Roe, English is Return on Equity It can be used to evaluate the ability of listed companies to convert investment costs into profits.Usually, the higher the ROE value, the stronger the company’s ability to transform costs into profits, and the stronger the ability to reinvest in profit, thereby increasing profits.

Like other investment analysis index values, the ROE value also has its own limitations.How should investors use ROE values when evaluating investment objects?

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- What is net asset yield?

- What is ROE TTM?

- How to use net asset yields to evaluate companies?

- What kind of net asset yield is good?

- How to check the ROE of the boss company?

- ROE in different industries?

- What are the differences and connections between ROE and ROA?

- common problem

- More investment strategies

What is net asset yield?

The yield of net assets, also known as the return on equity, is named: Return On Equity, abbreviated as ROE.

The yield of net assets is to measure the company’s ability to transform the equity investment into profit by calculating the percentage of the company’s net income in the investment in the company’s net income.The calculation formula is as follows:

Net asset yield = net income / net assets

ROE = Net Income / Shareholder Equity

in,

- Net income, English is Net InCome, also known as Net Profit, or after Tax Profit.

- Net assets, also known as Shareholder Equity, are the remaining parts of the company’s total assets minus liabilities (Total Liabilities)

For example, the net income of Company A is $ 35,500,000, and the average shareholder equity is $ 578 million.Then the ROE of Company A this year is:

ROE = $ 35,500,000 / $ 578,000,000 = 6.14%

That is, every dollar of shareholders’ equity can generate a net income of 6.14 cents.The ROE value shows the profit from the company’s equity of each US dollar shareholder, which is expressed at percentage.

All information required by the company’s shareholders’ equity can be found on the company’s Balance Sheet.

Total Assets include mobile assets and non-flow assets.Moral assets refer to assets that can be converted into cash within a period of time, such as cash, accounts receivable, inventory, etc.Non-liquid assets refer to assets that cannot be converted into cash or consumed, such as investment, real estate, plant and equipment, and at the same time, including intangible assets, such as patents.

In the process of calculating the assets, some R & D and Development (R & D) need to be used as assets rather than expenses.This will lead to the reduction of the ROE value after adjustment.

According to the International Financial Report Standard (International Financial Reporting Standards ( IFRS) It is stipulated that if the company can prove that the assets in development are commercial feasibility, that is, the technology or products in development may pass the approval process and generate income, then its research and development cost can be capitalized.Essence

What is ROE TTM?

ROE TTM, the full name, is TRAILING 12 MONTHS RETURN On Equity.The calculation data is to divide the average shareholders’ equity of the net income of the past 12 months:

Roe TTM = 12 Months Network / Average Shareholder Equity

Its value reflects the company’s share capital into profitability in the past year.

How to use net asset yields to evaluate companies?

According to the calculation method of ROE, investors always want to see a higher ROE value, because it indicates that the company can effectively use its investor’s funds more effectively.

The high net assets of net assets are always relatively low in net assets.However, it should be noted that ROE must use comparison of different companies in the same industry or comparison in different periods of the same company, because different types of corporate assets and debt levels are different, and their income levels are different.The ROE value does not have indexant significance.

A.For the same company

Observing the ROE value of a company in different periods, you can deeply understand how the company’s management uses equity financing to develop business.

If the company’s ROE value will continue to increase over time, it indicates that the company has good equity utilization capabilities, that is, without injection of new share capital, effectively invest in reinvestment to generate higher profitsEssence

In contrast, the decline of ROE may mean that management has made a wrong decision when investing in capital.

B.For different companies in the same industry

By comparing the company’s ROE with the average level of the industry, the company’s competitive advantage can be determined.

ROE, which is higher than its industry, can be considered a good ROE.New York University professor Aswath Damodaran has calculated the average ROE of many industries.As of January 2021, the average market ROE was 8.25% 【source】 Essence

Comparing ROE to different companies in the same industry, you can get better investment options.

C.Note

ROE is not an absolute indicator of investment value.The growth of ROE is sometimes not the increase in the company’s profitability, but due to the increase in cost.

For example, if the company’s liabilities increase, then net assets will decrease, resulting in the increase in the calculated ROE.Therefore, the ROE at this time is not caused by the improvement of profitability.

If the company’s intangible assets, such as intellectual property and brand value when calculating ROE, are calculated in the inside, then the actual ROE will be high.Therefore, while viewing the ROE value, we must also consider changes in net income and net assets.

What kind of net asset yield is good?

Under normal circumstances, the higher the ROE value in the same industry, the higher the company’s ability to use the share capital.

However, different industries have their own average ROE values.It is meaningful to compare it in the same industry.For example, as a building supplies sales company, the ROE industry average is about 20%, while medical care products sales companies are about 7%.It can be seen that it can be seen that it can be seen that it can be seen.Comparing the ROE value cross-industry is meaningless.

But does the higher ROE value have its true guiding significance?

the answer is negative.for example:

- When the company has a stock repurchase behavior, it will directly lower the shareholders ‘equity, but the impact on the company’s income is not as great as the shareholders’ equity.At this time, the ROE value will be increased because the degree of denominator decreases than the molecule, but it is not caused by the company’s optimized share capital utilization rate.

- High ROE may be caused by high debt: because shareholders ‘equity is assets subtracting liabilities, and liabilities include long-term and short-term debt.When the assets are the same, the more debt in the company, the less its shareholders’ equity, and the higher the ROE value, the higher the ROE valueEssence

For example, Company A and Company B have $ 1000 assets and net income of $ 120.Company A has a debt of $ 500 and Company B has $ 200 debt.

Then the ROE value of Company A is: $ 120 / ($ 1000 -$ 500) = 24%, and the ROE value of Company B is: $ 120 / ($ 1000 -$ 200) = 15%.

Through ROE, although Company A seems to have higher profitability, because it has more debt, the benefits of investors will be limited.

At this time, it may be more appropriate to evaluate if the Return on Investled Capital (ROIC) is more appropriate, and it more comprehensively reveals the correlation of debt and return.

How to check the ROE of the boss company?

You can use Macrotrends to query the ROE of each listed company.The following is a specific query step:

step one: exist Macrotrend Enter the company name or stock code you want to query on the homepage.Taking Apple as an example, in the drop-down menu, select “Revenue”

Step 2: In the option, select “Other Ratios”, and then select “ROE”

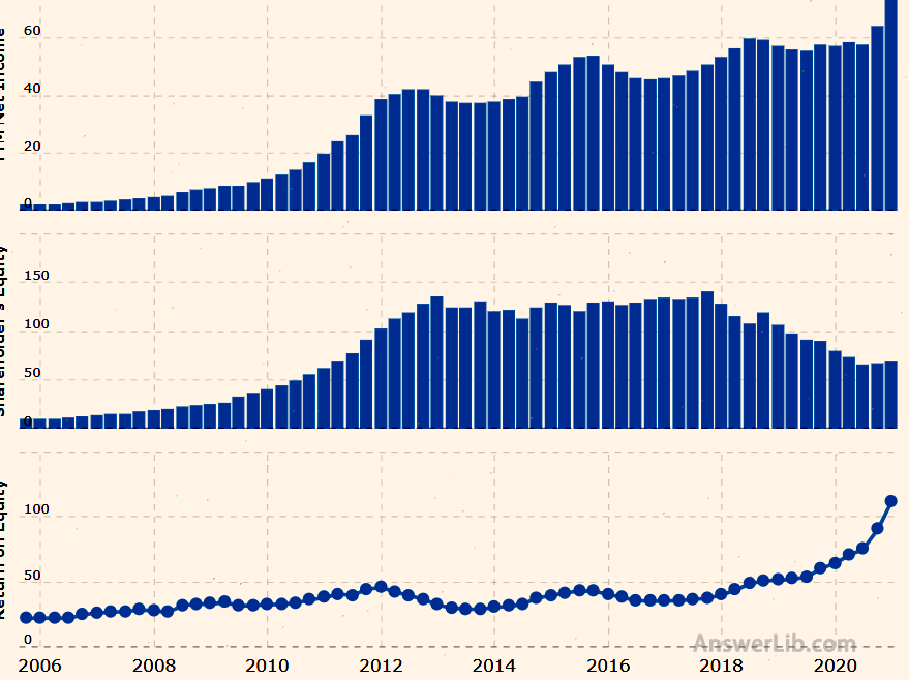

Step 3: Continue to roll the page to find the net income value of Apple’s TTM, shareholder equity value, and ROE value

ROE in different industries?

Below is the ROE value of different industries and the ROE value adjusted by R & D.

Industry name | Number of firms | ROE (Unadjusted) | ROE (Adjusted for R & D) |

|---|---|---|---|

| Advertising | 61 | 2.93% | 2.45% |

| Aerospace/defense | 72 | 8.54% | 6.90% |

| Air Transport | 17 | -47.03% | -46.40% |

| Apparel | 51 | -8.19% | -8.12% |

| Auto & Truck | 19 | 4.49% | 2.39% |

| Auto Parts | 52 | -14.31% | -11.47% |

| Bank (Money Center) | 7 | 7.41% | 7.41% |

| Banks (Regional) | 598 | 8.22% | 8.22% |

| Beverage (alcoholic) | twenty three | 10.10% | 10.10% |

| Beverage (soft) | 41 | 28.86% | 27.83% |

| Broadcasting | 29 | 0.24% | 0.24% |

| Brokerage & Investment Banking | 39 | 12.08% | 12.07% |

| Building Materials | 42 | 20.54% | 18.13% |

| Business & Consumer Services | 169 | 6.81% | 6.72% |

| Cable TV | 13 | 11.47% | 11.40% |

| Chemical (BASIC) | 48 | -1.82% | -1.73% |

| Chemical (DIVERSIFIED) | 5 | 13.25% | 11.52% |

| Chemical (Specialty) | 97 | 2.50% | 2.20% |

| Coal & Related Energy | 29 | -41.66% | -41.62% |

| Computer service | 116 | 13.50% | 11.03% |

| Computers/Peripherals | 52 | 50.53% | 29.56% |

| Construction support | 46 | 13.20% | 10.77% |

| DIVERSIFIED | 29 | 10.62% | 10.12% |

| Drags (biotechnology) | 547 | -1.19% | 1.30% |

| Drugs (PHARMACEUTICAL) | 287 | 18.98% | 11.98% |

| Education | 38 | -5.66% | -5.29% |

| Electrical Equipment | 122 | 17.67% | 14.62% |

| Electronics (consumer & office) | twenty two | -4.89% | -1.67% |

| Electronics (General) | 157 | 6.67% | 5.48% |

| Engineering/Construction | 61 | 2.54% | 2.52% |

| Entertainment | 118 | -2.87% | -2.10% |

| Environmental & Waste Services | 86 | 6.21% | 6.21% |

| Faring/agriculture | 32 | 14.03% | 11.85% |

| Financial svcs.(Non-BANK & Insurance) | 235 | 64.28% | 61.83% |

| Food Processing | 101 | 10.12% | 9.85% |

| FOOD WHOLESALERS | 18 | -5.03% | -5.03% |

| Furn/home furnishings | 40 | 13.37% | 11.67% |

| Green & Renewable Energy | 25 | -20.59% | -20.51% |

| Healthcare Products | 265 | 10.55% | 8.39% |

| Healthcare Support Services | 129 | 16.60% | 16.56% |

| HeathCare Information and Technology | 139 | 14.11% | 12.00% |

| Homebuilding | 30 | 17.70% | 17.70% |

| HOSPITALS/HealthCare Facilities | 32 | 70.64% | 70.59% |

| Hotel/Gaming | 66 | -30.40% | -28.37% |

| Household Products | 140 | 31.60% | 27.38% |

| Information Services | 77 | 14.35% | 13.41% |

| Insurance (general) | twenty one | 1.49% | 1.51% |

| Insurance (Life) | 26 | 5.61% | 5.61% |

| Insurance (PROP/CAS.) | 55 | 9.19% | 9.19% |

| Investments & Asset Management | 348 | 12.35% | 12.24% |

| Machinery | 125 | 12.65% | 11.15% |

| Metals & Mining | 86 | 2.67% | 2.61% |

| Office Equipment & Services | twenty two | 6.36% | 5.16% |

| OIL/GAS (Integrated) | 3 | -6.19% | -6.09% |

| OIL/GAS (Production and Exploration) | 278 | -37.09% | -37.04% |

| Oil/Gas Distribution | 57 | 1.28% | 1.28% |

| Oilfield SVCS/EQUIP. | 135 | -26.63% | -25.74% |

| Packaging & Container | 26 | 9.76% | 9.48% |

| Paper/Forest Products | 15 | 4.69% | 4.66% |

| POWER | 55 | 7.69% | 7.67% |

| Precious metals | 93 | 8.27% | 8.13% |

| Publishing & newSpapers | 29 | -14.18% | -14.00% |

| R.E.I.T. | 238 | 2.17% | 2.17% |

| Real Estate (Development) | 25 | -0.13% | -0.13% |

| Real Estate (General/DIVERSIFIED) | 11 | 2.00% | 2.00% |

| Real Estate (Operations & Services) | 61 | 4.71% | 4.77% |

| Recuction | 69 | -7.19% | -5.32% |

| Reinsurance | 2 | 2.42% | 2.42% |

| Restaurant/dining | 79 | Na | Na |

| Retail (Automotive) | 30 | 36.28% | 36.28% |

| Retail (Building Supply) | 15 | 0.27% | 0.27% |

| Retail (Distributors) | 85 | 9.67% | 9.67% |

| Retail (general) | 17 | 20.64% | 20.61% |

| Retail (Grocery and Food) | 14 | 30.63% | 30.63% |

| Retail (online) | 75 | 27.05% | 12.88% |

| Retail (SPECIAL LINES) | 85 | -0.64% | -0.56% |

| Rubber & Tires | 3 | -25.69% | -20.52% |

| Semiconductor | 70 | 22.13% | 14.38% |

| Semiconductor Equip | 40 | 32.23% | 21.20% |

| Shipbuilding & marine | 11 | -5.70% | -5.70% |

| Shoe | 11 | 23.70% | 23.44% |

| Software (Entertainment) | 101 | 17.71% | 13.44% |

| Software (Internet) | 36 | -11.23% | -4.11% |

| Software (System & Application) | 388 | 28.09% | 17.83% |

| Steel | 32 | -2.84% | -2.82% |

| Telecom (Wireless) | 16 | 8.91% | 9.15% |

| Telecom.Equipment | 96 | 17.10% | 10.42% |

| Telecom.Services | 58 | 11.27% | 11.08% |

| Tobacco | 15 | -0.23% | -0.23% |

| Transportation | twenty one | 22.77% | 22.73% |

| Transportation (railroids) | 6 | 21.47% | 21.47% |

| Trucking | 35 | -17.70% | -17.27% |

| Utility (general) | 16 | 7.49% | 7.48% |

| Utility (Water) | 17 | 8.99% | 8.98% |

| Total Market | 7582 | 8.25% | 7.44% |

| Total Market (without Financials) | 6253 | 7.78% | 6.83% |

Data Sources: Nyu

It can be seen from the data in the table that the five industries with the highest ROE value after the R & D funding are adjusted:

- HOSPITALS/HealthCare Facilities: 70.59%

- Financial svcs.(Non-Bank & Insurance): 61.83%

- Retail (Automotive): 36.28%

- Retail (Grocery and Food): 30.63%

- Computers/peripherals: 29.56%

What are the differences and connections between ROE and ROA?

The calculation formula of ROE and ROA is as follows:

- ROA = net income / total assets = net income / total asset

- ROE = net income / (total assets-total debt) = net income / equity

It can be seen from the formula that ROA reflects the profit margin generated by the common funds of shareholders and creditors, and ROE is a profit margin generated by the funds invested by shareholders.

If you want to truly understand the real operating ability of a company, you should analyze the two indicators of ROE and ROA.

- When a company has no debt, the ROE and ROA values are the same;

- When a company’s liabilities are within a reasonable range, if its ROA value looks good, then its ROE value should be good, and the difference with the ROA will not be too large;

- When a company bear too much debt, the difference between the ROE value and ROA will be very large, indicating that the company does not use the equity fund well, but borrows too much debt to maintain the company’s operation profit.When you just look at the ROE value, it is easy to mislead investors’ judgment on the company’s profitability;

common problem

Question 1: What is the yield of net assets?The yield of net assets, also known as the return on equity, is named: Return On Equity, abbreviated as ROE.The yield of net assets is to measure the company’s ability to transform the equity investment into profit by calculating the percentage of the company’s net income in the investment in the company’s net income.

See More

Under normal circumstances, the higher the ROE value in the same industry, the higher the company’s ability to use the share capital.However, different industries have their own average ROE values.It is meaningful to compare it in the same industry.For example, as a building supplies sales company, the ROE industry average is about 20%, while medical care products sales companies are about 7%.It can be seen that it can be seen that it can be seen that it can be seen.Comparing the ROE value cross-industry is meaningless.

See More

According to the calculation method of ROE, investors always want to see a higher ROE value, because it indicates that the company can effectively use its investor’s funds more effectively.The high net assets of net assets are always relatively low in net assets.However, it should be noted that ROE must use comparisons in different companies in the same industry, or compare in different periods of the same company, because different types of corporate assets and debt levels are different and the income level is different.Compared with its ROE valueIt does not have indicator significance.

See More

At present, the five industries with the highest ROE value are:

HOSPITALS/HealthCare Facilities: 70.59%

Financial svcs.(Non-Bank & Insurance): 61.83%

Retail (Automotive): 36.28%

Retail (Grocery and Food): 30.63%

Computers/peripherals: 29.56%

See More