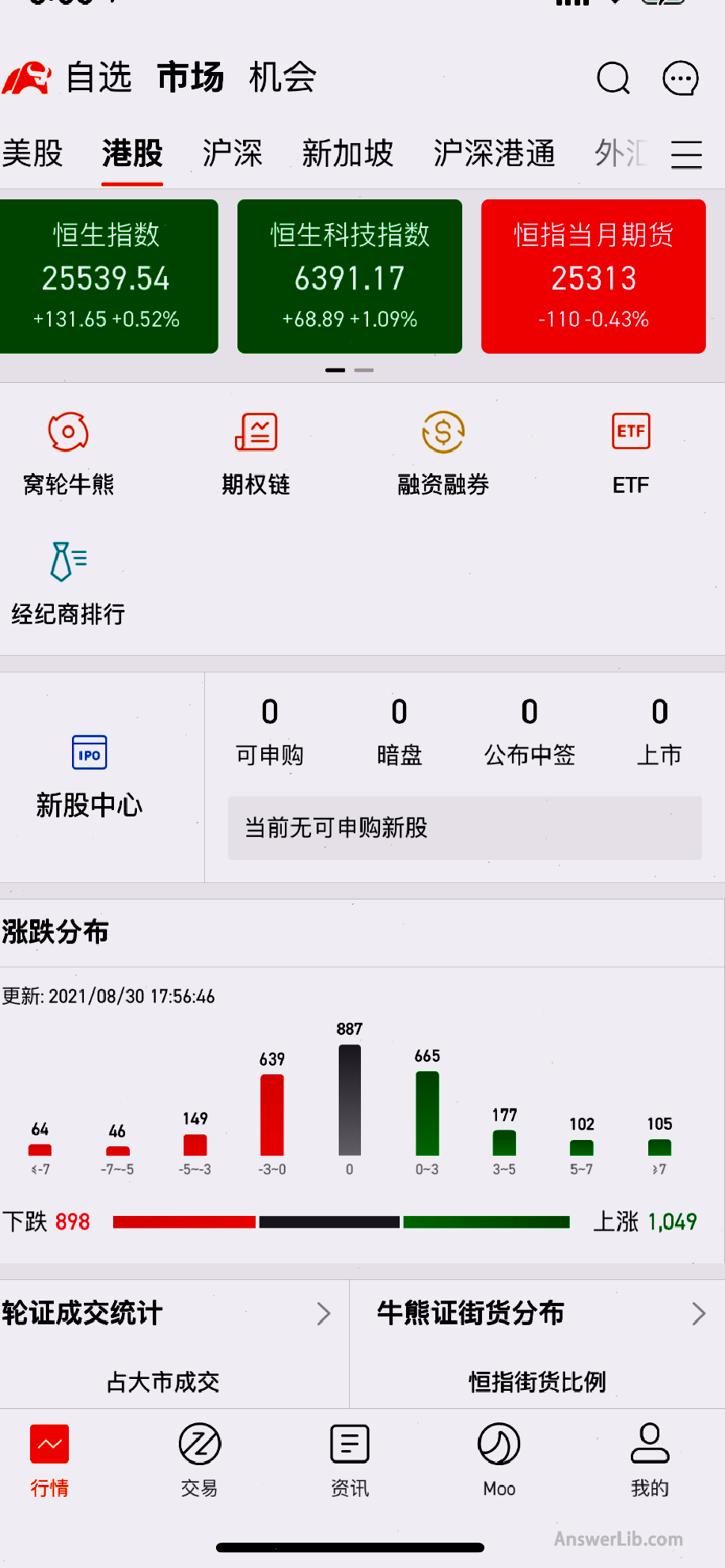

The Hong Kong Stock Exchange is the fifth largest stock exchange in the world after the New York Stock Exchange, the Nasdaq Stock Exchange, the Tokyo Stock Exchange, and the Shanghai Stock Exchange.

Due to the unique geographical advantages of Hong Kong, the Hong Kong Stock Exchange has also become an important channel for Europe and the United States to develop the Asian financial sector.How do investors in the United States invest in the Hong Kong stock market in the most convenient way?

Directory of this article

- What is Hong Kong stock transaction?

- How do I invest in Hong Kong stocks in the United States?

- What are the advantages of Hong Kong stock transactions?Why invest in Hong Kong stocks?

- Which technology companies are listed in Hong Kong stocks?

- More investment strategies

What is Hong Kong stock transaction?

Hong Kong stock trading refers to investors investing in financial products such as shares such as the joint exchange of Hong Kong, or through the ETF or American Depositary Receipt (& NBSP; ADR) to participate in the company’s shares listed on the Hong Kong Stock Exchangein transaction.

Hong Kong stock transactions are generally available Four via:

- Directly invest in Hong Kong stocks through Futu Moomoo:

So, let’s introduce it in detail below, how to invest in Hong Kong stocks for US Person?

How do I invest in Hong Kong stocks in the United States?

Hong Kong stocks are a securities market that is very worthy of attention and investment.What ways can residents in the United States make Hong Kong stock investment through?

Method 1: Invest in Hong Kong stocks through Futu Moomoo [Recommended]

This is the most effective, most convenient, most comprehensive, and free investment method of Hong Kong stocks.Choosing a compliant and secure trading platform is the best choice for investors, such as Futu Moomoo, Interactive Brokers, Jiaxing(Charles Schwab) and Fidelity.

in, Futu Moomoo supply Minimum account opening requirements As well as The optimal commission rate, support for fragmented stock transactions Essence

Futu Moomoo is a one-stop American stock and Hong Kong stock investment platform.It supports a account to trade US stocks and Hong Kong stocks at the same time, and there is no need to open a Hong Kong stock account separately.

At present, the registered Futu Moomoo, in addition to getting the US Level 2 quotation for free, can also get a 30 -day free Hong Kong stock Level 2 market (worth $ 54.99).30 days of free Hong Kong stock Level 2 is a limited time benefit, and the activity time is: 9/13 ~ 10/20.

The following is the detailed comparison of Futu Moomoo and other brokers, when trading Hong Kong stocks:

| platform | Hong Kong stock commission | Account opening type | Currency exchange fee | Hong Kong stock financing interest rate | Hong Kong stock crushed stock transaction |

|---|---|---|---|---|---|

| Futu Moomoo | The transaction amount is 0.03%commission, the platform fee is HKD $ 15/single | No need to open an account alone | For details, see FUTUTRADE official website | 6.80% | support |

| Interactive brokers Penetrate | The transaction amount is 0.08%commission, the lowest platform fee HKD $ 18/single | No need to open an account alone | 0.20 Base point*transaction value, minimum USD $ 2 (1 basis point = 0.0001) | 2.5% -Pro 3.5% -live | not support |

| Charles SCHWAB Jiaxin Finance | Resident fixed HKD 250 | You need to open Global Account separately | 0.20%-1.00% | Do not support financing | not support |

| Fidelity Extent | Resident fixed HKD 250 | No need to open an account alone | 0-1.00% | Do not support financing | not support |

| TD Ameritrade Demei | Do not support Hong Kong stock transactions to American residents | ||||

| Tradeup tiger | |||||

| Webull Micro-cow | |||||

Here are several advantages to use Futu Moomoo to invest in Hong Kong stocks:

1.Easy investment in Hong Kong stocks

It is very easy to invest in US stocks in the United States.It is not easy to find a regulatory brokerage firm, but it is not so easy to invest in Hong Kong stocks abroad through a broker or trading platform.

Futu Moomoo It provides American investors with the same convenience as investing in its own land and U.S.stocks.

As long as the FUTU INC.Securities account is opened through the Futu Moomoo platform and chose to invest in Hong Kong stocks, you can invest in US stocks and Hong Kong stocks under the same personal securities account.The channel is as simple as.

Another highlight is that Futu Moomoo supports Hong Kong stocks fragmentation stock investment, that is, investors can purchase Hong Kong stocks with less than one hand with a small amount of funds.

U.S.investors in the United States know that supporting the purchase of fragmented stocks can make the investment portfolio more flexible.At present, among the securities firms or trading platforms in the US market, Futu Moomoo is the only platform that supports Hong Kong stocks.Seamless switching investment, Futu Moomoo brings the most convenient Hong Kong stock investment experience to investors.

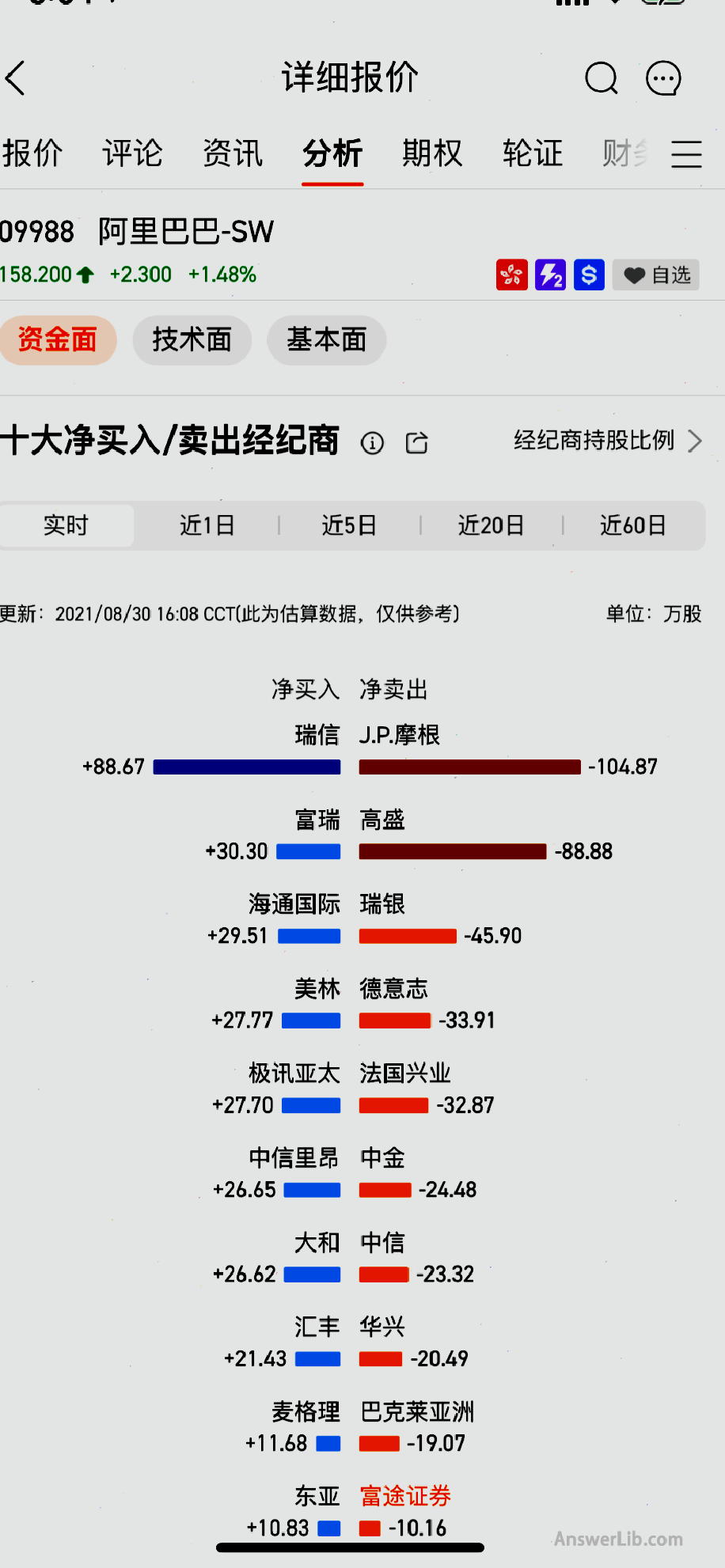

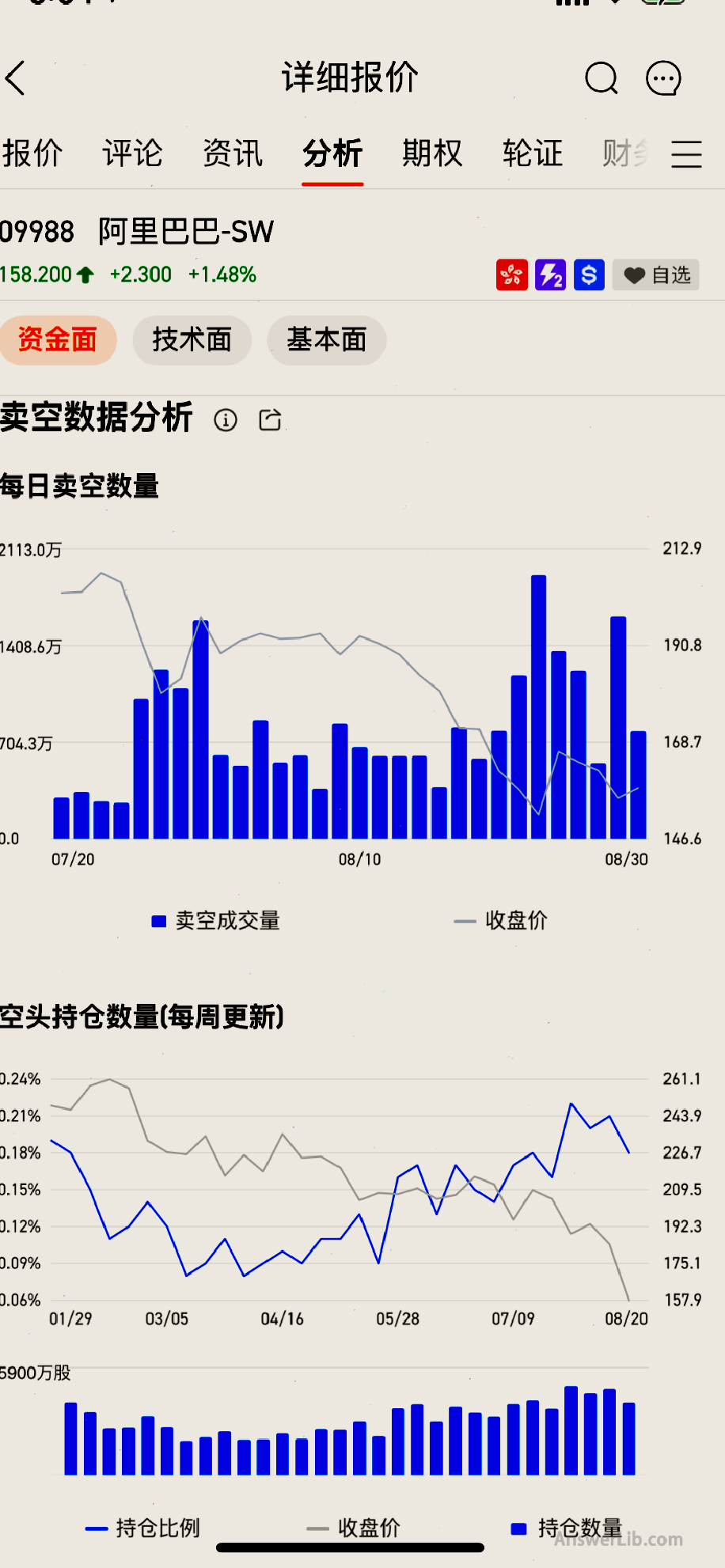

Finally, Futu Moomoo provides the most powerful Hong Kong stock market analysis tools, including the top ten net buying and selling brokers data, short-selling data analysis, index interpretation, analyst rating, etc.

The Hong Kong stock Level 2 provided by Futu Moomoo can help predict the market trend and benefit more.

The function of Hong Kong stock Level 2 is as follows:

- Real-time price: The Hong Kong stock LV2 is a real-time push price, which is the latest, and there is no need to refresh manually.

- Record of transaction one by one: The transaction records listed each trading time, transaction price, and transaction volume.It has greatly improved market transparent shares.For example, in the transaction one by one, you can find large orders and super large orders to understand the movement of the main force.Finally, transactions can also help judge the future trend.In particular, if you continue to buy it occasionally, it means that the buying willingness is strong, and the valuation will show a rise.And if it is continuously buying, it means that the buying awareness is strong, and the stock price will show a rise; if it is continuously actively selling, it means that the willingness to sell is stronger, and the valuation will enter the downward.

- Sale of ten stalls: The Hong Kong stock LV2 -bit order provides a detailed quotation of ten files, so users can make accurate orders.You can see the quotation and orders of both parties and sellers, and you can also judge the future valuation trend.By hanging the single volume, you can judge the general support and resistance.

- Sale of sale: The proportion of current orders will also be displayed in the market ten market market.From the budding set of the brokerage queue, you can roughly judge the location of your hanging order, so as to decide whether to follow or wait and see.The Hong Kong stock market position is the agency of “trading participants” on the exchange.The Hong Kong Exchange will be assigned to one or more unique four-digit numbers for each participant in each person, that is, the seater number.The entrusted order of the securities firms will be updated in real time in the quotation screen, which can reflect the real-time orders, transactions, and relevant statistical data of all stocks.

2.Ultra-low investment cost

Any investment hopes to maximize benefits.This is why local securities firms are constantly compressing their own trading commission and other expenses to maximize investors’ benefits.

However, for Hong Kong stock investment, because of the distant region, securities firms or transactions hold resources by hand, and higher commissions will be set up to earn benefits, and investors’ benefits will be reduced.

Futu Moomoo Provide 0 threshold account opening, no exchange rate, and the lowest transaction commission in peers.

The transaction commission ratio provided by Futu Moomoo is the lowest of the current peers, a ratio of 0.03%, and the platform fee is charged HKD $ 15 per order.Among other securities firms, the transaction securities supporting Hong Kong stock transactions collect a ratio of 0.08%, the platform fee is HKD $ 18, while Jiaxin and Fidelity receive a fixed commission HKD $ 250.

Let ’s take 100 shares of Tencent stocks as an example.Let’ s compare the costs required to use different brokers:

100 Tencent = HKD 50,000, at the same time HKD 1 = USD 0.13

Therefore, through low commissions and no currency exchanges, Futu Moomoo brings the most affordable investment cost for investors in the United States.

3.Safety and guarantee

As an investor, the security of the trading platform is the primary consideration.Futu Moomoo All the investment products and related services provided are provided by its parent company FUTU Inc..

FUTU Inc.is a securities broker registered at the SEC of the US Securities and Exchange Commission.It is also a member of the US Financial Supervision Administration FINRA and the US securities investor protection company SIPC.It provides a protection of up to $ 500,000 for securities customers’ account funds.

Futu Group’s licensed brokerage in Hong Kong has received comprehensive supervision in the United States and protects investors’ account security.In the Hong Kong market, the number one online trading platform in the market and part of the MSCI Hong Kong index.It is enough to prove that Futu Securities has sufficient trust in Hong Kong.

Whether it is the United States who invests in and Hong Kong, which is investing in destinations, Futu Moomoo provides investors with the safest trading platform.

4.Excellent account opening/Gold is good

Futu Moomoo For American investors with generous account opening and gold rewards.

New users can get a free stock with a maximum value of $ 350.In addition, when you deposit $ 2,000 and maintain an average asset of $ 2,000 or more within 30 days, you will guarantee to obtain a free GM general car stock (September 2, 2021, about $ 48).

5.Friendship with Chinese

Futu Moomoo On the basis of the English interface, a Chinese trading interface is launched.At the same time, it supports Chinese customer service and provides Chinese communities.It can be said that it is the best choice for Chinese Chinese trading Hong Kong stocks.

6.Occupy local advantages

Futu Moomoo It was launched by Moomoo Inc., and its parent company is FUTU, and FUTU itself is part of the Hong Kong index of MSCI Morgan Stanley Capital International Company.Not only in the United States, in Hong Kong, Futu Niu Niu is also the number one online trading platform app.

Therefore, FUTU INC.can provide more comprehensive local information about Hong Kong stock market than all other American online trading platforms, not only the official information of the Stock Exchange and the Hong Kong Exchange, but also many Hong Kong local people’s analysis views on Hong Kong stocks.

In addition, Futu Moomoo provides comprehensive Chinese services, including the Chinese version of the platform interface, Chinese customer service, and the Chinese community forum.It can be said that Futu Moomoo is the best choice to provide the most authentic Hong Kong stock investment services for Chinese people in the United States.

Deepen reading The How about Futu Moomoo [Send U.S.Stocks] Account supports three markets

Method 2: Invest in Hong Kong stock ETF

ETF, including Hong Kong stocks, is also a choice of Hong Kong stock investment.

The advantage of investing in the Hong Kong stock ETF is that there are professionals selected Hong Kong stocks worth investing in, and then packaged for investment.Investors do not have to analyze Hong Kong stocks one by one, and judge the trend of ups and downs separately.It is relatively easy to invest.

However, for investors who are biased towards technical analysis, it is the main way to determine the market for investment in the market to judge the market for target stocks.In this case, the Hong Kong stock ETF cannot provide sufficient flexibility and freedom, and on the contrary, there will be certain investment limitations.

In addition, Hong Kong stocks ETF contains limited Hong Kong stocks, and investors may not be able to complete the good benefits of Hong Kong stock investment.

Method 3: Use ADR to invest

Some companies listed in Hong Kong will be in the US local securities market.For example, the New York Stock Exchange or the Nasdaq Stock Exchange is listed in the form of American Depository Receipts (ADR).

American investors invest in it like investing in local stocks.When some Hong Kong stocks enter the US stock market in the form of ADR, US investors can invest in Hong Kong stocks by investing in these deposit vouchers.

The benefits of Hong Kong stock investment through ADRS are convenient.Investors do not need to open other accounts, and other currencies can invest in foreign stocks.

However, this method of investment in Hong Kong stocks has great limitations.

- First of all, it takes certain conditions to be able to enter the US market in the US market in the form of ADRS, which leads to few investors’ investment targets;

- Secondly, after Hong Kong stocks enter the US stock market, they will not bring all comments and analysis to enter the US market together.When investors invest in this way, it is difficult for them to obtain a comprehensive dynamic analysis of stocks., Will not make a standard judgment like a high-quality platform directly invest in Hong Kong stocks to obtain the maximum benefits.

Method 4: Open a personal investment account in Hong Kong

Of course, the channels for direct investment in Hong Kong stocks are not a single only through the US local securities firms or transactions.

However, when U.S.residents choose Hong Kong agents to invest in Hong Kong stocks, they need to pay attention to the “Foreign Account Tax Compliance Law” -Foreign Account Tax Compliance Act, referred to as FATCA restrictions, the decree aims to eliminate US citizens’ investment, operations and earnings in foreign countries.Tax evasion after tax income.

As a type of overseas investment in Hong Kong stock investment, when its income exceeds a certain amount, it must be reported to the US tax department, otherwise it will be regarded as tax evasion and tax evasion.Tax evasion is a serious illegal incident.

Therefore, many Hong Kong securities firms have avoided American citizen investors for fear of FATCA.

As a result, Hong Kong stock investment is the best choice for American investors through a convenient and secure American local trading platform like Futu Moomoo.

What are the advantages of Hong Kong stock transactions?Why invest in Hong Kong stocks?

1.Powerful historical background

The Hong Kong stock market has a long history.The earliest exchange was the Hong Kong Joint Exchange -The Stock Exchange of Hong Kong Limited, referred to as the Stock Exchange, was established in 1891.It is the earlier large-scale stock exchange worldwide.

The journey of more than 100 years has made the Hong Kong Stock Exchange a mature and secure financial investment place.

Before Hong Kong returned to China in 1997, Britain has been managing Hong Kong.Many British companies are stationed in Hong Kong, established corporate distribution, and expand their market in Asia.As a result, after the establishment of the Hong Kong Stock Exchange, it has become the financial investment center of Europe and the United States in Asia.The free environment, good liquidity, and the convenient trade convenience brought by natural geographical location has made the Hong Kong stock market flourish.Disposal in the world.

After Hong Kong returned to China in 1997, the governance policy of one country, two systems, and two systems gave Hong Kong a great financial freedom environment.Even if some enterprises were afraid of the replacement of the central government and decided to withdraw from the Hong Kong market, it still does not affect the continuation of the Hong Kong financial market.Growth, instead, companies in some countries and regions choose to go to Hong Kong for development due to the improvement of political situations, thereby bringing new power to the Hong Kong stock market.

In 1999, the Hong Kong Union Exchange and the Hong Kong Futures Exchange, & NBSP; and The Hong Kong Securities Clearing Company Limited announced the merger to the Hong Kong Exchange Holdings Company ( GES and ClearingLimited), as a financial whole, providing financial investment platforms and services for people from all walks of life.

In November 2014, the “Shanghai -Hong Kong Stock Connect” channel was announced, which means that traders from the Shanghai Stock Exchange can purchase Hong Kong stock securities through securities companies.In reverse, traders of the Stock Exchange can purchase stock securities of Shanghai Stock Exchange through securities brokers.

Subsequently, in December 2016, the “Shenzhen -Hong Kong Stock Connect” channel was announced.The opening of the two channels means that investors in mainland China and Hong Kong have obtained a broader and free investment field.

At present, the market value of Hong Kong has become the fifth largest stock exchange in the world, and Hong Kong dollar is ranked 14th in the global currency trading volume of the Hong Kong dollar of Hong Kong dollar at the International Settlements.

At the same time, due to the opening of the Shanghai -Hong Kong Stock Connect and the Shenzhen -Hong Kong Connect, the Hong Kong Stock Exchange, Shanghai Stock Exchange, and Shenzhen Stock Exchange currently occupy the largest share in the Asian financial market, with a total market value of more than $ 10 trillion.

2.Perfect market supervision

The Hong Kong financial trading market implements the dual supervision of the Hong Kong Exchange and the Hong Kong Government’s financial agencies.All data are backups, which is more secure and perfect.

At the same time, the financial statements of all listed companies are more transparent and real to ensure the interests of all shareholders.

3.Superior financial location

The geographical location of Hong Kong has a natural superiority in financial trade.It is a port area connecting the outside world and mainland China.

Under the policy of one country, two systems, Hong Kong has obtained the largest trade and financial freedom, tax and fiscal management are highly autonomous, and a loose financial atmosphere attracts many investors.Compared with the rigorous trading restrictions in mainland China, many high-quality enterprises in the mainland willChoose to be listed on the Hong Kong Stock Exchange to grow up in a more loose environment, which provides foreign investors with a good opportunity to invest in mainland Chinese companies.

On the other hand, the opening of the Shanghai -Hong Kong Stock Connect and Shenzhen -Hong Kong Stock Connect provided the conditions for overseas investment for many mainland investors, so this attracted many high-quality foreign companies to set up the Asia -Pacific headquarters in Hong Kong and listed on the Hong Kong Stock Exchange.To get better and better financing.

Therefore, whether it is an overseas investor investing in mainland China companies in Hong Kong stocks, such as Tencent, Sinopec, PetroChina, etc., or foreign companies such as HSBC banks, such as HSBC, Hong Kong stocks have received capital injection from mainland investors.Preferred choice.

4.Rich investment derivatives

Hong Kong’s financial investment derivative market was initially developed in the 1980s.After more than 30 years of development, it has formed a rich variety and mature derivative market.It is currently one of the most active derivative markets in Asia.

5.Seduced dividend tax

Investing in the US stock market, investors’ dividends often need to pay certain taxes.

But in Hong Kong, the dividend paid by the registered company does not require taxes.This is a very attractive condition for shareholders, which means that more investment returns can be obtained.

Which technology companies are listed in Hong Kong stocks?

At present, high-quality technology stocks in the Hong Kong Stock Exchange are (Disclaimer: Note that the following stocks are not recommended stocks, but listed some technology companies listed in Hong Kong):

- Tencent Holdings (00700)

- Alibaba (09988)

- Baidu (09888)

- Jingdong Group (09618)

- Xiaomi Group (01810)

- Meituan Review (03690)

- Bilibili (09626)

- Netease (09999)