Weighted average capital cost English is the Weight Average Cost of Capital, referred to as WACC, which is an indicator for measuring a company’s financing capabilities.WACC is the method of capital costs calculated according to the proportion of the total capital of the company’s various capitals and the weighted average.During the calculation process, it is necessary to considerThe weight of the total capital is multiplied.After the product is added, the cost of weighted average capital can be obtained.

As a financial indicator for measuring the company’s financing capabilities, the higher the WACC value, the higher the financing cost of the company, the greater the corresponding investment risk; the lower the WACC value, the lower the financing cost of the company, and the corresponding investment risk may be less.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- How to calculate the cost of weighted the average capital?

- How to calculate Apple’s weighted average capital costs?

- What are the investment guidance significance of weighted average capital costs?

- What are the limitations of weighted average capital costs?

- More investment strategies

How to calculate the cost of weighted the average capital?

The calculation method of the weighted average capital cost is to multiply the financing cost of each capital, multiplied by its weight in the total capital, and then added.

Investment capital mainly includes equity and debt.If the company sets up preferred shares, the part of the preferred shares must be added.If there is no preferred shares, it does not need to be calculated.

At the same time, because enterprises can deduct interest fees from tax payment, the net cost of corporate debt is that the total interest amount paid to be reduced its corresponding tax, namely: debt cost-debt cost X tax rate.

Therefore, if you do not consider preferred equity, then the calculation method of weighted the average capital cost is:

Weighted average capital cost = equity weight × equity cost + bond weight × debt cost × (1 -tax rate)

WACC = (E/V × Re) + (D/V × RD × (1−TC))

in:

- E: The company’s ordinary shares, here the company’s market value (Market & nbsp; CAP) is calculated, and the company’s circulating shares are calculated by the stock price;

- D: The company’s debt (DEBT) can be calculated with total debt;

- V: The company’s capital value (Total Value of Capital) is the company’s total market value and debt, v = e + d;

- RE: The company’s equity cost (COST & Nbsp; of & Nbsp; Equity), which is a numerical value with a certain subjectivity.It is usually a percentage value set by investors based on its own analysis of the company and combined with the company’s historical return rate., Or can also use the CAPM model to estimate the equity cost.

- RD: The company’s debt cost (Cost & nbsp; of & nbsp; debt), which can divide the company’s total interest expenditure in the financial year and calculate

- TC: The company’s corporate tax rate (Corporate Tax Rate) can be found in the financial report of the listed company.

For equity costs, you can consider using the Capital Asset Pricing Model (CAMP model) to estimate the use of capital asset pricing models.The calculation method is:

RE= RF+ β (R (Rm– RF.

in:

- RE: Stock expectation return rate

- RF: Zero risk returns, generally use US 10 -year national debt ratio as R as RF valueThe current data is 2.74%【source】

- Rm,:The market expects return rate, which can be calculated using the average return rate of Standard Purcelling 500, for example: 10%

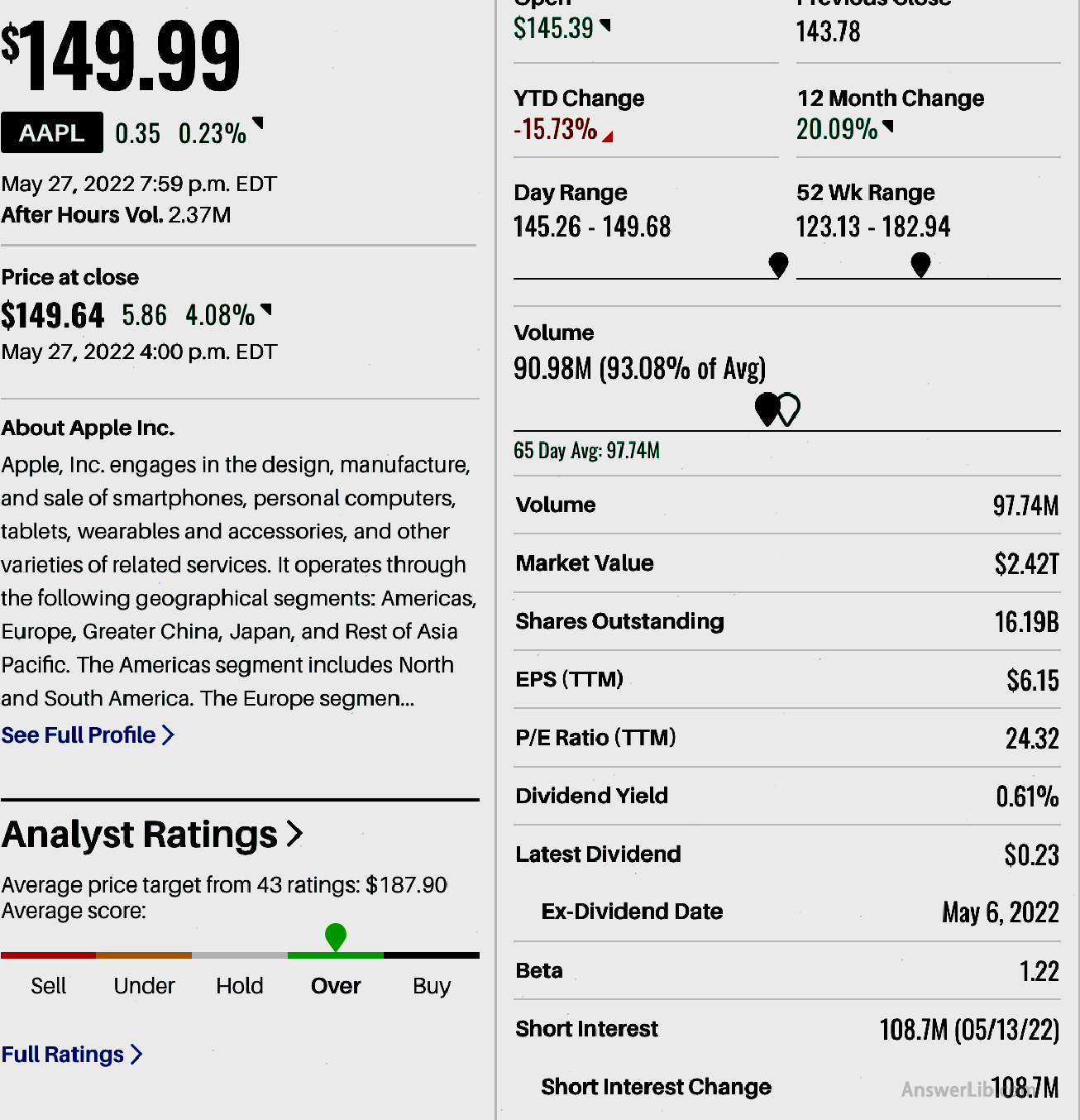

- Β: The system’s system risk factor for the entire stock market, for example, Apple’s current β coefficient is 1.22 【source】

In the CAMP model, the higher the β coefficient, REThe higher the value, the higher the expected return of investors.

how Calculate Apple’s weighted average capital costs?

This chapter will be released by 10-k released by Apple in September 2021 Financial report Calculate the instance:

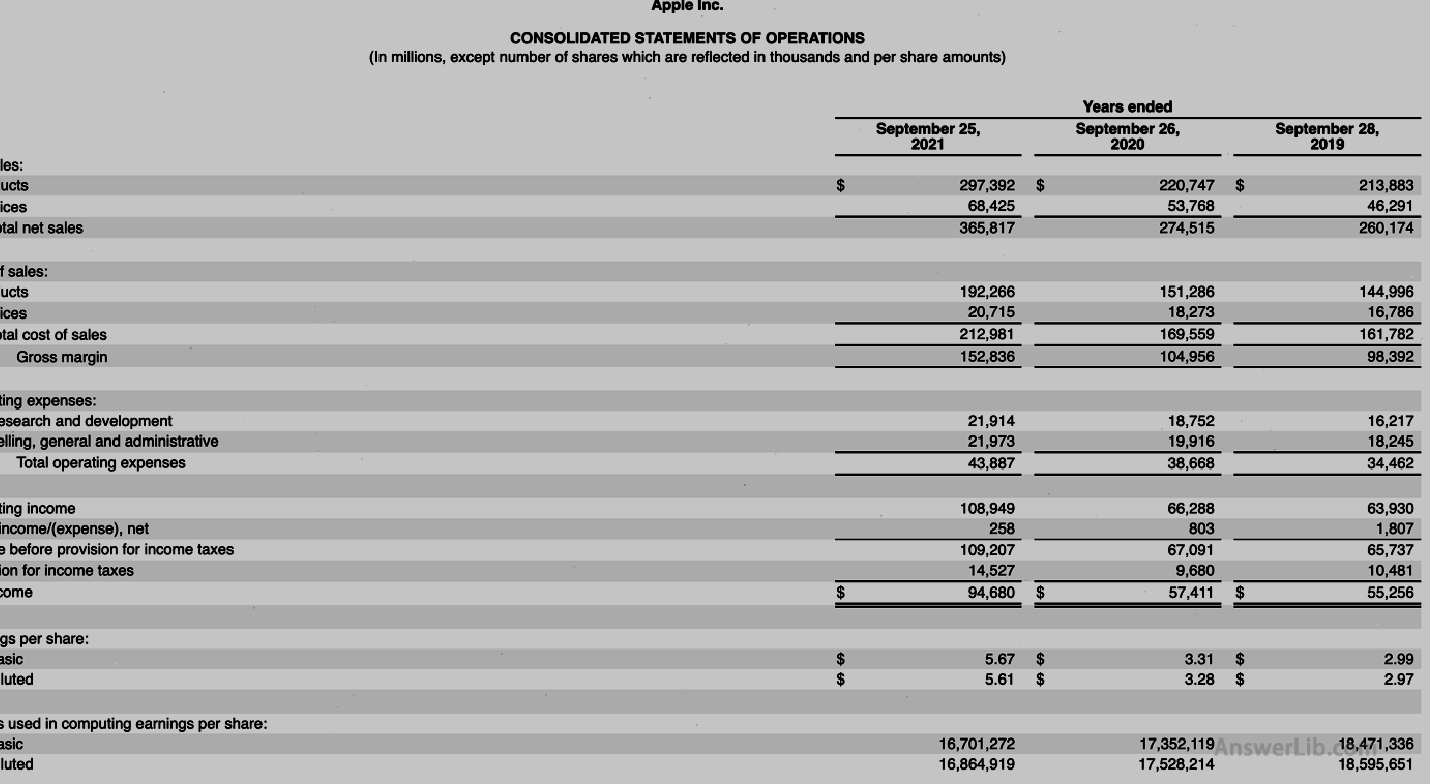

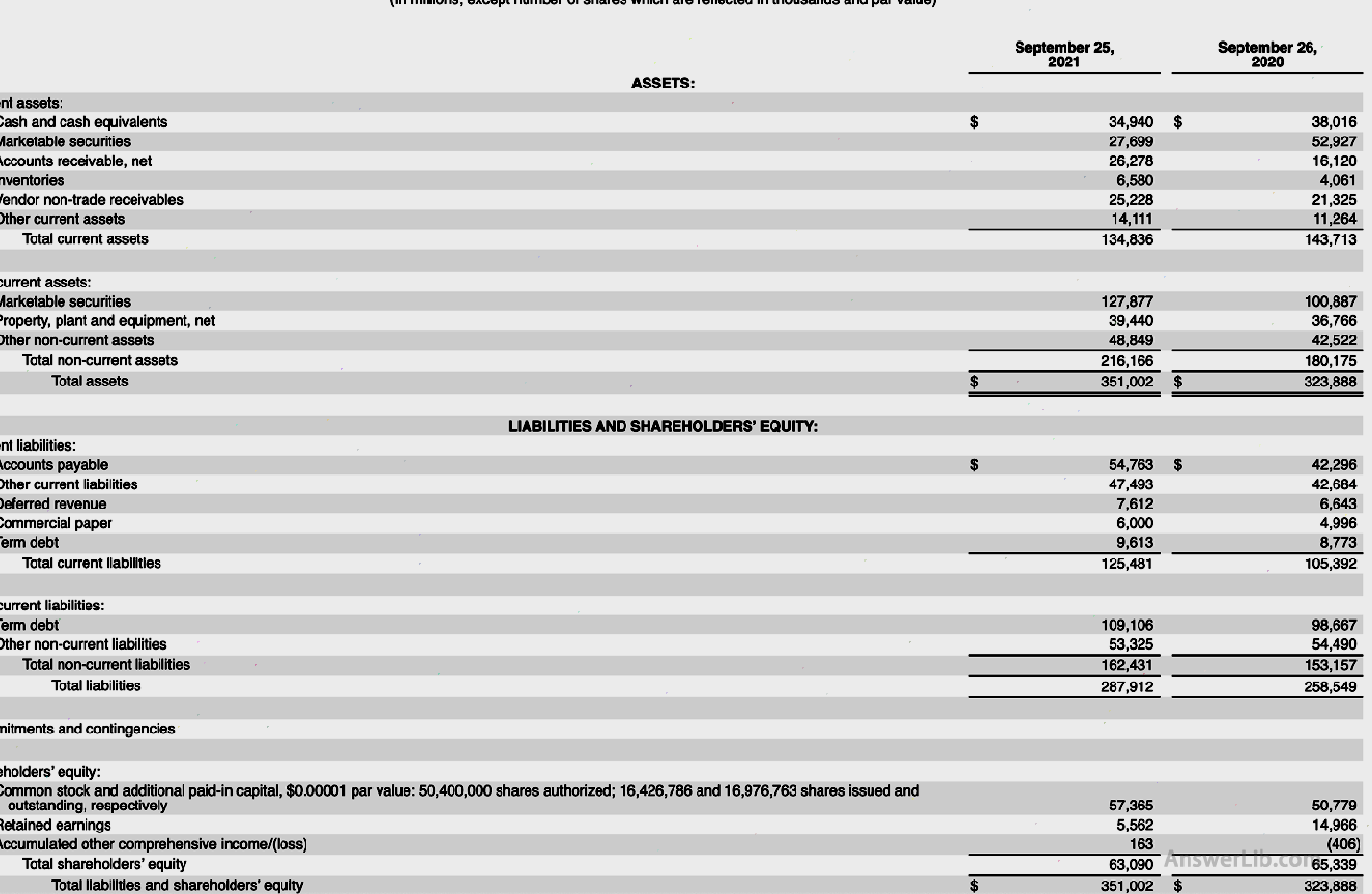

AAPL Financial Report middle Loser As well as Balance sheet The data table is shown below:

Profit table:

Asset liabilities:

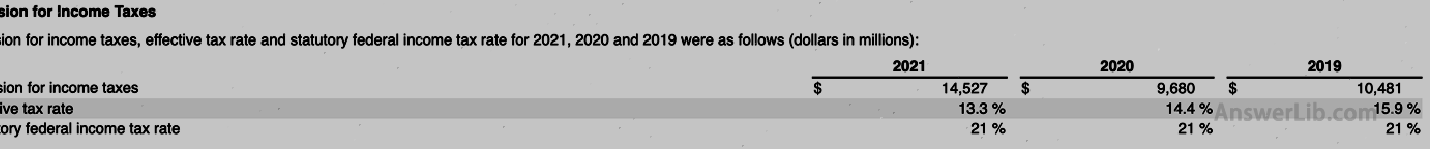

Enterprise tax rate:

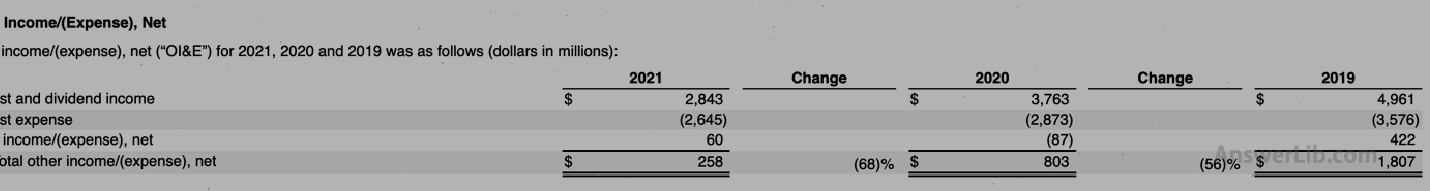

Interest expenditure:

Apple Investment portal website Get the current stock price:

From the data map, we can see:

Number of circulation shares | 16,701,272,000 |

share price | $ 149.64 |

Total interest expenditure | $ 2,645 m |

Total debt | $ 287,912 m |

Corporate tax rate | 13.3% |

so:

Market value E = Circulation stocks × stock price

= 16,701,272,000 × $ 149.64

= $ 2,499,178 m

Debt D = $ 287,912 m

Capital value v = e + d

= $ 2,499,178 m + $ 287,912 m

= $ 2,787,090 m

= $ 2,787 T

The cost of the equity is calculated based on the CAMP model:

RE= RF+ β (R (Rm– RF.

RFIt is 2.74%

The average return rate of S & P 500: Rm= 10%

Apple’s current β coefficient: β = 1.22

so,

RE= RF+ β (R (Rm– RF.

= 2.74% + 1.22 (10% -2.74%)

= 11.60%

Debt cost RD = interest expenditure / total debt

= $ 2,645 m / $ 287,912 m

= 0.92%

Weighted average capital cost = share capital weight × share capital cost + debt weight × debt cost × (1-tax rate)

WACC = (E/V × Re) + (D/V × RD × (1−TC))

= ($ 2,499,178 m / $ 2,787,090 m × 11.60%) + ($ 287,912 m / $ 2,787,090 m × 0.92%× (1 – 13.30%)))

= 10.40% + 0.08%

= 10.48%

What are the investment guidance significance of weighted average capital costs?

Investors usually use the cost of weighted average capital to measure the company’s investment value.The value represents the return required by investors including debt and securities, including debt and securities.

- When the WACC value is low, it means that the company’s financing cost is low;

- When the WACC value is high, the company’s financing cost is higher.

When analyzing the company, it is best to compare the WACC value with the ROIC (investment capital return rate) to measure the possibility of investment gain.

- When RoIC is greater than WACC, it means that the return on investment will be greater than the investment cost, and it is possible to invest in investment;

- When ROIC is less than WACC, it means that the company’s investment income is less than its average investment cost, and investing in it may not be able to obtain returns, indicating that this is a high-risk investment.

At the same time, WACC can also be used as a discounted rate to come to the future cash flow.

- The higher the value of the WACC, the lower the current value of the cash flow sticker in the future, and the lower the profitability of the company in the future;

- The lower the value of the WACC, the higher the current value of cash flow, and the higher the profitability of the company in the future.

For the company’s internal, WACC is also used to measure the company’s specific project development or the possibility of further financing by expanding debt or equity investment.

- The lower the value of the WACC, the less likely the project development or financing is less likely;

- The higher the WACC value, the possibility of project development or financing.

What are the limitations of weighted average capital costs?

In the actual calculation process, the computing values of weighted average capital costs are greatly affected by market fluctuations.Whether it is the US Treasury yield and the company’s market value, it will have a significant effect on WACCUsing WACC to evaluate the company’s investment costs may get different results, which will then lead to different investment value evaluation results, so users should combine more other objective data for financial analysis and evaluation.