Peter Lynch’s fair value, English is Peter Lynch Fair Value.It is a calculation model that measures the inherent value of a growth company.It can be used to evaluate whether the company’s stock is overestimated.

Peter Lynch’s fair value is by the investment master Peter Linqi(Peter Lynch) proposed that it was the company’s company P / Ery of Growth(PEG) multiplied by the current 5 -year average income growth rate (EPS GROWTH RATE) for the current 12 months of earnings per share (EPS TTM).Investors can judge whether the company’s stock is overvalued compared with the current stock price compared with the current stock price.When the fair value of Peter Lynch is less than the current stock price, the company’s stock price is considered overestimated, and the greater the difference, the greater the extent of being overestimated; when Peter Lynch’s fair value is greater than the current stock price, it is believed that the price of the stock is considered to be the price of the stock price.It is undervalued, and the greater the difference, the greater the degree of underestimation.

In actual use, Peter Link’s fair value is more suitable for evaluating growth companies.For start-up companies and emerging companies, there will be greater evaluation deviations, and the calculation method based on Peter Lynch’s fair value.The evaluation of the stock price is based on the company’s future development speed will be the same as the past development speed.Therefore, it is often underway to underestimate companies with slower growth and overestimate companies that grow faster.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- Who is Peter Link?

- How to use Peter Link’s fair value?

- How to calculate the fair value of Apple’s Peter Lynch?

- What is the investment guidance significance of Peter Link’s fair value?

- What are the limitations of the fair value of Peter Lynch?

Who is Peter Link?

Peter Link is one of the most successful common fund managers in history and one of the most successful investors.He wrote “One Up On Wall Street”, as well as “Beating the Street” They are one of the best-selling investment books.

Affiliate Link

@AmazonAffiliate Link

Peter Lynch was born in 1966.After receiving a bachelor’s degree in Boston College, he obtained an MBA degree at Wharton School of Business at the University of Pennsylvania.

After entering the field of financial investment, Peter Links managed Magellan Fund from 1977 to 1990.Through its unique investment concept, Magellan Fund received nearly 30%of the evaluation return on investment during this period, so that Peter Peter· Link’s reputation.

In his investment management career, Peter Link proposed his own valuation method to evaluate the value of the stock, which is now recognized as Peter Lynch’s fair value.

How to use Peter Link’s fair value?

Peter Lynch’s fair value calculation method is the company’s P / Ery of Growth(PEG) By the company’s average income growth rate in the first five years, multiplied by the recent TTM earnings per share, that is:

Peter Link’s fair value = PEG X has grown earnings per share in the past 5 years X’s earnings per share in the past 12 months

Peter Lynch Fair Value = PEG X EPS Growth Rate X EPS TTM

in:

Peter Lynch believes that the price-earnings ratio of a growth company should be equivalent to its income growth rate per share, that is, the P / Ery growth rate (PEG = 1.

Peter Lynch Fair Value = EPS Growth Rate X EPS TTM

When using the above formula, there are several precautions:

- When using the growth rate of per share to the above formulas, please use a percentage value without percentage.For example, if the growth rate per share is 19%, the 19th generation is used into the above formula.

- Second, the growth rate per share should use the average value of the growth rate of EBITDA per share in the previous five years when calculating.The EBITDA here refers to Extraction of interest and tax pre-amortization benefits Because EBITDA is more difficult to be tampered with compared to other income indicators, and can avoid the impact of some occasional events on the company’s income.At the same time, for the growth rate per share of less than 5%, because the values are too small, it cannot reflect the company’s growth.For companies, 20 is more suitable for 20;

EBITDA’s calculation method is to add the company’s net income, interest, taxes and depreciation and amortization fees, that is,:

EBITDA = net income + tax + interest cost + depreciation and amortization

EBitda = network + taxes + interest expense + depreciation & amortization

in:

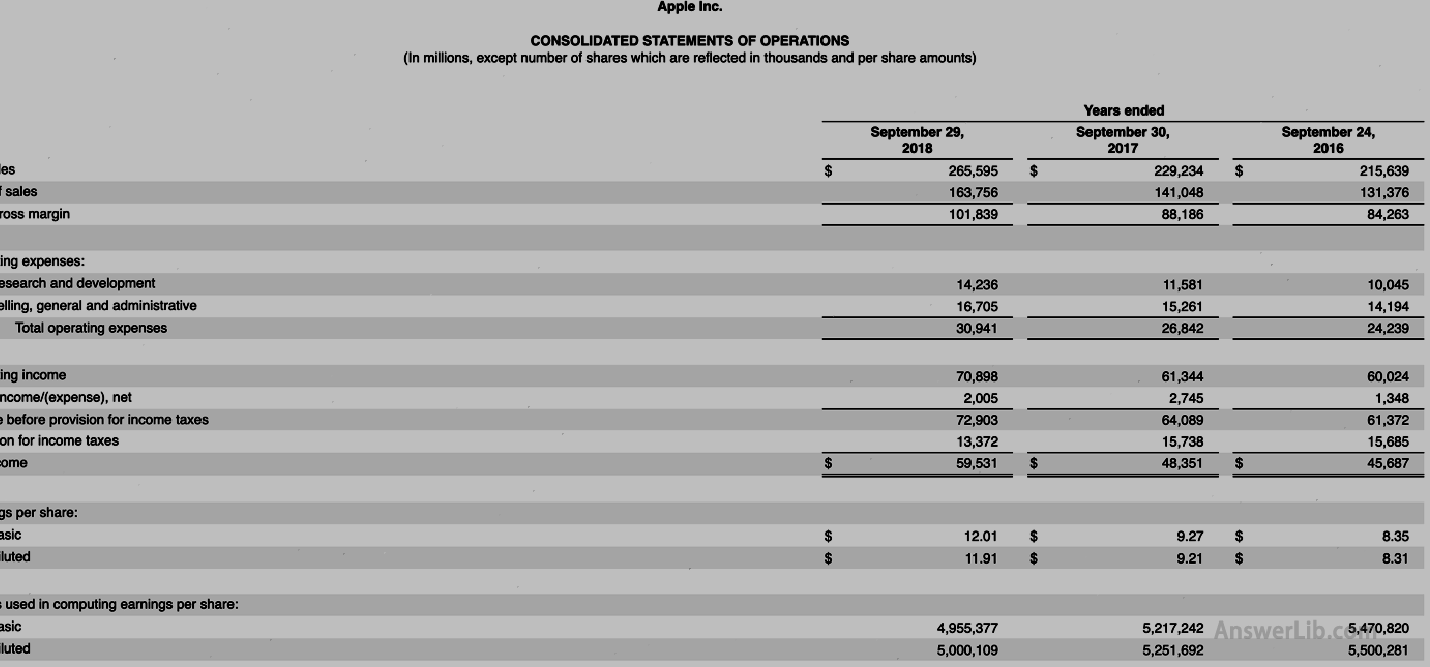

- The number of net income, taxes, and circulation shares can be found in the company’s profit or loss statement (Statements of Operations);

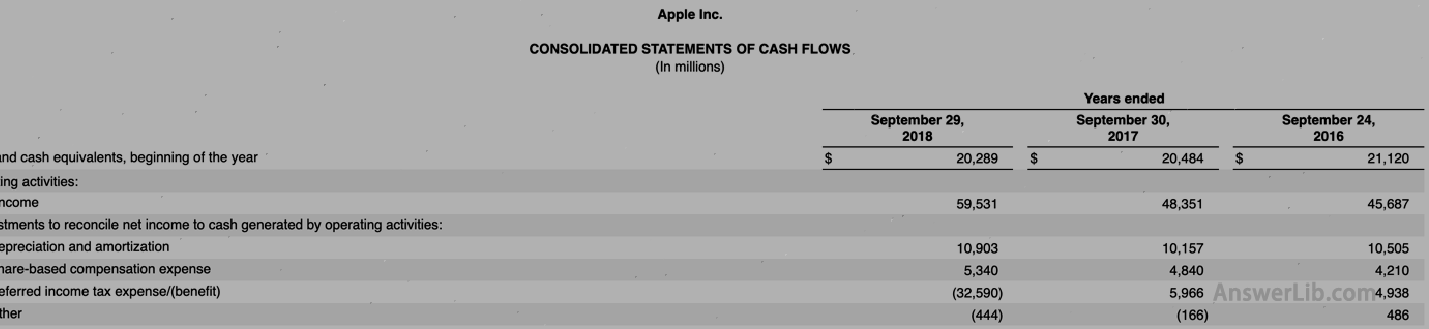

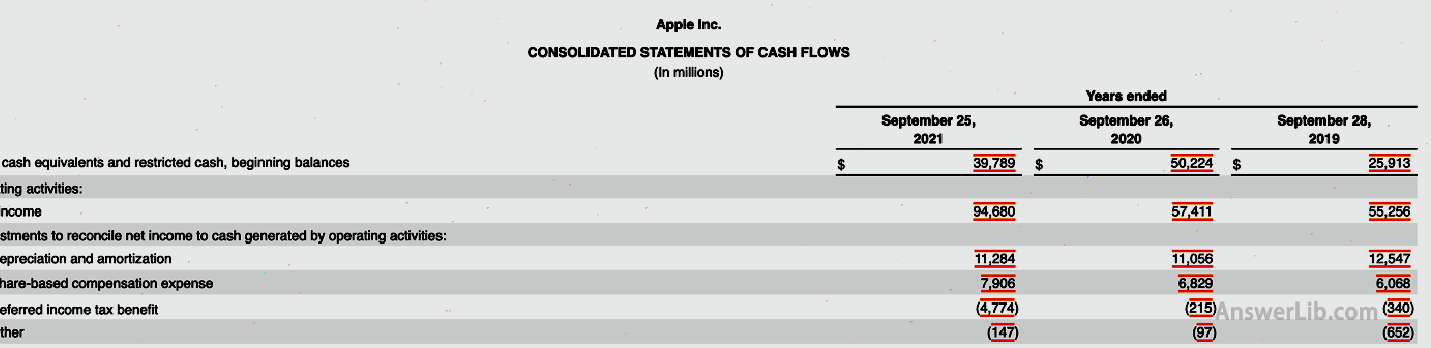

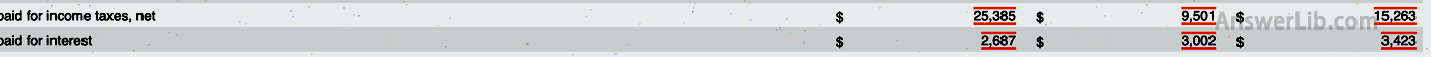

- Depreciation and amortization and interest costs can be found in the Statement of Cash Flows;

- Ebitda per share should also be calculated by issuing the number of diluted shares in addition to the issuance of dilution shares.

How to calculate the fair value of Apple’s Peter Lynch?

This chapter will be released by Apple in September 2021 10-K financial report Calculate the instance:

from AAPL’s past 10 -K -K You can get in the financial report:

Check the data from 2016 to 2018:

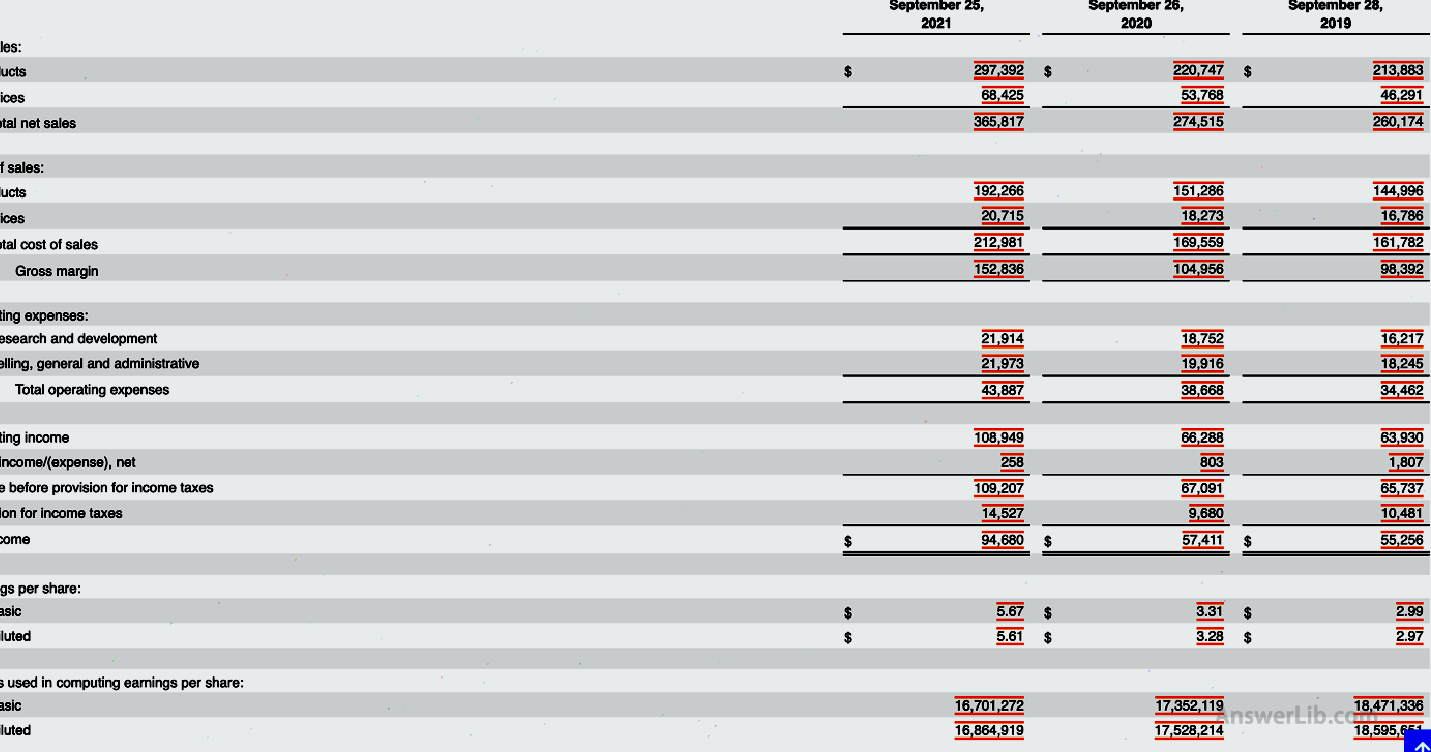

Data from 2019 to 2021:

Note that Apple adopted 1 X 4 stock split in 2020, that is, the 4 shares after splitting the original 1 shares, and the number of issuance shares below was converted into the split after splitting.Value.

| years | Net income (Millions) | Interest (Millions) | Tax (Millions) | Depreciation amortization (Millions) | Ebitda (Millions) | Number of issuance shares | EBITTA earnings per share | Growth rate per share |

|---|---|---|---|---|---|---|---|---|

2016 | $ 45,687 | $ 1,316 | $ 1,456 | $ 10,505 | $ 58,964 | 22001,124K | $2.68 |

|

2017 | $ 48,351 | $ 2,092 | $ 2,323 | $ 10,157 | $ 62,923 | 21,006,768K | $2.995 | 11.75% |

2018 | $ 59,531 | $ 3,022 | $ 3,240 | $ 10,903 | $ 76,696 | 20,000,435 k | $3.835 | 28% |

2019 | $ 55,256 | $ 3,423 | $ 3,576 | $ 12,547 | $ 74,802 | 18,595,651k | $4.023 | 4.9% |

2020 | $ 57,411 | $ 3,002 | $ 2,873 | $ 11,056 | $ 74,342 | 17,528,214K | $4.241 | 5.1% |

2021 | $ 94,680 | $ 2,687 | $ 2,645 | $ 11,284 | $ 111,296 | 16,701,272K | $6.664 | 57% |

average value | 21.35% |

From AAPL Investment portal website It can be learned that Apple’s latest stock price is $ 137.59

so,

Peter Lynch Fair Value = EPS Growth Rate X EPS TTM

= 1 x 21.35 x $ 6.664

= $ 142.28

That is, the fair value of Apple’s current Peter Lynch is $ 142.28, which is slightly underestimated compared to the current stock price $ 137.59.

What is the investment guidance significance of Peter Link’s fair value?

First of all, Peter’s fair value is suitable for growth companies, that is, the average income growth rate of the company is about 10% to 20%.When this scope is beyond this, Peter Link’s fair value is used to evaluate the company’sThe stock price will have serious deviations.

When using Peter Link’s fair value to evaluate suitable company stock prices:

| Peter Link’s fair value and stock price | Significance |

|---|---|

Peter Link’s fair value is greater than the stock price | The company’s stock price is underestimated |

Peter Link’s fair value is equal to the stock price | The company’s stock price is relatively fair |

Peter Link’s fair value is less than the stock price | The company’s stock price is overestimated |

Therefore, for investors, when using Peter Lynch’s fair value to evaluate the company’s stock price, the higher the fair value of Peter Lynch, the higher the stock price of the company, the more inclined to the company’s stock price.Space means a better investment.

What are the limitations of the fair value of Peter Lynch?

When using the fair value of Peter Lynch to analyze the slower growth company, the calculation value of Peter Link’s fair value will be small due to its small growth rate per share, so the company’s stock price will be considered to be considered to be considered to be considered to be considered to be considered to be considered to be considered to be considered to be considered to be considered to be considered as.It is overvalued, but in fact, the company’s stock may not be overwhelmed.Therefore, when using Peter Lynch’s fair value to evaluate the investment value of slower growth, there may be deviations.

Similarly, for companies with a faster development rate, because the growth rate of earnings per share will lead to a large calculation value of Peter Link’s fair value formula.A large investment may be made under this conclusion, but in essence, the stock price of this company may not be underestimated.It can be seen that when the investment value of companies that develop faster companies with the fair value evaluation of Peter Lynch may occur, it may occur.Investment value is overestimated.