Shareholders’ equity ratio, English is Equity To Asset Ratio.It is an important indicator of the company’s financial strength.It is the proportion of assets from the assets of the listed company, from the assets obtained by the stock sale.It can also be used to measure the solvency of the listed company.One of the important indicators of long-term financial stability.In general, the value of shareholders ‘equity ratio floats between 0 and 1, and the greater the shareholders’ equity ratio, which shows that the company’s financial leverage is low and the stronger financial strength.

A company’s total assets (Asset), equal to the sum of the total shareholders ‘equity (Equity) and Liability, and the shareholders’ equity ratio is to compare the equity of the total shareholders with the total assets.The proportion of assets obtained by stock sales can also be calculated to calculate the asset ratio obtained by debt in the company’s assets.

When the shareholders’ equity ratio is high, it means that most of the company’s assets come from the investment of shareholders, not foreign debt.In this way, the higher the benefits of all shareholders after the company repay all debts.

On the contrary, when the shareholders’ equity ratio is low, it indicates that most of the company’s assets come from foreign debt.If the company must repay all the debt, the income left to the shareholders will be very limited.The extreme situation is when the company is forced to clear the liquidation.The assets left to shareholders may be very small.In this case, investors need to be very cautious.

Bleak American broker:Transparent securities| | Futu Securities| | Microex Securities| | Tiger securities| | First securities| | Robinhood in| | American Langshang Daquan

Directory of this article

- How to calculate shareholders’ equity ratio?

- How to calculate Apple’s shareholders’ equity ratio?

- What is the investment guidance significance of shareholders’ equity ratio?

- The use of shareholders’ equity ratio is limited

- More investment strategies

How to calculate shareholders’ equity ratio?

The calculation formula of shareholders ‘equity ratio is to divide the company’s total shareholders’ equity with total assets, namely:

E Quity to Asset Ratio = Total Equity / Total Assets

in:

- The company’s total shareholders ‘equity, including the shareholders’ equity of the common shares and the shareholders ‘equity of the Preferred Equity, should calculate all the current circulation shares, and plus the retention of shareholders’ equity related to shareholders during the financial cycleRetain Earnings and cumulative other comprehensive income / losses (Accumulated Other Comprehensive Income / Loss) to obtain total shareholders’ equity.

- The company’s total assets include the Current Assets and the Non-Current Assets, where current assets are usually cash and cash equivalents, Marketable Securities, and receivables receivables(Accounts ReceIVABLE), Inventories, Vendor Non-Trade Receivles, and other mobile assets.Non-liquid assets mainly include Marketable Security ( S), property, Property, Plant and Equipment, and other non-current assets.Add all these assets to get the company’s total assets.

In actual use, investors and analysts can quickly find the total shareholders’ equity in the Statements of Shareholders’ or Balaance Sheets, which is usually labeled as Total Shareholders’ Equity.Find the company’s total assets in the balance sheet, and then perform simple computing computing to obtain the company’s shareholders’ equity ratio in this financial cycle.

how Calculate Apple’s shareholders’ equity ratio?

Book The chapter will be released by Apple in September 2021 10-K financial report Calculate the instance:

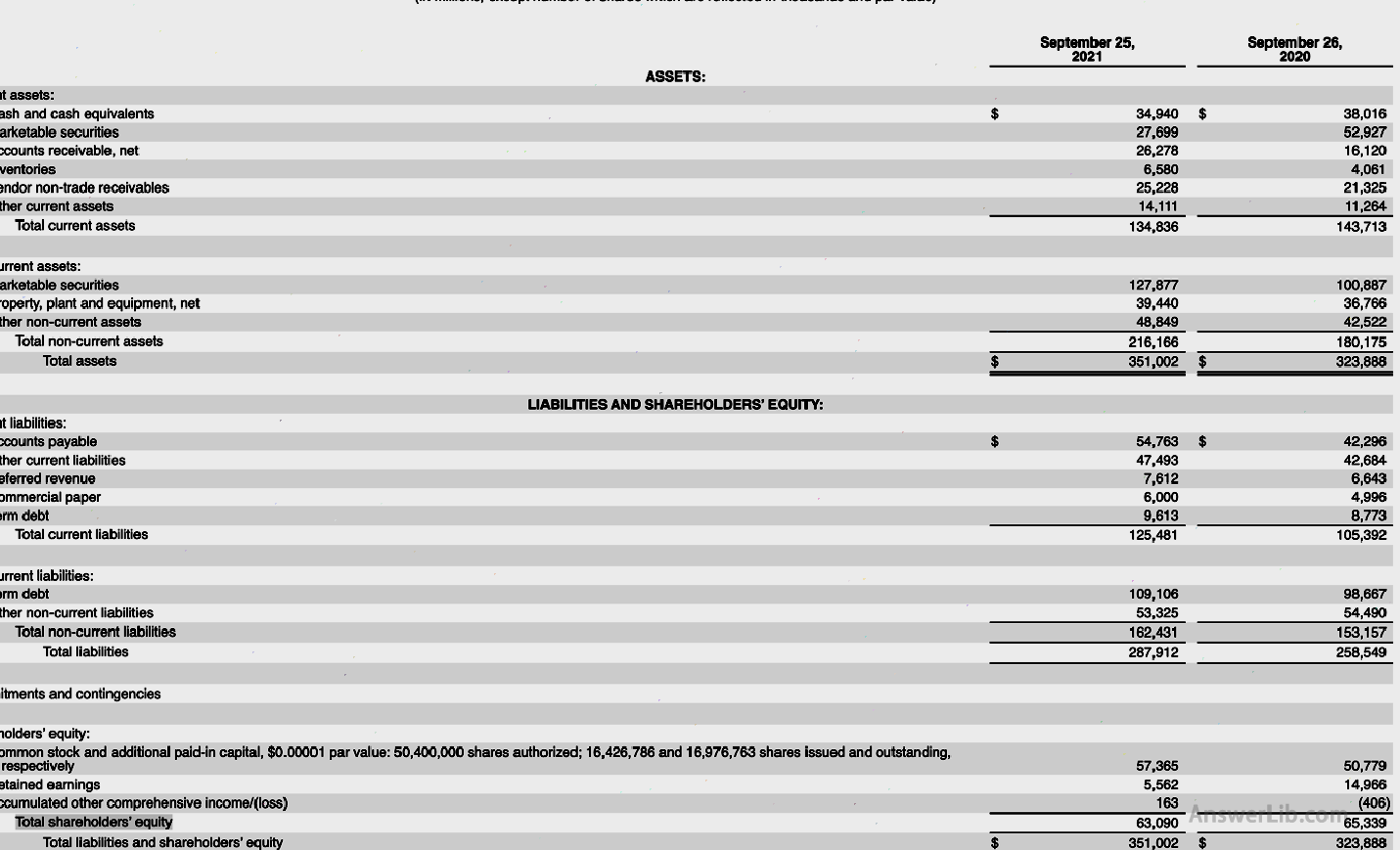

AAPL Financial Report middle Balance sheet As follows:

In the table above,

- You can find Apple’s total assets (Total Assets) in the 2020 ~ 2021 financial year to $ 351,002 m

- The Total Shareholders ’Equity of the financial year is $ 63,090 m

Therefore, Apple’s shareholders’ equity ratio of shareholders in September 2021 is:

Equity to Asset Ratio = Total Equity / Total Assets

= $ 63,090 m / $ 351,002 m

= 0.18

Therefore, the shareholders ‘equity ratio of Apple 2021 Financial Year is 0.18 or 18%.It can be understood that of Apple’s assets per $ 100, $ 18 comes from shareholders’ equity, and the remaining $ 72 comes from debt.

What is the investment guidance significance of shareholders’ equity ratio?

The higher the shareholders’ equity ratio, the higher the percentage of the assets of investors in the company’s total assets.When the company repay the debt, the higher the benefits of shareholders can obtain.At the same time, it also shows that the company’s assets are relatively less proportion of debt, and the higher the company’s ability to repay debt, the less likely to the company’s financial risk.

On the contrary, the lower the shareholders’ equity ratio, it shows that the company’s assets are more obtained through debt.Generally, it is considered to be considered a large hidden danger of financial risks, such as more likely to go bankrupt.

Under normal circumstances, companies with shareholders’ equity ratio of 0.5 and below are leverage companies.There are certain hidden risks in such companies, which may cause greater benefits to their investment, and they may also bring greater losses.Companies with a ratio of more than 0.5 are considered conservative companies, and their income or losses after investing are relatively stable.

For the shareholders’ equity ratio of 1, or 100%of the company, although the company’s shareholders enjoy all the company’s assets, such an asset distribution model is usually considered to be curbing the rapid development of the company, and some high-speed high-speed may miss some high-speed speeds.The opportunity for development, whether it is the expansion of the company or the growth of shareholders’ income, will have more serious limitations.

Limitation of shareholders’ equity ratio

When using the shareholders ‘equity ratio to compare the company, because companies in different industries have different operating models and asset distribution, they cannot use shareholders’ equity ratio to compare companies in different industries.HoweverIt has a certain degree of comparability.