Federal fund interest rate, English is Federal Funds Rates, including two types: Federal Funds Effective Rate and Federal Funds Target Rate.

Federal Funds Target Rate is a interest rate formulated by the Federal Public Committee (FOMC).Fed(Federal Reserve) In operation, the guidance of charging interest rates when borrowing between banks when borrowing between banks, playing the most direct role in regulating and controlling.Interest rates increase or decrease.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- Why is the federal fund interest rate important?

- How is the federal fund interest rate formulated?

- How to regulate economic activities by federal funds?

- What impact does the Federal Reserve affect the economy?

- More related reading

Why is the federal fund interest rate important?

The federal fund target interest rate first stipulates the interest rate of the bank overnight borrowing, because the Federal Reserve Law stipulates that all banks must ensure sufficient cash in the bank before the end of the day, which can ensure that the customer’s withdrawal requirements can be cope with the second day of the customer’s withdrawal requirements.When the bank ended on the same day, the reserve was insufficient, and it was necessary to borrow from other banks.The interest rate of the loan was called the overnight interest rate.It was also a type of inter Bank Offered Rate (IBOR).

In addition, Federal Funds Effective Rate is the weighted average of interest charged by the Fed when loaning to other banks across the country.It is based on Federal Funds Target Rate.

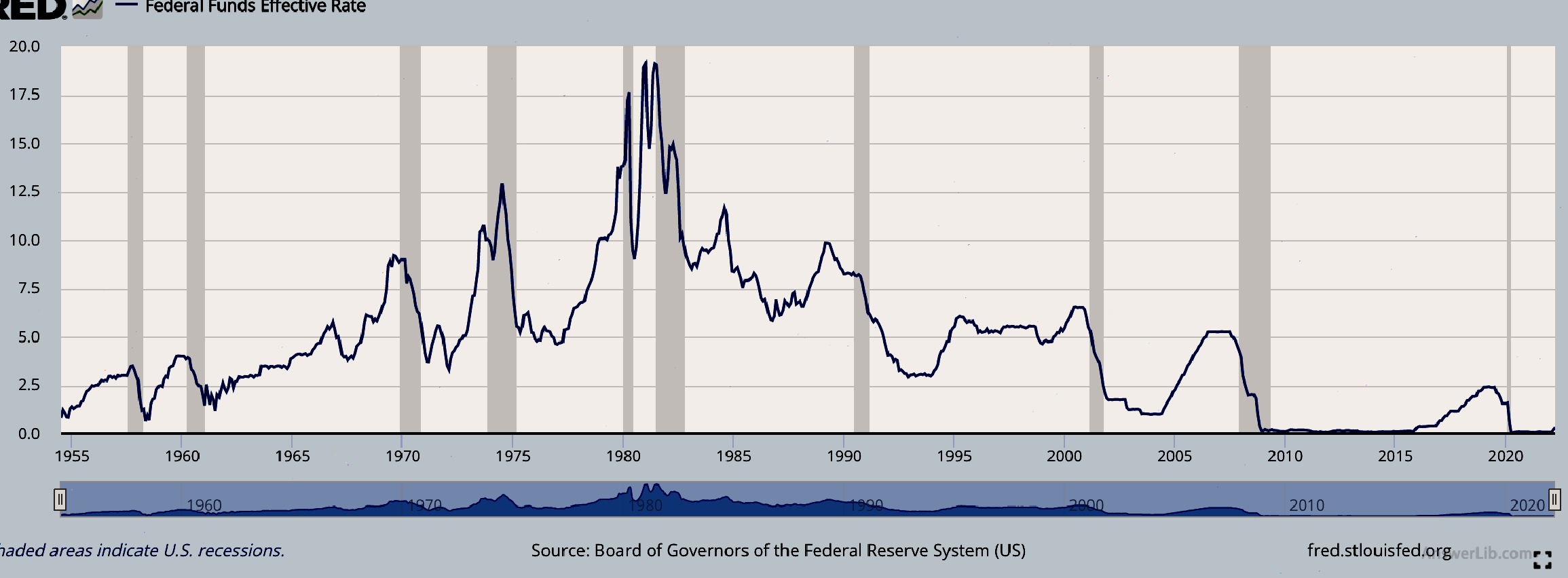

The valid interest rates of the federal fund from 1955 to 2022 are as follows: As of May 2, 2022, the federal funds in the United States were 0.33.

How is the federal fund interest rate formulated?

Federal Fund target interest rate (Target Rate) is formulated by the Federal Public Committee (FOMC).Usually, in one year, a formal meeting is held every seven weeks.Federal fund target interest rate.

The EFFECTIVE RATE is determined by the effective intermediate interest rate of overnight transactions within the previous working day.The New York Federal Reserve Bank will release it every day.

When making the federal fund target interest rate, the Fed mainly decided to increase or reduce interest rates based on the economic situation at that time.inflation Conditions to formulate the corresponding federal fund target interest rate.

- If the economy slows down, the Federal Public Marketing Committee may reduce interest rates to reduce the cost of corporate lending, investment and creation of employment opportunities.At the same time, consumers can allow consumers to borrow or consume more and stimulate the economy at once.

- If the economic growth is too fast and the inflation is severe, the Fed may increase interest rates to compress the expenditure and borrowing to control inflation.

| date | Effective interest rate (%) | Target interest rate (%) |

|---|---|---|

05/09/2022 | 0.83 | 0.75 ~ 1 |

05/06/2022 | 0.83 | 0.75 ~ 1 |

05/05/2022 | 0.83 | 0.75 ~ 1 |

05/04/2022 | 0.33 | 0.25 ~ 0.5 |

05/03/2022 | 0.33 | 0.25 ~ 0.5 |

05/02/2022 | 0.33 | 0.25 ~ 0.5 |

04/29/2022 | 0.33 | 0.25 ~ 0.5 |

04/28/2022 | 0.33 | 0.25 ~ 0.5 |

04/27/2022 | 0.33 | 0.25 ~ 0.5 |

04/26/2022 | 0.33 | 0.25 ~ 0.5 |

04/25/2022 | 0.33 | 0.25 ~ 0.5 |

04/22/2022 | 0.33 | 0.25 ~ 0.5 |

04/21/2022 | 0.33 | 0.25 ~ 0.5 |

04/20/2022 | 0.33 | 0.25 ~ 0.5 |

04/19/2022 | 0.33 | 0.25 ~ 0.5 |

04/18/2022 | 0.33 | 0.25 ~ 0.5 |

04/15/2022 | 0.33 | 0.25 ~ 0.5 |

04/14/2022 | 0.33 | 0.25 ~ 0.5 |

04/13/2022 | 0.33 | 0.25 ~ 0.5 |

04/12/2022 | 0.33 | 0.25 ~ 0.5 |

04/11/2022 | 0.33 | 0.25 ~ 0.5 |

04/08/2022 | 0.33 | 0.25 ~ 0.5 |

04/07/2022 | 0.33 | 0.25 ~ 0.5 |

04/06/2022 | 0.33 | 0.25 ~ 0.5 |

04/05/2022 | 0.33 | 0.25 ~ 0.5 |

How to regulate economic activities by federal funds?

The increase in interest rates of federal funds will have a profound impact on economic activities::

- When the federal fund interest rate decreases, that is, when other banks borrowed funds to borrow funds from the federal savings system, the interest rates of enterprises or individuals when borrowing from banks will decrease, including credit card swiping interest rates and loan interest rates.It can borrow money from banks at a lower interest rate, and the increase in consumption will increase the market demand for the market, so that manufacturers or service providers must increase a total of market demand.At the same timeThe scale, such as increasing the construction of a plant, and the increase in the cost of employees, thereby stimulating consumption, increasing employment rates, and accelerating the growth of the entire economic environment.

- On the contrary, if there is an excessive inflation in the market, the Fed will increase the interest rate of federal funds, leading to an increase in the cost of borrowing borrowing between banks, which will cause the cost of borrowing of the public to increase the cost of borrowing, which will reduce consumption to control prices.

What impact does the Federal Reserve affect the economy?

- The Federal Reserve interest rate cut means a reduction in loan interest rates.Individuals can use more affordable borrowing interest rates to purchase real estate or vehicles in loans.The company can also get more low-interest loans and increase investment;

- After the Federal Reserve cuts interest rates, the savings interest on savings accounts will be reduced;

- The Federal Reserve ’s interest rate cut usually boosted the stock market, because investors can borrow loans with lower interest and invest in the stock market;

- Stimulating consumption caused by the Federal Reserve’s interest rate cuts can improve the industry and service industry, and at the same time increase employment.

More related reading

- What is the national financial status index?

- What is the Buffett index?Buffet indicator

- What is the U.S.Treasury volatility index?Move index

- What US dollar index?US dollar index

- What is a bank deposit reserve?Bank reserves

- What is an open market operation?Open Market Operations

- What is the reserve balance interest rate?Interest on Reserve Balances

- What is personal consumption expenditure index?PCE Price Index

- What is overnight reverse repurchase?On Reverse Repurchase

- What is unemployment rate?UNEMPLOYMENT RATE

- What is non-agricultural employment data?NON FARM PAYROLLS

- What is the house price index?House Price Index

- What is currency supply?Money Supply M0, M1, M2

- What is the federal fund interest rate? Federal Funds Rate

- What is the Federal Reserve?Federal Reserve